Management Messages

Sustainable growth through transformation

Director and Executive OfficerArinobu Soga

FY2020 review

FY 2020 was a challenging year for society, our clients and our business. The restrictions imposed across the globe impacted spend on advertising and marketing as the COVID crisis caused a slowdown in global demand.

The impact of COVID-19 on our Group was felt from the first quarter of 2020 and continued throughout the year. The second quarter was the trough in our performance and although the Group delivered sequential quarterly improvement through the third and fourth quarters, the Dentsu Group reported organic revenue decline of -11.1% for FY2020.

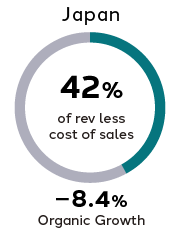

Dentsu Japan Network reported -8.4% and Dentsu International reported -13.0% organic revenue decline.

In Japan, although client spend on advertising decreased with the pandemic, the digital solutions business maintained momentum throughout the year, supporting clients’ ever-growing needs for digital transformation. This remains a significant opportunity for the Group as we enter FY2021. ISID and Dentsu Digital significantly contributed to the group revenue less cost of sales, both posting double-digit organic growth for the full year, giving confidence our solutions are well placed to meet clients’ needs.

At Dentsu International, media spend remained low throughout the year and our creative service line suffered from a reduction in project-based work due to the impact of the pandemic. However, the CXM service line was much more resilient showing an organic revenue decline of -3.2%, while Merkle saw a decline of only -1%. The CXM business and Merkle in particular are well positioned to see an improvement in revenues in FY2021 as clients increasingly focus on first party data combined with robust ecommerce and D2C strategies. The performance media business also performed well in the final months of FY2020, with client spending focused on personalization and we expect that trend to continue into 2021.

FY2020 revenue ratio and organic growth by region

Swift cost actions

In order to mitigate the impact of the expected revenue decline due to COVID-19, we reacted swiftly and took a number of cost actions in the first quarter of 2020. These actions included an immediate review of contractor roles and arrangements, improvement of business efficiency, and containment of M&A-related expenses by pausing M&A activity.

Personnel cost management was implemented in Japan through more flexible work-time management, and measures at Dentsu International including reduced working hours in exchange for a temporary salary reduction. I would like to offer my personal thanks to all our people who showed such dedication and resilience during an enormously challenging year.

These actions ensured our FY2020 operating margin stabilized at 14.8% as cost savings mitigated the top-line decline. However, as we looked beyond 2020, we recognized the need to ensure these temporary cost savings could become more permanent in order to return the Group to growth and deliver margin improvement.

Comprehensive review

In August 2020, the Group announced a comprehensive review to accelerate the structural reform and business transformation required. Ultimately, the review addressed how to improve value for our shareholders, employees, and clients.

The review launched with four clear focused areas:

- Create a more simplified structure

- Structurally and permanently lower operating expenses

- Enhance the efficiency of our balance sheet

- Maximize long-term shareholder value

The Group took swift, decisive action, with a number of initiatives announced at the FY2020 results. In the six months after the announcement of the comprehensive review, the Group has made significant progress but there is much more to do. We look forward to updating you on our continued progress throughout FY2021.

1. Create a more simplified structure: benefiting both clients and internal operations

Dentsu Japan Network will simplify its structure into four business lines: Advertising transformation, Business transformation, Customer experience transformation, and Digital transformation. This new structure will streamline operations, drive revenue synergies as well as create efficiency among corporate functions.

Dentsu International announced the decision to rationalize the number of brands from 160 to six global leadership brands. This will create a simplified, integrated and more efficient organization that is easier for our clients to navigate, reducing duplication and complexity across the business.

2. Structurally and permanently lower operating expenses: 75.0 billion yen saving from 2022

The structural reform announced at Dentsu Japan Network will generate 21 billion yen of cost reductions by 2022 through reviewing the human resource strategy and the reduction of real estate costs.

The transformation at Dentsu International announced on December 7, 2020, will deliver more than 54.7 billion yen of permanent cost reductions from personnel and other sources on an annual basis from the end of FY2021.

These cost reduction programs give us a strong line of sight on margin improvement the Group will deliver in the coming years. The Group remains committed to delivering an operating margin of 20% by 2022 for Dentsu Japan Network and 15% for Dentsu International—aiming to reach 17% at the Group level by 2024.

3. Enhance the efficiency of our balance sheet

On November 30, Dentsu Group announced the decision to divest the majority of its stake in Recruit Holdings, in line with our policy to reduce security assets. In Q4 FY2020, we sold 50 million shares of Recruit Holdings and continue to review our strategic shareholdings.

The review of non-trading assets to enhance shareholder value continues. In March 2021 we announced the sale of two smaller property assets in Japan and we have confirmed the review of the sale of the headquarters building in Shiodome, Tokyo.

4. Maximize long-term shareholder value

A buyback of 30 billion yen (maximum) was announced with our FY2020 results in February 2021 as we look to improve long-term shareholder value. We will continue to consider further shareholder returns following the sale of any additional exceptional assets.

Statutory operating loss in FY2020

As a result of the charges relating to the comprehensive review and accelerated transformation combined with an impairment charge, the Group reported a statutory operating loss of 140.6 billion yen in FY2020.

The associated cost of the Accelerated Transformation Plan is 78.3 billion yen by the end of FY2020 with an approximated total amount of 56 billion yen expected for FY2021. These costs will deliver annualized savings of approximately 75 billion yen from FY2022, with about 50 billion yen of savings expected to be booked in FY2021.

The carrying value of goodwill was reviewed for impairment each quarter during FY2020 in view of the global economic impact of the COVID-19 pandemic.

This review resulted in a decision to record a goodwill impairment amounting to 140.3 billion yen by recalculating the net present value of Dentsu International with a conservative view. This will leave the Group well placed as it looks to 2021 and beyond.

Strong balance sheet

The Group closed the year well capitalized, with a strong balance sheet, 530 billion yen of cash and cash equivalents. The Group’s credit rating from Japan’s Rating & Investments Information Inc. (R&I) remained at AA-.

Well placed to benefit from digital investments

The impact of COVID-19 accelerated many trends we already recognized within our society and our industry. Digital adoption and direct-to-consumer channels are a necessity for all our clients as consumer behavior continues to evolve. Our clients’ have recognized the need to respond, by leveraging data, while creatively engaging with consumers to create meaningful brand experiences.

Our fastest growth area remains digital, with 53.9% of the Groups total revenue less cost of sales from digital activities—a sharp increase from 47.5% in 2019 (640bp YoY).

The Group’s total revenue from Customer Transformation & Technology reached 28% of Group revenue in 2020, 25% from Japan and 30% from Dentsu International. Our industry-leading assets including Merkle, ISID and Dentsu Digital have generated together a CAGR of over 20% over the past three years demonstrating our ability to deliver bespoke solutions that address client needs by combining data, analytics, and technology.

This area is where we will focus our M&A spend going forward.

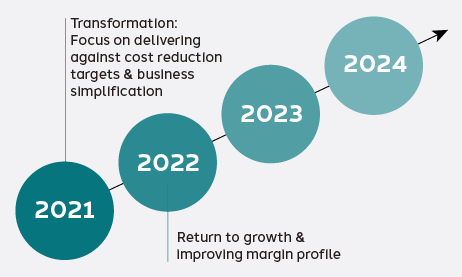

Medium-Term Management Plan and targets

The Dentsu Group Medium-term Management Plan: “Sustainable Growth through Transformation” for the four-year period from 2021 to 2024 was released in February 2021, providing our stakeholders with a roadmap for the next four years.

FY2021 remains a transitional year for the Group with FY2022 and beyond, delivering a return to growth and improving margin profile.

We have created four pillars against which our targets and commitments are set.

FY2021 remains a transitional year for the Group with FY2022 and beyond delivering a return to growth and improving margin profile

Dentsu Group’s external targets 2021: 2024

1.Transformation and Growth

- Organic growth of 3-4% CAGR 2021: 2024

- Customer Transformation & Technology to reach 50% of Group revenue less cost of sales over time

2.Operations & Margin

- Progressive year-on-year improvement in underlying operating margin: 17%+ by 2024 (DJN:20%, DI:15% by 2022)

3. Capital allocation & Shareholder returns

- Medium-term average of 1.5x Net Debt / EBITDA (non IFRS 16 basis)

- Dividend payout ratio to reach 35% of underlying basic EPS over the next few years

4. Social Impact & ESG

- 46% absolute reduction in CO2 & 100% renewable energy (in markets where available) by 2030

- Improvement in employee engagement score

- Diverse & inclusive workforce

1.Transformation & Growth

Growth will be driven through the continued rollout of Integrated Growth Solutions and dentsu Sustainable Business Solutions.

2.Operations & Margin

Reducing complexity across our business is the focus for our simplification—reducing duplication across the Group improves efficiency and reduces costs.

3. Capital allocation & Shareholder returns

The Group will adopt a disciplined approach to capital allocation with a priority to enhancing shareholder value.

The Group will aim for a medium-term average of 1.5x Net debt / EBITDA, although this may be lower in the short term.

We will invest for growth, both in organic growth through investment in new technology and product innovation, and also in-organic growth though M&A. Acquisitions will be a priority in the coming years with a focus on high growth data and digital assets in both Japan and the international markets.

We have committed to a progressive dividend policy, with the payout ratio reaching 35% of underlying basic EPS over the next few years.

4. Social impact & ESG

We consider it essential to commit to our social impact and ESG goals for the sustainability of our business. Group-wide initiatives, including the establishment of the “Sustainable Business Board,” will support our specific goals.

The outlines of our plans are introduced in Dentsu Integrated Report 2021.

Looking ahead

Despite the challenges of this year we remain focused on our strategy of delivering Integrated Growth Solutions that drive top-line growth for our clients beyond marketing.

Our high performance and agile culture gives me the utmost confidence the Group can emerge from this crisis stronger with a keen focus on creating value for all our stakeholders.