Dentsu Group Inc. FY2022 Consolidated Financial Results

Feb 14, 2023

- IR-Voluntary Disclosure

- Management

(The full year ended December 31, 2022 – reported on an IFRS basis)

・Dentsu Group Inc. reports record results for net revenues, underlying operating profit, underlying basic EPS and dividend per share for FY22

・FY22 organic growth of 4.1%* driven by growth across all four regions, with continued demand for Customer Transformation & Technology services. Q4 organic growth 3.5%*

・FY22 operating margin 18.4%*, +20bp* yoy (cc) as a result of continued organizational simplification, functional efficiencies and reduction of the Group’s property footprint. Q4 margin 22.6% +580bp yoy.

・Underlying basic EPS JPY 485, +23.9% yoy, leading to a full year dividend per share of JPY 155 as the dividend payout ratio is increased to 32%

Customer Transformation & Technology (CT&T) contributed 32.3% of Group revenues in 2022, growing 17.5% yoy (cc), led by ISID and Dentsu Digital in Japan and Merkle across the three international regions. The Group remains well positioned to benefit from the structural growth in Customer Transformation & Technology with the long-term outlook for client spend on digital experiences and customer focused transformation remaining robust.

The Group has announced five acquisitions over the past 12 months, welcoming over 1,800 talented new colleagues. The acquisitions bring a mix of consulting expertise, cloud engineering knowledge, and marketing technology capabilities and are in line with the stated strategy of reaching 50% of net revenues generated by CT&T. The acquisition pipeline remains active.

Clients remain focused on growth, investing in technology, data and media to enable business expansion. The outlook for client spend remains solid in 2023 and the Groups position at the convergence of marketing, technology and consulting ensures our services become embedded within our clients’ businesses.

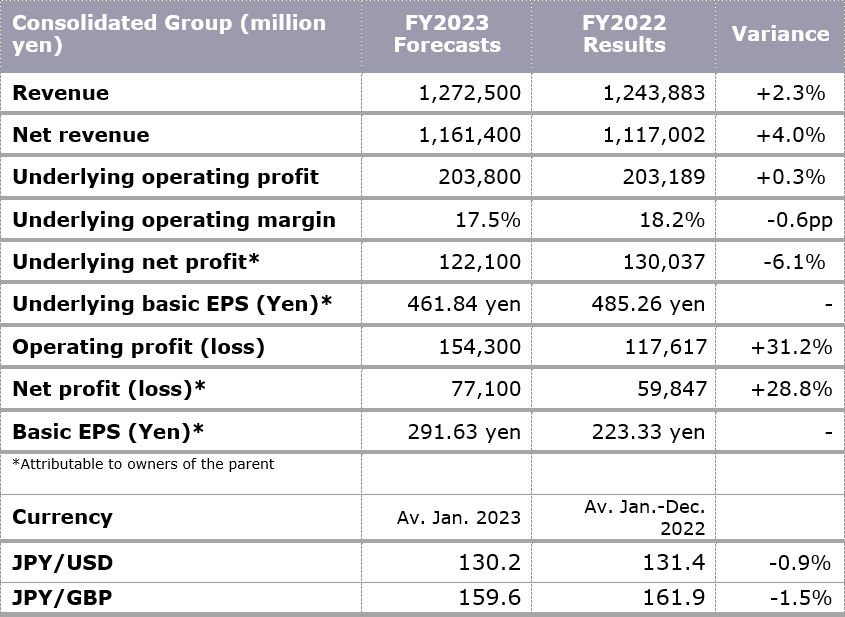

FY2023 guidance is for Group organic growth c.4%, with underlying operating margins 17.5%. The strong margin delivery in 2022 allows for additional investment in One dentsu to support future growth. Investments will continue to be made in the client and solutions platform capability expansion to further differentiate the Groups client offer as well as enterprise architecture to deliver One dentsu. The Group remains confident in the medium-term targets of 4-5% organic growth CAGR 2022:24 and returning to an 18% margin in 2024.

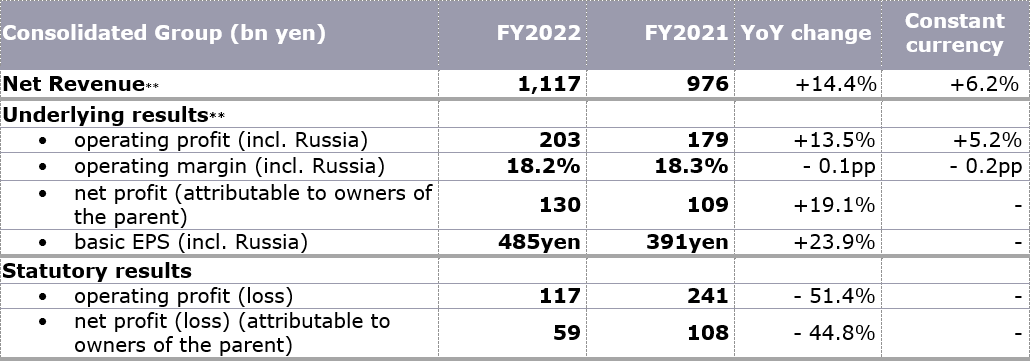

FY2022 (Jan – Dec) Financial Results Summary

* Figures reported ex Russia / **See below for definitions

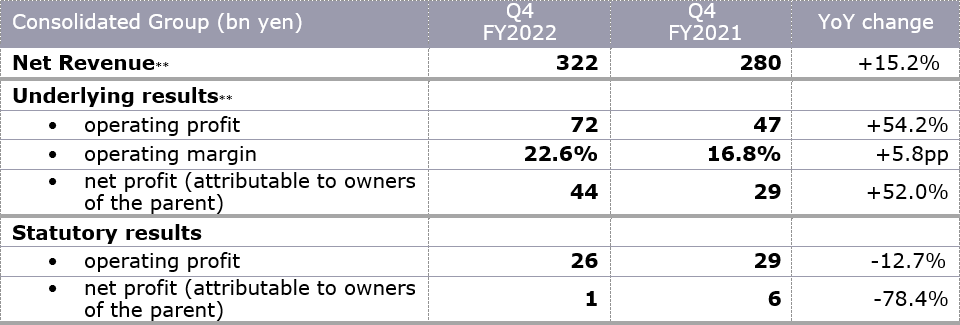

Q4 (Oct-Dec) FY2022 Financial Results Summary

**See below for definitions

FY2022 (Jan – Dec) Results: Key Financials

Group net revenue JPY 1,117.0 bn (YoY +14.4%, +6.2% constant currency basis).

- 5.5% growth in net revenue in Japan, 28.5% (8.8% on a constant currency basis) in Americas, 15.0% (5.9% on a constant currency basis) in EMEA, and 15.5% (2.5% on a constant currency basis) in APAC (excluding Japan).

- Net revenue increased due to organic growth of JPY 34 bn, currency positively impacted by JPY 75 bn, and M&A contributed JPY 30 bn.

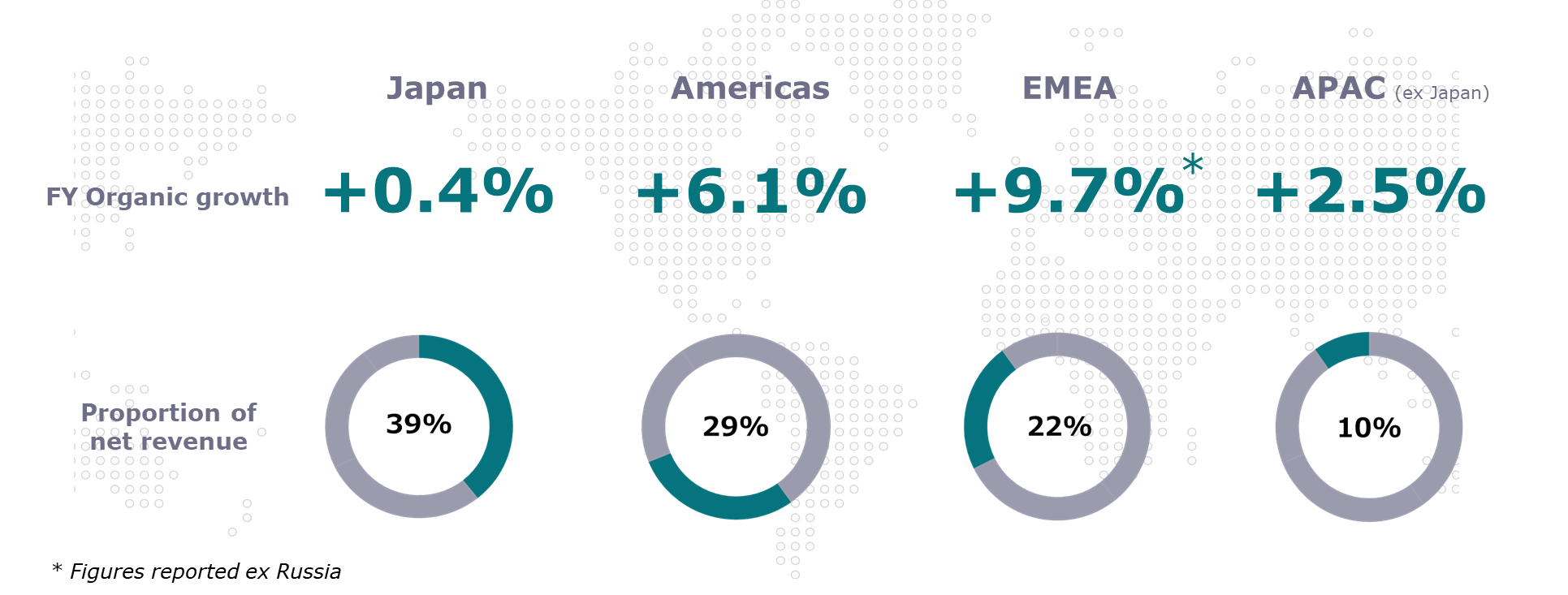

Group organic growth was 4.1%*.

- Japan delivered 0.4% organic growth, despite strong prior year comparable of 17.9%. The Americas reported 6.1% organic growth. EMEA delivered the highest organic growth of the four regions at 9.7% (5.1% including Russia), and APAC (excluding Japan) grew 2.5%.

- Performance driven by structural growth in Customer Transformation & Technology with clients investing in digital transformation initiatives and a strong performance in media in the International markets.

Group underlying operating profit increased by 13.5% (5.2% cc) yoy to JPY 203 bn. Operating margin improved by 20 bp* (20 bp* cc) to 18.4%* reflecting the simplification agenda across the Group as well as improved efficiencies across Group functions.

- Fourth quarter profitability in Japan was particularly strong, delivering a FY22 margin beat of 40bp versus upgraded guidance.

Group underlying net profit (attributable to owners of the parent) increased by 19.1% yoy to JPY 130 bn. due to the increase of underlying operating profit.

- Underlying basic EPS JPY 485.26, +23.9% yoy (FY2021: JPY 391.71).

Group statutory operating profit and net profit (attributable to owners of the parent) are respectively JPY 117 bn and JPY 59 bn, lower yoy due to prior year asset sales.

* Figures reported ex Russia

Hiroshi Igarashi, President and CEO, Dentsu Group Inc., said:

“In 2022 Dentsu reported record high net revenues, record underlying operating profit, a record underlying basic EPS and a record dividend per share at JPY 155. Our transformation continues to deliver a simplified organization with a focused strategy of growing revenues in the structural growth area of our industry, Customer Transformation & Technology.

“In 2022 Dentsu reported record high net revenues, record underlying operating profit, a record underlying basic EPS and a record dividend per share at JPY 155. Our transformation continues to deliver a simplified organization with a focused strategy of growing revenues in the structural growth area of our industry, Customer Transformation & Technology.

The future of brand loyalty and competitive advantage is the customer experience. To deliver against this, brands must continue to invest and keep pace with an ever-changing marketplace – and ever-growing consumer expectations.

Together with our clients, Dentsu delivers a shared vision for how these investments will translate to customer value. Our unmatched skills in understanding consumer insights combined with strengths in consulting, creative, media, analytics, data, identity, CX/commerce, technology and loyalty ensure we can deliver growth for our clients through our integrated solutions.

Dentsu set a vision of ‘To be at the forefront of people-centred transformations that shape society.’ To realize this vision, we have already established a diverse Group Management Team and started to operate our business under one global management structure.

In 2023 and ahead, we remain focused on the opportunity to further consolidate and strengthen our competitive position at the convergence of marketing, technology and consulting. This distinct market position will drive value for our clients, our people and our shareholders.

The diversity of thought within our organization is a testament to our global footprint combined with our Japanese heritage. Our industry leading talent bring ideas to life through purpose-driven collaboration. I would like to offer my thanks to all of our 65,000 employees for their dedication and hard work in 2022.”

FY2022 Business Updates

Total revenue from Customer Transformation and Technology reached 32.3% of Group net revenue in 2022 (+310 bp on a constant currency basis). The Group continues to make progress towards the stated strategy of reaching 50% of net revenue generated by CT&T.

Regional proportion of net revenue and organic growth for FY2022

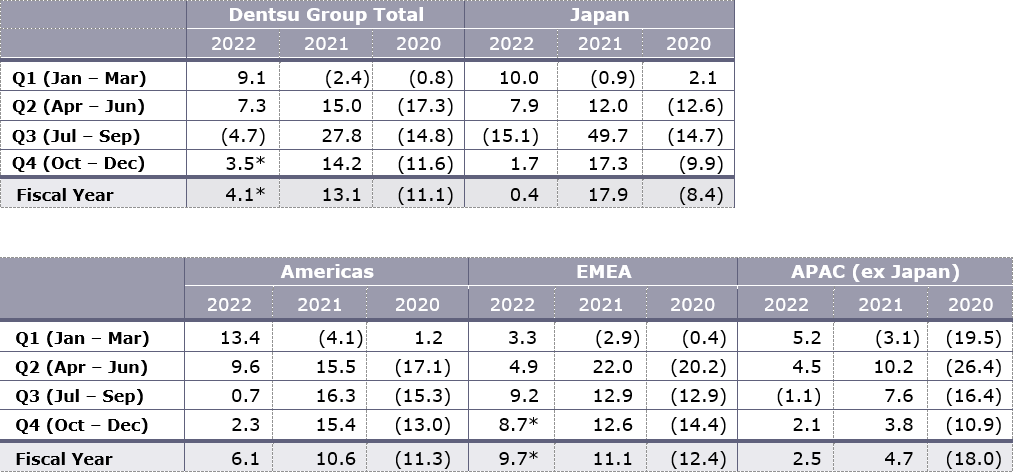

Quarterly Organic Revenue Performance

* Figures reported ex Russia

• In Japan, FY2022 organic growth was 0.4% and 1.7% in Q4 FY2022

Despite the challenging macro-environment, Japan delivered a record high net revenue figure as the proportion of revenue from the structural growth area of Customer Transformation & Technology continued to increase. Dentsu Japan retained its position as the largest player by billings in digital advertising due to the contribution from SEPTENI HOLDINGS, which became a consolidated subsidiary. While a slight slowdown in demand for online advertising was observed in the fourth quarter, the FIFA World Cup Qatar 2022™ and the strong Customer Transformation & Technology performance delivered as expected.

The digital solution business maintained momentum throughout the year, supporting clients’ ever-growing needs for digital transformation. Customer Transformation & Technology share of net revenue increased 440bp to 28.5% compared to the previous year due to the contribution from Ignition Point from Q222 onwards and from ISID and Dentsu Digital whose organic growth rates were 16.9% and 7.3% respectively.

• In Americas, FY2022 organic growth was 6.1% and 2.3% in Q4 FY2022

The positive 2022 full year Organic growth in the Americas is due to upsides in Canada 9.2% and USA 6.2%, Brazil reported organic decline in 2022. Canada’s performance was boosted by incremental scopes from existing clients and new logo wins in Creative and Media service line.

Customer Transformation & Technology saw some slowing of decision making from clients into the fourth quarter, but still delivered almost 7% growth for the full year. The pipeline of opportunities in 2023 remains strong. The acquisition of Extentia further bolsters Merkle’s existing Salesforce capabilities, adding scale, a focus on enterprise mobility, cloud engineering, and user experiences. Media grew 7.7% for the full year with a strong fourth quarter as client confidence returned. Creative saw a return to growth in the fourth quarter with creative delivering 1% organic growth for the full year.

• In EMEA (excluding Russia), FY2022 organic growth was 9.7% and 8.7% in Q4 FY2022

Excluding Russia, EMEA reported the highest 2022 organic growth among all four regions at 9.7% for the full year. EMEA also reported a strong fourth quarter +8.7%; led by Denmark, Italy, Netherland, Spain, Switzerland, and UK, all reporting double digit organic growth.

In FY2022, Customer Transformation & Technology delivered almost 15% organic growth with momentum across the region on focusing on retention, expansion of existing client new work, and new logo acquisition. Newly acquired Pexlify continues to perform well and integration is progressing as planned. Dentsu Creative was successfully launched across 13 markets (UK, Spain, Italy, France, NL, Germany, SA, Poland, Hungary, Romania, Czechia, Bulgaria & Croatia) delivering a turnaround in performance with 6.3% organic growth. Media grew high single digit organic growth as client optimism grew as the year progressed.

• In APAC (excluding Japan), FY2022 organic growth was 2.5% and 2.1% in Q4 FY2022

India delivered growth of over 20% in FY2022 due to increased client spend and new client wins, capitalising on the economic recovery of the market after the lifting of COVID restrictions and accelerated GDP growth in the market. South-East Asia markets also performed well led by strong, double-digit growth in Singapore which benefited from increased client demand across all services. Vietnam and Indonesia also performed well.

The continuation of Covid-related policies continued to impact China's performance, which resulted in consequential decline in client spend. Key appointments in H2 continue to bolster the leadership of the market. Within the North Asia cluster, Taiwan performed well, delivering growth of almost 10%.

Despite economic headwinds, the Australia and New Zealand business delivered revenue growth in FY22 of 5.0%. This was supported by the strength of the Media business and growth in New Zealand. Customer Transformation & Technology capabilities were boosted through the recent acquisition of Aware Services and the business cemented its local leadership team by announcing Patricio De Matteis as Chief Executive Officer for Australia and New Zealand.

Forecast of Consolidated Financial Results for the FY2023 (IFRS)

Dentsu Group Inc. forecasts Group organic growth at c.4% for FY2023, with operating margin 17.5%

For further details please see the presentation on Dentsu Group Inc. website.

URL: https://www.group.dentsu.com/en/ir/

The accounts are, in line with usual practice, unaudited and subject to final audit.

– Ends –

Definitions

- Net revenue : The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit : KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin : Underlying operating profit divided by net revenue.

- Underlying net profit (attributable to owners of the parent) : KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS : EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA : Operating profit before depreciation, amortization and impairment losses.

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: https://www.group.dentsu.com/en/ir/

Forward-Looking Statements

This material contains statements about dentsu that are or may be forward-looking statements. All statements other than statements of historical facts included in this presentation may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “estimates”, “projects” or, words or terms of similar substance or the negative thereof, are forward-looking statements. Forward-looking statements include statements relating to the following: information on future capital expenditures, expenses, revenues, earnings, synergies, economic performance, and future prospects.

Such forward-looking statements involve risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof.

About dentsu

Dentsu is the network designed for what’s next, helping clients predict and plan for disruptive future opportunities and create new paths to growth in the sustainable economy. Taking a people-centered approach to business transformation, we use insights to connect brand, content, commerce and experience, underpinned by modern creativity. As part of Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), we are headquartered in Tokyo, Japan and our 65,000-strong employee-base of dedicated professionals work across four regions (Japan, Americas, EMEA and APAC). Dentsu combines Japanese innovation with a diverse, global perspective to drive client growth and to shape society.

https://www.dentsu.com/

https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | NEW YORK | |

| MEDIA Please contact Corporate Communications |

Jumpei Kojima: +81 3 6217 6602 jumpei.kojima@dentsu.co.jp |

Matt Cross: +44 7446 798 723 matt.cross@dentsu.com |

Jeremy Miller: +1 917-710-1285 jeremy@dentsu.com |

| INVESTORS & ANALYSTS Please contact Investor Relations |

Yoshihisa Okamoto: +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 kate.stewart@dentsu.com |