Dentsu Group Inc. Q2 FY2022 Consolidated Financial Results

Aug 12, 2022

- IR-Timely Disclosure

- Management

(The second quarter ended June 30, 2022 – reported on an IFRS basis)

Dentsu Group reports a strong second quarter with organic growth of 8.2%, Dentsu Japan Network 7.9% and Dentsu International 8.4% as clients continue to invest in their brands, supported by technology, data and digital solutions to enhance their customer strategies.

Operating margin increased to 13.9%, +120bp yoy. Margin growth was supported by continued organizational simplification and cost efforts the Group has been undertaking over the past two years. (Figures excluding Russia*)

- Customer Transformation & Technology grew 22.5% reaching 32.3% of Group revenues, 27.5% at Dentsu Japan Network and 35.7% at Dentsu International. Growing exposure to the structural growth area of Customer Transformation & Technology provides a more resilient revenue mix, placing the Group in a strong position as we enter the second half of the year.

- The Group has completed two acquisitions in recent weeks, in line with our stated strategy of reaching 50% of revenues generated by Customer Transformation & Technology. Pexlify a UK and Ireland based Salesforce consultancy and Extentia a global consultancy delivering solutions across mobile, cloud and experience. Both acquisitions further cement our position as Salesforce’s largest agency partner. Pexlify and Extentia grew 15% and over 50% respectively in the second quarter. The acquisition pipeline remains active.

- Given the robust H1 FY2022 performance, the Group guides to the upper end of 4 to 5% organic growth with 17.7% operating margin, despite the dilutive impact of Russia on operating margins. Excluding the impact of Russia, the Group operating margin would reach 18.0%. Underlying basic EPS is today upgraded by 8.1% due to updated FX, a reduced tax rate at Dentsu International and the reduced number of shares following the buyback completed year to date.

- The Group today announces a record interim dividend of 70.25 yen per share for FY2022, +39% yoy.

- The Group retains confidence in the medium-term targets of 4 to 5% Group organic growth, 18.0% Group margins with a pay-out ratio reaching 35.0% by FY2024.

* Including the impact of the Russian business Group organic growth Q2 was 7.3%, 7.9% at Dentsu Japan Network and 7.0% at Dentsu International. Group operating margins were 13.5%, +120bp; Dentsu Japan Network reported 15.0% and Dentsu international 13.6%. All figures in the rest of the release refer to results including the impact from Russia.

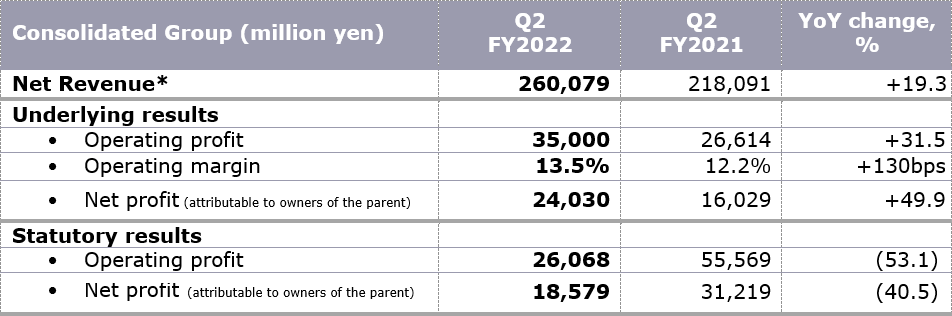

Q2 (April to June) FY2022 Financial Results Summary

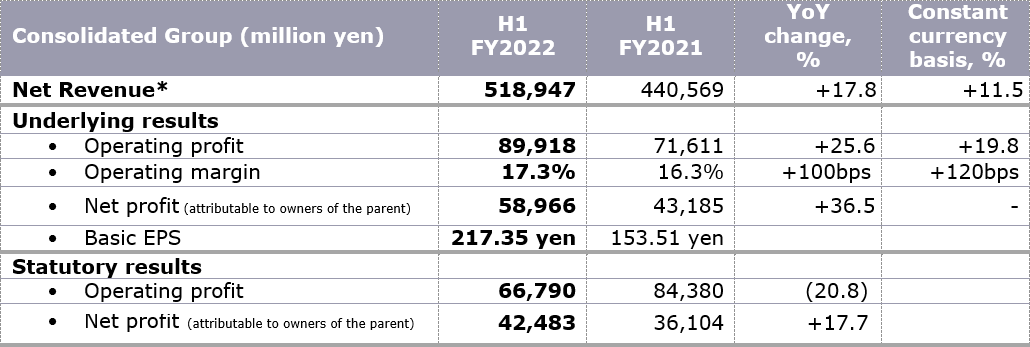

H1 (January to June) FY2022 Financial Results Summary

*Notation of “Revenue less cost of sales” was changed to “Net revenue” from the first quarter

H1 (January to June) FY2022 Results: Key Financials

Group net revenue JPY 518.9 bn (YoY +17.8%, +11.5% on a constant currency basis)

- 14.6% growth in net revenue at Dentsu Japan Network, and 20.2% (9.5% on a constant currency basis) at Dentsu International.

- Net revenue increased due to organic growth of JPY 39.2 bn, currency positively impacted by JPY 24.7 bn, and M&A contributed JPY 14.3 bn.

Group organic growth was 8.2%. (8.9% excluding Russia)

- 9.0% organic growth at Dentsu Japan Network, and 7.6% at Dentsu International (8.8% excluding Russia). H1 FY2022 saw growth in all regions by continued growth in media as well as increased client spend on digital transformation initiatives.

Group underlying operating profit increased by 25.6% (19.8% on a constant currency basis) yoy to JPY 89.9 bn. Operating margin improved by 100 bp (120 bp on a constant currency basis) to 17.3% reflecting operating leverage from higher revenues and the continued focus on costs.

- At Dentsu Japan Network, underlying operating profit was JPY 57.1 bn (YoY +32.6%); operating margin of 26.5% (YoY +360 bp)

- At Dentsu International, underlying operating profit was JPY 36.1 bn (YoY +16.8%, +5.1% on a constant currency basis); operating margin excluding Russia of 12.5% and operating margin including Russia of 11.9% (YoY -20 bp, -50 bp on a constant currency basis).

Group underlying net profit (attributable to owners of the parent) increased by 36.5% yoy to JPY 58.9 bn due to the increase of underlying operating profit.

- The underlying basic EPS of JPY 217.35 (H1 FY2021: JPY 153.51).

Group statutory operating profit and net profit (attributable to owners of the parent) are of JPY 66.7 bn and JPY 42.4 bn.

- Statutory operating profit is lower yoy due to a one-off increase in FY2021 on the gain on sale of non-current assets. In Q2 FY2022 the Group sold further property assets in Japan, continuing with our stated strategy of streamlining our balance sheet and reviewing all non-trading assets.

Business transformation costs increased yoy as previously highlighted.

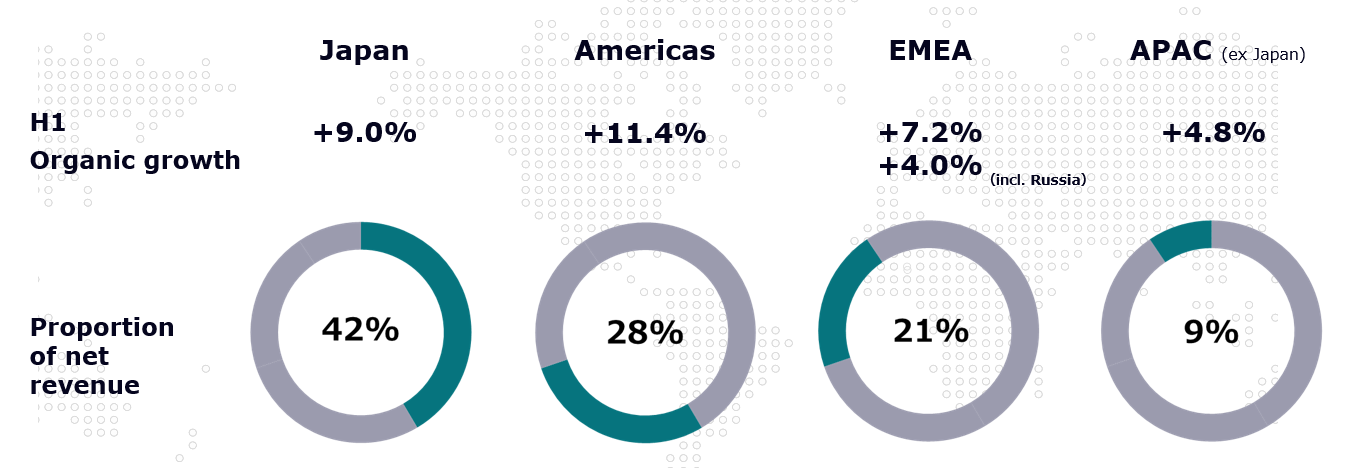

H1 (January to June) FY2022 Organic growth and Proportion of net revenue by Region

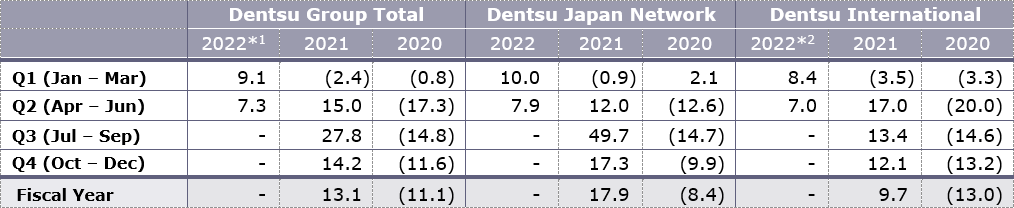

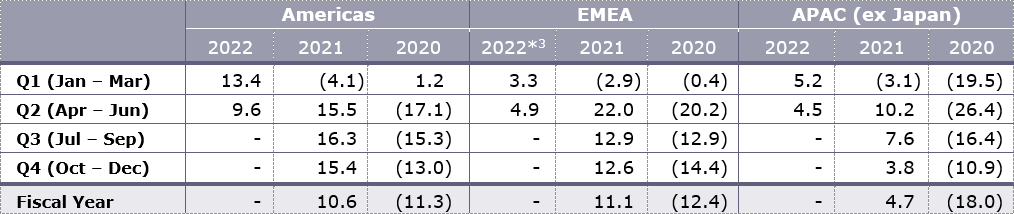

Quarterly Organic Revenue Performance

Quarterly Organic Revenue Performance for Dentsu International by Region

*1 Dentsu Group Total excluding Russia - Q1: 9.6% / Q2: 8.2%

*2 Dentsu International Total excluding Russia - Q1:9.2% / Q2: 8.4%

*3 EMEA excluding Russia - Q1: 5.3% / Q2: 8.9%

Hiroshi Igarashi, President and CEO, Dentsu Group Inc., said:

“The Group’s strong performance continued into the second quarter as we reported 8.2% organic growth and 120 bp margin improvement (exc. Russia). The quarter saw success with new client wins across the Group as well as significant success at the Cannes Lions International Festival of Creativity 2022, winning Agency of the Year, Regional Network of the Year, a Titanium and three coveted Grand Prix awards – my deepest congratulations to all our teams involved.

“The Group’s strong performance continued into the second quarter as we reported 8.2% organic growth and 120 bp margin improvement (exc. Russia). The quarter saw success with new client wins across the Group as well as significant success at the Cannes Lions International Festival of Creativity 2022, winning Agency of the Year, Regional Network of the Year, a Titanium and three coveted Grand Prix awards – my deepest congratulations to all our teams involved.

Clients continue to invest in their brands, supported by hyper-personalized customer experiences, driven by insights, data and technology. By connecting data across our clients’ organization we can bring a cohesive, 360-degree view of their customers – driving competitive differentiation, brand resilience and measurable business results for our clients.

Our strategy of growing our revenues in the fast growth area of our industry, Customer Transformation & Technology, brings a number of benefits to the Group - transforming our client offer, our revenue profile and our cost structure. We retain our ambition of generating 50% of our net revenues from this structural growth area as we shift our business to a hybrid agency / consultancy.

We continue to grow revenues in Customer Transformation & Technology both organically and through acquisition and I am delighted to welcome all 950 employees from both Pexlify and Extentia who joined the Dentsu Group in recent weeks.

The 65,000 dedicated employees across the Group are what gives dentsu its competitive edge – and as always, I would like to thank them for their commitment.

Whilst the macro-outlook may remain uncertain, we enter the second half of the year with confidence. Our improved revenue mix, our deep client relationships, strong balance sheet underpinned by the transformation the Group has undertaken over the past two years positions us well for the future.

H1 (January to June) FY2022 Business Updates

Customer Transformation & Technology ratio of net revenues

- Net revenue from Customer Transformation & Technology reached 32.3% of Group net revenue (YoY +280 bp, +290 bp on a constant currency basis), 27.5% (YoY +280 bp) from Dentsu Japan Network and 35.7% (YoY +270 bp, +310 bp on a constant currency basis) from Dentsu International.

Japan business (Dentsu Japan Network)

- In Japan, organic growth was 9.0%.

Japan, the biggest region with 42% of Group net revenue, reported 9.0% organic growth, with strong demand for digital solutions. In addition to the significant increase in Customer Transformation & Technology net revenue, client spend on advertising remained robust throughout the first half. Dentsu Inc., accounting for the half of the Japan business net revenue, significantly contributed with advertising remaining buoyant. The digital/consulting business maintained momentum throughout the quarter, supporting clients’ ever-growing needs for business and digital transformation. By company, Dentsu Inc., ISID and Dentsu Digital reported 4.2%, 20.8% and 10.1% organic growth, respectively. ISID grew over 20%, supported by strong demand from clients for digital transformation toward their business and operations.

SEPTENI HOLDINGS, consolidated in the first quarter, reported 11.9% organic growth and cements the Group’s position as the leader in digital advertising in Japan.

Together with the increase in net revenue, a transformed cost base contributed to the higher operating margin of 26.5%.

In May 2022, Dentsu Japan Network acquired two companies, IGNITION POINT Inc., a consultancy business in the Customer Transformation & Technology space, focused on Business Transformation (BX) & Digital Transformation (DX) and Dig into Inc., a digital marketing operations company (AX). The company’s name was changed to Dentsu Digital Anchor Inc. from June 1.

International business (Dentsu International)

By region:

- In the Americas, organic growth was 11.4%.

The Americas reported 11.4% organic growth in the first half with both Media and CXM reporting double digit organic growth. The US market continued to perform very strongly driven by new client wins and expansion of existing client relationships in Media. Canada continues to perform well on growing scope from existing clients within Media & Creative. The US and Canada offset weakness seen in Brazil & Mexico. - In EMEA, organic growth was 4.0%, excluding Russia was 7.2%.

CXM continued to report double digit growth in EMEA with particular strength in the UK market, Denmark and Germany. Creative momentum continued into the second quarter with Italy and the UK showing particular strength. Media saw client losses within certain markets within the region. Highlights include the UK reporting organic growth of 8.3%, Italy 10.8% and Denmark over 20%. - In APAC (excluding Japan), organic growth was 4.8%.

The APAC region saw strong growth from a number of markets including Australia, India, Korea, and Singapore. The Chinese market continued to be impacted by social restrictions due to COVID-19 which began to be lifted as the quarter progressed. India reported a very strong quarter, with organic growth up double digit, following increased scope from clients in both Creative & Media. Australia Q2 organic growth was 8% benefited from growing scope in our Gaming business supported by favorable growth in CXM and Media with strong pipeline conversion. Demand for data, tech enablement, and customer experience solutions remained high.

By service line:

- MEDIA

H1 organic growth for Media was 5.8% with double digit growth seen in the Americas and APAC. The Group’s largest clients continue to grow faster than the wider client base. The pipeline of opportunities in Media is strong at over $5 billion with a good mix of local and global clients. The pipeline is over 75% offensive opportunities.

Brand investment continues as clients wish to retain the premium price points of the products and services. - CREATIVE

Year-to-date the Creative service line reported just over 1% organic growth, with over 4% growth in EMEA and the Americas offset by weakness in APAC, particularly the Chinese market. The Creative service line launched the new integrated offer, Dentsu Creative. Dentsu Creative will serve as the sole creative network for Dentsu International. The launch is part of a broader strategy aimed at simplifying client engagement and injecting creativity across all client work at Dentsu International. FY2022 remains a year of transition for the Creative business under the new leadership of Fred Levron. - CXM

The CXM Service Line year-to-date reported growth of +13.6%, with double digit organic growth across all three regions. EMEA reported growth of over 20% with UK and Germany particular highlights in the second quarter. The acquisition of UK based Pexlify will further strengthen the client offer in the EMEA region, expanding our Salesforce capabilities. Revenue and cost synergies will be seen from the Pexlify acquisition. In APAC momentum remains strong in Australia with new business wins. The pipeline remains strong across all three regions.

RUSSIA COMMENTARY

- The Group has reached agreement in principle to sell the business to our local partners, subject to legal and binding agreements.

- Upon conclusion, the Group expects further charges related to the transfer. These charges will not impact underlying figures, affecting only statutory figures. The majority of the charges will be non-cash, relating to re-cycling of FX translation differences out of reserves and back through the income statement.

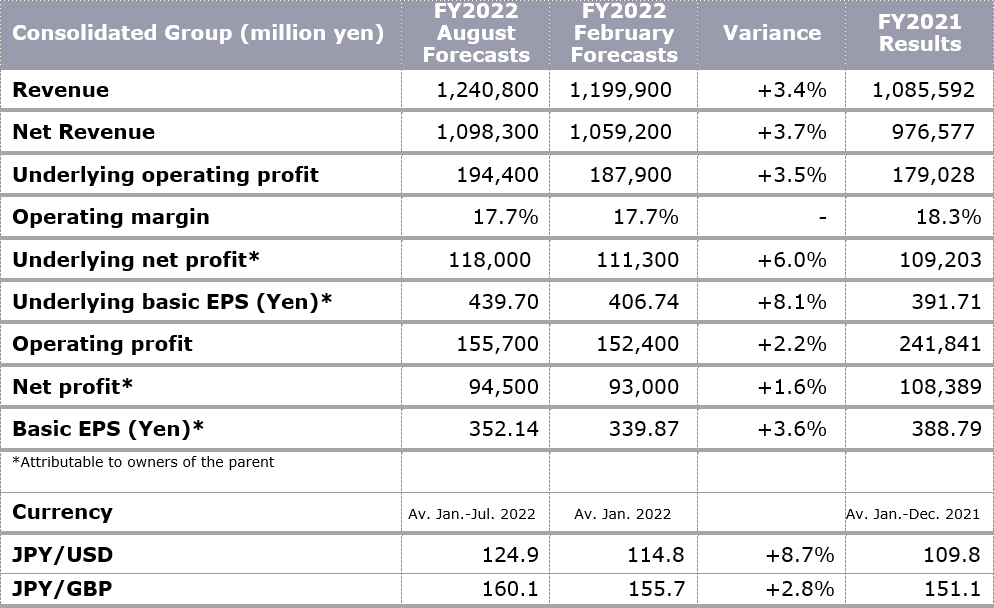

Forecast of Consolidated Financial Results for the FY2022 (IFRS)

Given the robust H1 FY2022 performance, the Group guides to the upper end of 4 to 5% organic growth with 17.7% operating margin, despite the dilutive impact of Russia on operating margins. Excluding the impact of Russia, the Group operating margin would reach 18.0%. Underlying basic EPS is today upgraded by 8.1% due to updated FX, a reduced tax rate at Dentsu International and the reduced number of shares following the buyback completed year to date.

The Group aims to progressively raise the dividend payout ratio to 35.0% of underlying basic EPS in FY2024, under the dividend policy in the Medium-term Management Plan. In FY2022 the payout ratio is expected to be 32.0% of underlying basic EPS. By taking the updated FY2022 guidance into account, the annual dividend per share forecast rises from 130.0 yen to 140.5 yen, and the interim dividend rises from 65.0 yen to 70.25 yen, both of which are record high since the Group listed. Compared to the previous fiscal year, the annual dividend per share is expected to increase by 23.0 yen and 39% yoy.

For further details please see the presentation on Dentsu Group Inc. website.

URL: https://www.group.dentsu.com/en/ir/

– Ends –

Definitions

- Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin: Underlying operating profit divided by Net revenue.

- Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS: EPS based on underlying net profit (attributable to owners of the parent).

Forward-Looking Statements

This material contains statements about Dentsu Group that are or may be forward-looking statements. All statements other than statements of historical facts included in this presentation may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “estimates”, “projects” or, words or terms of similar substance or the negative thereof, are forward-looking statements. Forward-looking statements include statements relating to the following: information on future capital expenditures, expenses, revenues, earnings, synergies, economic performance, and future prospects.

Such forward-looking statements involve risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof.

About Dentsu Group (dentsu)

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees dentsu’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees dentsu’s agency operations outside of Japan.

With a strong presence in approximately 145 countries and regions across five continents and with 65,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its five leadership brands—Carat, dentsu X, iProspect, Dentsu Creative, and Merkle—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website: https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | |

| MEDIA Please contact Corporate Communications |

Shusaku Kannan +81 3 6217 6602 s.kannan@dentsu.co.jp |

Dani Jordan +44 7342 076 617 dani@dentsu.com |

| INVESTORS & ANALYSTS Please contact Investor Relations |

Yoshihisa Okamoto +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart +44 7900 191 093 kate.stewart@dentsu.com |