Dentsu Group Inc. Q3 FY2021 Consolidated Financial Results

Nov 12, 2021

- IR-Timely Disclosure

- Management

(The third quarter ending September 30, 2021 – reported on an IFRS basis)

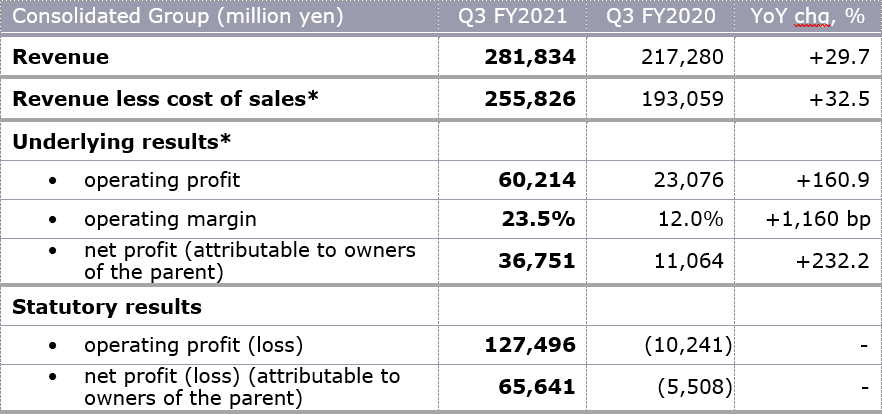

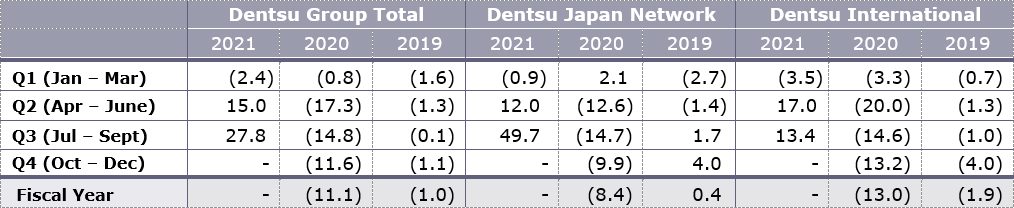

The third quarter results show a recovery across the Group, with organic growth at 27.8% and underlying operating margin +1,160 bp yoy.

Dentsu Japan Network saw an exceptionally strong quarter, +49.7% organic growth, exceeding expectations following a recovery across all advertising mediums, with particular strength in television and digital solutions.

Dentsu International reported double digit organic growth, +13.4%, strengthened by the continued recovery in Media +17.3% as clients recognize the importance of brand investment to drive growth. CXM also saw double digit organic growth, 11.2%.

Strength in the structural growth areas of commerce and experience continued, with demand strong for technology implementation, data services and activation, through creative and media.

Operating margin was substantially ahead of the prior year, showing the gearing effect of higher revenue together with the impact of continued cost reductions.

The Group today raises FY2021 guidance for Group organic growth to 12.0%, with Group margins raised to 18.0% (+320 bp, yoy) from 16.4% previously. Fourth quarter margins are expected to be lower yoy due to phasing of investments, despite this, FY2021 underlying operating profit is expected to be over 40% higher yoy. FY2021 annual dividend per share guidance is raised to JPY 113.5, a record high. The Group remains well positioned to benefit from the structural growth in Customer Transformation & Technology in 2022 and beyond.

Dentsu Group Inc. today announces a number of management changes, including Hiroshi Igarashi’s appointment as Representative Director, President and CEO, Dentsu Group Inc. and Norihiro Kuretani as President and CEO, Dentsu Japan Network, with a number of changes to the Board to lead Dentsu Group to the next stage of growth. The changes will support the Group in achieving the goals of the medium-term management plan ending in FY 2024 and driving continued sustainable growth in the years ahead.

Q3 (July to Sep) FY2021 Financial Results Summary

*See below for definitions

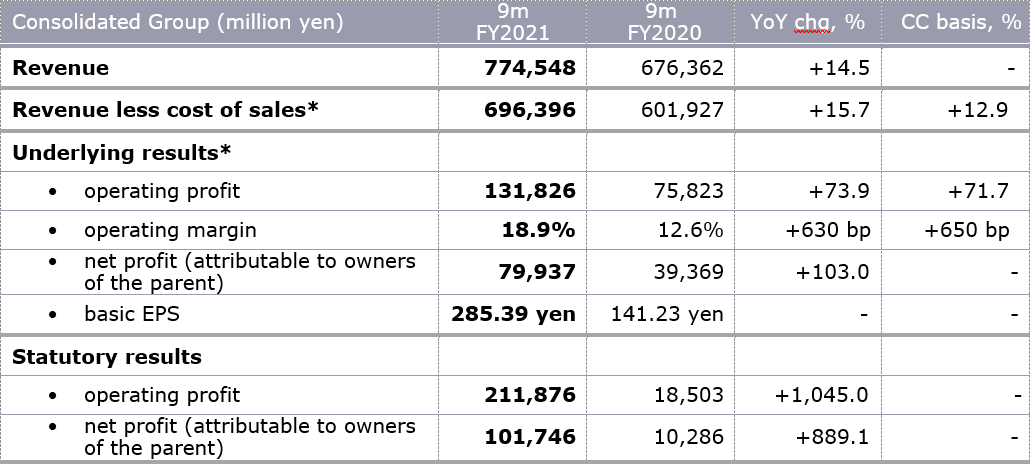

9m (Jan-Sep) FY2021 Financial Results Summary

*See below for definitions

9m (Jan to Sep) FY2021 Results: Key Financials

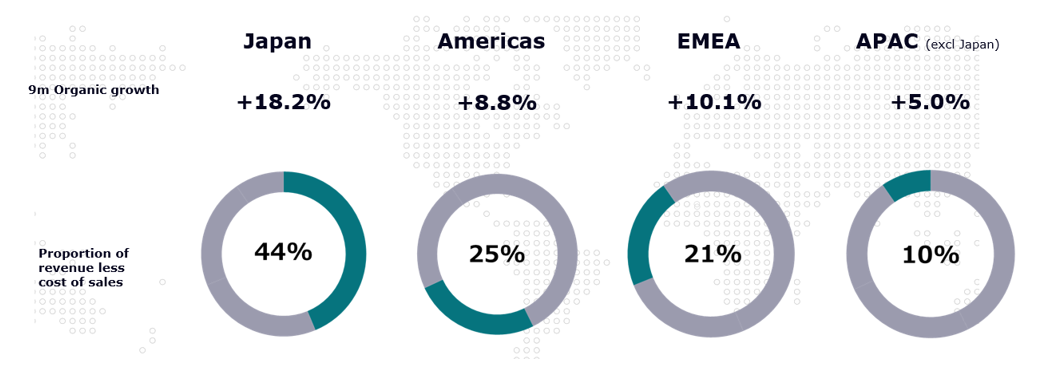

9m Group revenue (LCoS) JPY 696.3 bn (YoY +15.7%, +12.9% constant currency basis)

- 19.4% growth in revenue (LCos) at Dentsu Japan Network, and 12.9% (8.3% on a constant currency basis) at Dentsu International.

- Revenue (LCoS) increased due to organic growth of JPY 78.0 bn, currency positively impacted by JPY 14.8 bn, and M&A contributed JPY 1.5 bn.

9m Group organic growth was 12.6%.

- 18.2% organic growth at Dentsu Japan Network, and 8.6% at Dentsu International. 9m FY2021 saw a significant rebound in performance due to the increase in advertising across all mediums as Japanese consumer confidence continued to increase.

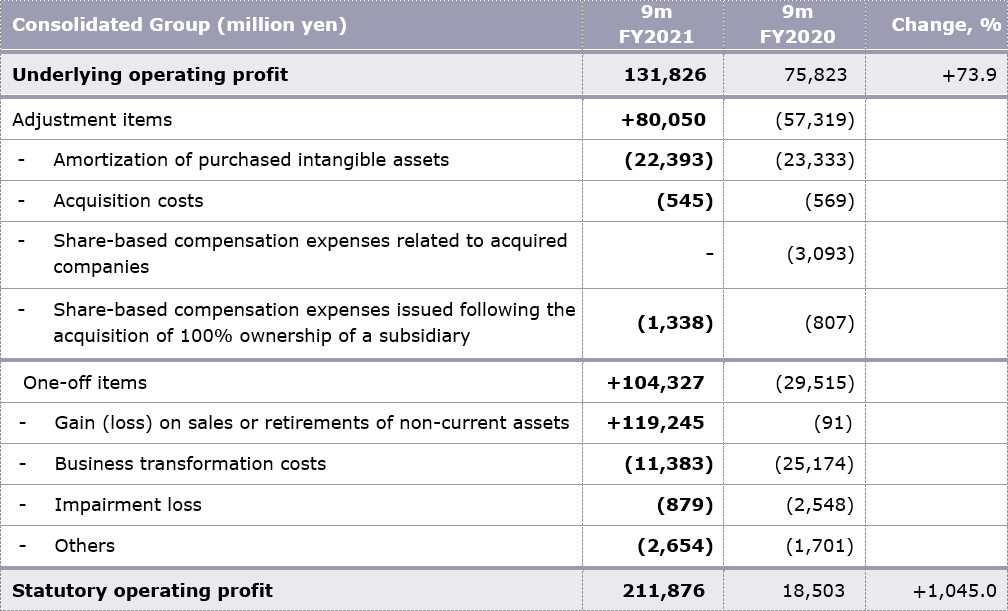

9m Group underlying operating profit increased by 73.9% (71.7% on a constant currency basis) yoy to JPY 131.8 bn. Operating margin improved by 630 bp (650 bp on a constant currency basis) to 18.9% reflecting operating leverage from higher revenues and the continued focus on costs across the Group.

- At Dentsu Japan Network, underlying operating profit was JPY 82.0 bn (YoY +87.4%); operating margin of 26.9% (YoY +980 bp).

- At Dentsu International, underlying operating profit was JPY 53.5 bn (YoY +49.3%, +45.5% on a constant currency basis); operating margin of 13.7% (YoY +330 bp, +350 bp on a constant currency basis).

9m Group statutory operating profit increased by 1,045% to JPY 211.8 bn.

- Statutory operating profit helped by gain on sale of non-current assets of JPY 119.2 bn, including the sale of Dentsu headquarters building sold on September 30.

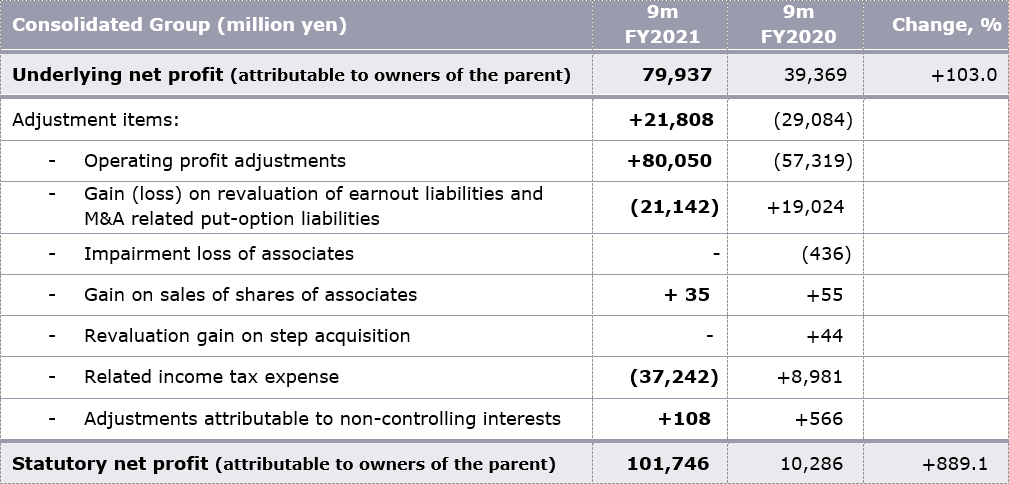

9m Group underlying net profit (attributable to owners of the parent) increased by 103.0% mainly due to the increase of underlying operating profit.

- The underlying basic EPS of JPY 285.39 (9m FY2020: JPY 141.23).

9m Group statutory net profit increased by 889.1% to JPY 101.7 bn.

- Statutory net profit increased due to the increase of statutory operating profit, partially offset by the charge of net finance costs, net by JPY 39.8 bn, and the increased income tax expenses.

9m (Jan to Sep) FY2021 Organic Growth and Proportion of Revenue (LCoS) by Region

Quarterly Organic Revenue Performance

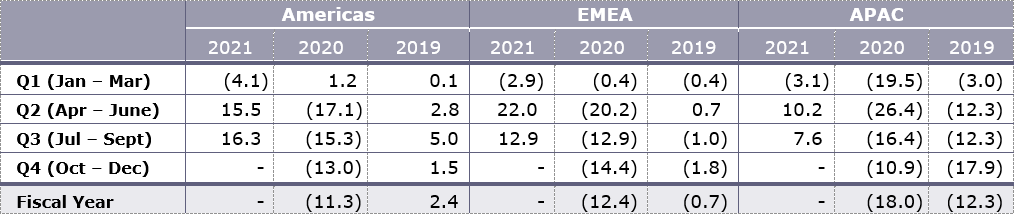

Quarterly Organic Revenue Performance for Dentsu International by Region

Toshihiro Yamamoto,

President and CEO, Dentsu Group Inc., said:

“ After 40 years of service, and five years leading Dentsu Group, I will be stepping down from my role as President and CEO of Dentsu Group Inc. at the end of the year.

It has been an honor and a privilege to serve a company with such a rich history in such an exciting, fast paced industry.

Over the past 12 months we have laid the foundation for the company to achieve sustainable growth and the third quarter results show a company that’s recovering, capitalizing on the market opportunities with rebounds across all business lines.

Under new leadership from within, and with a refreshed Board, Dentsu Group will accelerate the path forward to become the world’s leading organization that transforms our client’s business, driving top line growth through the power of our creativity, technology, and people.

I have been the proud custodian of Dentsu Group for five years and I am confident that, Hiroshi Igarashi, Wendy Clark and Norihiro Kuretani will lead our people, our clients and our business into a new and exciting chapter of change and growth from 2022.

I would like to extend my thanks to all our clients, partners, shareholders and all our 64,000 talented employees for their continued support and I believe that everyday, together, we are one step closer to achieving our vision to realize a better society.”

9m FY2021 Business Updates

Revenue less cost of sales from digital and Customer Transformation & Technology

- Total revenue (LCoS) from digital activities grew to 51.9% (9m FY2020: 52.7%, YoY -80 bp, (cc: +10 bp)), including 34.0% in Dentsu Japan Network (YoY: +80 bp), and 65.8% in Dentsu International (YoY: -130 bp (cc: +90 bp)).

- Total revenue (LCoS) from Customer Transformation & Technology reached 28.7% (9m FY2020: 27.7%, YoY +90 bp, (cc: -70 bp)) of Group revenue (LCoS). 23.2% (YoY -80 bp) for Dentsu Japan Network and 32.9% (YoY +240 bp, (cc: -30 bp)) for Dentsu International.

- The Group remains committed to reaching 50% of Group revenue (LCoS) from Customer Transformation & Technology over time.

Business updates by business segment

- For the third quarter, in line with a global recovery from the pandemic, business confidence and consumer sentiment has steadily increased, boosting demand for TV and digital (internet) advertising across all markets. The 2020 Olympic and Paralympic Games additionally boosted that demand in Japan.

- Dentsu Japan Network reported 18.2% organic growth in 9m FY2021 and 49.7% in Q3 FY2021.

In Japan, Client spend increased as consumer confidence returned to the Japanese economy in the third quarter and has continued as COVID-19 related restrictions continue to be lifted. Client spend across all advertising mediums continued to recover with Dentsu Japan Network seeing an improvement driven by Internet sales +35.6%. Content services (+355.5% yoy), TV (+35.3% yoy) and Creative (+14.7% yoy) also showed a substantial increase. The largest company, Dentsu Inc.’s organic growth significantly improved to 20.5% in 9m FY2021, giving confidence our solutions are well-placed to meet clients’ needs. All sectors traded well, but technology, beverages, financials and luxury goods were particular stand out.

The digital solutions business continued its momentum, supporting client needs for digital transformation, with specialists across Japan collaborating from ISID, Dentsu Digital and Dentsu Inc. around the needs of our clients’. Dentsu Digital reported organic growth of 40.9% in 9m FY2021 while CARTA HOLDINGS reported organic growth of over 15.8%. Collaboration between Septeni and Dentsu Digital continues with the number of shared clients continuing to grow.

On October 28, the Group announced that it would make Septeni Group a consolidated subsidiary on January 4, 2022, expanding Dentsu Japan Network’s market share to become the largest digital marketing company in Japan. The deal will bring additional expertise into Dentsu Japan Network, allowing the Group to bid on larger scale projects and also brings complementary client exposure to Dentsu Japan Network.

Today management changes were also announced for Dentsu Japan Network, including the appointment of Norihiro Kuretani as President and CEO, Dentsu Japan Network, and President and CEO, Dentsu Inc. - Dentsu International reported 8.6% organic growth in 9m FY2021 and 13.4% in Q3 FY2021

- Americas reported 8.8% organic growth 9m FY2021 and 16.3% in Q3 FY2021.

- The US market reported 16% organic growth in the third quarter driven by media which reported over 25% organic growth in the quarter, with the month of September particularly strong. Increased spend and expanding scope from existing clients was complemented by a number of new client wins.

Demand remains strong for CXM services, despite resilient revenues in 2020, with over 20% growth in commerce and experience; the B2B practise area saw over 30% growth. Clients continue to invest in personalised customer experiences to differentiate their offer.

The Creative business in the Americas reported almost 20% organic growth in the quarter driven by incremental projects from existing clients and the return of some experiential marketing events, particularly in beverages.

Canada recorded Q3 organic growth of 19% while Brazil saw a number of client losses impact revenue.

- EMEA reported 10.1% organic growth in 9m FY2021 and 12.9% in Q3 FY2021.

- Media and CXM both reported double digit organic revenue growth across EMEA in the third quarter, with September a record revenue month for CXM. Creative revenues continued to be impacted due to exposure to experiential and live events.

The UK market grew 15% organic in the third quarter due to strong media revenues as clients look to maintain share of voice with continued brand investment.

In Europe, Denmark, Germany, Italy, Russia, Sweden and Switzerland all reported double digit organic revenue growth boosted by client media spend.

- APAC (ex.Japan) reported 5.0% organic growth 9m FY2021 and 7.6% in Q3 FY2021

- Australia reported over 20% organic growth in the third quarter boosted by strength in creative services. Singapore and Indonesia also performed very well following strong new business wins in media and higher than expected growth in CXM. China reported a decline in organic revenues due to shortfalls in the Creative business due to a number of delayed projects. Media partially offset this with the expansion of scope from multi-national clients operating in China. CXM performed well in China with a number of new client wins across a range of industries. India returned to growth reporting 9% organic growth for the quarter.

Changes to Dentsu Group Inc.’s management and Board

Dentsu Group Inc. today announces a new era of leadership to build on current momentum and lead the Group into the next phase of growth.

- Toshihiro Yamamoto to retire from roles of President and CEO, Dentsu Group Inc., and Hiroshi Igarashi, President and CEO of Dentsu Japan Network, to succeed as President and CEO, Dentsu Group Inc., effective January 1, 2022

- Tim Andree to become Non-Executive Chairman of the Board, Dentsu Group Inc., effective March 2022

- The Board broadens its global experience and diversifies capabilities across industries through the appointment of four new Independent Outside Directors, effective March 2022

Under Tim Andree’s Chairmanship, four new Independent Directors will be nominated at the March AGSM to the Group’s Board, with four retirements also to come into effect. The new appointments represent a cross-section of leaders, across a broad range of capabilities including global corporate management, digital, finance and audit to reinforce the governance that is the foundation of future growth.

These changes are far reaching and provide the group with a broad range of capabilities including corporate management, digital, finance and audit to reinforce the governance that is a foundation of future growth.

For full details please see the news release on the Dentsu Group Inc. website.

URL: https://www.group.dentsu.com/en/news

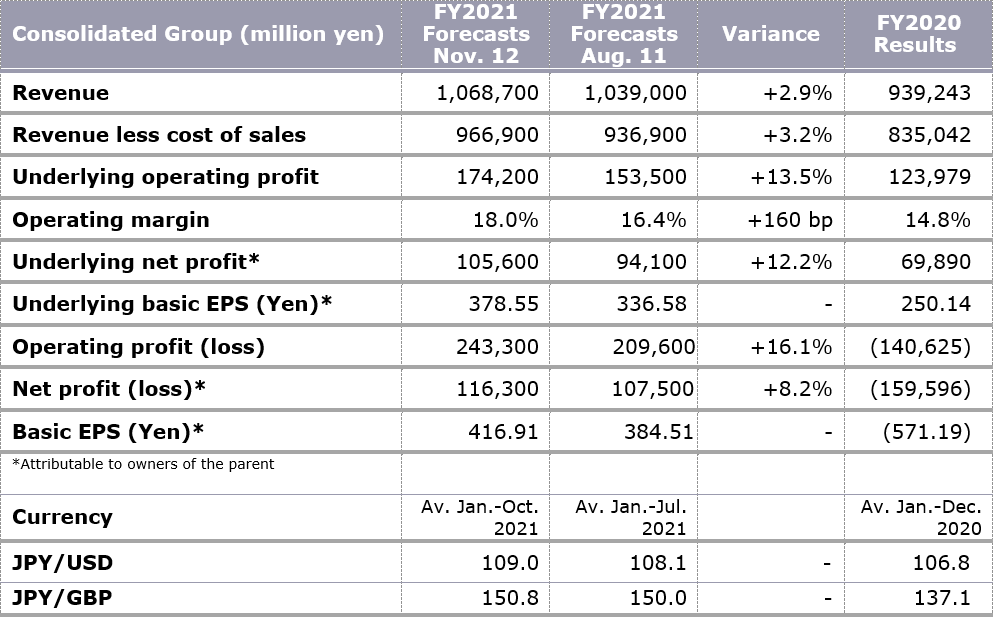

Revised Forecast of Consolidated Financial Results for the FY2021 (IFRS)

The Group has upwardly revised FY2021 guidance. The Group now expects to deliver approx. 12.0% organic growth for FY2021. Following the exceptional performance in the third quarter, growth in the fourth quarter in Japan is expected to be more modest, leading to guidance of approx. 17.0% organic growth FY2021 with guidance for Dentsu International at high single digit organic growth FY2021.While group margin delivery has been strong up to the 9m stage, due to phasing of timing of investments in talent, training and technology, the fourth quarter margins are expected to be lower year-on-year. FY2021 margin guidance is 23.5% for Dentsu Japan Network and 15.0% for Dentsu International, implying a consolidated margin improvement of 310 bp yoy at 18.0%.

One of the major factors reflected in the FY2021 forecast is the total gain on sale and other associated expenses (net) associated with the sale of the headquarter building in the third quarter. It had a one-time positive impact on operating profit of approximately JPY 87.0 bn and net profit attributable to owners of the parent of approximately JPY 49.0 bn.

Business transformation cost is also reflected in the FY2021 forecast. The cost estimate was reduced to JPY 16.0 bn from JPY 28.0 bn as of August 2021 on a consolidated basis. The charge of JPY 14.5 bn is expected at Dentsu Japan Network and JPY 1.5 bn at Dentsu International due to lower than anticipated costs to achieve the targeted savings.

– Ends –

Dividends

The Group aims to progressively raise the dividend payout ratio to 35% of underlying basic EPS over the next few years from FY2021, under our renewed dividend policy in the Medium-term Management Plan. In FY2021 the payout ratio is expected to be 30% of underlying basic EPS. By taking the updated FY2021 guidance into account, the dividend per share forecast rises from 101.0 yen to 113.5 yen, which is a record annual dividend payment.

Appendix

Reconciliation from Underlying to Statutory Operating Profit, 9m FY2021

Reconciliation from Underlying to Statutory Net Profit in 9m FY2021

Definitions

- Revenue less cost of sales : The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit : KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin : Underlying operating profit divided by Revenue less cost of sales (LCoS).

- Underlying net profit (attributable to owners of the parent) : KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS : EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA : Operating profit before depreciation, amortization and impairment losses.

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: https://www.group.dentsu.com/en/ir/

About Dentsu Group (dentsu)

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 64,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its six leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, and Merkle—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website: https://www.group.dentsu.com/en/

For Additional Inquiries

| Tokyo | London | |

|---|---|---|

| Media – Please contact Corporate Communications: |

Shusaku Kannan: +81 3 6217 6602 s.kannan@dentsu.co.jp |

Dani Jordan: +44 7342 076 617 dani@dentsu.com |

| Investors & analysts – Please contact Investor Relations: |

Yoshihisa Okamoto: +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 kate.stewart@dentsu.com |