Dentsu Group Inc. Q1 FY2021 Consolidated Financial Results

May 14, 2021

- IR-Timely Disclosure

- Management

(The first quarter ended March 31, 2021 – reported on an IFRS basis)

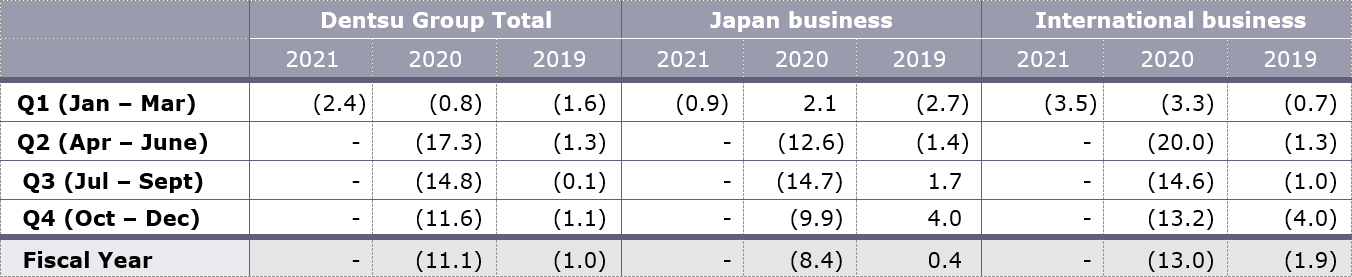

Q1 FY2021 organic revenue growth saw a further progressive improvement as client confidence returned and spend increased. Organic revenue decline of -2.4% was expected for Q1 FY2021, reflecting pre-COVID-19 comparators. However, there was progressive recovery during the quarter, with March showing a return to growth at 2.5%. Underlying operating margin was substantially ahead of the prior year reflecting one time operating cost reductions in Japan and the continued impact of cost actions that took effect from the second quarter in FY2020 in the international business. Good progress has been made against the Comprehensive Review to accelerate the Group’s transformation. Looking ahead, the Group remains well positioned to benefit from the post-pandemic recovery in media & digital solutions and structural growth in Customer Transformation & Technology.

- Q1 FY2021 total revenue less cost of sales (LCoS) declined -1.8% (on a constant currency basis (cc)) and organic revenue declined -2.4%. In Q1 FY2021, Dentsu Japan Network organic revenue declined -0.9% and Dentsu International organic revenue declined -3.5%.

- Q1 FY2021 Group underlying operating margin increased +400 bp (cc) yoy to 20.2% due to continued cost actions across the Group. Statutory operating profit was JPY 28.8 bn due to an increase in underlying operating profit, partially offset by an increase of business transformation costs previously announced in Q4 FY2020. Net cash flows from operating activities increased JPY 30 bn due to a decrease of working capital.

- The Group has had a very encouraging start to the year, with improving trends across the business, yet given the macro uncertainty in a number of major markets, retains its FY2021 guidance of delivering positive organic revenue growth on a full year basis with underlying operating margin broadly flat on a constant currency basis. The Group expects to be able to share FY2021 financial forecasts at the H1 FY2021 results in August.

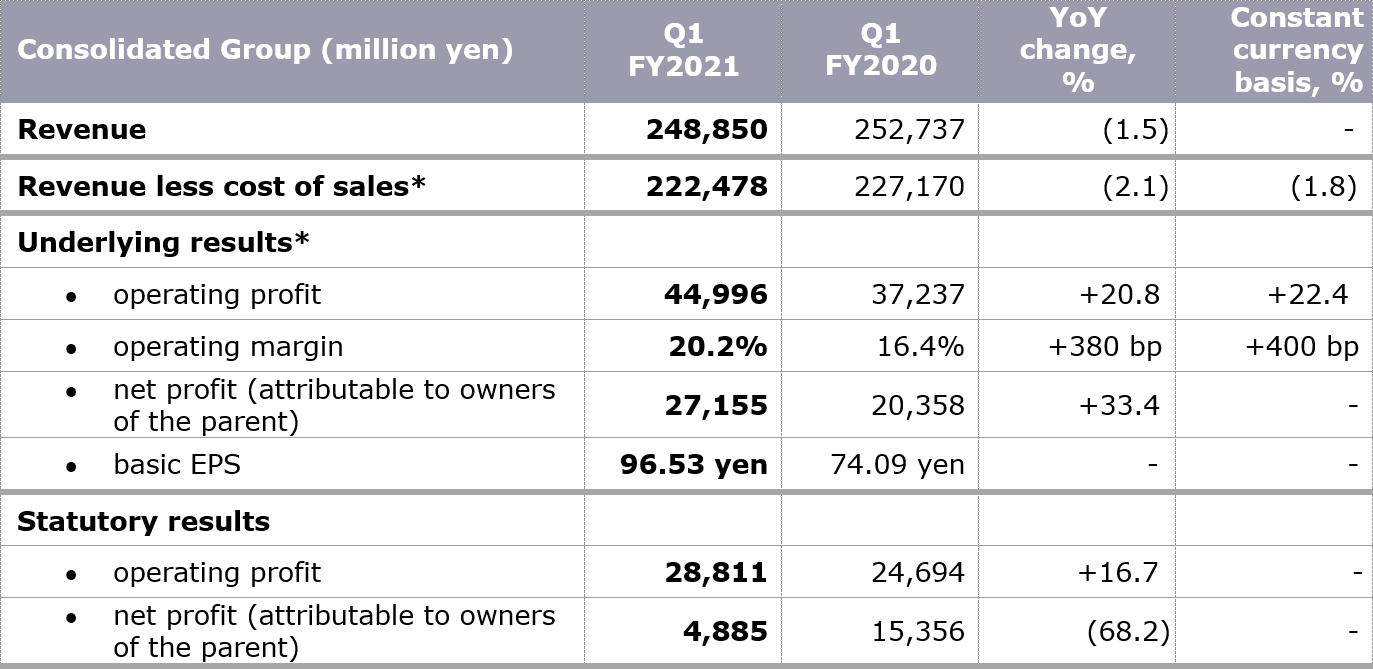

Q1 FY2021 Financial Results Summary

*See below for definitions

Q1 FY2021 Results: Key Financials

Group revenue (LCoS): JPY 222.4 bn (YoY -2.1%, or -1.8% on a constant currency basis).

- +0.0% at Dentsu Japan Network, and -3.5% (-3.1% on a constant currency basis) at Dentsu International.

- Revenue (LCoS) declined due to organic revenue decline of JPY 5.5 bn, M&A contributed JPY 0.6 bn, and currency positively impacted by JPY 0.2 bn.

Group organic revenue decline was -2.4%.

- -0.9% at Dentsu Japan Network, and -3.5% at Dentsu International.

- The pre-COVID-19 comparators impacted the first quarter performance across the Group, with the speed of recovery varying by region.

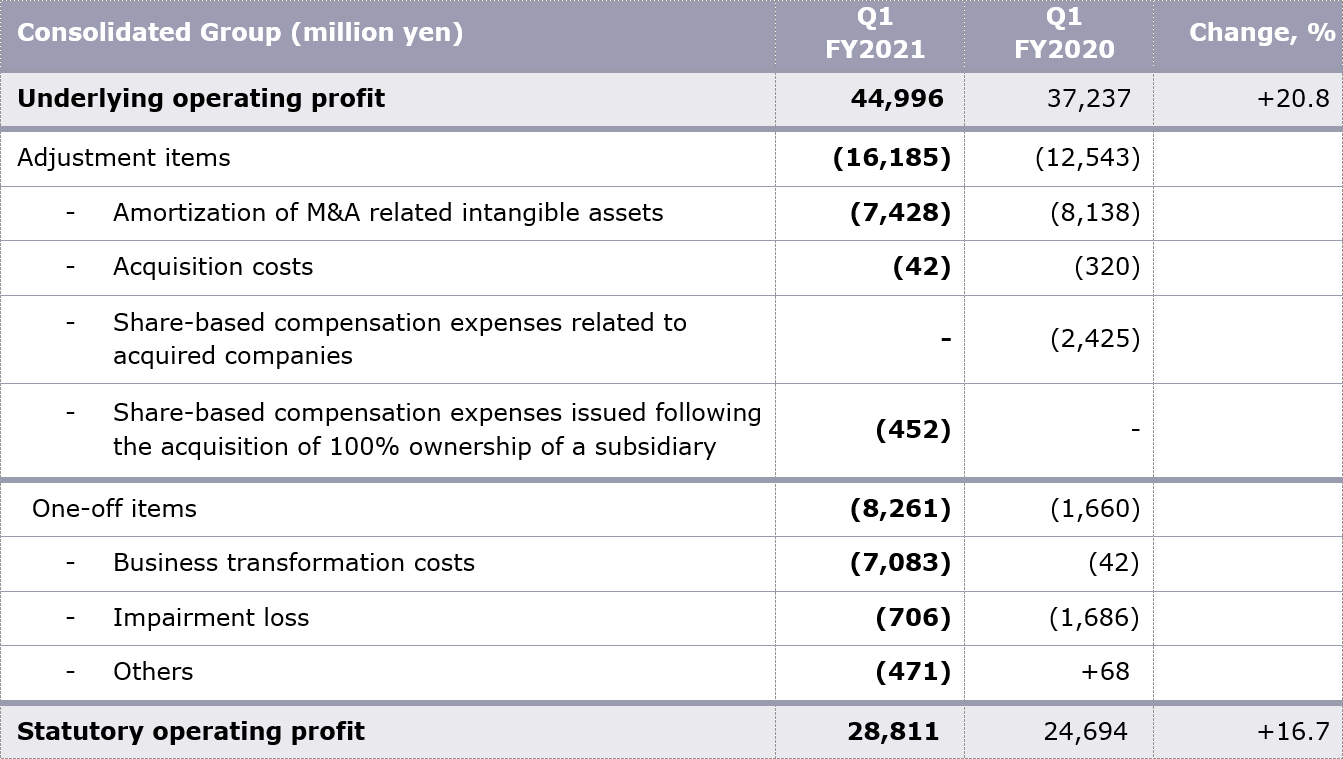

Group underlying operating profit increased by 20.8% (22.4% on a constant currency basis) yoy to JPY 44.9 bn. Underlying operating margin improved by 380 bp (400 bp on a constant currency basis) to 20.2%.

- At Dentsu Japan Network, underlying operating profit was JPY 33.9 bn (YoY +12.1%) due to one- time operating cost reductions, with operating margin of 32.8% (YoY +350 bp). Operating costs and general expenses are expected to rise as the year progresses with the principal benefit of the permanent cost savings to come in FY2022.

- At Dentsu International, underlying operating profit was JPY 12.2 bn (YoY +41.8%, +49.7% on a constant currency basis) reflecting the robust cost measures that were implemented last year to protect profitability. The operating margin was 10.3% (YoY +330 bp, +360 bp on a constant currency basis). The margin comparables become more challenging from the second quarter onwards, but Dentsu International still expects to deliver modest margin improvement yoy.

Group statutory operating profit increased by 16.7% to JPY 28.8 bn.

- Previously announced business transformation cost of JPY 7.0 bn partially offset the increase of underlying operating profit.

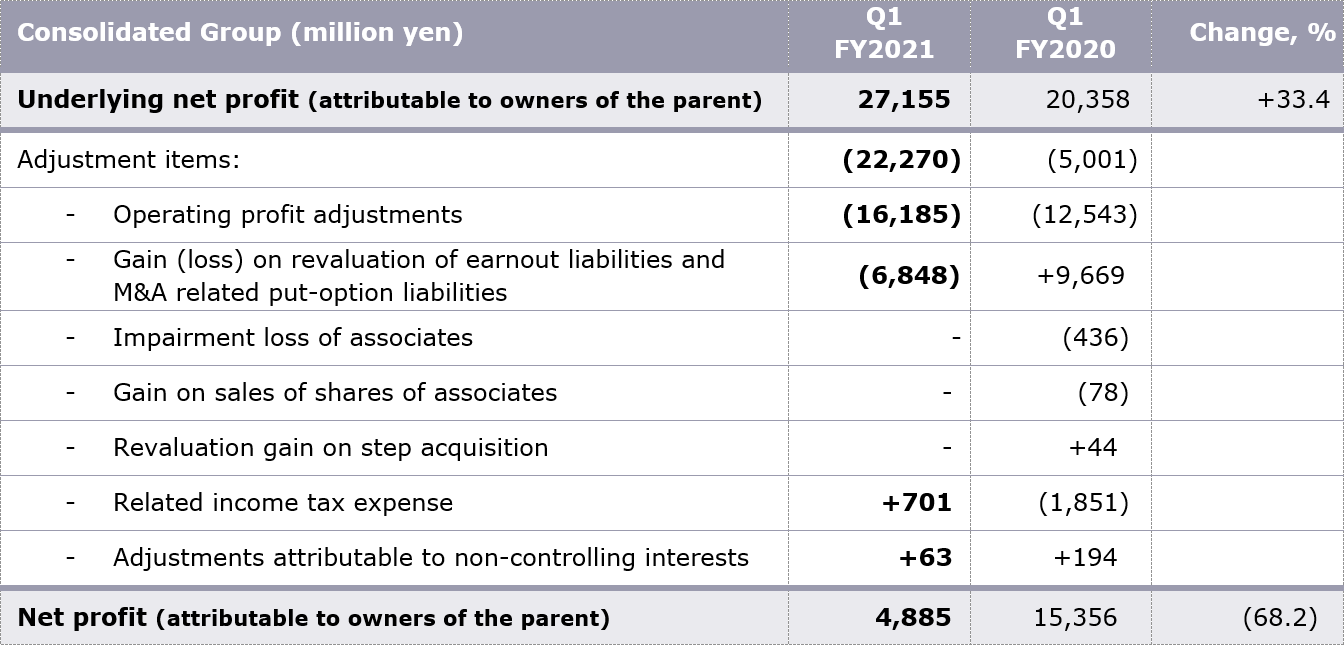

Group underlying net profit (attributable to owners of the parent) increased by 33.4% mainly due to the increase of underlying operating income.

- The underlying basic EPS was JPY 96.53 (Q1 FY2020: JPY 74.09).

Group statutory net profit decreased by 68.2% to JPY 4.8 bn.

- Due to the charge on revaluation of earn-out liabilities and M&A related put-option liabilities as the expected performance of the assets under earn-out improved yoy.

Outlook

- The Group has had a very encouraging start to the year, with improving trends across the business, yet given the macro uncertainty in a number of major markets, retains its FY2021 guidance of delivering positive organic revenue growth on a full year basis with underlying operating margin broadly flat on a constant currency basis. The Group expects to be able to share FY2021 financial forecasts at the H1 FY2021 earnings announcement in August.

- The Group remains confident in the mid- term targets of organic growth of 3-4% CAGR 2021-4 with annual improvement in operating margins, and confirms its policy of a progressive dividend, reaching 35% payout ratio over the next few years.

Toshihiro Yamamoto,

President and CEO, Dentsu Group Inc., said:

Our first quarter results showed a continued progressive improvement in our organic performance despite the pre-COVID-19 comparators facing the Group for most of the quarter. Consumer and client confidence is returning, and this is reflected in the positive momentum in our revenue growth. Profit has been particularly strong, demonstrating our relentless focus on costs and commitment to growing our margins.

Uncertainties remain about the progress of the pandemic, and, in particular, with new waves affecting several countries. However, we believe that our momentum will continue to build, underpinning the medium-term commitments we gave in February.

Our people across the Group have continued to show dedication and diligence with many still working from home. I would like to offer them all my full thanks and appreciation.

Strong progress has been made against each of the four objectives of our comprehensive review to accelerate the transformation of our business. We are tracking ahead of many of our internal targets and demonstrating that we are prepared to take unprecedented action to transform our service to clients and give returns to shareholders. This includes radical rationalisation of brands and divestment of assets.

As we look forward to the remainder of 2021 and beyond, Dentsu Group remains well positioned to benefit from the cyclical recovery in digital solutions and media spend, combined with our leading position in the structural growth area of Customer Transformation & Technology. Client demand for CX Transformation services, commerce and loyalty and B2B services remains strong as our clients adapt to meeting their consumers wherever and however they choose to engage with brands.

Our unique opportunity is in the seamless integration of our services to provide bigger, more comprehensive answers for our clients. We are combining our strengths in consumer intelligence, modern creative, data and technology to deliver top line growth for our clients through Integrated Growth Solutions.

Q1 FY2021 Business Updates

Revenue less cost of sales from digital and Customer Transformation & Technology

- Total revenue (LCoS) from digital activities grew strongly to 51.3% (Q1 FY2020: 48.1% YoY +310 bp, (cc: +410 bp), including 35.7% in Dentsu Japan Network (Q1 FY2020: 29.2%), and a record 64.7% in Dentsu International (Q1 FY2020: 64.2%).

- Total revenue (LCoS) from Customer Transformation & Technology reached 29.1% of Group revenues, 24.0% for Japan and 33.5% for Dentsu International.

- The Group remains committed to reaching 50% of Group revenue (LCoS) from Customer Transformation & Technology over time.

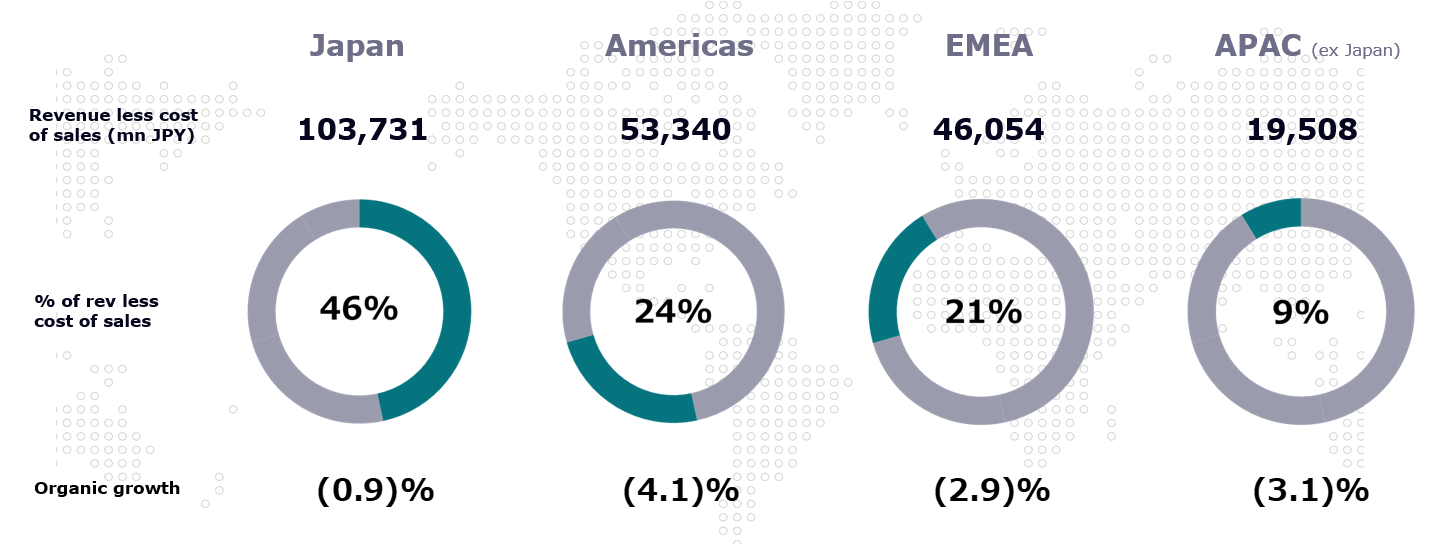

Revenue less cost of sales by Region

-

The regional organic growth performance reflects the differing speed of impact of the pandemic across the globe, with earlier recovery seen across Japan and APAC.

-

Dentsu Japan Network (DJN), Q1 FY2021 its organic revenue decline -0.9%.

In Japan, client spend on advertising continued to recover and Dentsu Japan Network saw an improvement through the first quarter with March reporting mid-single-digit growth. The digital solutions business continued its momentum, supporting client needs for digital transformation. ISID, Dentsu Digital and CARTA HOLDINGS significantly contributed to Group revenue (LCoS), and Dentsu Inc.’s organic revenue decline significantly improved to -1.9% in Q1 FY2021 from -13.2% for FY2020, giving confidence our solutions are well-placed to meet clients’ needs.

As part of the comprehensive review, Dentsu Japan Network is undergoing simplification with the announcement of mergers of four DJN companies consolidated into two. Dentsu Isobar in Japan will be consolidated into Dentsu Digital and DA search & link into Dentsu Direct Marketing on July 1, 2021. Combining these brands creates easier access to talent for our clients and strengthens the brands within the network. FY2021 is the year of transformation for DJN and additional initiatives will be announced as the year progresses. -

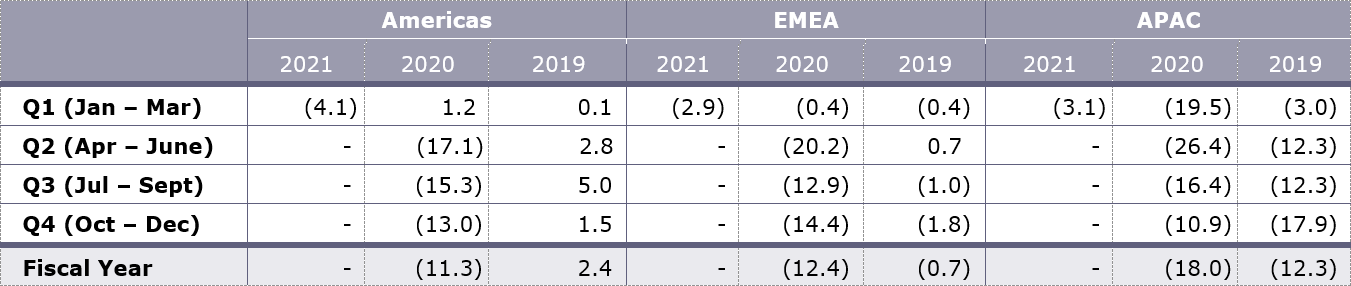

Americas, Q1 FY2021 organic revenue decline -4.1%

North America reported Q1 organic revenue decline of -3.8%, impacted by pre-COVID-19 comparators due to a stellar performance of CXM service line in Q1 FY2020. Merkle in particular remains well positioned to see a significant pick up in revenues in FY2021 as clients increasingly focus on first party data combined with robust ecommerce and D2C strategies. US Media service line recorded a strong performance in Q1 FY2021, up mid-single digit, benefitting from a combination of new client wins in FY2020, scope expansion from existing clients and an overall improvement in client spend. The Creative service line was impacted by client losses in FY2020 and a reduction in revenue associated with our events business. -

EMEA, Q1 FY2021 organic revenue decline -2.9%

The EMEA region saw continued improvement throughout the quarter with March reporting over 3% positive organic growth despite many COVID-19 restrictions still in place across the region. Germany and Switzerland posted positive organic growth for the quarter, with all other markets recording organic revenue decline. CXM was flat yoy and whilst Media improved as the quarter progressed. The Creative reported organic decline, but excluding our events business, would have been flat for the quarter. -

In APAC (excluding Japan) Q1 FY2021 organic revenue decline -3.1%

The APAC region also saw continued improvement throughout the quarter, reporting positive organic growth for March. Client confidence is improving across the region with positive growth for the quarter recorded in India, Indonesia, Singapore and Taiwan. China saw a number of new business wins across all three service lines. The Creative in APAC was flat for the quarter as client spend returned, while Media saw improvement throughout the quarter. Pitch activity across the region is increasing across all three service lines.

Quarterly Organic Revenue Performance

Quarterly Organic Revenue Performance for Dentsu International by Region

Comprehensive Review Update

In August 2020, the Group announced a comprehensive review to accelerate the structural reform and business transformation required to return the Group to growth and deliver margin improvement.

The review launched with four clear objective and progress against each objective has continued in the first quarter.

1. Create a simplified structure, benefitting both clients and internal operations

The Group is proceeding with an unprecedented reorganization that will deliver a simplified, integrated and more efficient organization that is easier for our clients to navigate, reducing duplication and complexity across the business. Dentsu Japan Network announced the mergers of two DJN companies to be completed on July 1, 2021. It will strengthen the CX and DX business domains and its competitiveness while maximizing the power of the individual companies in the network. Dentsu International simplification has seen the rationalisation of over 50 brands year-to-date, ahead of internal targets.

2. Structurally and permanently lowering operating expenses

Dentsu Japan Network has begun to deliver permanent cost reductions due to the voluntary early retirement program at Dentsu Inc. in FY2020. Dentsu International has dramatically accelerated the cost savings, announced on December 7, 2020, driven by the re-negotiation of over 50 property leases and previously announced headcount reduction.

The Group remains confident in delivering JPY 75 bn cost reductions from FY2022.

3. Enhance the efficiency of our balance sheet

In the first quarter the Group announced the sale of two property assets in Japan, generating a gain on the sale of fixed assets of approximately JPY 30.0 bn in Q2 FY2021. The sale of these assets will improve capital efficiency, further strengthen the Group's financial structure, and secure funds to invest for growth. The Group also announced the sale of all 2.59 million shares in Macromill Inc. The Group will continue to review all non-trading assets including cross-shareholdings to improve long-term shareholder value. The review of the Shiodome headquarters building is progressing.

4. Maximizing long-term shareholder value

A buyback of JPY 30.0 bn was approved by the Board and announced in February 2021 as we look to improve long-term shareholder value. We will continue to consider further shareholder returns following the sale of any additional exceptional assets.

The Group remains committed to its mid-term targets shared in February:

Dentsu Group’s Mid-term Targets 2021:2024

– Ends –

Appendix

Reconciliation from Underlying to Statutory Operating Profit, Q1 FY2021

Reconciliation from Underlying to Statutory Net Profit in Q1 FY2021

Definitions of “underlying” and “EBITDA”

- Revenue less cost of sales : The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit : KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin : Underlying operating profit divided by Revenue less cost of sales (LCoS).

- Underlying net profit (attributable to owners of the parent) : KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS : EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA : Operating profit before depreciation, amortization and impairment losses.

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: https://www.group.dentsu.com/en/ir/

About dentsu

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 65,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its eight leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, Merkle, MKTG and Posterscope—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website: https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | |

|---|---|---|

| MEDIA Please contact Corporate Communications: |

Shusaku Kannan +81 3 6217 6602 s.kannan@dentsu.co.jp |

Manus Wheeler +44 20 7070 7785 manus@dentsu.com |

| Investors & analysts Please contact Investor Relations: |

Yoshihisa Okamoto +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart +44 7900 191 093 kate.stewart@dentsu.com |