Dentsu Group Inc. FY2020 Consolidated Financial Results

Feb 15, 2021

- IR-Timely Disclosure

- Management

(The full year ended December 31, 2020 – reported on an IFRS basis)

FY2020 organic revenue performance was ahead of guidance, with the fourth quarter ahead of expectations. FY2020 underlying operating margin was broadly maintained, demonstrating swift cost action throughout the year, mitigating top-line decline. Significant progress has been made against the Comprehensive Review to accelerate the Group’s transformation.

The Group today announces a share buyback of JPY 30.0 bn.

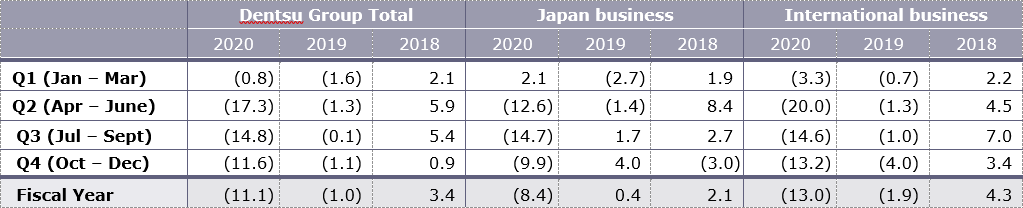

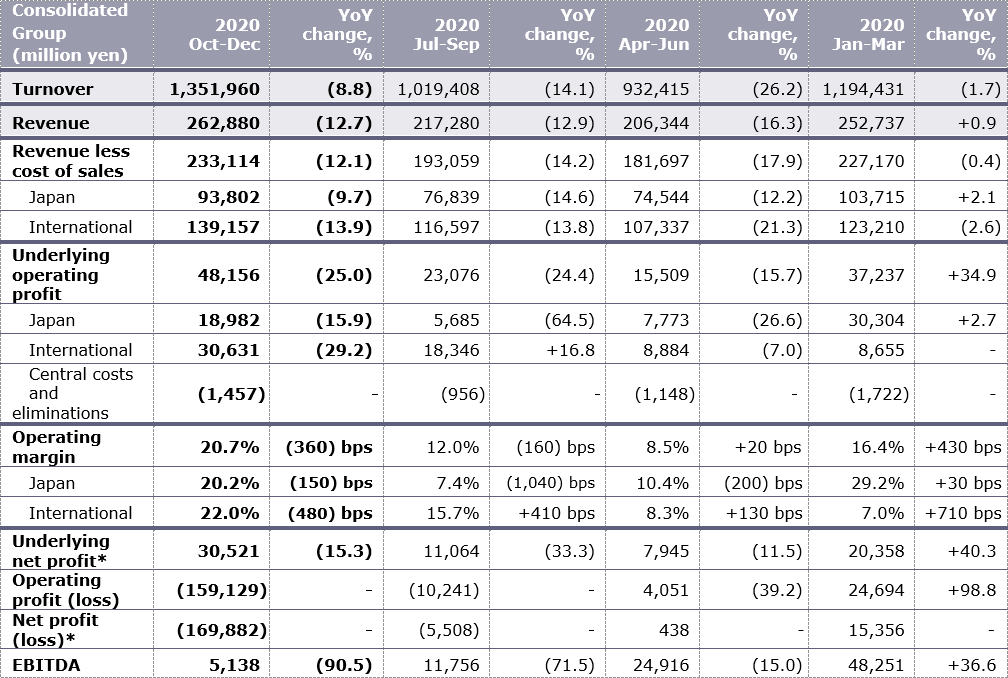

- FY2020 total revenue less cost of sales (LCoS) declined -9.8% (constant currency). Although organic revenue declined -11.1%, it was ahead of guidance with progressive quarterly improvement in organic revenues from Q2 FY2020 onwards.

- FY2020, Dentsu Japan Network organic revenue declined -8.4% and Dentsu International organic revenue declined -13.0%, attributed to the unprecedented impact that the continuing COVID-19 pandemic has had on advertising and media markets globally.

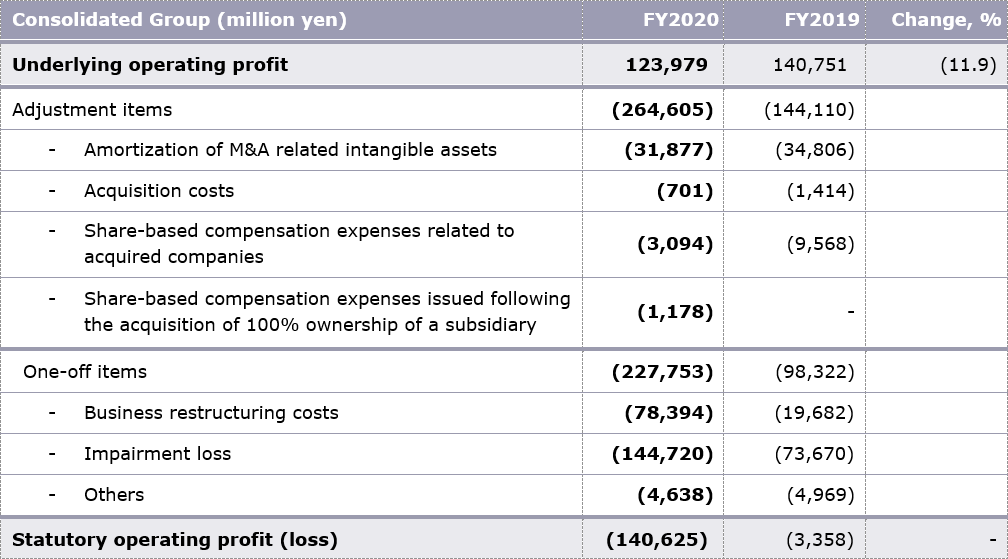

- FY2020 Group underlying operating margin stabilized at 14.8%, -20 bps yoy as cost savings offset the revenue decline. Previously announced restructuring costs arising from the Comprehensive Review totalled JPY 78.3 bn and an impairment loss, reflecting the downturn caused by the pandemic, was JPY 144.7 bn. This led to a statutory operating loss of JPY 140.6 bn.

- The Group aims to progressively raise the dividend payout ratio to 35% of underlying basic EPS over the next few years from FY2021, under our renewed dividend policy in the Mid-Term Management Plan, announced today.

- Our short-term outlook remains highly dependent on the variable macro outlook and the progress of the pandemic with restrictions still in place across many of our markets, particularly across EMEA and the Americas. The Board believes that greater clarity on the market is required before earnings and further dividend guidance can be meaningfully resumed for FY2021.

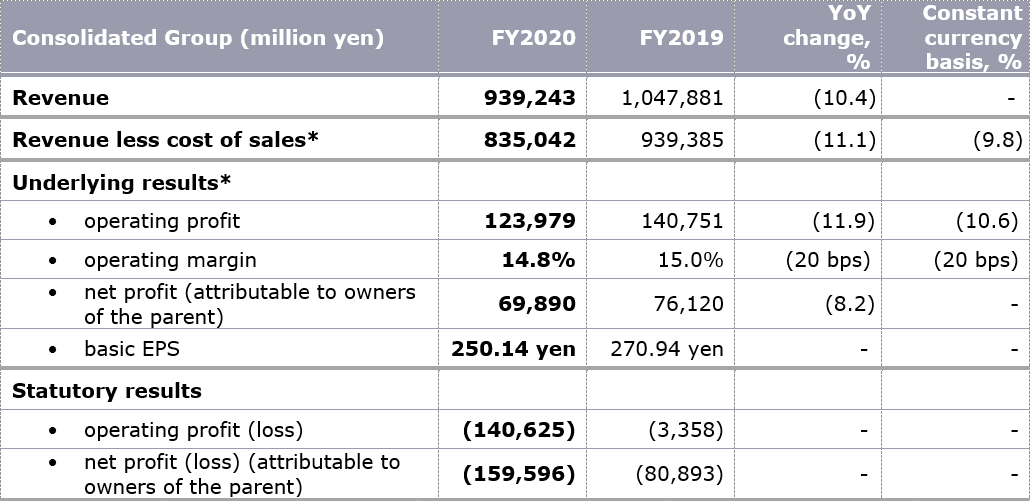

FY2020 Financial Results Summary

*See below for definitions

FY2020 Results: Key Financials

Group revenue (LCoS): JPY 835.0 bn (YoY -11.1%, or -9.8% on a constant currency basis).

- -8.3% at Dentsu Japan Network, and -13.1% (-10.9% on a constant currency basis) at Dentsu International.

- Organic revenue decline impacted revenue by JPY 103.9 bn, M&A contributed JPY 13.8 bn, and currency translation negatively impacted revenues by JPY -14.3 bn.

Group organic revenue decline was -11.1%.

- 8.4% at Dentsu Japan Network, and -13.0% at Dentsu International.

- The COVID-19 pandemic caused a slowdown in demand across our industry. This put pressure on our performance across all regions, resulting in a material decline in revenues.

Group underlying operating profit declined by 11.9% (-10.6% on a constant currency basis) yoy to JPY 123.9 bn. Underlying operating margin decreased by 20 bps (-20 bps on a constant currency basis) to 14.8%.

- At Dentsu Japan Network, underlying operating profit was JPY 62.7 bn (YoY -20.3%) due to weakness of revenue (LCoS), with underlying operating margin of 18.0% (YoY -270 bps). Permanent cost reductions are now planned that will deliver material savings in FY2022.

- At Dentsu International, underlying operating profit was JPY 66.5 bn (YoY -2.7%, +0.2% on a constant currency basis) supported by temporary cost measures in FY2020. Future margin delivery will be supported by permanent cost reductions, implemented from December 2020. The operating margin was 13.7% (YoY + 150 bps).

Group statutory operating loss increased by JPY 137.2 bn yoy to JPY 140.6 bn.

- Impairment loss and business restructuring costs increased JPY 71.0 bn and JPY 58.7 bn, respectively.

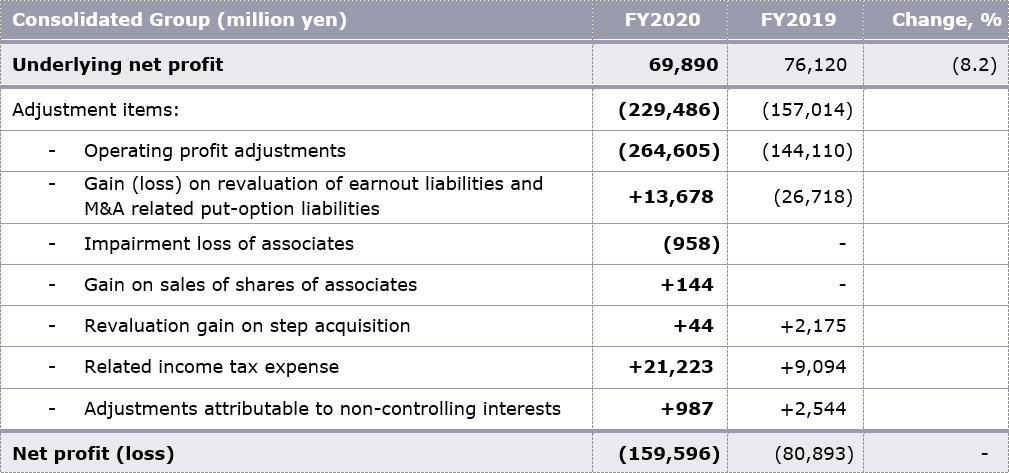

Group underlying net profit (attributable to owners of the parent) decreased by 8.2% mainly due to the decrease of underlying operating income.

- The underlying basic EPS was JPY 250.14 (FY2019: JPY 270.94)

Group statutory net loss increased by JPY 78.7 bn yoy to JPY 159.5 bn mainly due to the decrease of statutory operating income.

Outlook for FY2021

- Our short-term outlook remains highly dependent on the variable macro outlook. The Board believes that greater clarity on the market is required before earnings guidance can be meaningfully resumed.

- The Group faces strong first quarter comparables prior to the widespread outbreak of COVID-19. The Group therefore expects negative organic growth in Q1 FY2021, returning to positive growth on a full year basis. Underlying operating margin will be broadly flat with FY2020 on a constant currency basis.

Toshihiro Yamamoto,

President and CEO, Dentsu Group Inc., said:

“2020 was a challenging year for society, for our clients, our business and of course, our people. I am very proud of the dedication, determination, and resilience shown by our people across the Group. I want to express my thanks for the extraordinary effort made by so many colleagues to support our business during a time of tremendous change.

In August 2020 the Group announced a comprehensive review to accelerate the transformation of our business and we have already made significant progress against each of the four aims.

Business simplification is underway in dentsu japan network and dentsu international leading to enhanced efficiency and reduced complexity across the business. Cost savings totalling over JPY 70.0 bn across the entire Group will be achieved by 2022 to permanently lower our cost base.

The review of our balance sheet to enhance shareholder value continues and we have already announced the sale of 50 million shares of Recruit Holdings.

Today we are pleased to announce additional returns to our shareholders of JPY 30 bn through a share buyback.

Our Mid-Term Management Plan announced today positions the Group for a common goal: to deliver top line growth for our clients. Our strategy of Integrated Growth Solutions remains the centerpoint of our vision with particular focus on the strongest growing sectors, Customer Transformation & Technology, which we expect to reach 50% of Group revenue over time.

With 95 of the world’s top 100 advertisers already our clients, our opportunity as a Group is to deepen our existing client relationships.

The long-term effect of the pandemic will be to further boost digital use and innovation across the world. This fits precisely with our competitive advantage as one of the very few integrated global communication, data and marketing innovators.

As we look forward into 2021, uncertainties remain, but the Board remains confident that the medium- and long-term growth drivers for our business are strong. With greater cost and balance sheet efficiency, we believe that our strategy will deliver future value for all of our stakeholders.”

FY2020 Business Updates

Digital revenue less cost of sales

- Total revenue (LCoS) from digital activities grew strongly to 53.9% (FY2019: 47.5% YoY +630 bps), including 34.8% at Dentsu Japan Network (FY2019: 29.3%), and a record 67.5% at Dentsu International (FY2019: 59.9%)

- Total revenue from Customer Transformation and Technology reached 27.6% of Group revenues, 25% from Japan and 30% from Dentsu International.

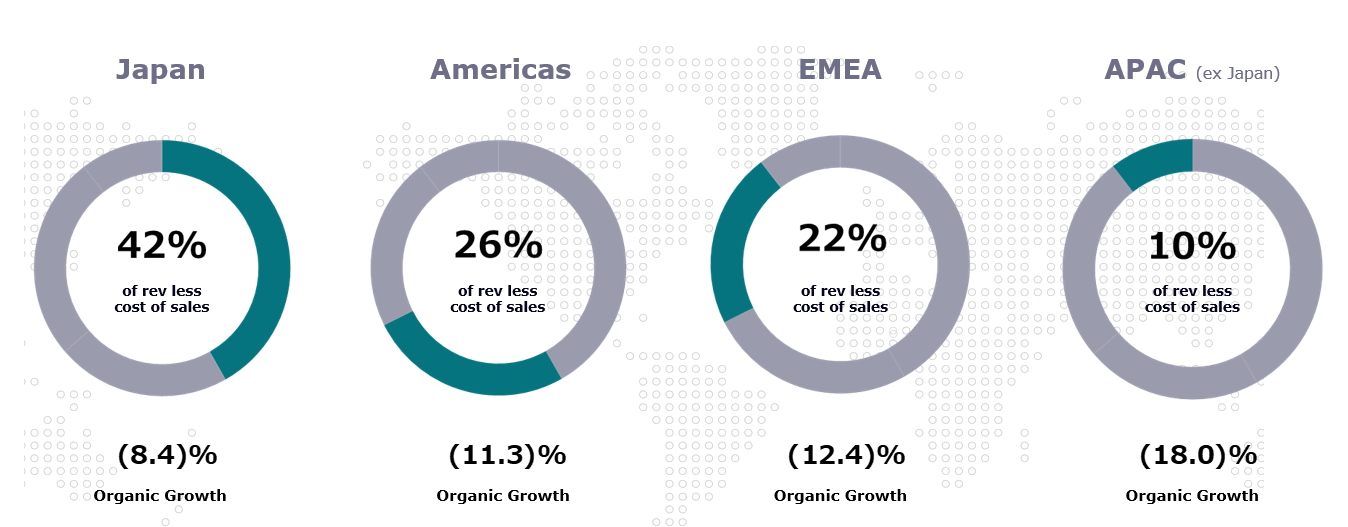

Regional revenues less cost of sales

- At Dentsu Japan Network, FY2020 organic revenue decline was -8.4% in FY2020 and -9.9% in Q4 FY2020. In Japan, although client spend on advertising decreased with the pandemic, the digital solution businesses maintained momentum throughout the year, supporting clients’ ever-growing needs for digital transformation. This remains a significant opportunity for the Group as we enter FY2021. ISID and Dentsu Digital significantly contributed to Group revenue (LCoS), both posting double-digit organic growth for the full year, giving confidence our solutions are well placed to meet clients’ needs. One initiative as part of the structural reform plan at Dentsu Japan Network is an early retirement program at Dentsu Inc., announced in our Q3 FY2020 results and implemented in FY2020. This is the main reason of the restructuring cost of JPY 24.0 bn charged in Japan business in FY2020. This initiative will contribute to structural cost reduction and an improvement of operating margin in FY2021 and beyond.

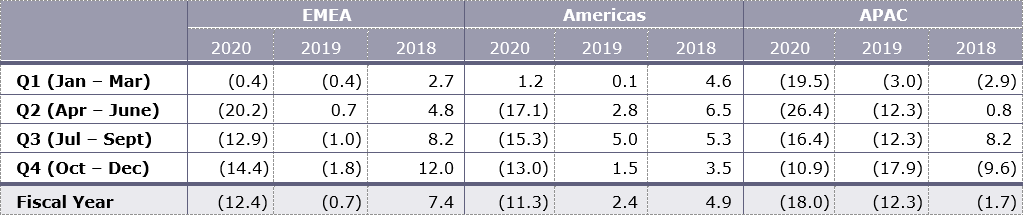

- In the Americas, organic revenue decline was -11.3% in FY2020 and -13.0% in Q4 FY2020. In the US market, the CXM business saw late revenues in the fourth quarter helped by additional spending from tech clients. The CXM business and Merkle in particular is well positioned to see a pickup in revenues in FY2021 as clients increasingly focus on first-party data combined with robust e-commerce and D2C strategies. The performance media business also performed well in the final months of the year with client spending focused on personalization. Media spend remained low throughout the year and Creative suffered from a reduction in project-based work due to the impact of the pandemic.

- In EMEA, organic revenue decline was -12.4% in FY2020 and -14.4% in Q4 FY2020. The fourth quarter performance was in line with the nine month performance. CXM and Creative were more resilient, and as expected out-of-home advertising and experiential marketing suffered. Russia was the only market to post positive organic growth over the full year in the EMEA region. Across France, Germany and the Netherlands, weakness continued into the fourth quarter with many COVID-19-related restrictions still in place across the region. The UK and Spain saw reduced client spend particularly across the media business.

- In APAC (excluding Japan), organic revenue decline was -18.0% in FY2020 and -10.9% in Q4 FY2020. The APAC region saw a stronger than expected fourth quarter due to improved performance from CXM and Media with Creative seeing a slower recovery in project-based work. Australia posted positive organic growth in the fourth quarter and while China remained negative in the final quarter, performance improved throughout the year. India saw significant improvement in the fourth quarter versus the nine-month stage with a mixed picture across the rest of the region.

Quarterly Organic Revenue Performance

Quarterly Organic Growth/Organic Revenue Decline for International Business by Region

Comprehensive Review Update

The impact of COVID-19 has accelerated many trends we already recognized within our society and our industry. Our clients’ needs and consumer behavior have also evolved.

In August 2020 the Group announced a comprehensive review to accelerate the structural reform and business transformation required to return the Group to growth and deliver margin improvement. Ultimately, how to address improving value for our shareholders, our employees and our clients.

The review launched with 4 clear objectives:

- Creating a simplified structure, benefitting both clients and internal operations

- Structurally and permanently lowering operating expenses

- Enhancing the efficiency of our balance sheet

- Maximizing long-term shareholder value

We have taken swift action, with a number of initiatives already announced:

1. Creating a simplified structure, benefitting both clients and internal operations

Dentsu Japan Network will transform its business into four domains; Advertising transformation, Business transformation, Customer Experience transformation and Digital transformation. This new structure will streamline operations, drive revenue synergies as well as creating efficiency among corporate functions.

Dentsu International announced last year the decision to rationalize the number of brands from 160 to 6 global leadership brands. This will create a simplified, integrated and more efficient organization that is easier for our clients to navigate, reducing duplication and complexity across the businesses.

2. Structurally and permanently lowering operating expenses by over JPY 70 bn by FY2022

The structural reform announced for Dentsu Japan Network will generate JPY 21 bn of cost reductions by FY2022 through a review of the human resources strategy and the reduction of real estate costs.

For full details, please see the news release titled “Notice Concerning the Structural Reform of the Dentsu Group’s Japan Business and Expected Expenses” announced today.

The transformation at Dentsu International, announced on December 7, 2020, will deliver more than JPY 54.7 bn of permanent cost reductions from personnel and other sources on an annual basis from the end of FY2021.

3. Enhancing the efficiency of our balance sheet

On November 30, 2020, Dentsu Group Inc. announced the decision to divest the majority of its stake in Recruit Holdings, in line with our policy to reduce cross-shareholdings. In Q4 FY2020, we sold 50 million shares of Recruit Holdings. Early consideration is being given to a possible sale and leaseback of the Dentsu Headquarters building. There is no certainty that this will happen, and a further announcement will be made if there is anything more to report. We will continue to improve the efficiency of the non-trading assets on our balance sheet to enhance shareholder value.

4. Maximizing long-term shareholder value

A buyback of JPY 30 bn has been announced as we look to improve long-term shareholder value. We will continue to consider further shareholder returns following the sale of any additional exceptional assets.

In six months the Group has made significant progress – but there is much more to do – we look forward to updating you on our continued progress throughout FY2021.

Mid-Term Management Plan

The Dentsu Group Mid-Term Management Plan: “Sustainable Growth through Transformation” for the four-year period from FY2021 to FY2024 is released today.

The Group’s purpose: “we exist to realize a better society by contributing to the growth of our clients, partners, and all consumers.”

The strategy of Integrated Growth Solutions will deliver top line growth for our clients by combining our diverse capabilities across the Group. The Group occupies a unique market position with expertise across Content & Sports Marketing, Media Activation, Creative, Marketing Technology, CXM, and Systems Integration – all underpinned by our deep expertise in consumer intelligence.

The Group is well positioned in the fast growth areas of the market with 54% of group revenues generated from digital activities and 28% of group revenues generated from Customer Transformation & Technology. Over time, we expect to see a portfolio shift from 28% of our revenues generated by Customer Transformation & Technology to 50% of our group revenues driven by both organic growth and acquisitions.

Our industry leading assets including Merkle, ISID and Dentsu Digital have generated a CAGR of over 20% over the past 3 years demonstrating our ability to deliver bespoke solutions that address our clients’ needs combining data, analytics and technology.

As part of the Group’s commitment to generating social value we will create a Sustainable Business Board, dedicated to integrating social impact efforts with client growth strategies. As a company with a 120-year history, as a bridge between business and society, it is the Dentsu Group's mission to contribute to our customer's business transformation through co-value creation.

We believe that by focusing on creating social value at the core of our business strategy, we can support clients to address their own sustainability issues.

The question facing the management of every company is how to integrate the creation of social value with the growth of the business. Consumers require companies to provide social value through both corporate behavior and products.

We provide "dentsu Sustainable Business Solutions" - by leveraging our rich insights into consumer behavior, creativity, and most importantly, our eco-system that makes radical co-creation possible with our client and partners. We support our clients to create positive impact & sustainable growth through integrated solutions that help consumers & society.

We will focus on the following four pillars:

1. Transformation and Growth

- Acceleration of Integrated Growth Solutions and dentsu Sustainable Business Solutions

- With the establishment of Customer Transformation & Technology business, and the innovation in marketing communication business, we offer integrated solutions.

- Global clients: revenue synergies scaling key client relationships

- Investment strategy:

Investment for growth, both in organic growth through investment in new technology and product innovation, and in M&A focusing on high growth Customer Transformation & Technology for adding capabilities and scale. - Leadership targets:

- Organic growth of 3-4% CAGR from FY2021 to FY2024

- Customer Transformation & Technology to reach 50% of Group revenues (LCoS) over time.

2. Operations and Margin

- Simplification: reducing duplication and complexity

- Increase use of near-shore and off-shore capabilities

- Transform how our people connect through increased use of technology and rationalization of property costs

- Standardizing Group functions: Cost synergies

- Leadership target:

- Progressive year-on-year improvement in operating margin from FY2021 to FY2024

3. Capital Allocation Priorities & Shareholder Returns

- Disciplined approach to capital allocation

- Investment for growth across the Group

- Progressive dividend policy

- Additional shareholder returns considered following exceptional asset sales

- Leadership targets:

- Mid-term average of 1.5x Net Debt / EBITDA (non IFRS 16 basis).

- Investment focusing on high growth Customer Transformation & Technology.

- Payout ratio to progressively reach 35% of underlying basic EPS over the next few years

4. Social Impact and ESG

- Dentsu Sustainable Business Board newly established to drive social value for society & clients

- Play our role in mitigating the worst impacts of climate change

- Support the growth of every individual in our organization through a diverse and inclusive culture

- Good governance to generate long-terms business success

- Leadership targets:

- 46% absolute reduction in CO2 by 2030; 100% renewable by 2030 (in markets where available)

- Improvement in employee engagement score

- Diverse & inclusive workforce

FY2021 remains a transitional year for the Group with FY2022 and beyond delivering a return to growth and improving margin profile. For further details please see the presentation on our Group website.

In October 2020, the Group adopted the new dentsu vision and values with the tagline “an invitation to the never before.” as its long-term direction and “8 WAYS” as its values. Under this vision, Dentsu Group companies and individuals around the world promote teaming with each other as well as with external partners for the creation of value. The aim is to build a culture of co-creation to widely permeate the corporate culture that connects diversity to competitiveness.

Based on this culture and its corporate culture, the Group aims to achieve the management goals and policies which are centered on the four pillars of this mid-term management plan.

Goodwill Impairment

Throughout FY2020 the pandemic caused a slowdown in demand across our industry and the Dentsu Group was not immune. This put pressure on our performance across our business in FY2020, resulting in a decline in revenues. Whilst we expect to see growth in revenues for the full year in FY2021, the macro environment remains highly variable.

The carrying value of goodwill has been reviewed for impairment each quarter during FY2020 in view of the global economic impact of the COVID-19 pandemic. In addition to the quarterly reviews, Dentsu Group Inc. carried out its annual review of the carrying value of goodwill in the fourth quarter.

This review has resulted in a decision to record a goodwill impairment amounting to JPY 140.3 bn in the fourth quarter by recalculating the net present value of Dentsu International with a conservative view. An impairment loss was also recognized in Japan, bringing the total impairment charge for the fourth quarter to JPY 142.1 bn. This will leave the Group well placed as it looks to FY2021 and beyond.

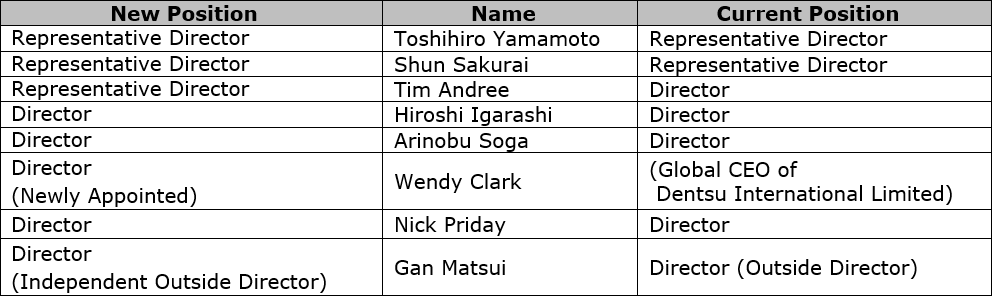

Board of Directors Nominations

Today, Dentsu Group Inc. also announces prospective members of the Board. The existing seven Directors are re-nominated, with the addition of the nomination of Wendy Clark, Global CEO of Dentsu International. The nomination of Wendy Clark brings a highly talented executive to strengthen the Board, as well as enhancing diversity with greater international representation.

Tim Andree, Director and Executive Vice President, Dentsu Group Inc., will be given the right of representation after his reappointment.

Please see the Appendix for full details of Board nominations.

– Ends –

Appendix

Reconciliation from Underlying to Statutory Operating Profit, FY2020

Reconciliation from Underlying to Statutory Net Profit in FY2020

Quarterly Results

* attributable to owners of the parent

Prospective Members of the Board

1. Eight (8) Incoming Directors, Members of the Board

As the terms of all seven (7) Dentsu Group Inc. Directors, Members of the Board will expire at the conclusion of the March 2021 Ordinary General Meeting of Shareholders, the following eight (8) candidates will be nominated as Director, Member of the Board candidates at the same meeting.

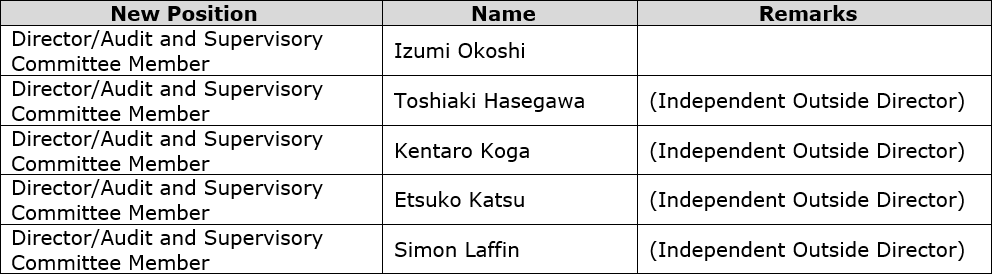

2. Five (5) Directors/Audit and Supervisory Committee Members

As the terms of all five (5) Directors/Audit and Supervisory Committee Members will expire at the conclusion of the March 2022 Ordinary General Meeting of Shareholders, the following five (5) candidates will be out of the scope of the appointment proposal at the March 2021 Ordinary General Meeting of Shareholders.

Supplemental Information

- The Representative Directors will be appointed at the Board of Directors meeting held after the Ordinary General Meeting of Shareholders scheduled to be held in March 2021.

- The total number of directors will increase by 1, from 12 to 13. (Article 20, Paragraph 1 of the Articles of Incorporation stipulates that the maximum number of directors be within 15.)

- Gan Matsui will be registered as an Independent Director and the total number of Independent Outside Directors will be 5 out of 13 Outside Directors (over one-third of the total).

Definitions of “underlying” and “EBITDA”

- Revenue less cost of sales: The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin: Underlying operating profit divided by Revenue less cost of sales (LCoS).

- Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS: EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA: Operating profit before depreciation, amortization and impairment losses.

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: http://group.dentsu.com/en.

About dentsu

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 64,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its nine leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, Merkle, MKTG, Posterscope and Vizeum—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website URL: https://www.group.dentsu.com/en/

For Additional Inquiries

| TOKYO | LONDON | |

|---|---|---|

| MEDIA Please contact Corporate Communications: |

Shusaku Kannan +81 3 6217 6602 s.kannan@dentsu.co.jp |

Manus Wheeler +44 20 7070 7785 manus@dentsu.com |

| Investors & analysts Please contact Investor Relations: |

Yoshihisa Okamoto +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart +44 7900 191 093 kate.stewart@dentsu.com |