Update regarding the Accelerated Transformation Process and FY2020 Forecasts

Dec 7, 2020

- IR-Timely Disclosure

- Management

- International

Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004; President & CEO: Toshihiro Yamamoto; Head Office: Tokyo; Capital: 74,609.81 million yen) announces the forecast of consolidated financial results for the fiscal year ending December 31, 2020 (FY2020) with details of the accelerated transformation at Dentsu International, Dentsu Group’s international business. The comprehensive review and accelerated transformation launched in August 2020 will deliver a return to growth and margin improvement for Dentsu Group, whilst benefiting our clients through the delivery of integrated, bespoke client solutions. The business restructuring at Dentsu International is one of the initiatives of the review, with full details to be announced in February 2021.

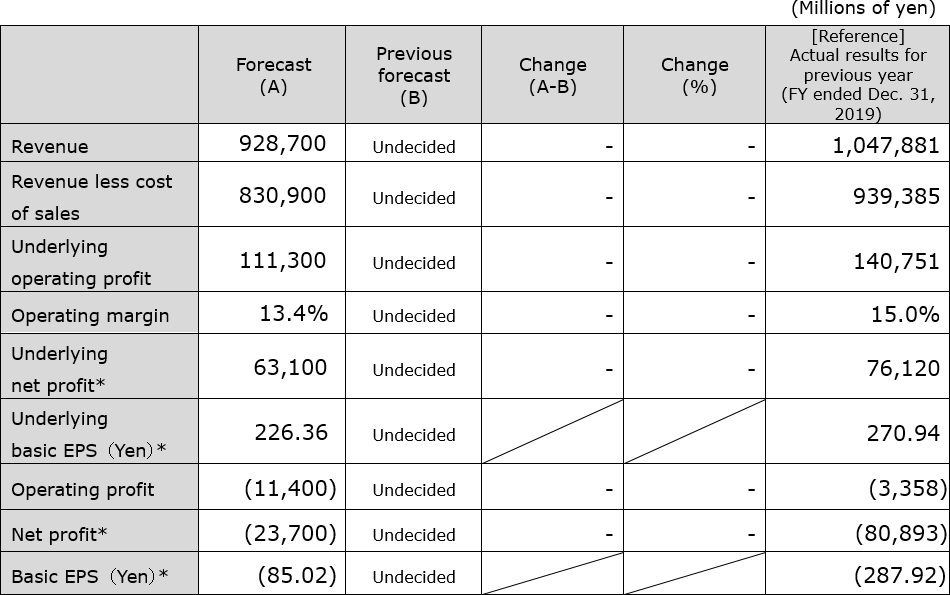

Forecast of Consolidated Financial Results for FY2020 (IFRS)

*Attributable to owners of the parent

Please see below for the definitions of underlying operating profit, operating margin and underlying net profit.

FY2020 Forecast Announcement

In the press release “Notice regarding the Changes to the Forecast of Consolidated Financial Results for the Fiscal Year Ending December 31, 2020” issued on May 27, 2020, the Dentsu Group announced the withdrawal of the FY2020 earnings forecast. The global pandemic caused a slowdown in demand for services across the industry and the operating environment on which the full-year consolidated financial forecast was based had changed significantly.

Today the FY2020 forecast is confirmed based on the first nine-month result and the estimate of business restructuring cost at Dentsu International to be charged within FY2020.

We expect FY2020 organic revenue decline to be towards at the higher end of the range of

-12.5% to -12.0% and operating margin at 13.0% to 13.5%, which remains unchanged from the Q3 earnings announcement.

Business Transformation

The Group’s objective is to deliver world class services tailored to our client’s needs, and in doing so create value for all our stakeholders. Our strategy of Integrated Growth Solutions is the center-point of our vision, with particular focus on the strongest growing sectors, digital solutions and customer experience management.

In August 2020, the Dentsu Group announced a comprehensive review and accelerated transformation program. Involving every region, the review will support the focused strategy of integrated solutions and is aimed at: simplifying the business for both clients and operations; structurally and permanently lowering operating expenses; enhancing the efficiency of our balance sheet; and maximizing long-term shareholder value. This will create a simplified, integrated and more efficient organization that is easier for our clients to navigate, delivering bespoke client solutions that are ideas led, data driven and tech enabled, delivering competitive advantage, further growth and margin enhancement.

• Dentsu International

The accelerated transformation will fully integrate the brand portfolio, moving from 160+ brands to six global leadership brands within two years. This transformation program will initially be led by our largest markets which cover over 80% of Dentsu international’s revenue, but will include all markets. The transformation will also include all service lines, functions and central teams.

The transformation will result in an approximate 12.5% reduction in total headcount across Dentsu International, subject to local regulations. The estimated cost for FY2020 and FY2021 at Dentsu International is expected to be approximately GBP 640 million (JPY 87.6 billion). GBP 410 million (JPY 56.1 billion) will be recognized in the fiscal year ending December 31, 2020 and the remainder will be recognized in the fiscal year ending December 31, 2021. More than GBP 400 million (JPY 54.7 billion) of related cost reductions from personnel and other sources is expected to be saved on an annual basis from the end of FY2021.

• Dentsu Japan Network

At Dentsu Japan Network the transformation program has also begun. The early retirement program launched in the third quarter of FY2020 will structurally lower operating expenses going forward. A wider transformation program within Japan is currently being designed as the business is simplified into four operating pillars. Its associated costs and savings, which are still being developed, will be reflected in the FY2021 earnings forecast to be announced in February 2021.

• Balance Sheet Review

The review of balance sheet efficiency is continuing and, as announced on 30th November, Dentsu Group has decided to divest a part of its shareholdings in Recruit Holdings Co., Ltd. The use of proceeds will be to support the accelerated transformation program and the pay-out for Merkle and other M&A related payments. The review of non-trading assets to enhance shareholder value continues and further details will be provided in February 2021.

Goodwill Impairment Test

The carrying value of goodwill has been reviewed for impairment each quarter during FY2020 in view of the global economic impact of the COVID-19 pandemic. In addition to the quarterly reviews, Dentsu Group will carry out its annual review of the carrying value of goodwill in the fourth quarter. This review will also be carried out within the context of the COVID-19 pandemic having had an unprecedented impact on our revenues in FY2020 and creating continued uncertainty in the operating environment. We will announce the results of the review as soon as it is known.

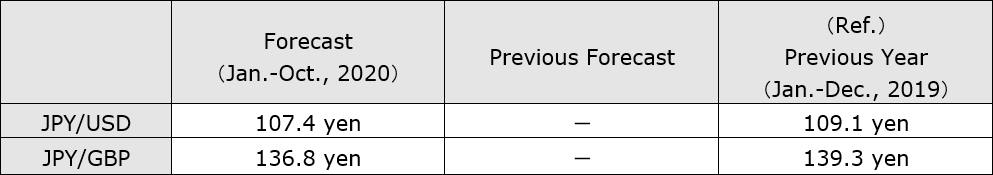

Reference: Currency Exchange Rate

#####

Definitions of underlying operating profit, operating margin and underlying net profit

Underlying operating profit:

KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items. M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary. One-off items: items such as business restructuring costs, impairment loss and gain/loss on sales of non-current assets.

Operating margin:

Underlying operating profit divided by revenue less cost of sales.

Underlying net profit (attributable to owners of the parent):

KPI to measure recurring net profit attributable to the owners of the parent which is calculated as net profit added with adjustment items related to operating profit, reevaluation of earn-out liabilities/M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

About dentsu

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu Group’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu Group’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 66,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its nine leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, Merkle, MKTG, Posterscope and Vizeum—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website URL: https://www.group.dentsu.com/en/

For Additional Inquiries

| Tokyo | London | |

|---|---|---|

| Media – Please contact Corporate Communications: |

Shusaku Kannan: +81 3 6217 6602 s.kannan@dentsu.co.jp |

Manus Wheeler: +44 20 7070 7785 manus@dentsu.com |

| Investors & analysts – Please contact Investor Relations: |

Yuji Ito: +81 3 6217 6613 y.ito@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 kate.stewart@dentsu.com |