Dentsu Group Inc. Q3 FY2020 Consolidated Financial Results

Nov 11, 2020

- IR-Timely Disclosure

- Management

Executive Summary

- The Group’s Q3 organic revenue decline lessened vs Q2 FY2020 as clients’ business confidence started to return. Despite the revenue decline, continued cost reductions have offset the revenue decline, allowing Group operating margin for the first nine months to rise by 120 bps yoy. The Group is tracking ahead of the targeted 7% cost reduction announced in May 2020, although many of these savings are temporary at this stage.

- In August this year, the Group announced a comprehensive review and accelerated transformation program. Involving every region, it will support the focused strategy of integrated solutions, aimed at simplifying the business for both clients and operations, structurally and permanently lowering operating expenses, enhancing the efficiency of our balance sheet and maximizing long-term shareholder value.

- The final outcome of the review will be presented, as planned, as part of Dentsu Group’s mid-term plan, in February 2021. However, initiatives already commenced include simplifying the Japanese business into four operating pillars and focusing the international business from having over 160 agency brands, to a portfolio of six global leadership brands. A review of non-trading assets is underway to enhance shareholder value by challenging whether we are the natural owner for these assets.

- An announcement about expected savings and implementation costs is anticipated before the end of the year, along with full FY2020 forecast guidance. However, the board has confirmed that the year-end dividend per share forecast is JPY 23.75.

- Group has seen a number of new client wins in the quarter, but the COVID-19 pandemic continues to cause uncertainty and weak market conditions across the globe. Accordingly, the Group remains cautious on Q4 performance and expects FY2020 organic revenue decline to be within the range of -12.5% to -12.0% with operating margin around 13.0% to 13.5%.

- The Group remains well-capitalized, with a strong balance sheet, JPY 545.1 bn of unused credit lines and JPY 288.4 bn of cash. The Group credit rating is “AA-” from Japan’s Rating and Investment Information, Inc. (R&I).

Financial Results for First Nine Months of FY2020

* Definitions are described below.

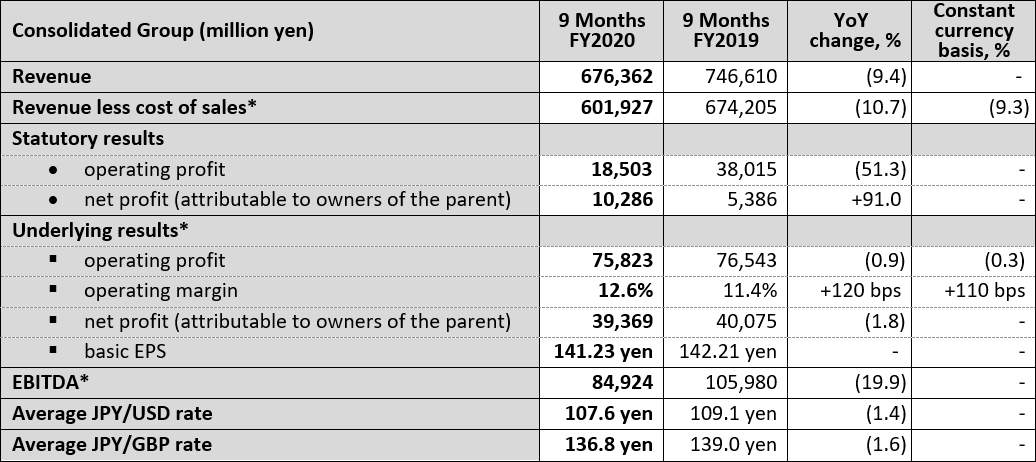

First Nine Months (9M) of FY2020 Results: Key Financials

- Dentsu Group delivered a decline in revenue (LCoS) of -10.7% (-9.3% on a constant currency basis).

- -7.7% in Japan, and -12.8% (-10.4% on a constant currency basis) at International business.

- Organic revenue decline was -10.9%.

- -7.9% in Japan, and -12.9% at International business. The Japan business suffered from the industry-wide impact from the COVID-19 pandemic, but also benefitted from growth in digital solutions and digital transformation. The International business performance was in line with expectations, showing a gradual improvement versus the second quarter with relative outperformance from digital.

- Digital business participation of total revenue (LCoS) grew strongly to 52.7% (9M FY2019: 47.8%), including 33.2% Japan (9M FY2019: 28.6%), and a record 67.1% in International (9M FY2019: 61.1 %).

- International participation of total revenue (LCoS) reduced slightly to 57.6% (9M FY2019: 59.0%).

- Group underlying operating profit declined slightly, by 0.9% (-0.3% on a constant currency basis) yoy to 75.8 billion yen (9M FY2019: 76.5 billion yen).

- 43.7 billion yen in Japan (9M FY2019: 56.1 billion yen), and 35.8 billion yen in International (9M FY2019: 25.0 billion yen).

- The Group cut costs in the first nine month to mitigate the impact of the organic revenue decline due to COVID-19, including the temporary removal of incentives, managing personnel costs, a reduction in the executive officers’ compensation and a reduction in other operating expenses. The Group is tracking ahead of the targeted 7% cost reductions against the planned FY2020 consolidated cost base.

- Group underlying operating margin improved by +120 bps (+110 bps on a constant currency basis) to 12.6% (9M FY2019: 11.4%).

- 17.2% in Japan (9M FY2019: 20.3%), and 10.3% at International business (9M FY2019: 6.3%).

- International business improved its net margin by 400 bps due to the cost reduction, most of which are temporary at this stage, but which also include savings, announced in December 2019, ahead of the £45m target for FY2020. In Japan, cost actions which include managing operating expenses, and personnel costs achieved by improving efficiency through remote working and other initiatives, however the margin declined 310 bps yoy as cost actions could not mitigate the fall in revenues.

- Underlying net profit (attributable to owners of the parent) decreased by 1.8% mainly due to the decrease of underlying operating income.

- In view of the global economic impact of the COVID-19 pandemic, the carrying value of goodwill has been reviewed for impairment each quarter during FY2020. As at Q3 FY2020, no impairment charges have been required. We will perform a full annual impairment review in Q4 FY2020.

Toshihiro Yamamoto, President and CEO, Dentsu Group Inc., said:

“Client confidence has steadily returned through Q3, with a pickup in new pitch activity in both Japan & internationally. We have won a number of new clients and significantly expanded many of our existing relationships, including KraftHeinz, American Express and Heineken. We are beginning to see the benefit from combining our talent, process, and technology in integrated solutions for our clients. However, we remain cautious on the short-term outlook, given the uncertainty surrounding the impact from COVID-19 as restrictions have now been increasing in many countries across the globe.

We are making real progress on the comprehensive review announced in August. The review is aimed at simplifying the business, permanently reducing operating costs and enhancing the efficiency of the balance sheet. We simply have too many brands, almost 300 across both Japan and internationally. We have already decided to simplify the Japan business into four pillars and internationally to have only six global leadership brands. This radical new structure will be more logical and transparent for our clients, enabling us to serve them better. It will also enable us to reduce costs significantly as our operations become simpler with more common systems and processes, increasing our use of shared service centers, rationalizing office space and reviewing property ownership globally. In Japan we announced an early retirement program, in pursuit of a leaner organization with better cost efficiency. The business is now well through a rigorous review of our non-trading assets to enhance shareholder value by challenging whether we are the natural owner for these assets.

Our objective is to deliver world class services tailored to our client’s needs, and in doing so create value for our stakeholders. Our strategy of Integrated Growth Solutions remains the centerpoint of our vision, with particular focus on the strongest growing sectors, digital solutions and customer experience management. Internationally, we have Merkle, a world leading digital agency and in Japan Dentsu Digital and ISID drive our digital transformation capabilities.

I would like to thank all our 66,000 employees for their fortitude, determination and dedication through a very challenging year. They have had to adapt to home working, especially during lockdowns, and many have taken temporary pay cuts. Structural change in our businesses will bring further challenges for our people next year. We would also like to thank our clients for their continued partnership, and we pledge to serve them even better all over the world in the future.”

The First Nine Months of FY2020 Consolidated Financial Results

Japan Business:

Client spend on advertising fell during the third quarter, promotional spend also pulled back after a strong start to the year. The digital solutions business maintained momentum throughout the first nine months, supporting client needs for digital transformation. ISID and Dentsu Digital significantly contributed to Group revenue (LCoS), both posting double digit organic growth in the first nine months.

One initiative as part of the accelerated transformation at Dentsu Inc. is an early retirement program. This initiative will offer 230 Dentsu Inc. retiree’s the opportunity to take partial early retirement and work as a partner up to a maximum of 10 years from FY2021 with “New Horizon Collective G.K.,” a company to be established under Detnsu Inc. With this decision, a total of 22.5 billion yen, of which 7.2 billion yen of allowances was for an additional early retirement bonus and 15.2 billion yen of allowances was for possible future loss, was charged for the Q3. This initiative will contribute to structural cost reduction and an improvement of operating margin in FY2021 and beyond.

In Q4, the Japan business faces strong comparables from the positive impact of the Rugby World Cup and the Tokyo Motor Show in Q4 FY2019.

International Business:

A strong run of new business wins across all three lines of business is encouraging as client confidence slowly returns. In Q3, we expanded existing relationships with a number of world class brands as clients’ consolidate their business with our teams, in many cases without calling a formal review.

Our largest clients continue to show the greatest resilience and we see a gradual improvement in the investment clients are willing to make in media, project-based business and technology services. The new business pipeline is growing in all areas as clients’ focus on brand strategy, experience and transaction.

The International business has taken further cost actions where appropriate to limit the impact on margin delivery, reporting +400 bps margin improvement for 9M. While costs are expected to increase in the fourth quarter, the International business still expects to deliver meaningful margin improvement on a full year basis.

International Business – Regions:

In EMEA, organic revenue decline was - 11.5% in 9M of FY2020 and -12.9 % in Q3 FY2020.

Lower client spend impacted all markets across the region. Germany, Switzerland, Denmark and Sweden posted single digit declines, with Russia the only market to post positive organic growth. The Netherlands and France continued to underperform due to relatively higher exposure to the media market. Spain saw some delayed projects in creative following economic restrictions in response to the global pandemic.In the Americas, organic revenue decline was -10.7% in 9M of FY2020 and -15.3% in Q3 FY2020.

The US market delivered -9.6% organic revenue decline in 9M of FY2020 showing greater resilience due to the higher exposure of CXM (Customer Experience Management). Merkle remains well positioned as its deep data, technology, and analytic capabilities deliver meaningful brand experiences for our clients and their consumers. US saw media spend up across a number of consumer good clients, but pressure on media spend and Creative came from a number of other sectors. A strong run of new business wins in the region is encouraging.APAC region (excluding Japan) delivered -20.8% organic revenue decline in 9M of FY2020 and -16.4% in Q3 FY2020.

The region’s revenues continued to be impacted by reduced client spend due to COVID-19 throughout 9M, although a number of mid-sized markets continue to fare better than expected including Taiwan and Thailand. China continued building on new business success with two new account wins in the quarter, against a backdrop that the Chinese market generally is recovering more slowly than forecast. Early signs of a positive momentum is emerging in Australia with improved performance in Q3 particularly in the CXM Line of Business.– Ends –

Further information

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: https://www.group.dentsu.com/en/.Definitions of “underlying” and “EBITDA”

- Revenue less cost of sales: The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as business restructuring costs, impairment loss and gain/loss on sales of non-current assets.

- Operating margin: Underlying operating profit divided by Revenue less cost of sales (LCoS).

- Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS: EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA: Operating profit before depreciation, amortization and impairment losses.

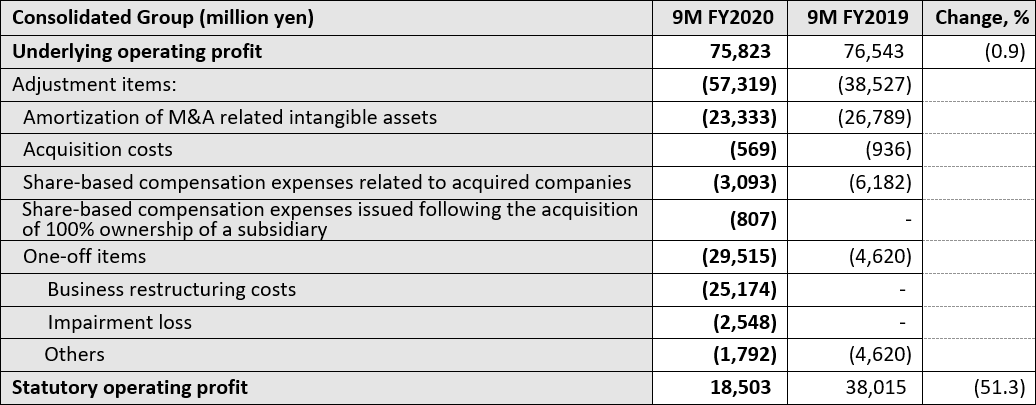

Reconciliation from Underlying to Statutory Operating Profit in the First Nine Months FY2020

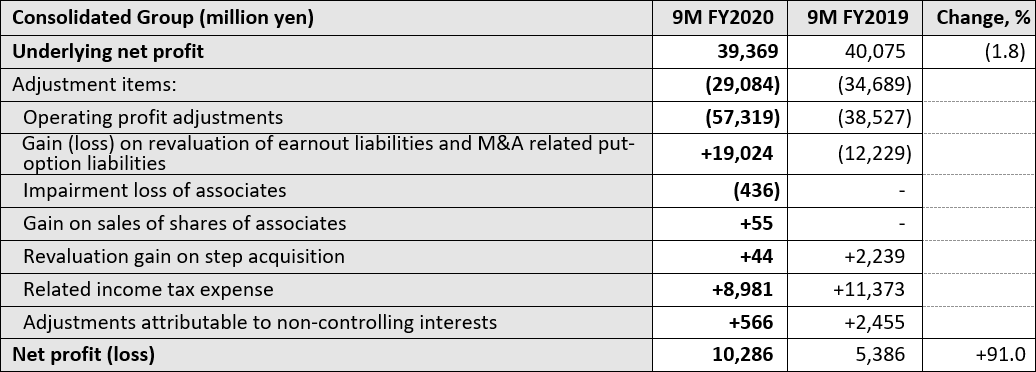

Reconciliation from Underlying to Statutory Net Profit in 9M FY2020

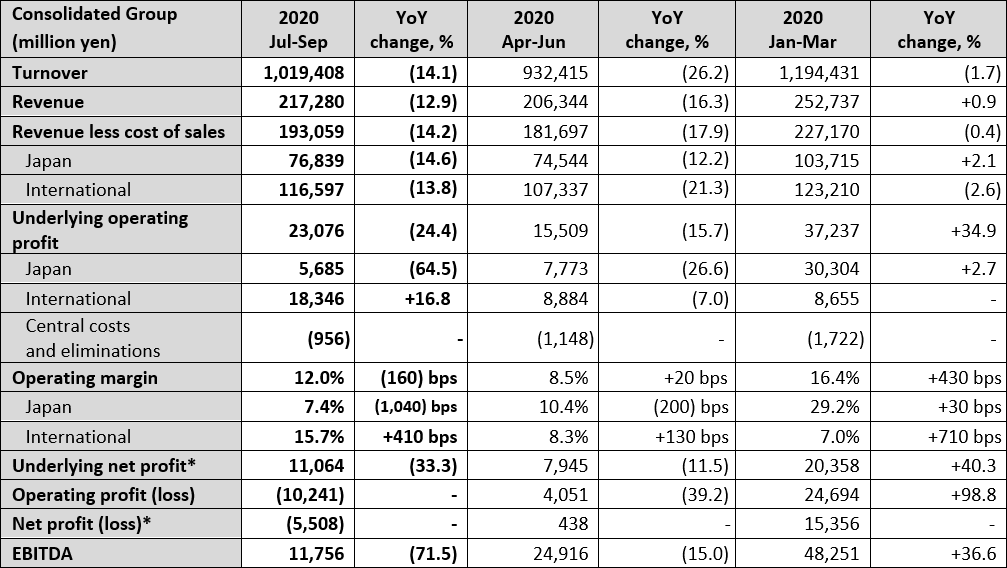

Quarterly Results

* attributable to owners of the parent

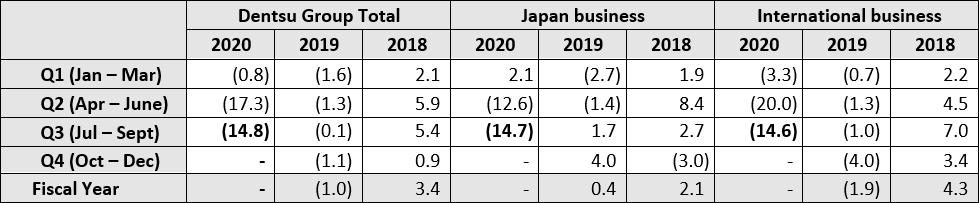

Quarterly Organic Growth/Organic Revenue Decline for the Dentsu Group, Japan Business, and International Business

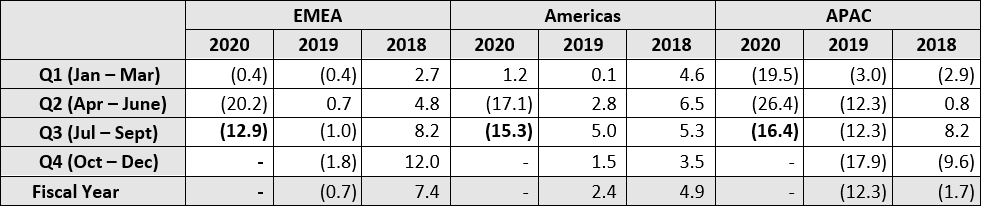

Quarterly Organic Growth/Organic Revenue Decline for International Business by Region

About dentsu

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu Group’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu Group’s agency operations outside of Japan. With a strong presence in over 145 countries and regions across five continents and with more than 66,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its nine leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, Merkle, MKTG, Posterscope and Vizeum—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale. Dentsu Group Inc. website URL: https://www.group.dentsu.com/en/For Additional Inquiries

Tokyo London Media –

Please contact

Corporate Communications:Shusaku Kannan:

+81 3 6217 6602

s.kannan@dentsu.co.jpManus Wheeler:

+44 20 7070 7785

manus@dentsu.comInvestors & analysts –

Please contact

Investor Relations:Yuji Ito:

+81 3 6217 6613

y.ito@dentsu.co.jpKate Stewart:

+44 7900 191 093

kate.stewart@dentsu.com - Dentsu Group delivered a decline in revenue (LCoS) of -10.7% (-9.3% on a constant currency basis).