Dentsu Group Inc. Q1 FY2020 Consolidated Financial Results

May 27, 2020

- IR-Timely Disclosure

- Management

The first quarter ended March 31, 2020 – reported on an IFRS basis

Executive Summary

- In Q1 FY2020, the Dentsu Group delivered total growth in revenue less cost of sales (LCoS) of -0.4% (+1.3% on a constant currency basis) and organic growth of -0.8%.

- The Japan business delivered total growth in revenues (LCoS) of +2.1% and organic growth of +2.1%, due to a strong start to the year in digital solutions and marketing promotions.

- The international business, Dentsu Aegis Network, delivered total growth in revenues (LCoS) of -2.6% (+0.3 % on a constant currency basis) and organic growth of -3.3%, impacted by weakness across APAC.

- The Group has taken a number of cost actions in the first quarter to mitigate the impact of the expected revenue decline due to COVID-19* and is targeting a 7% cost reduction against the planned FY2020 consolidated cost base.

- Underlying operating margin increased +430 bps (+400 bps on a constant currency basis) yoy to 16.4%.

- FY2020 guidance* announced on February 13, 2020 is withdrawn due to the level of uncertainty caused by the impact of COVID-19.

- The Dentsu Group remains well capitalized, with a strong balance sheet, JPY 326 bn of unused credit lines and JPY 259 bn of cash, the Group credit rating is “AA-” from Japan’s Rating & investment, Inc (R&I).

* Please refer to the separate news releases announced today “Dentsu Group: Review of Initiatives to address COVID-19” and “Notice regarding the Forecast of Consolidated Financial Results for the Fiscal Year Ending December 31, 2020” for details.

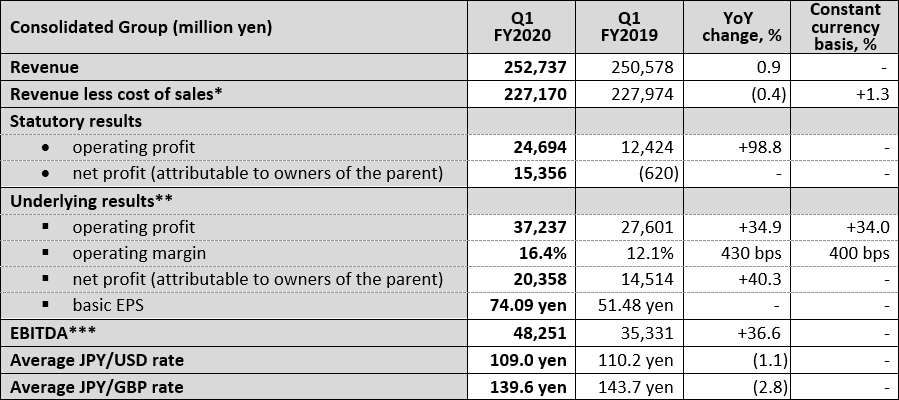

Financial Results for Q1 FY2020

* Revenue less cost of sales is the metric by which the Group’s organic growth is measured. Organic growth represents the constant currency year-on-year growth after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

** See page 6 for definition of “underlying.”

*** See page 6 for definition of “EBITDA.”

Highlights of Q1 FY2020 results

- The Dentsu Group delivered growth in revenue (LCoS) of -0.4% (1.3% on a constant currency basis).

o 2.1% Japan, and -2.6% (0.3% on a constant currency basis) at Dentsu Aegis Network. The breakdown in contribution is: +4.6 billion yen from M&A, (1.7) billion yen by organic growth, and (3.6) billion yen from foreign exchange rates. - The Group produced organic growth of -0.8%.

- 2.1% Japan, and -3.3% at Dentsu Aegis Network. The Japan business grew due to an increase in digital-solutions, marketing promotions and activations for event related work. The international business was impacted by negative growth in APAC, particularly the Chinese and Australian markets due to account lost in FY2019 and some early impact from COVID-19.

- Digital business contribution to total revenue (LCoS) reached 48.1% (Q1 FY2019: 47.0%), including 29.2% Japan (Q1 FY2019: 27.7%), and 64.2% at Dentsu Aegis Network (Q1 FY2019: 62.5%).

- International business contribution to total revenue (LCoS) reached 54.3% (Q1 FY2019: 55.5%).

- Group underlying operating profit was 37.2 billion yen (Q1 FY2019: 27.6 billion yen).

- 28.8 billion yen in Japan (Q1 FY2019: 27.7 billion yen), and 8.6 billion yen at Dentsu Aegis Network (Q1 FY2019: -1.8 billion yen). At Dentsu Aegis Network, profit increased due to a number of cost actions related to COVID-19 and due to benefits from the restructuring plan announced in December 2019.

- Group underlying operating margin was 16.4% (Q1 FY2019: 12.1%).

- 27.8% in Japan (Q1 FY2019: 27.4%), and 7.0% at Dentsu Aegis Network (Q1 FY2019: -0.1%).

- The increase in Japan was mainly due to the higher revenue (LCoS) and continued focus on operating expenses. At Dentsu Aegis Network, the 700 bps year-on-year improvement (on a constant currency basis) in margin is attributed to COVID-19 related cost actions as well as the restructuring announced in December 2019.

- Underlying net profit (attributable to owners of the parent) increased by 40.3% mainly due to the increase of underlying operating income.

- Cost Actions under the Circumstances of COVID-19

- In order to mitigate the negative impact from COVID-19, Dentsu Group implemented a number of cost actions from February 2020.

- These include stopping all non-essential travel and discretionary spending, an immediate review of contractor roles and arrangements, improvement of business efficiency, containment of M&A related expenses by pausing of all M&A activity until at least the end of Q2 FY2020, and personnel costs management.

- In personnel cost management, there were various cost measures implemented in Japan and the international business including reduced working hours, temporary salary reduction and acceleration of operational efficiency in line with respective market restrictions.

- All these actions contributed to an improvement of operating margin for the first quarter.

- Given the current and expected business performance, Dentsu Group Inc. will reduce the executive officers’ compensation from the second quarter onward.

- The Group is targeting a 7% cost reduction against the planned FY2020 consolidated cost. The Group will continue to work on cost actions with swift and flexible decision-making.

Toshihiro Yamamoto, President and CEO, Dentsu Group Inc., said:

In the first quarter, Dentsu Group delivered organic growth of -0.8%. The Group saw a relatively solid start to the year, but the performance was impacted towards the end of the quarter due to COVID-19.

COVID-19 is causing a slowing in demand across our industry, and we are not immune. This has put pressure on our performance in Japan and the International business. We are therefore anticipating a material decline in revenues across our business in FY2020.

We have taken swift cost actions to mitigate this revenue decline, protect margin and safeguard our people’s jobs. Despite this, given the level of uncertainty caused by COVID-19 we are withdrawing our FY2020 guidance.

Our priority throughout the COVID-19 crisis is the health, safety and well-being of our people and their families, as well as that of our clients, their customers, and our communities. This fundamental principle is shaping our response to COVID-19.

With the working life of our people disrupted, the business has reacted at speed. Our teams remain connected through our collaborative work platforms. Our new business teams have quickly adapted to hosting, and winning, pitches virtually. We are supporting our clients to ensure they can emerge even stronger post crisis by providing rich consumer insights and adapting our services to support their evolving needs.

As we look ahead, we continue our journey of transformation. In Japan, we remain focused on transitioning the Group to deliver sustainable, less cyclical revenue growth as we diversify our revenues and broaden client relationships across the Dentsu Japan Network. Strengthening the collaboration among our highly specialized brands, Dentsu Digital, ISID and CARTA HOLDINGS will lead to integrated solutions that allow us to support the digital transformation of our clients.

In the International business, our transformation will simplify our offer delivering world class services and integrated solutions tailored around the client need. The restructuring announced in December 2019 is progressing as planned and will deliver the previously announced cost savings in 2020 and 2021. The accelerated buyout of the remaining Merkle shares, announced in March, will ensure key talent retention and deliver EPS accretion for 2020. Merkle is a key pillar in the delivery of DAN’s differentiated data-driven and tech-enabled client offering. We also announced the appointment of Wendy Clark as Global CEO of Dentsu Aegis Network and look forward to welcoming her to the Group from September.

The importance of working together, collaborating and integrating the Japan and International business is essential to respond to COVID-19 and support our clients’ transformation, particularly during this period of disruption. The concept of one dentsu has never felt more important, our employees are our greatest asset, and I am proud to lead the 66,000 diverse and talented people we have within the Dentsu Group.

Q1 FY2020 Consolidated Financial Results

1. Q1 FY2020 Performance Review

Japan Business:

The Group’s operations in Japan delivered organic growth of 2.1% in Q1 FY2020.

The Japan business performed well in the first quarter exceeding both expectations and previous year results, although the impact from COVID-19 started to appear from late March. Event-related business was in line with expectations in the first quarter. Marketing promotions was strong as was the digital solutions business. ISID, Dentsu Live and Dentsu Digital significantly contributed to the group revenue (LCoS) and underlying operating profit. Traditional media saw a decline in line with the recent trend.

Underlying operating margin in Japan improved by 50 bps to 27.8% related to cost actions which started from February due to uncertainty over COVID-19. Cost actions include tightly managing operating expenses such as travel cost and entertainment cost, and personnel costs achieved by improving efficiency through remote working and other initiatives.

International Business:

Dentsu Aegis Network delivered organic growth of -3.3% in Q1 FY2020. The Americas reported positive organic growth, EMEA was flat, with a mixed performance across the region and APAC (excluding Japan) was negatively impacted by weakness in China and Australia.

Performance was also mixed across the three Lines of Business. CRM reported +3.9% organic growth and remains the most defensive part of the business due to long term contracts, driving transformation within our clients’ businesses. Media and Creative reported negative organic growth of -5.9% and -6.5% respectively.

The restructuring announced in December 2019 is on track in all seven markets and is still expected to deliver the GBP 100 million cost savings we previously announced, GBP 45 million of which will be delivered in FY2020 and impact the full year margin. A number of other cost saving initiatives have been implemented in the first quarter to support the full year margin including reducing discretionary spend, a hiring freeze and a review of contractor roles.

The transition to the new business model is progressing well, reducing the complexity within the organization – and the associated cost – to improve our operating margin over the medium term. It also ensures our services are easier to navigate and globally consistent, so we are set up to help our clients win, keep and grow their best customers – by being data driven, tech enabled and idea-led. Our transformation puts the client at the center by becoming a fully integrated business capable of delivering market-leading integrated solutions.

International Business – Regions:

In EMEA, Dentsu Aegis Network reported -0.4% organic growth in Q1 FY2020.

There was a wide range of performance across the region. The UK returned to growth after four quarters of negative growth. Russia delivered double digit organic growth and Italy, Sweden, Switzerland, Denmark and Spain all posted positive results. France, Germany and the Netherlands all saw an organic decline for the quarter due to a pull back in client spend.

In the Americas, Dentsu Aegis Network reported 1.2% organic growth in Q1 FY2020.

The Americas saw a solid Q1 performance. Strength in the US market, +2.2% organic growth for the quarter, was driven by the CRM Line of Business and M1, our people based identity and data platform, which performed well with a number of our largest US clients. Growth at Merkle remained in the high single digits. Weakness was seen in Canada and Brazil.

In the APAC region (excluding Japan), Dentsu Aegis Network reported -19.5% organic growth in Q1 FY2020.

The region saw continued challenges in the Chinese and Australian markets due to accounts lost in FY2019. This was further impacted by the impact from COVID-19. However, a number of local market new business wins were recorded in China through the first quarter and the new Australia CEO has made a strong start and is inspiring confidence of a turnaround in that market. India saw reduced client spend, recording organic decline of -11.2% while Hong Kong and New Zealand both reported positive organic growth.

International Business – Acquisitions:

In Q1 FY2020, a total of three new acquisitions were signed, all aligned to the Merkle brand and CRM Line of Business in the Americas:

- MEDIA STORM: the largest independent data-driven audience planning and targeting agencies.

- 4CITE: a leading data services technology company in the eCommerce sector.

- Digital Pi: a leading digital marketing agency focused on marketing automation consulting services in the business-to-business (B2B) sector.

The acquisition strategy remains focused on gaining scale and geographical infill in high growth areas. However, due to the impact of COVID-19, the M&A agenda is on hold until the end of Q2 FY2020, when this will be reviewed.

2. FY2020 Forecasts

FY2020 forecast announced on February 13, 2020 is withdrawn due to the level of uncertainty related to the impact from COVID-19. Please refer to the separate news release announced today “Notice regarding the Forecast of Consolidated Financial Results for the Fiscal Year Ending December 31, 2020” for detail.

– Ends –

Further information

Further details of these results, including all related financial statements, can be found in the Investor Relations section of the Dentsu Group Inc. website: https://www.group.dentsu.com/en/.

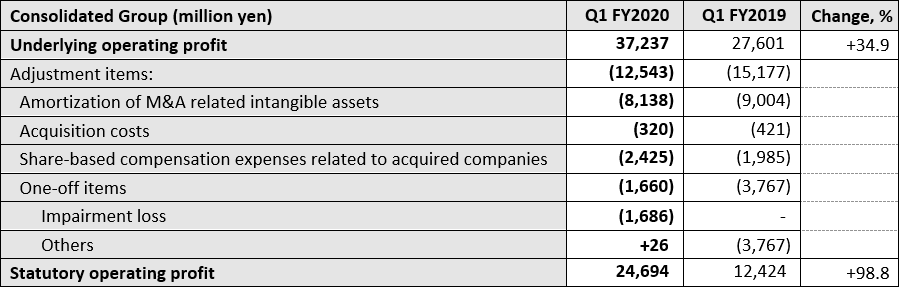

Definitions of “underlying” and “EBITDA”

- Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with amortization of M&A related intangible assets, acquisition costs, share-based compensation expenses related to acquired companies and one-off items such as gain/loss on sales and retirement of non-current assets and impairment loss.

- Operating margin: Underlying operating profit divided by Revenue less cost of sales.

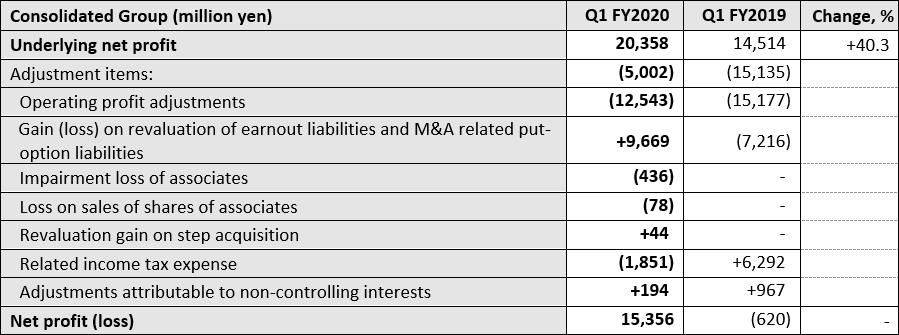

- Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS: EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA: Operating profit before depreciation, amortization and impairment losses.

Reconciliation from Underlying to Statutory Operating Profit in Q1 FY2020

Reconciliation from Underlying to Statutory Net Profit (Loss) in Q1 FY2020

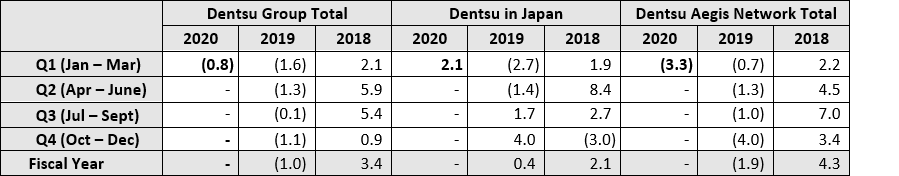

Quarterly Organic Growth for the Dentsu Group, Dentsu in Japan, and Dentsu Aegis Network

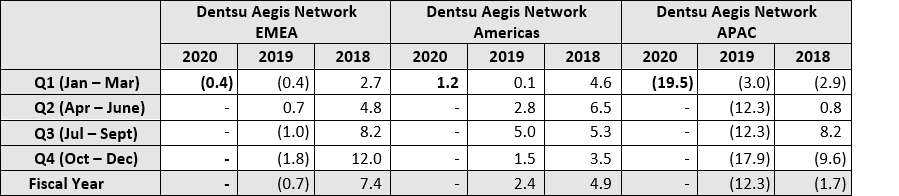

Quarterly Organic Growth for Dentsu Aegis Network by Region

About the Dentsu Group

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: Dentsu Japan Network, which oversees Dentsu’s agency operations in Japan, and Dentsu Aegis Network, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 66,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its ten global brands—Carat, Dentsu, dentsu X, iProspect, Isobar, dentsumcgarrybowen, Merkle, MKTG, Posterscope and Vizeum—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website URL: https://www.group.dentsu.com/en/

For Additional Inquiries

| Tokyo | London | |

|---|---|---|

| Media – Please contact Corporate Communications: |

Shusaku Kannan: +81 3 6217 6602 s.kannan@dentsu.co.jp |

Dani Jordan: +44 7342 076 617 Dani.Jordan@dentsuaegis.com |

| Investors & analysts – Please contact Investor Relations: |

Yuji Ito: +81 3 6217 6613 y.ito@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 Kate.Stewart@dentsuaegis.com |