Dentsu Group Announces the Recognition of Impairment Charge and the Changes to the Forecast of Financial Results for the Fiscal Year Ending December 31, 2019

Feb 12, 2020

- IR-Timely Disclosure

- Management

Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004; President & CEO: Toshihiro Yamamoto; Head Office: Tokyo; Capital: 74,609.81 million yen) announces a recognition of impairment charge and a revision to the financial forecasts for the fiscal year ending December 31, 2019. The major changes relate to an improvement in underlying operating profit and to a revision of statutory operating profit and statutory net profit due to non-underlying issues that impacted the fourth quarter of 2019.

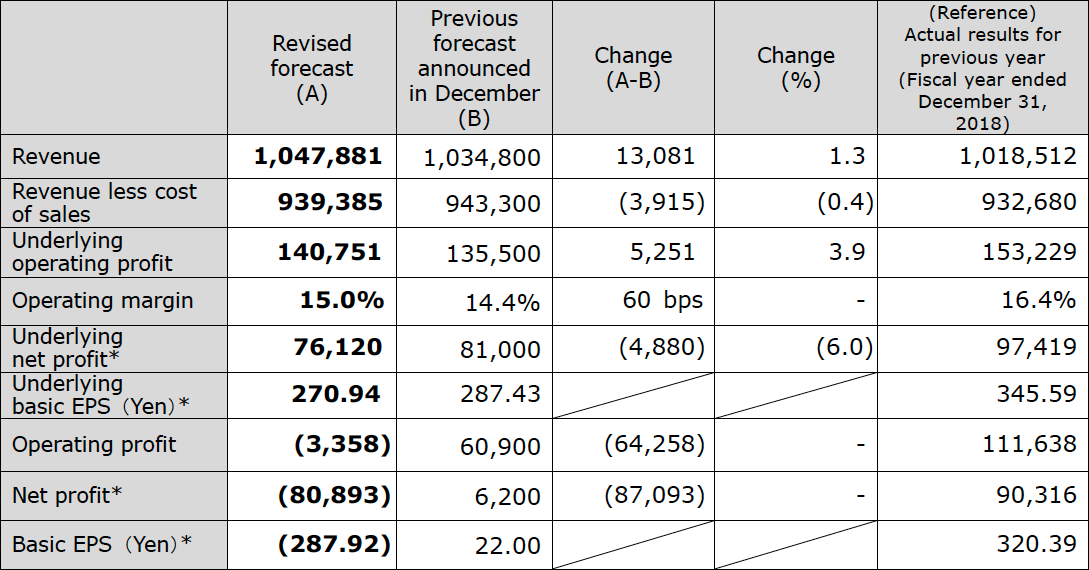

1. Changes to the Forecast of Consolidated Financial Results for the Fiscal Year Ending December 31, 2019 (IFRS)

(Millions of yen)

*Attributable to owners of the parent

Notes:

Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with amortization of M&A related intangible assets, acquisition costs, share-based compensation expenses related to acquired companies and one-off items such as impairment loss and gain/loss on sales of non-current assets.

Operating margin: Underlying operating profit divided by revenue less cost of sales.

Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to the owners of the parent which is calculated as net profit added with adjustment items related to operating profit, reevaluation of earn-out liabilities/M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

2. Reason for the recognition of impairment charge and changes to the Forecast of Consolidated Financial Results for the Fiscal Year Ending December 31, 2019 (IFRS)

Revenue less cost of sales is expected to be largely in line with forecasts issued in December 2019.

Underlying operating profit is upwardly revised by 3.9% due to lower SG&A cost enabled by successful cost control in Japan in the fourth quarter.

Underlying operating profit and operating profit (excluding impairment charge) are upwardly revised by 5.2 billion yen and 5.9 billion yen, respectively.

The forecast for statutory operating profit is revised due to the impact from a goodwill impairment recognition of 70.1 billion yen in the APAC region (excluding Japan). As previously reported, the regional performance has been impacted throughout 2019 due to two challenged markets, Australia and China. In Australia, we had a significant impact from the changing media transaction landscape and the loss of a number of clients. In China, the business faced challenges due to a rapidly changing media transaction environment led by a rise of local platformers and competition with local advertising companies. In addition, an increasing macro uncertainty in the APAC region centered around China has resulted in a decision to record a goodwill impairment amounting to 70.1 billion yen in the fourth quarter by recalculating the present value of the cash-generation unit of APAC with a conservative view.

The statutory net profit (attributable to owners of the parent) forecast is revised by 87.0 billion yen due to stronger than expected performance of acquired companies, resulting in an increased loss on revaluation of earnout liabilities and M&A related put-option liabilities of 15.6 billion yen. Other factors impacting statutory net profit include increases of 2.3 billion yen of income tax expense and 2.7 billion yen of net profit attributable to non-controlling interests in addition to the revised statutory operating profit.

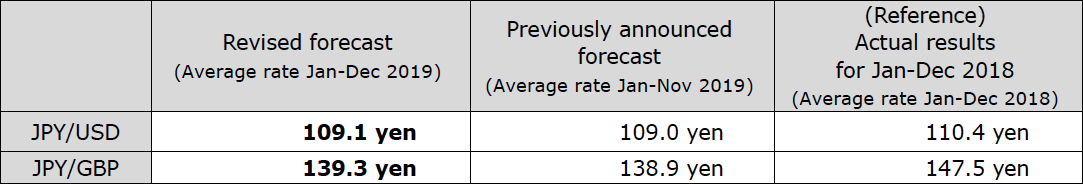

(Reference) Currency Exchange Rate

#####

About the Dentsu Group

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: Dentsu Japan Network, which oversees Dentsu’s agency operations in Japan, and Dentsu Aegis Network, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 62,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its ten global brands—Carat, Dentsu, dentsu X, iProspect, Isobar, mcgarrybowen, Merkle, MKTG, Posterscope and Vizeum—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website URL: https://www.group.dentsu.com/en/

For Additional Enquiries

| Tokyo | London | |

| Media – Please contact Corporate Communications: |

Shusaku Kannan: +81 3 6216 8042 s.kannan@dentsu.co.jp |

Dani Jordan: +44 7342 076 617 Dani.Jordan@dentsuaegis.com |

| Investors & analysts – Please contact Investor Relations: |

Yuji Ito: +81 3 6216 8015 y.ito@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 Kate.Stewart@dentsuaegis.com |