Dentsu Group Inc. Q2 FY2023 Consolidated Financial Results

Aug 14, 2023

- IR-Timely Disclosure

- Management

(The second quarter ended June 30, 2023 – reported on an IFRS basis)

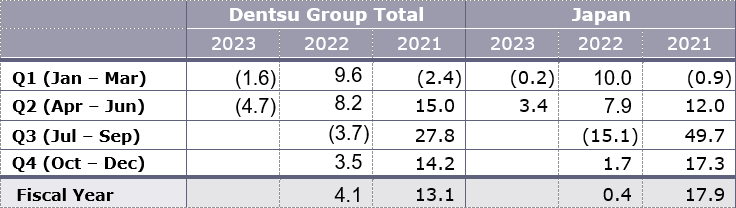

• Dentsu Group Inc. reports Q2 FY2023 net revenues* -0.1% year-on-year (yoy), with organic revenue decline* of -4.7%, against strong prior year comparables.

• Q2 performance was impacted by continued conservatism from technology and finance clients plus a one-off financial impact in the DACH cluster within the EMEA region.

• The Group now expects FY2023 organic growth* 0% to -2%, operating margins of c.17%

• The Group continues to expect performance to be second half weighted, with Q22023 expected to be the trough for organic growth. One-off events such as the Rugby World Cup and Tokyo Mobility Show and easing comparables will support H22023 performance. Underlying basic EPS guidance of 461 yen is re-confirmed, supported by acquisitions and a material reduction in financing costs of JPY 4-5bn in 2023.

• In line with the commitment to improving shareholder returns, the Group announces a record interim dividend of 78.5 yen per share, +11.7% yoy. The interim dividend is based on FY2023 dividend guidance of 157 yen calculated on a 34% payout ratio.

Customer Transformation & Technology (CT&T) revenues grew 0.5% (cc) yoy in the first half, reaching 33% of Group revenues. In Japan, CT&T reported double digit organic growth driven by Customer Experience and Digital Transformation offerings. The US CT&T market continued to be impacted by a lengthening of the sales cycle as previously highlighted, but has seen revenue stabilization.

The acquisition of Tag is complete and will contribute to Group revenues from July 1st. Tag will significantly enhance the Group’s global digital production capabilities, supporting dentsu’s strategy of offering integrated client solutions at the convergence of marketing, technology, and consulting.

Second quarter operating margin 8.7%, 520bp lower yoy as a result of net revenue decline in the Americas and APAC regions, plus the impact of DACH within EMEA. In Japan, the change in timing of incentive recognition as highlighted in Q12023 also impacted. Swift cost mitigation ensures the Group remains confident of delivering a c.17% margin FY2023.

The Group continues to accelerate the shift to One dentsu through removal of silos to drive greater collaboration whilst streamlining costs. One dentsu will further integrate the Group’s diverse capabilities to deliver top line growth for clients, while allowing dentsu to realize sustainable enhancement of corporate value.

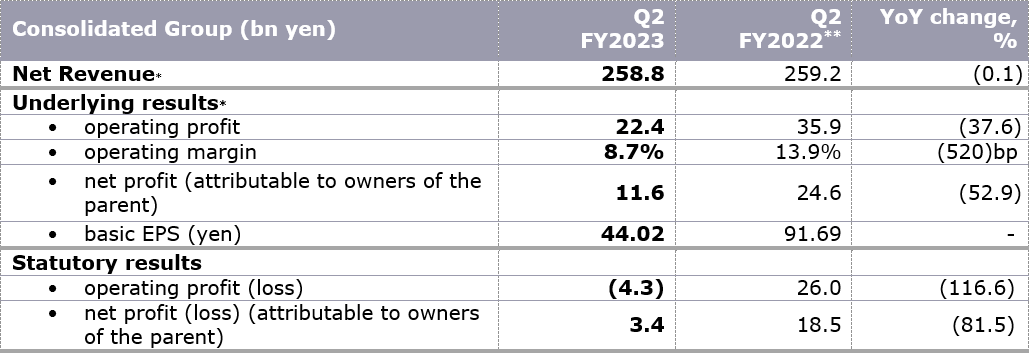

Q2 FY2023 Financial Results Summary

*See below for definitions / **Statutory results include Russia.

Q2 FY2023 (April-June) Key Financials

Group net revenue JPY 258.8 bn (YoY -0.1%)

• On a constant currency basis Japan reported 3.6% growth in net revenue in the second quarter, the Americas recorded a decline of -6.3%, EMEA a decline of -9.9% and APAC a decline of -5.0%.

• Reported net revenue decreased -0.1% with currency positively impacting by JPY 8.6bn and M&A contributing JPY 3.6bn.

Group organic revenue decline -4.7%.

• The Group faced strong comparables from the prior year, that ease into the second half, with Q2 2023 expected to be the trough for organic growth.

• Japan returned to positive organic growth, reporting +3.4%, despite high prior year comparables, with growth led by ISID and Dentsu Consulting. Americas reported organic decline due to continued weakness in client spend from the technology & finance sectors. EMEA’s Q2 results recorded a decline due to a one-off financial impact within the DACH cluster. APAC (ex Japan) recorded an organic decline, but reported strength in North Asia and Southeast Asia.

Group underlying operating profit declined 37.6% yoy to JPY 22.4bn. Operating margin declined by 520bp

• Second quarter mar gins in Japan were higher yoy, driven by stronger revenue growth. H1 margins were lower yoy impacted by the timing of incentive recognition, as highlighted in the first quarter.

Second quarter margins in the Americas were marginally higher yoy as a result of swift cost mitigation that began in the first quarter. H1 margins were flat yoy despite organic revenue decline as costs are managed in line with revenue expectations. In EMEA margins were lower as a result of a one-off financial impact and APAC (ex Japan) margins were lower as a result of revenue decline.

• Cost management has been implemented for FY2023 to ensure margin delivery; longer term, cost actions will be consistent with the move towards One dentsu, as further simplification and integration across the Group will streamline costs.

Group underlying net profit (attributable to owners of the parent) decreased by 52.9% yoy to JPY 11.6bn, due to the fall in underlying operating profit.

• Underlying basic EPS JPY 44.02

Group statutory operating profit and net profit (attributable to owners of the parent) were respectively JPY -4.3bn and JPY 3.4bn.

• The statutory operating profit is lower year-on-year largely due to the impact from asset sales in H12022 and the impact from a goodwill impairment recognition of JPY14.6 billion in the APAC region (excluding Japan) in Q22023.

Group net debt / underlying EBITDA* (LTM) 0.2x, below the medium term expected range of 1.0x to 1.5x (non IFRS 16 basis), providing the flexibility to invest for growth in acquisitions as opportunities arise.

• Progress on balance sheet simplification continues with the sale of security assets. Eight further stakes were sold in the second quarter, taking the total for H12023 to 12.

Hiroshi Igarashi, President and CEO, Dentsu Group Inc., said:

“Our second quarter performance reflects the continued impact of the slowdown in spend from clients in the technology and finance sectors. We expect to see an improving trend in organic growth in the second half with our focus on delivering growth and measurable business results for our clients.

“Our second quarter performance reflects the continued impact of the slowdown in spend from clients in the technology and finance sectors. We expect to see an improving trend in organic growth in the second half with our focus on delivering growth and measurable business results for our clients.

We are pleased to welcome 2,800 new colleagues from Tag who officially joined the Group on July 1st. Tag brings AI-driven technology and global content capabilities to add immediate value to dentsu’s clients.

Tag will provide high quality content at speed and scale for creative, a scaled personalization engine for customer experience management (CXM), as well as adding power to media with Dynamic Content Optimization (DCO). We consider Tag's capabilities as "the last mile", ensuring dentsu provides an integrated, full-service offering that is, increasingly, desired by our global clients.

In July we announced the latest milestone in dentsu’s longstanding partnership with Microsoft, launching enterprise-wide access to advanced Azure OpenAI technologies, further expanding our AI product offerings.

As we look forward, we are confident in our positioning at the convergence of marketing, technology and consulting. Client pitches require ever-closer integration of our services and by accelerating our One dentsu philosophy and mindset we will encourage the collaboration required amongst our people to anticipate and exceed our clients’ expectations.

The collective strength of our 72,000 employees brings dentsu its unique culture. Our ability to generate new ideas and innovate, by bringing together expertise and fostering creativity enables us to deliver integrated solutions that grow our clients’ businesses.”

H1 FY23 Business Updates

• Total net revenue from Customer Transformation & Technology reached 33% of Group net revenues at end of June 2023 (YoY + 130bp, + 80bp on a constant currency basis). The Group continues to make progress towards the stated strategy of reaching 50% of net revenues generated by CT&T.

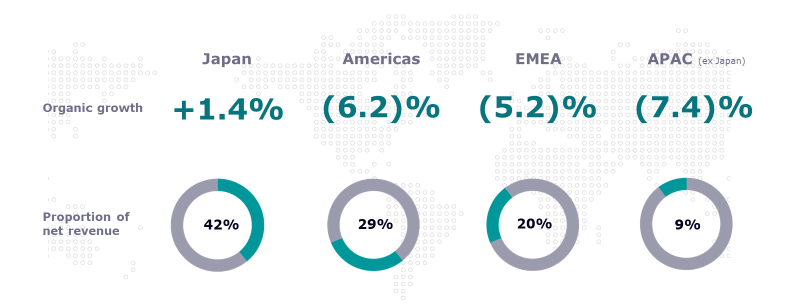

Regional organic growth and proportion of net revenues for H1 2023

• Japan, Q2 organic revenue 3.4%, H1 organic revenue 1.4%

In Japan, the second quarter saw a return to growth driven by continued double digit organic growth in CT&T, led by the Customer Transformation and Digital Transformation practices. Client spend in the financial, transportation and household/personal products sectors was strong. Consulting services delivered a strong performance with Dentsu Consulting reporting client growth from projects across a diverse range of client sectors, including pharma, retail and telecoms. Ignition Point, the digital consulting business acquired in 2022 delivered 50%+ growth in revenues yoy. ISID also performed well with strength in business and manufacturing solutions. Advertising saw revenues decline yoy on strong comparables, with some caution from clients on TV and internet advertising spend.

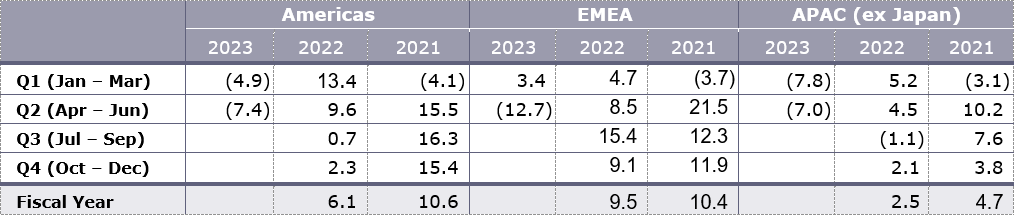

• Americas Q2 organic revenue -7.4%; H1 organic revenue -6.2%

The Americas region was weaker with organic revenue decline in both Media and CT&T due to weaker client spend – but also impacted by tough prior year comparables which ease significantly into the second half of the year.

Media saw reduced client spend, particularly from clients in the technology sector, although consumer goods remained relatively robust. CT&T results continued to be impacted by the lengthening of the sales cycle as highlighted last year, although revenue has stabilized. Creative in the Americas delivered 0.5% growth in H1 as a result of expanding client remits and a number of new client wins.

In June Michael Komasinski was appointed as CEO of dentsu Americas, overseeing the integrated growth strategy and business execution for dentsu within the Americas region. Most recently Michael served as CEO, CXM International Markets. Michael’s experience in bringing together the skills, technology and data to grow revenues in the region will prove critical as dentsu takes its next steps towards becoming a people-centered transformation business.

• EMEA Q2 organic revenue -12.7%; H1 organic revenue -5.2%

EMEA Q2 performance recorded a one-off financial impact in the DACH cluster, with the results adversely affected by a complex business transformation and systems integration. The impact is one-off and accounted for within the second quarter results. Excluding this one-off financial impact, EMEA would have reported positive organic growth for H12023.

A number of new client wins were reported across the region with success across Media, Creative and CXM with a number of integrated pitches. Media reported positive growth in the second quarter as a result of good conversion on new clients and expanded scope from existing clients in a number of markets. CT&T saw a number of new business wins in Northern Europe and the UK. Creative was lower in the second quarter as a result of project delays in a number of markets – but did see some momentum in new client wins. The UK, Spain, the Netherlands, Denmark and Norway all delivered positive organic growth.

• APAC (ex Japan) Q2 organic revenue -7.0%; H1 organic revenue -7.4%

Macro-economic headwinds continue to impact performance in China with market deflation resulting in reduced spend in cyclical industries where dentsu has greater client exposure. A more stable H2 performance is expected following a number of client retentions. In China, the newly appointed market CEO, Chun Yin Mak, will bring strong market knowledge and expertise in technology and business transformation consulting that will drive growth in high value areas including CT&T. Performance in North Asia remained consistent, delivering low single digit organic growth in Taiwan and Hong Kong.

India experienced the impact of client losses from the Media business in Q2, however a new leadership team under Anita Kotwani in Media and Harsha Razdan as CEO, India has led to a radical shift towards more effective collaboration and a focus on client centricity. Recent client wins demonstrate a return to competitiveness.

In Southeast Asia, Vietnam delivered standout performance of over 9%. However, pull back in spend in the Tech sector and ATV switch off in Indonesia continued to impact performance. Wins across the cluster in Q2 provide a more encouraging outlook for H2.

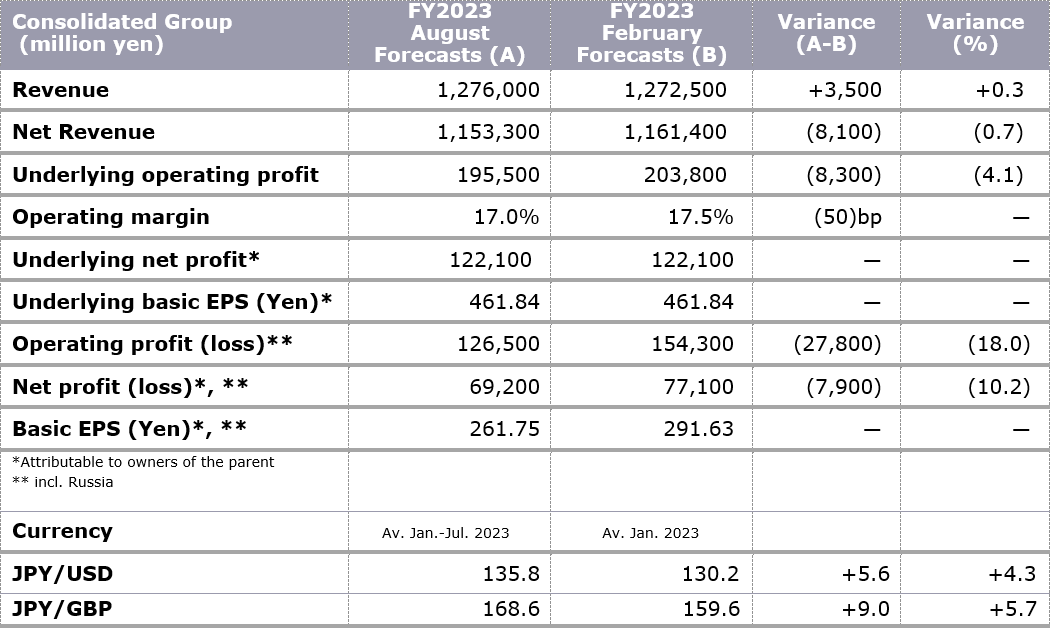

Forecast of Consolidated Financial Results for FY2023 (IFRS)

Dentsu Group Inc. issues updated guidance. Group organic growth is now forecasted at 0% to -2% for FY2023.

For further details please see the presentation on Dentsu Group Inc. website.

URL: https://www.group.dentsu.com/en/ir/

The accounts are, in line with usual practice, unaudited and subject to final audit.

– Ends –

Definitions

- Net revenue : The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit : KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin : Underlying operating profit divided by net revenue.

- Underlying net profit (attributable to owners of the parent) : KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS : EPS based on underlying net profit (attributable to owners of the parent).

- -Underlying EBITDA : Underlying operating profit before depreciation and amortization (excluding depreciation adjustments under IFRS 16).

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: https://www.group.dentsu.com/en/ir/

Forward-Looking Statements

This material contains statements about Dentsu Group that are or may be forward-looking statements. All statements other than statements of historical facts included in this presentation may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “estimates”, “projects” or, words or terms of similar substance or the negative thereof, are forward-looking statements. Forward-looking statements include statements relating to the following: information on future capital expenditures, expenses, revenues, earnings, synergies, economic performance, and future prospects.

Such forward-looking statements involve risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof.

About dentsu

Dentsu is the network designed for what’s next, helping clients predict and plan for disruptive future opportunities and create new paths to growth in the sustainable economy. Taking a people-centered approach to business transformation, we use insights to connect brand, content, commerce and experience, underpinned by modern creativity. As part of Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), we are headquartered in Tokyo, Japan and our 72,000-strong employee-base of dedicated professionals work across four regions (Japan, Americas, EMEA and APAC). Dentsu combines Japanese innovation with a diverse, global perspective to drive client growth and to shape society.

https://www.dentsu.com/

https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | NEW YORK | |

| MEDIA Please contact Corporate Communications |

Jumpei Kojima: +81 3 6217 6602 kojima.jumpei@dc1.dentsu.co.jp |

Matt Cross: +44 7446 798 723 matt.cross@dentsu.com |

Jeremy Miller: +1 917-710-1285 jeremy@dentsu.com |

| INVESTORS & ANALYSTS Please contact Investor Relations |

Yoshihisa Okamoto: +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 kate.stewart@dentsu.com |