Dentsu Group Inc. Q1 FY2023 Consolidated Financial Results

May 15, 2023

- IR-Timely Disclosure

- Management

(The first quarter ended March 31, 2023 – reported on an IFRS basis)

・Dentsu Group Inc. reports Q1 FY2023 net revenues +4.5%* yoy, with organic revenue decline of -1.6%*, against strong prior year comparables.

・Despite a slightly slower start to the year, the Group reiterates FY2023 net revenue, operating margin and underlying EPS guidance issued in February, with a stronger than expected contribution from recent acquisitions.

・The Group continues to expect performance to be second half weighted driven by a number of one-off events later in the year. Underlying basic EPS guidance of 461 yen is re-confirmed, supported by a reduction in financing costs.

・The Group today guides to organic growth of 1-2% for FY2023 versus c.4% previously.

Customer Transformation & Technology (CT&T) reached 35% of Group revenues, growing 6.7% (cc) in the first quarter. In Japan and EMEA, CT&T reported double digit organic growth; the US market was impacted by a lengthening of the sales cycle, as highlighted in Q4 FY22. The CT&T pitch pipeline internationally is currently 8% higher year-on-year (yoy) with an improving rate of new business wins, providing visibility on the growth outlook for H2 FY23. Clients continue to invest in digital transformation enabled by centralized data strategies to engage consumers, creating meaningful brand experiences.

In March, two acquisitions were announced in line with the Group’s stated strategy of expanding in CT&T and aiming for 50% of net revenues generated by this business. Shift7, a US based B2B experience and commerce agency, further bolstered the Group’s offering in Salesforce B2B Commerce, Sales, and Service Cloud capabilities. Tag, announced in March, will add dynamic digital production capabilities, providing high quality content at speed with a scaled personalization engine for customer experience management. The acquisition will support dentsu’s strategy of offering integrated client solutions at the convergence of marketing, technology, and consulting.

First quarter operating margin 14.2%*, lower yoy due to high comparables across the business. The first quarter margin is in line with internal forecasts.

Progress on balance sheet simplification continues with the sale of security assets. Four further stakes were sold in the first quarter. *Figures reported ex Russia

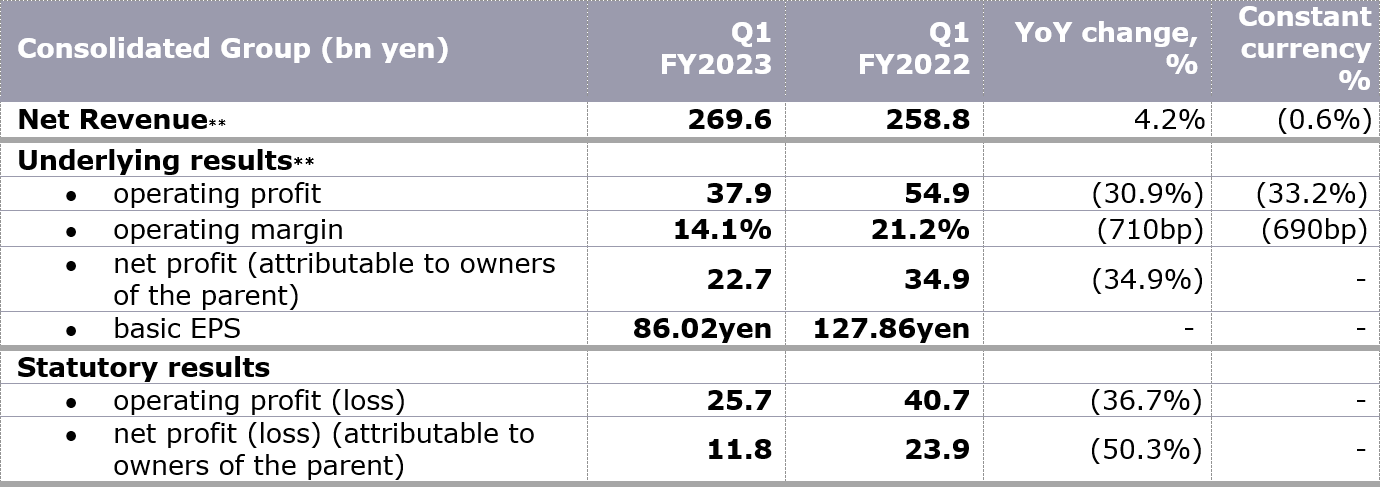

Q1 FY2023 Financial Results Summary **See below for definitions

Q1 FY2023 (Jan – Mar) Results: Key Financials

Group net revenue JPY 269.6 bn (YoY +4.2%, -0.6% at constant currency)

• On a constant currency basis Japan reported 0.4% growth in net revenue in the first quarter, the Americas a decline of -5.0%, EMEA growth of 6.6%* and APAC a decline of -6.1%.

• Reported net revenue increased 4.2% with currency positively impacting by JPY 13.2 bn and M&A contributing JPY 2.6 bn.

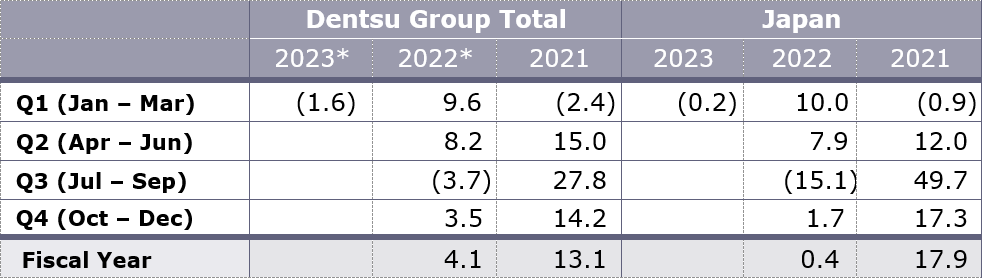

Group organic revenue decline 1.6%*

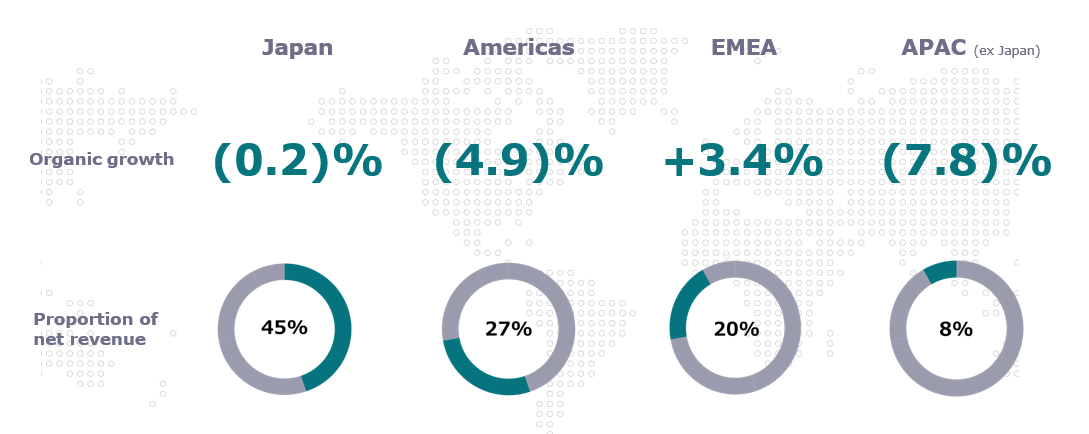

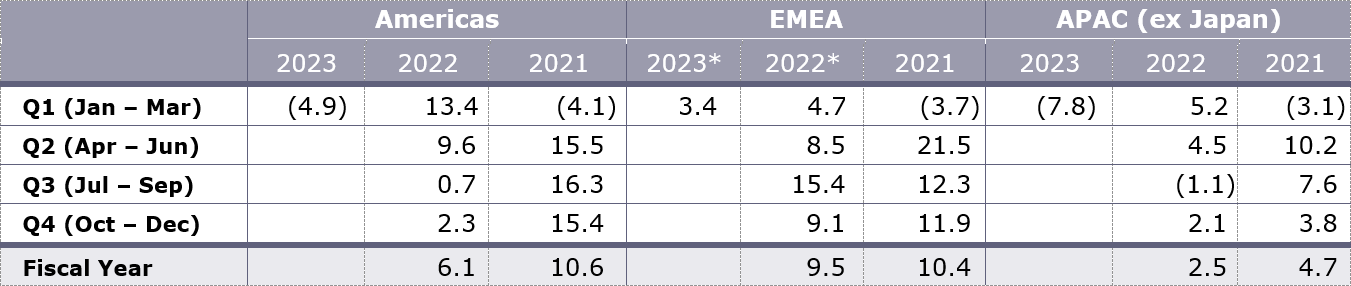

• The Group faced strong comparables from the prior year, that are expected to ease into the second half. Japan delivered 0.2% organic revenue decline in the first quarter, the Americas reported 4.9% organic revenue decline. EMEA delivered positive organic growth of 3.4%*, and APAC (excluding Japan) declined 7.8%.

• Performance continues to be driven by structural growth in Customer Transformation & Technology, led by ISID in Japan and Merkle in EMEA in the first quarter.

Group underlying operating profit declined 33.2% (cc) yoy to JPY 37.9 bn. Operating margin declined by 690 bp* on a constant currency basis to 14.1%*

• The fall in margin yoy is largely due to a change in the accounting methodology for incentives in Japan. The first quarter margin is in line with expectations.

Group underlying net profit (attributable to owners of the parent) decreased by 34.9% yoy to JPY 22.7 bn due to the fall in underlying operating profit

• Underlying basic EPS JPY 86.02 in line with expectations.

Group statutory operating profit and net profit (attributable to owners of the parent) were respectively JPY 25.7 bn and JPY 11.8 bn

Group net debt / underlying EBITDA (LTM) 0.52x, below the medium term expected range of 1.0x to 1.5x (non IFRS 16 basis), providing the flexibility to invest for growth in acquisitions as opportunities arise.

Hiroshi Igarashi, President and CEO, Dentsu Group Inc., said:

The first quarter delivered a 4.5*% increase in net revenues with an organic revenue decline of -1.6*%, against strong prior year comparables.

The first quarter delivered a 4.5*% increase in net revenues with an organic revenue decline of -1.6*%, against strong prior year comparables.

The first quarter was impacted by a lengthening of the sales cycle for Customer Transformation & Technology contracts in the US, as highlighted in the fourth quarter. A growing pipeline and increase in new business wins in the first quarter provides greater visibility for an improvement in second half growth.

Our strategy of growing revenues in the fast growth market of Customer Transformation & Technology is progressing well, with 35% of net revenues generated by CT&T in the first quarter. Our services empower our clients to transform their data, technology, and organizational capabilities to deliver differentiated customer experiences that drive growth.

We remain clear that the future of our industry is greater convergence and integration of services. Our latest announced acquisition, Tag, will position us well to deliver the integrated solutions our clients are looking for at the convergence of marketing, technology & consulting. We expect completion in the second half of the year.

I would like to thank all our 69,000 employees across the Group for their continued commitment. Together, we look to continue to grow corporate value through our vision of People-centered Transformation.

Q1 FY23 Business Updates

• Total net revenue from Customer Transformation and Technology reached 35% of Group net revenues in Q1 FY23 (YoY +290 bp, +230 bp on a constant currency basis). The Group continues to make progress towards the stated strategy of reaching 50% of net revenues generated by CT&T.

Regional proportion of net revenues and organic growth for Q1 2023

Quarterly Organic Revenue Performance (*Figures reported ex Russia)

• Japan Q1 organic revenue -0.2%

In Japan, net revenue reached a record high in Q1 FY2023, with flat organic growth despite strong double-digit comparables from the prior year. TV spot advertising and Internet advertising businesses saw some slow down as the quarter progressed, but this was offset by a robust performance in Customer Transformation & Technology. CT&T showed double digit growth with continued strong performance seen in DX led by ISID and CX led by Dentsu Digital.

• Americas Q1 organic revenue -4.9%

The Americas region faced strong prior year comparables at over 13% organic growth in Q122, with the comparables easing significantly in the second half of the year. In the US market, slower spending from technology clients impacted media revenues, offsetting growth in other sectors. Customer Transformation & Technology was affected by slower decision making by clients in the second half of 2022 and against strong prior year comparables. The Customer Transformation & Technology pipeline is higher year-on-year demonstrating returning client confidence, and new business wins in the first quarter increased versus the second half of 2022. Creative saw continued momentum with growth driven by expanding remits from existing clients and incremental revenue from new clients. Canada saw organic growth of almost 2%, benefiting from new client account wins.

• EMEA Q1 organic revenue 3.4%

The EMEA region reported double digit organic growth in Customer Transformation & Technology, with continued momentum in client spend. The acquisition of Omega in February further bolstered dentsu’s leading position in Customer Transformation & Technology in Spain. The acquisition brings expertise in all key Salesforce Clouds with specialism across multiple industries, including health and life services, education, non-profit, manufacturing, utilities, and retail. Media reported flat organic growth year-on-year while Creative organic revenue declined due to revenue phasing. The Netherlands, Norway and Switzerland all reported double digit organic growth in the quarter, while Denmark, Poland, Spain and Sweden also performed well.

• APAC Q1 organic revenue -7.8%

The APAC region reported organic revenue decline in the first quarter. The region was impacted by client losses and lower spend from existing clients, particularly in the Tech sector. Lower spend in China and India as well as the switch off of ATV and lower spends in Indonesia have also had an impact. However, a streak of new business wins and key leadership appointments including Harsha Razdan as CEO, India and the strategic clustering of South-East Asia with the appointment of industry veteran Sanjay Bhasin as CEO, South-East Asia provides an encouraging outlook.

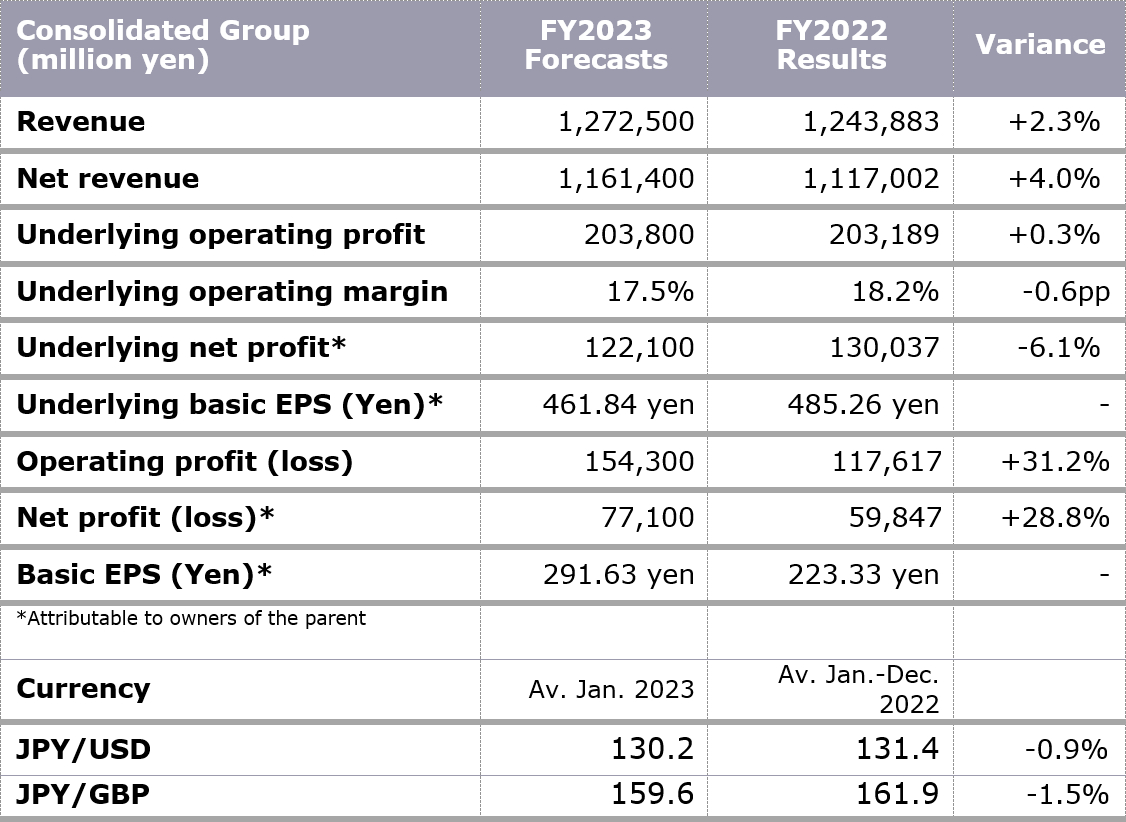

Forecast of Consolidated Financial Results for FY2023 (IFRS)

Dentsu Group Inc. reiterates guidance issued in February 2023. Group organic growth is now forecasted at 1 to 2% for FY2023.

For further details please see the presentation on Dentsu Group Inc. website.

URL: https://www.group.dentsu.com/en/ir/

The accounts are, in line with usual practice, unaudited and subject to final audit.

– Ends –

Definitions

- Net revenue : The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit : KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin : Underlying operating profit divided by net revenue.

- Underlying net profit (attributable to owners of the parent) : KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS : EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA : Operating profit before depreciation, amortization and impairment losses.

Forward-Looking Statements

This material contains statements about Dentsu Group Inc, that are or may be forward-looking statements. All statements other than statements of historical facts included in this presentation may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “estimates”, “projects” or, words or terms of similar substance or the negative thereof, are forward-looking statements. Forward-looking statements include statements relating to the following: information on future capital expenditures, expenses, revenues, earnings, synergies, economic performance, and future prospects.

Such forward-looking statements involve risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof.

About dentsu

Dentsu is the network designed for what’s next, helping clients predict and plan for disruptive future opportunities and create new paths to growth in the sustainable economy. Taking a people-centered approach to business transformation, we use insights to connect brand, content, commerce and experience, underpinned by modern creativity. As part of Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), we are headquartered in Tokyo, Japan and our 69,000-strong employee-base of dedicated professionals work across four regions (Japan, Americas, EMEA and APAC). Dentsu combines Japanese innovation with a diverse, global perspective to drive client growth and to shape society.

https://www.dentsu.com/

https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | NEW YORK | |

| MEDIA Please contact Corporate Communications |

Jumpei Kojima: +81 3 6217 6602 jumpei.kojima@dentsu.co.jp |

Matt Cross: +44 7446 798 723 matt.cross@dentsu.com |

Jeremy Miller: +1 917-710-1285 jeremy@dentsu.com |

| INVESTORS & ANALYSTS Please contact Investor Relations |

Yoshihisa Okamoto: +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 kate.stewart@dentsu.com |