Dentsu Group Inc. Q1 FY2022 Consolidated Financial Results

May 16, 2022

- IR-Timely Disclosure

- Management

(The first quarter ended March 31, 2022 – reported on an IFRS basis)

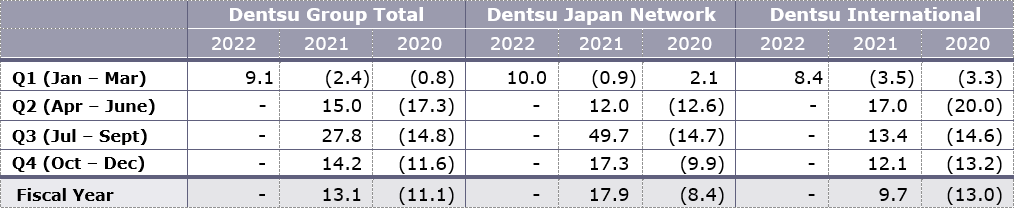

A strong start to the year, Dentsu Group reports 9.1% organic growth, Dentsu Japan Network 10.0% and Dentsu International 8.4%, marking a record high first quarter performance in net revenues, underlying & statutory operating profit. The Group upgrades FY2022 organic growth guidance to 4% to 5% from 4% previously. Operating margin increased 140 bp yoy on a constant currency basis (cc) driven by the transformation and simplification the Group has been undertaking over the past year.

- The first quarter saw continued confidence from clients investing in media services and digital solutions. The structural growth area of Customer Transformation & Technology reached 31.5% of Group net revenues (YoY +260 bp (cc)), growing +22.5% (cc). In Japan, ISID and Dentsu Digital reported organic growth of 17.7% and 11.8%, respectively, and the CXM service line in Dentsu International reported 14.8% organic growth. The outlook for client spend on digital experiences and customer focused transformation remains robust.

- Group operating margin expansion is driven by 310 bp improvement in Dentsu Japan Network with a 30 bp (cc) decline at Dentsu International. Operating leverage from the strong top line and the continued simplification drive across the Group delivered margin improvement.

- The Group has sold additional property assets as the review of non-trading assets on the balance sheet continues, contributing JPY 11.6 bn to statutory operating profit, this largely offset an asset write-down of JPY 14.2 bn largely related to the ongoing disposal of the Russia business.

- The acquisition pipeline remains active with a number of deals focused on expanding capabilities on Customer Transformation & Technology in line with the Group’s stated strategy. In May 2022 Dentsu Japan Network announced a majority stake in Ignition Point which will support Customer Transformation & Technology growth in Japan.

- Following the better than expected start to the year, the Group upgrades organic growth guidance for FY2022 to 4% to 5% from 4% previously. Dentsu Japan Network still expects 2% to 3% organic growth and Dentsu International increases guidance to 5% to 6% from 4% to 5% previously. Operating margin guidance of 17.7% remains as costs are expected to rise in Japan through the year as highlighted in February.

- The Group retains confidence in the medium-term targets of 4 to 5% Group organic growth, 18% Group margins with a pay-out ratio reaching 35.0% by 2024.

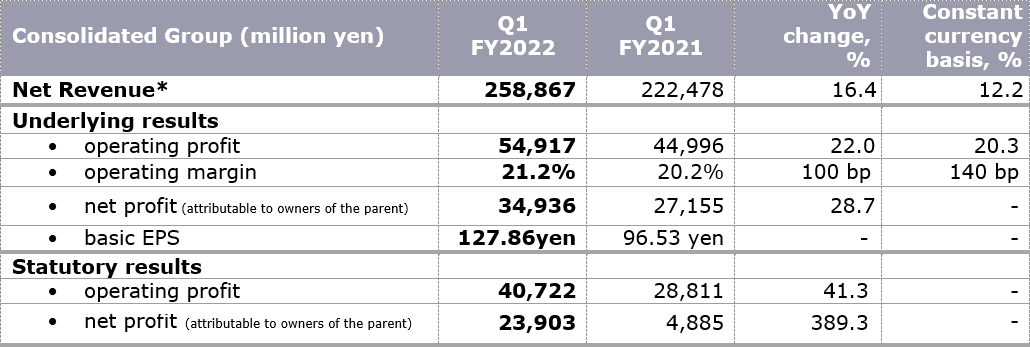

Q1 FY2022 Financial Results Summary

*Notation of “Revenue less cost of sales” was changed to “Net revenue” from this quarter

Q1 FY2022 Results: Key Financials

Group net revenue JPY 258.8 bn (YoY +16.4%, +12.2% on a constant currency basis)

- 14.9% growth in net revenue at Dentsu Japan Network, and 17.7% (10.1% on a constant currency basis) at Dentsu International.

- Net revenue increased due to organic growth of JPY 21.6 bn, currency positively impacted by JPY 8.1 bn, and M&A contributed JPY 6.6 bn.

Group organic growth was 9.1%.

- 10.0% organic growth at Dentsu Japan Network, and 8.4% at Dentsu International (9.2% excluding Russia). Q1 FY2022 saw a growth in all regions by continued recovery in media as well as increased client spend on digital transformation initiatives.

Group underlying operating profit increased by 22.0% (20.3% on a constant currency basis) yoy to JPY 54.9 bn. Operating margin improved by 100 bp (140 bp on a constant currency basis) to 21.2% reflecting operating leverage from higher revenues and the continued focus on costs across the Group.

- At Dentsu Japan Network, underlying operating profit was JPY 42.6 bn (YoY +25.6%); operating margin of 35.8% (YoY +310 bp); the highest ever first quarter margin. Costs are expected to increase through the year.

- At Dentsu International, underlying operating profit was JPY 13.8 bn (YoY +13.0%, +7.2% on a constant currency basis); operating margin excluding Russia of 10.4% and operating margin including Russia of 9.9% (YoY -40 bp, -30 bp on a constant currency basis).

Group underlying net profit (attributable to owners of the parent) increased by 28.7% yoy to JPY 34.9 bn due to the increase of underlying operating profit.

- The underlying basic EPS of JPY 127.86 (Q1 FY2021: JPY 96.53).

Group statutory operating profit and net profit (attributable to owners of the parent) are of JPY 40.7 bn and JPY 23.9 bn.

- Statutory operating profit and net profit (attributable to owners of the parent) were boosted by an increase of underlying operating profit and the gain on sale of property assets in Japan, partially offset by an asset write-down related to the ongoing disposal of the Russia business.

Hiroshi Igarashi, President and CEO, Dentsu Group Inc., said:

“Dentsu Group has seen a strong start to the year with organic growth ahead of expectations as clients continue to invest in brand experiences informed by data and analytics.

“Dentsu Group has seen a strong start to the year with organic growth ahead of expectations as clients continue to invest in brand experiences informed by data and analytics.

The changing macro impact from the Russia-Ukraine conflict, inflation, interest rates rises around the world, and the continued COVID-19 restrictions in China are well reported – however, we feel confident in our ability to deliver growth in 2022. Today we upgrade our 2022 organic growth outlook, guiding to 4-5% for Dentsu Group from 4% previously.

As we continue to grow our net revenues in Customer Transformation & Technology the Group becomes more exposed to a faster growing area of our industry, allowing us to deliver a truly differentiated offer to our clients as we shift our business to a hybrid agency / consultancy.

Our strengths in first-party data, combined with identity resolution, data management, marketing technology, data sciences, loyalty, CRM, personalization, and media/creative services, have created differentiation against an evolving competitive landscape. We have our sights set on becoming the market leader enabling and activating the total customer experience as we look to grow Customer Transformation & Technology to 50% of our Group net revenue over time.

The situation in Ukraine remains at the forefront of our minds and we continue to support our colleagues in the region with accommodation arrangements, border transfers and legal assistance. We continue to be led by one of our Group’s guiding principles “we must be a force for good”, in line with our position as a B2B2S (Business to Business to Society) company.

I would like to thank all of our 65,000 employees across the Group for their hard work and continued dedication.”

Q1 FY2022 Business Updates

Customer Transformation & Technology ratio of net revenues

- Net revenue from Customer Transformation & Technology reached 31.5% of Group net revenue (YoY +260 bp, +260 bp on a constant currency basis), 25.8% (YoY +210 bp) from Dentsu Japan Network and 36.4% (YoY +280 bp, +330 bp on a constant currency basis) from Dentsu International.

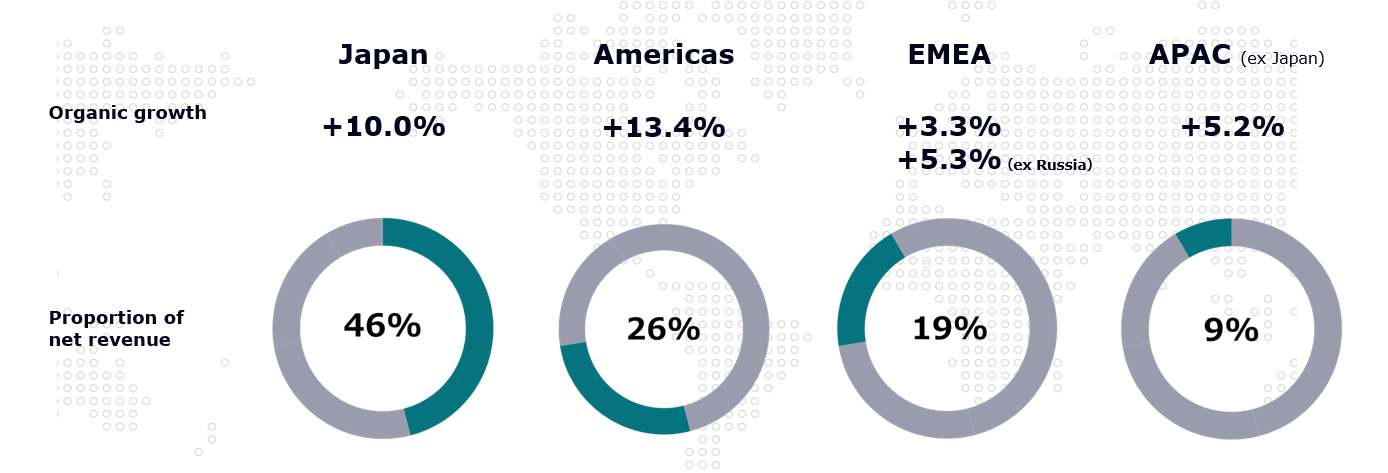

Regional net revenue and organic growth for Q1 FY2022

Quarterly Organic Revenue Performance

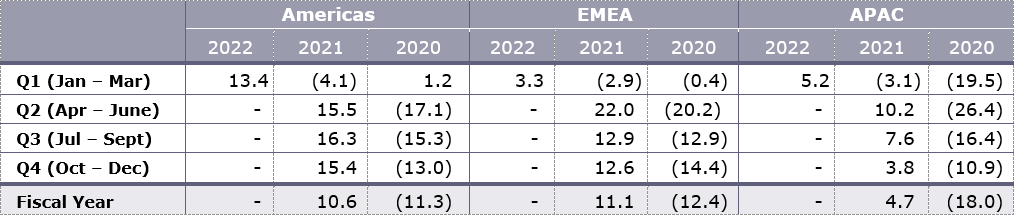

Quarterly Organic Revenue Performance for Dentsu International by Region

Japan business (Dentsu Japan Network)

- In Japan, organic growth was 10.0%.

In addition to the significant increase in Customer Transformation & Technology net revenue, client spend on advertising remained robust with client and consumer confidence continuing to rise into FY2022.

Dentsu Inc. significantly contributed to net revenue, as spend across all major advertising mediums remained buoyant. The digital/consulting business maintained momentum throughout the quarter, supporting clients’ ever-growing needs for business and digital transformation. By company, Dentsu Inc., ISID and Dentsu Digital reported 5.7%, 17.7% and 11.8% organic growth, respectively. SEPTENI HOLDINGS, consolidated for the first time this quarter, reported 13.9% organic growth and cements the Group’s position as the leader in the digital advertising business in Japan.

Together with the increase in net revenue, a transformed cost base contributed to the historical high operating margin of 35.8% as the first quarter. As highlighted in February, costs in Japan are expected to rise through the rest of the year due to investment for future growth and the FY2022 margin guidance of 22% remains.

In May 2022, Dentsu Japan Network announced the acquisition of Ignition Point, a consultancy business in the Customer Transformation & Technology space, focused on Business Transformation (BX) & Digital Transformation (DX). Ignition Point provides consulting services that combine innovation, creativity, and technology and grew revenue/sales over 30% in 2021.

This alliance will further Dentsu Group’s ambition of reaching 50% of consolidated net revenue generated by the structural growth area of Customer Transformation & Technology over time, in line with the medium-term management plan (2021 to 2024) updated by the Group in February 2022.

International business (Dentsu International)

By region:

- In the Americas, organic growth was 13.4%.

The Americas reported 13.4% organic growth in the first quarter, driven by incremental investments and new projects from clients across CXM and Media. Both the US market and Canada reported 14% organic growth boosted by strong Media spend. CXM, led by Merkle, outperformed expectations in the first quarter and Creative delivered mid-single digit organic growth. - In EMEA, organic growth was 3.3%, excluding Russia was 5.3%.

CXM growth was double digit across EMEA in the first quarter, with an increase in secured client income year-on-year and with larger pitch opportunities compared to FY2021. The Creative business saw strong new business wins across financial, luxury and travel clients with a strong pipeline of opportunities for the rest of the year. The UK market grew 10.6% boosted by growth in out-of-home. Highlights include Denmark 24.4% organic growth, Italy 8.1% and Germany 5.3%. - In APAC (excluding Japan), organic growth was 5.2%.

CXM reported almost 20% growth in the first quarter driven by client demand for analytics and marketing technology implementation. Australia reported 12.0% organic growth showing continued recovery with new client wins across Media, CXM and Creative. China saw reduced income in Creative but improved media spend. India saw a positive organic growth due to the significant growth of CXM. Taiwan and Thailand reported 6.0% and 8.0% respectively.

By service line:

- MEDIA

The Group’s largest clients continue to grow faster than Group due to expanding relationships with existing clients. The pipeline of opportunities in Media is strong with a good mix of local and global clients. The pipeline is 90% offensive opportunities. Clients remain upbeat with the majority of clients sustaining their media spend. - CREATIVE

The first quarter saw momentum in the EMEA and Americas regions with expanding remits with existing clients, supported by a number of new client wins. North America reported 8% growth with momentum in the UK, Spain, Australia, and Thailand. FY2022 remains a year of transition for the Creative business under the new leadership of Fred Levron. - CXM

Americas, EMEA, and APAC reported 15%, 14% and 20% organic growth, respectively, as our clients continue to invest in redefining their connection to consumers through technology and digital transformation. Experience and commerce remain the fastest growth areas. The proportion of revenue that is secured is higher than this point in FY2021 and the pipeline of opportunities is higher year-on-year with an increase in average deal size. The Group continues to forecast a long runway of growth with continued momentum throughout FY2022.

RUSSIA COMMENTARY

- The group continues to be in the process of negotiating the transfer of ownership of the Russian business to local partners.

- In the second quarter of the year the Group expects further charges related to the transfer. These charges will not impact underlying figures, affecting only statutory figures. The majority of the charges will be non-cash, relating to re-cycling of FX translation differences out of reserves and back through the income statement.

- There is no expected impact on FY2022 net revenue, organic growth, underlying operating profit, and operating margin forecasts from the disposal of the Russian business.

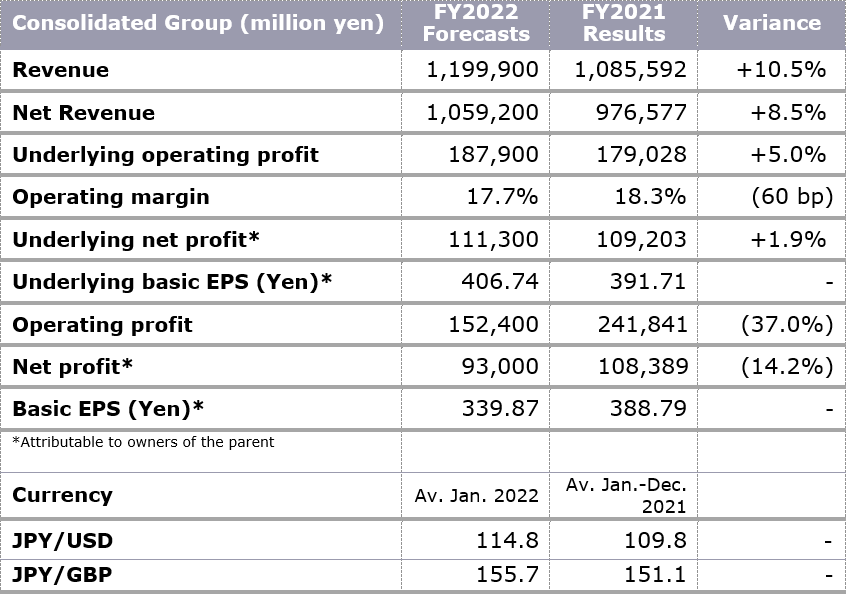

Forecast of Consolidated Financial Results for the FY2022 (IFRS)

The Dentsu Group forecasts Group organic growth at 4-5% for FY2022, upgraded from 4% announced in February, with Dentsu Japan Network at 2 to 3% and Dentsu International 5 to 6%, upgraded from 4 to 5% announced in February. Operating margin guidance remains unchanged at 17.7% with Dentsu Japan Network at 22% and Dentsu International at flat as FY2021 (15.9%). There is no change from February announcement other than organic growth guidance.

For further details please see the presentation on Dentsu Group Inc. website.

URL: https://www.group.dentsu.com/en/ir/

The accounts are, in line with usual practice, unaudited and subject to final audit.

– Ends –

Definitions

- Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin: Underlying operating profit divided by Net revenue.

- Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS: EPS based on underlying net profit (attributable to owners of the parent).

Forward-Looking Statements

This material contains statements about Dentsu Group that are or may be forward-looking statements. All statements other than statements of historical facts included in this presentation may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “estimates”, “projects” or, words or terms of similar substance or the negative thereof, are forward-looking statements. Forward-looking statements include statements relating to the following: information on future capital expenditures, expenses, revenues, earnings, synergies, economic performance, and future prospects.

Such forward-looking statements involve risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof.

About Dentsu Group (dentsu)

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in approximately 145 countries and regions across five continents and with 65,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its six leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, and Merkle—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website: https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | |

| MEDIA Please contact Corporate Communications |

Shusaku Kannan +81 3 6217 6602 s.kannan@dentsu.co.jp |

Dani Jordan +44 7342 076 617 dani@dentsu.com |

| INVESTORS & ANALYSTS Please contact Investor Relations |

Yoshihisa Okamoto +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart +44 7900 191 093 kate.stewart@dentsu.com |