Dentsu Japan Network Conducts Its Fourth “Consumer Survey on Carbon Neutrality”

Dec 9, 2021

- Research Report

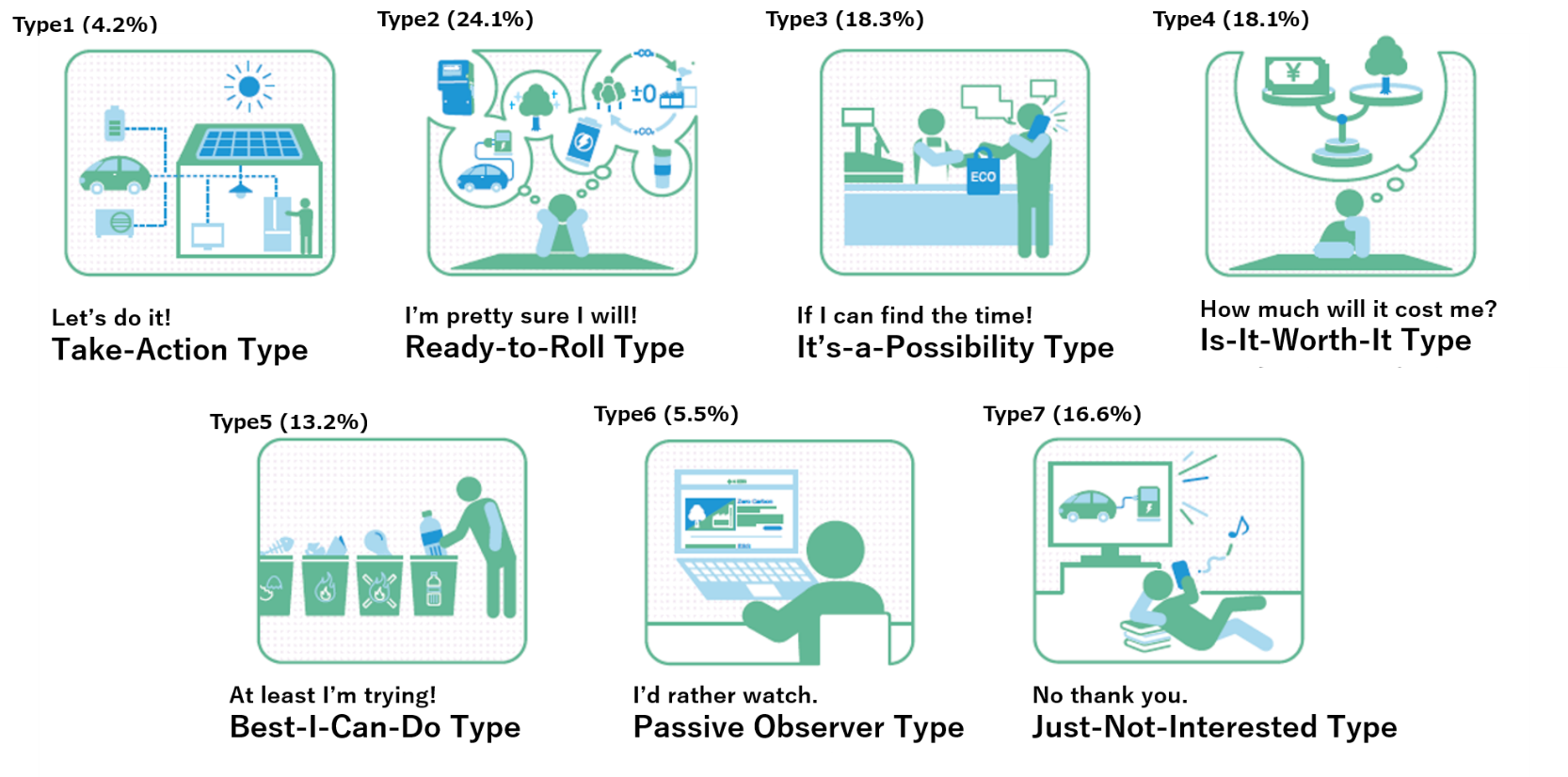

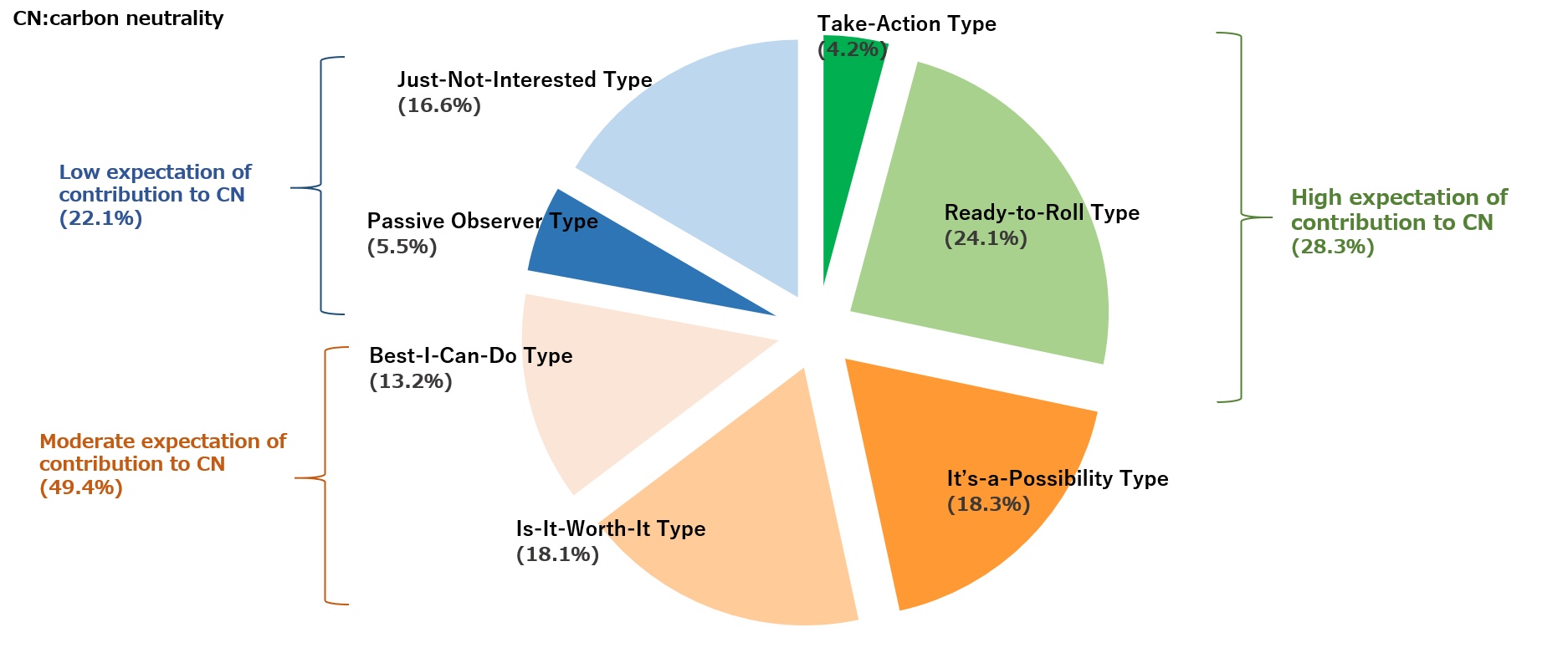

―Consumers are classified into seven types according to their awareness and behavior toward carbon neutrality. The largest is the “Ready-to-Roll Type”―

Dentsu Japan Network (President & CEO: Hiroshi Igarashi; Head Office: Tokyo; hereinafter referred to as “DJN”) conducted its fourth “Consumer Survey on Carbon Neutrality” (hereinafter referred to as “the survey”) from October 15 to 17, 2021. The survey was carried out by its DJN Sustainability Development Office and Dentsu Team SDGs, both of which promote sustainability projects across the Dentsu Group, and the respondents were 1,400 people across Japan with an age range spanning people in their teens to those in their 70s. The results of the first survey were announced in June this year, those of the second survey in August, and those of the third survey in October.

In this survey, DJN conducted a comparative analysis with the results of the three previous surveys this year with regard to the awareness of consumers in Japan toward “decarbonization” and “carbon neutrality,” which are important themes both in Japan and abroad, and the 14 priority fields identified in the “Green Growth Strategy Through Achieving Carbon Neutrality in 2050” announced by the Ministry of Economy, Trade and Industry. In addition, DJN investigated the status of efforts toward the “Zero Carbon Action 30” initiative which summarizes consumer decarbonization behavior and its merits in daily life and, for the first time, classified consumers into seven types from the perspective of awareness and behavior regarding carbon neutrality and then analyzed them.

This survey will continue to be conducted and published on a regular basis.

Main Topic

- Consumers are classified into seven types from the viewpoint of awareness and behavior regarding carbon neutrality. The “Ready-to-Roll Type,” which has the largest composition ratio of 24.1%, has a high proportion of elderly people and the percentage that uses newspapers as a source of information is also high. The percentage of the “Take-Action Type” which has the highest expectation of contribution is 4.2%, which is a small number, but it can be expected to increase in the future because it includes many young people.

Other Main Findings

- The carbon neutrality recognition rate*1 has surpassed the majority (approximately 52%) for the first time. The figure is over three quarters (around 75%), if those people who responded “I feel like I have seen or heard the term,” which does not quite reach the recognition rate criteria, are included.

- When looking at the recognition and expectations of carbon-neutral initiatives in each process of the supply chain by industry, automobiles rank high in a wide range of processes. In addition, there are high expectations for new energy development in the electric power and gas industries, for improvement of distribution processes in the shipping and transportation industries, and for investment in environmentally friendly companies in the finance industry. Thus, the areas where focus is expected differ depending on the industry.

- An analysis of the relationship between tolerance for additional spending by consumption expenditure item and recognition of relevance to carbon neutrality by expenditure item in daily life shows that even if there is recognition of a high degree of relevance, the tolerance is low for expenditure items that have a high consumption or payment frequency, but high for those expenditure items related to hobbies and tastes even if they are recognized as having a low degree of relevance.

- With regard to decarbonization efforts in daily life, the ones that are easy to do and that lead to saving are ranked high, because of the high degree of implementation of “sorting and separating waste for disposal,” “saving power,” and “saving water.”

- Generation Z has many carbon-neutral information sources such as social media and schools/private tuition schools, and is practicing “environmentally friendly fashion selection” and “sharing.” One of the characteristics of this generation is that their intention to implement and introduce these and other initiatives in the future is higher than that of other generations. While Generation Z has lower expectations for companies, the evaluation for companies that are proactive tends to be higher.

Notes

*1 Recognition (rate) is the ratio of the total number of consumers who answered “I understand the content” and “I only know the words” to the total number of respondents.

* Since the composition ratio (%) in this survey is rounded off to the second decimal place, the total may not add up to 100%.

For reference

- First survey (announced on June 9, 2021. Survey period: April 2 to 4, 2021):

https://www.group.dentsu.com/en/news/release/000587.html - Second survey (announced on August 12, 2021. Survey period: June 9 to 10, 2021):

https://www.group.dentsu.com/en/news/release/000588.html - Third survey (announced on October 21, 2021. Survey period: September 3 to 5, 2021):

https://www.group.dentsu.com/en/news/release/000634.html

#####

Media Inquiries:

Shusaku Kannan

Executive Director

Group Corporate Communications Office

Dentsu Group Inc.

Telephone: +81 (3) 6217-6602

E-mail: s.kannan@dentsu.co.jp