Dentsu Group Inc. FY2021 Consolidated Financial Results

Feb 14, 2022

- IR-Timely Disclosure

- Management

(The full year ended December 31, 2021 – reported on an IFRS basis)

FY2021 performance was ahead of guidance, with the Group reporting record high revenue less cost of sales, record high underlying and statutory operating profit and a record dividend at JPY 117.5. The results show a recovery across the Group, with FY2021 organic growth at 13.1% and underlying operating margin +360 bp yoy (cc) at 18.3%. The Group enters 2022 with a simplified business and a transformed cost base.

FY2021 revenues (LCoS) are above those reported in FY2019; with underlying operating profit 27.2% higher vs FY2019.

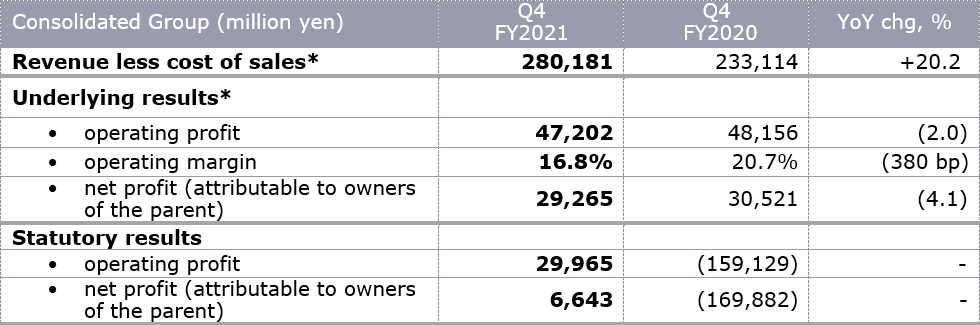

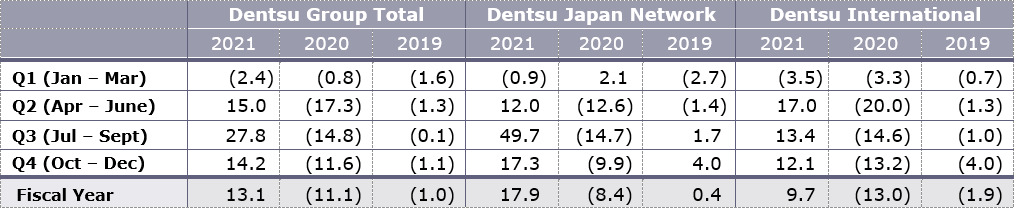

Fourth quarter revenues came in ahead of expectations due to increased spend from existing clients across the group with consumer confidence growing as the effects of the pandemic subside. Dentsu Japan Network reported Q4 FY2021 organic growth of 17.3% and Dentsu International reported organic growth of 12.1%. Spend remained strong in Customer Transformation & Technology, growing double digit, led mainly by Dentsu Digital in Japan and Merkle in the International business. Cloud solutions, commerce & experience and identity & analytics remain the fastest growth areas. Livearea, the acquisition announced in Q3 FY2021, reported over 30% organic growth in Q4 FY2021.

The Group today announces a buyback, up to JPY 40 bn in FY2022 and upgrades organic growth and margin targets for the medium-term outlook. The updated Medium-Term Management Plan guides to 4 to 5% organic growth CAGR (2022:2024) with a group operating margin of 18.0% by 2024. The Group also announces a JPY 250 bn to 300 bn acquisition fund to grow exposure to Customer Transformation & Technology, retaining the goal of generating 50% of revenues (LCoS) from this space over time; FY2021 revenue (LCoS) ratio was 29.1%.

The Group remains well positioned to benefit from the structural growth in Customer Transformation & Technology in FY2022 and beyond, with the outlook for client spend on digital experiences and customer focused transformation remaining robust.

The Group today issues FY2022 guidance for Group organic growth 4%, with Group margins marginally lower at 17.7% due to investment for future growth. Dentsu Japan Network is expected to grow 2 to 3% organically and Dentsu International 4 to 5%.

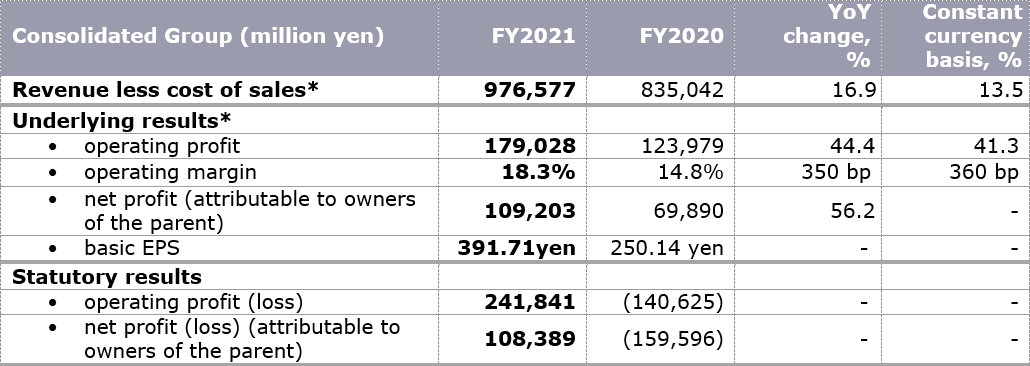

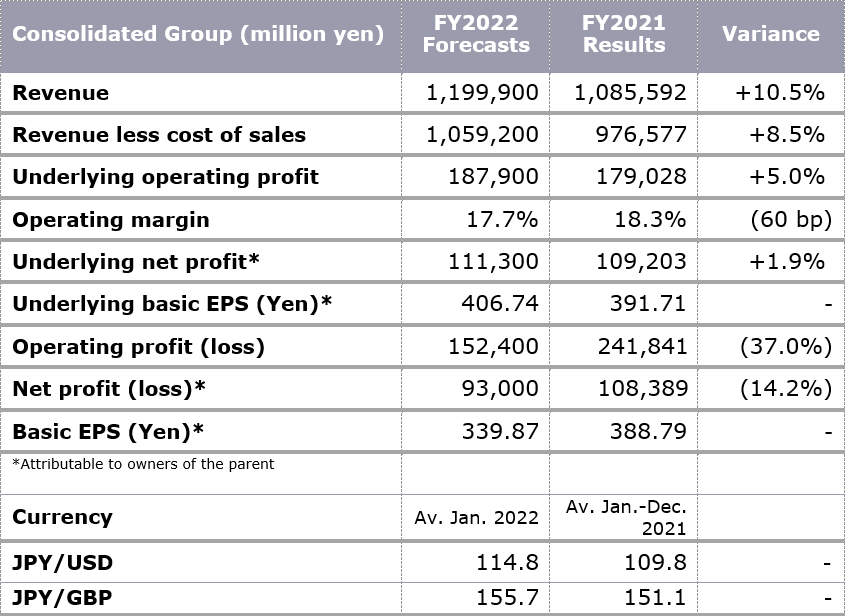

FY2021 Financial Results Summary

*See below for definitions

Q4 (Oct-Dec) FY2021 Financial Results Summary

*See below for definitions

FY2021 Results: Key Financials

Group revenue (LCoS) JPY 976.5 bn (YoY +16.9%, +13.5% constant currency basis)

- 19.2% growth in revenue (LCos) at Dentsu Japan Network, and 15.4% (9.6% on a constant currency basis) at Dentsu International.

- Revenue (LCoS) increased due to organic growth of JPY 112.7 bn, currency positively impacted by JPY 25.7 bn, and M&A contributed JPY 3.0 bn.

Group organic growth was 13.1%.

- 17.9% organic growth at Dentsu Japan Network, and 9.7% at Dentsu International. FY2021 saw a significant rebound in performance, led by the cyclical recovery in media as well as increased client spend on digital transformation initiatives.

Group underlying operating profit increased by 44.4% (41.3% on a constant currency basis) yoy to JPY 179.0 bn. Operating margin improved by 350 bp (360 bp on a constant currency basis) to 18.3% reflecting operating leverage from higher revenues and the continued focus on costs across the Group.

- At Dentsu Japan Network, underlying operating profit was JPY 95.3 bn (YoY +52.0%); operating margin of 22.9% (YoY +490 bp).

- At Dentsu International, underlying operating profit was JPY 88.9 bn (YoY +33.8%, +28.4% on a constant currency basis); operating margin of 15.9% (YoY +220 bp, +230 bp on a constant currency basis).

Group underlying net profit (attributable to owners of the parent) increased by 56.2% yoy to JPY 109.2 bn. due to the increase of underlying operating profit.

- The underlying basic EPS of JPY 391.71 (FY2021: JPY 250.14).

Group statutory operating profit and net profit (attributable to owners of the parent) marked the record-high number of JPY 241.8 bn and JPY 108.3 bn.

- Statutory operating profit and net profit (attributable to owners of the parent) were boosted by the gain on sale of non-current assets of JPY 118.9 bn, including the sale of Dentsu headquarters building sold on September 30, 2021.

Hiroshi Igarashi, President and CEO, Dentsu Group Inc., said:

”In 2021 Dentsu Group reported record high revenue (LCoS); record underlying and statutory operating profit and a record dividend at JPY 117.5.

”In 2021 Dentsu Group reported record high revenue (LCoS); record underlying and statutory operating profit and a record dividend at JPY 117.5.

We reduced our cost base, transformed our business and delivered margin improvement, resulting in a 44.4% operating profit increase yoy.

This performance is testament to the return to growth in our industry, the cyclical recovery in advertising as well as continued investment clients are making in commerce & experience. We remain confident in the long term growth outlook for the Group and upgrade our medium term targets. We look for Dentsu Group to deliver 4 to 5% organic growth CAGR (2022:2024) from a target of 3 to 4% previously.

In the structural growth area of Customer Transformation & Technology we see a long period of investment as our clients look to understand their customers better than ever. The greatest opportunity for brands today, as they build strategies for re-emergence from the COVID 19-driven recession, is customer experience transformation. This is the transformation of a company into a market leader through the implementation of a customer centered strategy and infrastructure.

In order to capture this opportunity, we announce a JPY 250 to 300 bn investment fund for the years 2022: 2024. This acquisition fund will be spent growing our exposure to Customer Transformation & Technology – our aim is to reach 50% of our revenue (LCoS) from Customer Transformation & Technology over time. This reflects our vision of where the future growth in the industry lies: data, technology integrated with creativity and innovation to deliver top line growth for our clients.

With the strong recovery in 2021 we will look forward in 2022 and beyond to unlock even more value within the Group, leveraging our competitive positioning, our strong product offering and the 65,000 talented individuals within the organization.”

FY2021 Business Updates

Digital revenue less cost of sales

- Total revenue (LCoS) from digital activities was 50.7% (YoY -320 bp, -180 bp on a constant currency basis), including 35.7% at Dentsu Japan Network (YoY +90 bp), and a 61.8% at Dentsu International (YoY -570 bp, -280 bp on a constant currency basis).

- Total revenue from Customer Transformation and Technology reached 29.1% of Group revenues (YoY +160 bp, +10 bp on a constant currency basis), 24.4% (YoY -00 bp) from Dentsu Japan Network and 32.6% (YoY +290 bp, +30 bp on a constant currency basis) from Dentsu International.

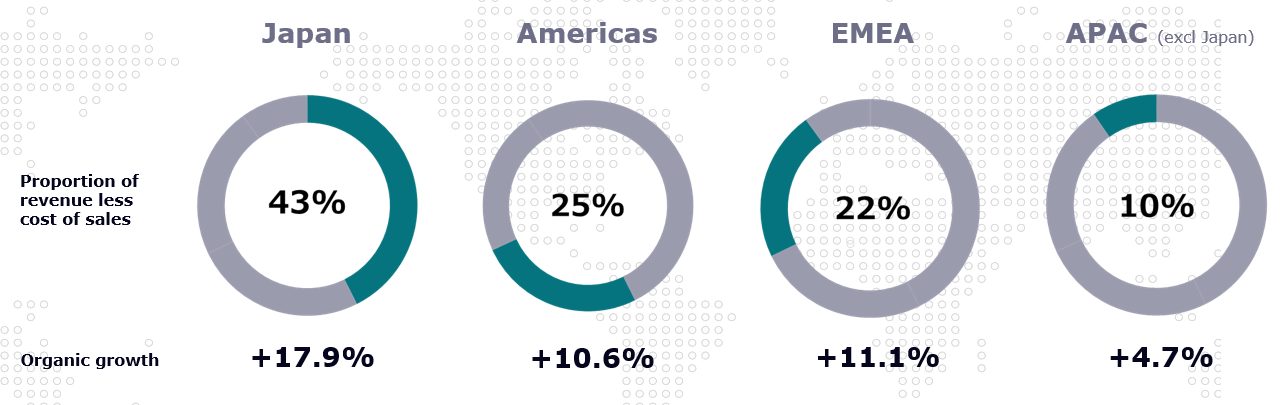

Regional revenues less cost of sales and organic growth for FY2021

Quarterly Organic Revenue Performance

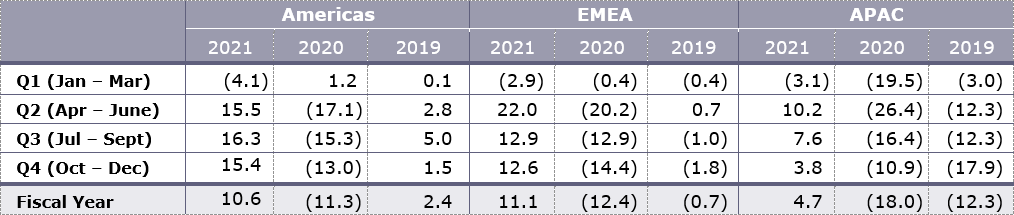

Quarterly Organic Revenue Performance for Dentsu International by Region

- In Japan, FY2021 organic growth was 17.9% in FY2021 and 17.3% in Q4 FY2021.

Client spend on advertising remained robust with client and consumer confidence continuing to rise into Q4. Dentsu Inc. significantly contributed to Group revenue (LCoS), as spend across all major advertising mediums remained buoyant. The digital solution business maintained momentum throughout the year, supporting clients’ ever-growing needs for digital transformation. This remains a significant opportunity for the Group as we enter FY2022. Dentsu Digital reported 31.2% organic growth for the full year. The consolidation of Septeni group cements our position as the leader in the digital advertising business in Japan. - In the Americas, organic growth was 10.6% in FY2021 and 15.4% in Q4 FY2021.

The Americas region reported strong growth in Q4 with the US market +14.1% and Canada +29.5%. The fourth quarter was ahead of expectations with December reporting over 20% organic growth, led by Media with increased spend from a number of clients across luxury, tech and finance into the holiday season. CXM, led by Merkle, finished the year with a strong performance despite more challenging comparables in the fourth quarter. The Americas region reported positive growth vs FY2019 in Q4.

Livearea, the commerce business we acquired in Q3 FY2021, delivered organic growth of over 30% in Q4 demonstrating the demand for differentiated and connected commerce experiences across the entire customer journey. Integration is progressing well, with Livearea already re-branded as Merkle.

The FY2021 YTD growth of 10.6% in the Americas is a result of growth in the US market +9.9% Canada +22.9%, partially offset by Brazil -8.9%. By service line, Creative reported continued acceleration in performance through H2. Media was the standout performer +18% yoy boosted by the cyclical recovery in advertising spend. The outlook for CXM remains strong with commerce and experience being the highest growth areas, with growing demand in data, analytics, technology enablement and personalization. - In EMEA, organic growth was 11.1% in FY2021 and 12.6% in Q4 FY2021.

EMEA reported a strong fourth quarter +12.6%; led by Denmark, France, Germany, Italy, Poland, Sweden and Switzerland all reporting double digit organic growth. All three service lines also reported double digit organic growth in Q4.

FY2021, the UK market grew 8.2% with five of the largest European markets reporting double digit organic growth with demand for services broad based across the region.

The FY2021 growth rate of 10.4% was led by CXM and the Merkle brand at +12.1% organic growth with a strong pipeline of opportunities heading into FY2022. Media reported 10.5% and Creative 6.2% organic growth. - In APAC (excluding Japan), organic growth was 4.7% in FY2021 and 3.8% in Q4 FY2021.

The Australian market saw good growth across all three service lines as the impact from the refreshed management team is beginning to show, with Q4 growing over 20%. India reported revenue declines in Q4 due to some disruption with local market clients. The interim CEO is leading the market to align with our global operating model which will ensure our services and products are globally consistent. In China the creative shortfall was largely offset by stronger than expected performance from CXM and Media in the final months of the year.

FY2021 growth was predominantly driven by strong performances in Singapore +24%, Indonesia +20.8%, and Australia +12.1%. This strong growth was offset by decline across India, China and Thailand. China experienced declines in creative towards the end of 2021, a continuation of the trend seen in Q3, reporting -2% revenue decline for the full year.

Forecast of Consolidated Financial Results for the FY2022 (IFRS)

The Dentsu Group forecasts Group organic growth at 4% for FY2022, with Dentsu Japan Network at 2 to 3% and Dentsu International 4 to 5%. The Group forecasts underlying operating margin at 17.7% with Dentsu Japan Network at 22% and Dentsu International flat yoy at 15.9%.

Shareholder Returns

Dividends

The Group aims to progressively raise the dividend payout ratio to 35% of underlying basic EPS by FY2024 under our dividend policy in the updated Medium-Term Management Plan. In FY2021 the payout ratio is 30% of underlying basic EPS. The dividend per share is at JPY 117.5 for FY2021, a record annual dividend payment. In FY2022 the payout ratio is targeted to be 32.0% of underlying basic EPS and the dividend per share is expected to be at 130.0 yen.

Share buyback

Today the Group announces additional shareholder returns with a buyback at up to JPY 40 bn.

Details of Acquisition of Own Shares (Share buyback)

| 1. Class of shares to be acquired: | Common stock of the Company |

| 2. Total number of shares that may be acquired: | 20,000,000 (maximum) shares (7.30% of the total number of shares issued (excluding treasury stock)) |

| 3. Total acquisition cost: | 40 billion yen (maximum) |

| 4. Acquisition period: | From February 15, 2022 to December 23, 2022 |

| 5. Method of acquisition: | Market purchase on the Tokyo Stock Exchange Through a discretionary trading authorization agreement (planned) |

(For Reference)

Treasury stock held as of December 31, 2021:

- Total number of shares issued (excluding treasury stock): 274,016,579 shares

- Number of treasury stock shares: 14,393,421 shares

Updated Medium-Term Management Plan

The Dentsu Group updates the Medium-Term Management Plan: “Sustainable Growth through Transformation” for the three-year period from FY2022 to FY2024, under the leadership of Hiroshi Igarashi who took office as President & CEO of Dentsu Group Inc. in January 2022.

The Group’s purpose remains: “we exist to realize a better society by contributing to the growth of our clients, partners, and all consumers.”

As a global leader in media and digital communications, we understand the power we have to influence the way that people think, feel and act. As part of the Group’s commitment to generating social value, Dentsu positions itself as a B2B2S company: Business to Business to Society, with the mission of creating value for all our stakeholders.

The updated Medium-Term Management Plan remains focused on the following four pillars.

1. Transformation and Growth

- M&A investments: focus on high growth Customer Transformation & Technology assets adding capabilities & scale

- Enhance marcomm competitiveness with Data & Tech

- Scale key client relationships through Integrated Growth Solutions

- Global launch of “dentsu good - a sustainability accelerator”; Social good through collaborations with clients and partners

Leadership targets:

- Organic growth vs. 2021 through 2024 CAGR 4-5%

- Customer Transformation & Technology to reach 50% of Group revenues (LCoS) over time

2. Operations and Margin

- Relentless simplification of the organization to improve efficiency

- Continue to invest in near and offshore capabilities to improve efficiency and reduce cost to deliver services

- Transform how our people connect through increased use of technology

Leadership target:

- 17.0-18.0% operating margin through 2023

- Reaching 18.0% in 2024

3. Capital Allocation Priorities & Shareholder Returns

- Capex investment in operations, capabilities & services; JPY c. 70 bn to 2024

- Disciplined M&A with JPY 250- 300 bn fund with focus on CT&T and fast integration of acquired businesses

- Progressive dividend payout ratio policy

Leadership targets:

- Upper limit of 1.5x Net debt / Underlying EBITDA yr end; indicative medium-term range of 1.0 to 1.5x (non IFRS 16 basis)

- Progressive dividend, reaching 35% payout ratio of underlying basic EPS by 2024

4. Social Impact and ESG

- Execution of “2030 Sustainability Strategy”

- Integration of Dentsu’s business growth and sustainability under the governance of “Sustainable Business Board”

- DE&I: Chief Diversity Officer, Dentsu Japan Network & Chief Equity Officers, Dentsu International

- Non-financial performance indicators linked to compensation

Leadership targets:

- 46% absolute reduction in CO2 by 2030; 100% renewable by 2030 (In markets where available)

- Improvement in employee engagement score

- Diverse, equal & inclusive workforce; female managers to reach 30% by 2030 (Dentsu Japan Network 25%; Dentsu International 50%)

For further details please see the presentation on Dentsu Group Inc. website.

URL: https://www.group.dentsu.com/en/ir/

The accounts are, in line with usual practice, unaudited and subject to final audit

– Ends –

Definitions

- Revenue less cost of sales: The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin: Underlying operating profit divided by Revenue less cost of sales (LCoS).

- Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS: EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA: Operating profit before depreciation, amortization and impairment losses.

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: https://www.group.dentsu.com/en/ir/

Forward-Looking Statements

This material contains statements about Dentsu Group that are or may be forward-looking statements. All statements other than statements of historical facts included in this presentation may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “estimates”, “projects” or, words or terms of similar substance or the negative thereof, are forward-looking statements. Forward-looking statements include statements relating to the following: information on future capital expenditures, expenses, revenues, earnings, synergies, economic performance, and future prospects.

Such forward-looking statements involve risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof.

About Dentsu Group (dentsu)

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 65,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its six leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, and Merkle—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website: https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | |

| MEDIA Please contact Corporate Communications |

Shusaku Kannan +81 3 6217 6602 s.kannan@dentsu.co.jp |

Dani Jordan +44 7342 076 617 dani@dentsu.com |

| INVESTORS & ANALYSTS Please contact Investor Relations |

Yoshihisa Okamoto +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart +44 7900 191 093 kate.stewart@dentsu.com |