Dentsu Group Inc. Q2 FY2021 Consolidated Financial Results

Aug 11, 2021

- IR-Timely Disclosure

- Management

(The second quarter ending June 30, 2021 – reported on an IFRS basis)

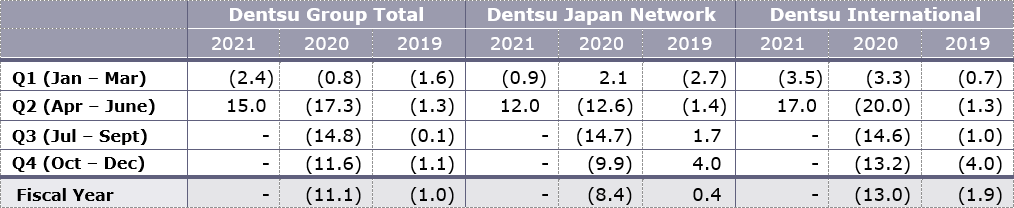

Q2 FY2021 organic revenue growth saw a significant rebound in performance, at 15.0%, with 12.0% at Dentsu Japan Network and 17.0% at Dentsu International, showing strong sequential improvement over Q1 decline of 2.4%.

As we pass the anniversary of the start of the pandemic, revenues continue to recover across all regions with strong growth in digital solutions. Client confidence is restoring with spending levels more resilient and predictable.

Operating margin improvement continues to exceed expectation, substantially ahead of the prior year, with Q2 improving +370 bp yoy, showing the gearing effect of higher revenue together with cost reductions being implemented.

The acquisition of LiveArea, announced in July, strengthens the Group expertise in the fast growth areas of consumer experience and commerce and aligns with the Group’s ambition of reaching 50% of revenues less cost of sales (LCoS) generated by Customer Transformation & Technology.

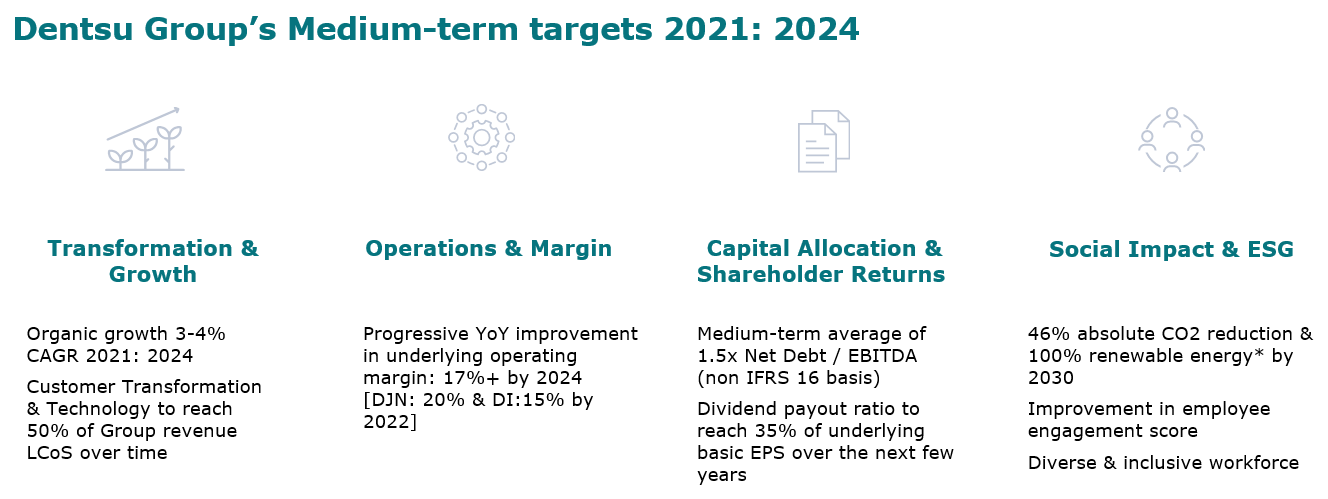

The Group expects high single digit organic growth for FY2021, with a line of sight to delivering the long held 2022 margin targets of 20% for Dentsu Japan Network and 15% for Dentsu International one year early, implying a Group margin improvement of +160 bp yoy. FY2021 forecasts are made in the context of a variable economic outlook as the effects of the pandemic remain unpredictable in a number of markets.

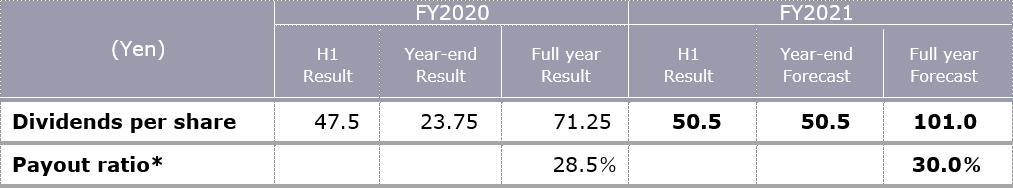

FY2021 annual dividend per share confirmed at JPY 101.0 (interim dividend JPY 50.5), a record high, at a 30% payout ratio for FY2021; in line with the Group’s progressive dividend policy, to reach 35% over time.

The Group remains well positioned to benefit from the recovery in media & digital solutions spend and the structural growth in Customer Transformation & Technology.

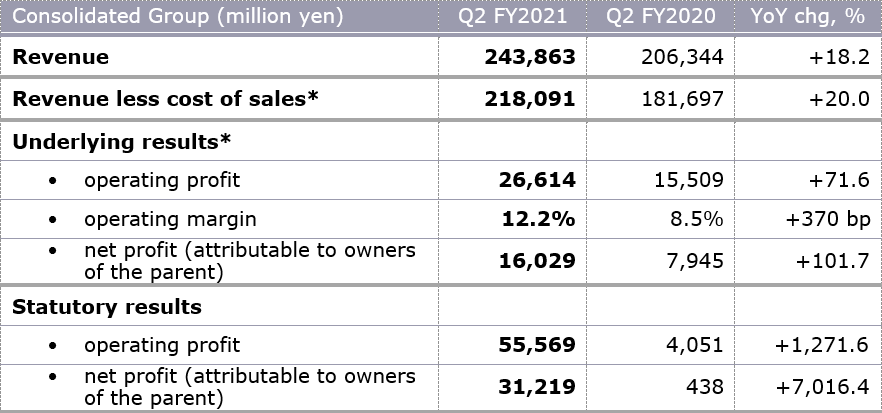

Q2 (April to June) FY2021 Financial Results Summary

*See below for definitions

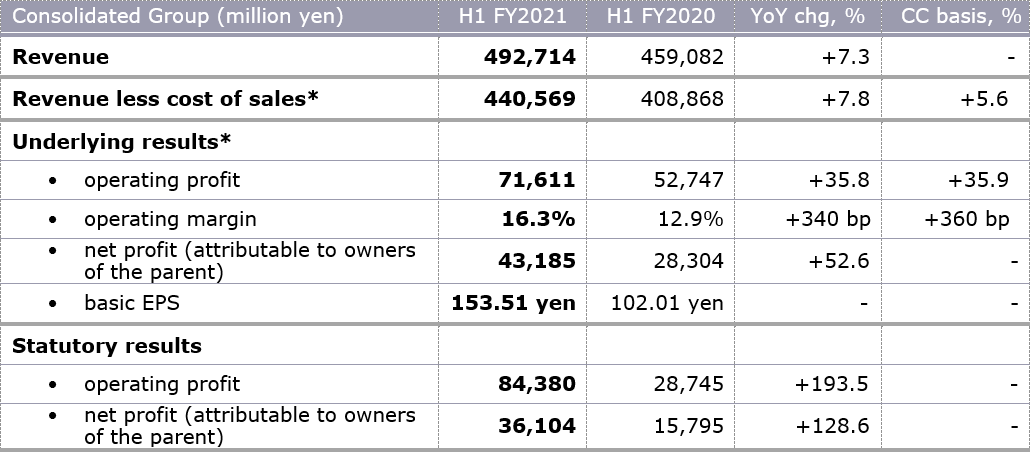

H1 FY2021 Financial Results Summary

*See below for definitions

H1 (January to June) FY2021 Results: Key Financials

Group revenue (LCoS) JPY 440.5 bn (YoY +7.8%, +5.6% on a constant currency basis).

- 5.5% at Dentsu Japan Network, and 9.7% (5.8% on a constant currency basis) at Dentsu International.

- Revenue (LCoS) increased due to organic growth of JPY 22.5 bn, M&A contributed JPY 0.6 bn, and currency positively impacted by JPY 8.5 bn.

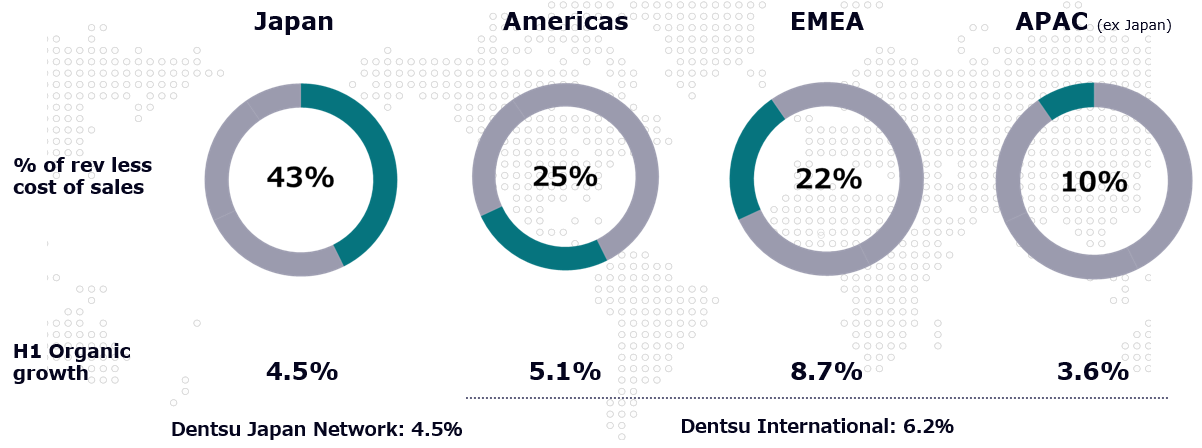

Group organic growth was 5.4%.

- 4.5% at Dentsu Japan Network, and 6.2% at Dentsu International.

- H1 FY2021 saw a significant rebound in performance as revenues continued to recover across all regions.

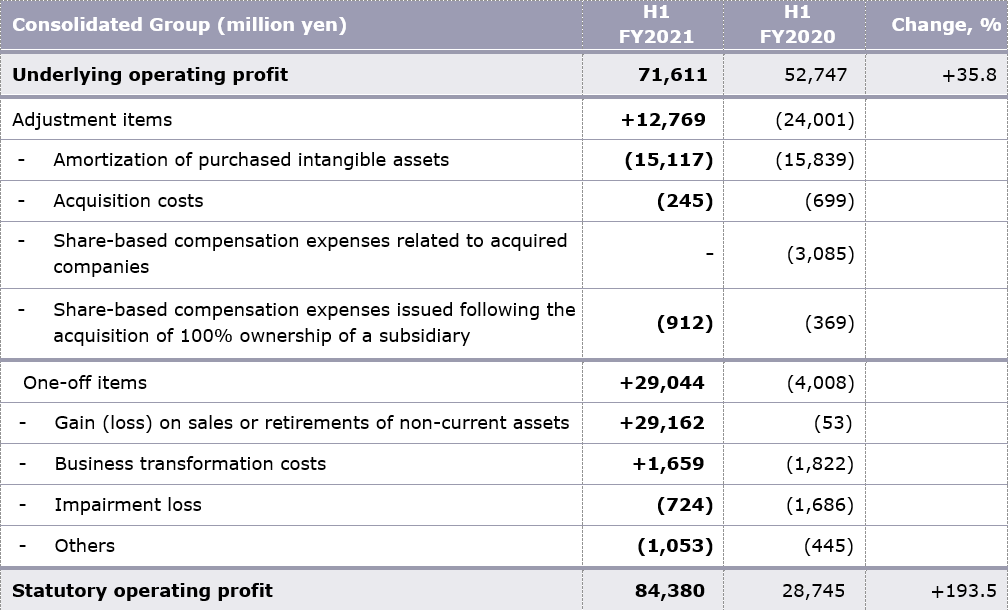

Group underlying operating profit increased by 35.8% (35.9% on a constant currency basis) yoy to JPY 71.6 bn. Operating margin improved by 340 bp (360 bp on a constant currency basis) to 16.3% reflecting operating leverage from higher revenues and the continued focus on costs across the Group.

- At Dentsu Japan Network, underlying operating profit was JPY 43.0 bn (YoY +13.1%); operating margin of 22.9% (YoY +160 bp).

- At Dentsu International, underlying operating profit was JPY 30.9 bn (YoY +76.7%, +77.5% on a constant currency basis); operating margin was 12.3% (YoY +460 bp, +500 bp on a constant currency basis).

Group statutory operating profit increased by 193.5% to JPY 84.3 bn.

- Statutory operating profit helped by gain on sales or retirements of non-current assets of JPY 29.1 bn.

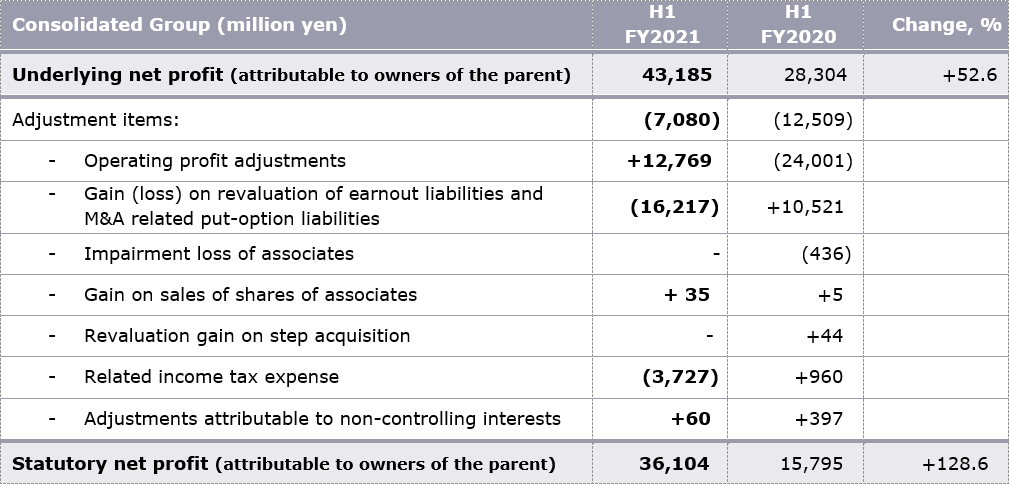

Group underlying net profit (attributable to owners of the parent) increased by 52.6% mainly due to the increase of underlying operating profit.

- The underlying basic EPS was JPY 153.51 (H1 FY2020: JPY 102.01).

Group statutory net profit increased by 128.6% to JPY 36.1 bn.

- Statutory net profit increased due to the increase of statutory operating profit, partially offset by the charge of net finance costs, net by JPY 22.5 bn, and the increased income tax expenses.

H1 (January to June) FY2021 Revenue Less Cost of Sales by Region

Quarterly Organic Revenue Performance

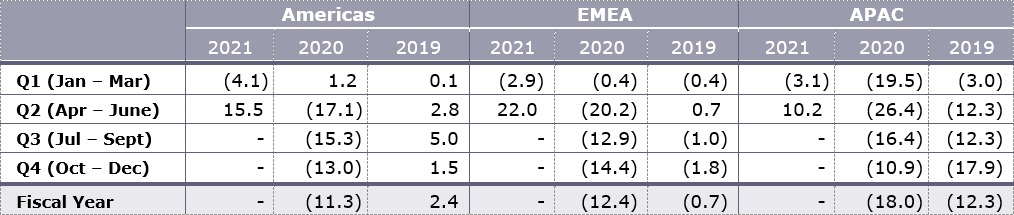

Quarterly Organic Revenue Performance for Dentsu International by Region

Toshihiro Yamamoto,

President and CEO, Dentsu Group Inc., said:

“Dentsu Group delivered a strong second quarter performance, reflecting the growing consumer and client confidence we see across all regions. Underling profit growth continues to be strong, exceeding our expectations, and demonstrates our commitment to our margin targets.

The second quarter saw a return to acquisitions for the Group with the announcement of an agreement to acquire LiveArea, a global customer experience and commerce agency that will join the Merkle brand within Dentsu International.

The acquisition perfectly aligns with Dentsu Group’s stated ambition of reaching 50% of revenue LCoS generated through Customer Transformation & Technology, encompassing the fast growth areas of customer experience and commerce.

These structural growth areas drive deeper client relationships as we become embedded within our clients’ data and technology. The greatest opportunity for brands today, as they build strategies to re-emerge from the pandemic, is customer experience transformation. Creating competitive differentiation through marketing strategies, supported by data, technology platforms, and analytics is where we see the greatest demand for our services. These services also transform our revenue profile, generating a higher level of recurring revenues through ongoing managed services whilst also transforming our ability to deliver services from lower cost locations.

With many of our people still working from home, their wellbeing and our future of work approach continue to be a priority for myself and the wider executive leadership team. The extraordinary talent throughout the organisation ensures we are well positioned to remain leaders in our industry. I would like to express my personal thanks to all our 64,000 people across the Group.

Whilst the future path of the pandemic remains uncertain, our full year guidance confirms our confidence in the outlook for the second half of FY2021, as well as our ability to meet our medium-term targets by 2024.”

H1 FY2021 Business Updates

Revenue less cost of sales from digital and Customer Transformation & Technology

- Total revenue (LCoS) from digital activities grew to 52.2% (H1 FY2020: 52.7%, YoY -50 bp, (cc: +20 bp)), including 36.7% in Dentsu Japan Network (YoY: +460 bp), and 63.6% in Dentsu International (YoY: -490 bp (cc: -320 bp)).

- Total revenue (LCoS) from Customer Transformation & Technology reached 29.4% (H1 FY2020: 27.6%, YoY +180 bp, (cc: +20 bp)) of Group revenue (LCoS). 24.6% (YoY +80 bp) for Dentsu Japan Network and 33.0% (YoY +240 bp, (cc: -40 bp)) for Dentsu International.

- The Group remains committed to reaching 50% of Group revenue (LCoS) from Customer Transformation & Technology over time.

Business updates by business segment

- Dentsu Japan Network reported 4.5% organic growth in H1 FY2021 and 12.0% in Q2 FY2021.

In Japan, client spend on advertising continued to recover with Dentsu Japan Network seeing an improvement, particularly in the second quarter driven by internet sales +40.3%. The digital solutions business continued its momentum, supporting client needs for digital transformation. Dentsu Digital reported organic growth of 43.1% in H1 FY2021 while CARTA HOLDINGS reported organic growth of over 16%. Collaboration between Septeni and Dentsu Digital continues with the number of shared clients continuing to grow. Dentsu Inc.’s organic growth significantly improved to 3.1% in H1 FY2021 from -8.9% for H1 FY2020, giving confidence our solutions are well-placed to meet clients’ needs.

As part of the comprehensive review, Dentsu Isobar in Japan was consolidated into Dentsu Digital and DA search & link into Dentsu Direct Marketing on July 1, 2021. Dentsu Group and Dream Incubator Inc., a company that has deep strengths in strategic consulting, business creation and innovation support, formed a capital and business alliance to strengthen our transformation capabilities. At present there are more than 20 Dentsu Japan Network companies that are headquartered in the Dentsu headquarters building or that will be relocating into the building. Dentsu Japan Network is preparing the building for a more collaborative work style to aid innovation between brands. FY2021 is the year of transformation for Dentsu Japan Network and additional initiatives will be announced as the year progresses. Dentsu Japan Network retains its vision of becoming an Integrated Growth Partner, supporting clients’ through their business transformation.

- Dentsu International reported 6.2% organic growth in H1 FY2021 and 17.0% in Q2 FY2021.

- Americas reported 5.1% organic growth in H1 FY2021 and 15.5% in Q2 FY2021.

- North America reported Q2 organic growth of 15.1%, driven by strong performances from Canada & the US market. The North American market is benefiting from a strong media performance that we expect to continue into the second half. A number of new client wins are also impacting revenues. CXM momentum continues as clients embrace data and digital transformation solutions to meet their customers’ experience needs and expectations. The Creative service line saw a strong new business performance in the second quarter and the impact of clients lost last year will end this quarter, benefitting the top line going forward.

- EMEA reported 8.7% organic growth in H1 FY2021 and 22.0% in Q2 FY2021.

- The EMEA region saw continued improvement throughout the quarter with double digit organic growth across all three service lines, Media, CXM and Creative, in the second quarter. France, Spain and the UK all delivered above 20% organic growth for the quarter demonstrating the economic recovery across the region following the impact of the COVID-19. Cross service line integration is benefitting a number of our major markets in the region as clients increasingly require solutions across a range of capabilities.

- APAC (excluding Japan) reported 3.6% organic growth in H1 FY2021 and 10.2% in Q2 FY2021.

- The APAC region reported double digit growth in the second quarter driven by double digit growth from Australia, Indonesia, South Korea, Singapore and Thailand. Australia saw the expansion of a number of existing client relationships across service lines. China reported high single digit organic growth and reported a strong new business performance in the quarter. India saw revenue decline for the quarter, impacted by the recent resurgence in COVID-19 cases.

- The transformation at Dentsu International continues at pace. The business has achieved over one third of the targeted agency brand optimization as we reduce the number of brands from 160 to six leadership brands to drive integration across all of our services. Property rationalization targets for FY2021 have already been achieved and 25% of the targeted reduction in legal entities has been completed.

- Dentsu Group had a successful year at Cannes Lions with 24 awards in total, including a coveted Grand Prix for dentsumcgarrybowen Taiwan with ‘In Love We Trust’. Ten dentsu leaders participated on juries with Dentsu contributing to many keynote sessions and industry discussions.

- To further elevate our focus on great work and creative, Dentsu Group is delighted to have recently appointed Fred Levron to the role of Global Chief Creative Officer, Dentsu International. Joining in November, Levron will lead the creative agenda across Dentsu International, managing the worldwide portfolio of creative agency brands. Fred will accelerate creativity throughout the entirety of the business, across all service lines and agency brands, as we transform to become the most integrated network in the world.

- Americas reported 5.1% organic growth in H1 FY2021 and 15.5% in Q2 FY2021.

The Group remains committed to delivering against the Medium-term targets 2021:2024

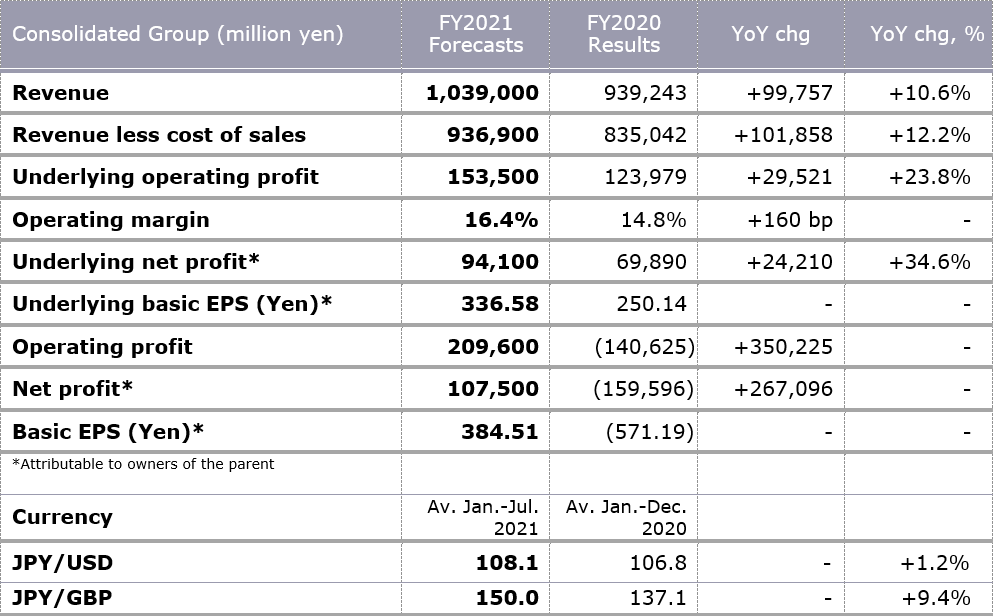

Forecast of Consolidated Financial Results for the FY2021 (IFRS)

The Group has released consolidated guidance for FY2021. FY2021 guidance is made in the context of a variable economic outlook as the effects of the pandemic still impact a number of markets.

The Group expects to deliver high single digit organic growth for FY2021, with line of sight to delivering the long held 2022 margins targets of 20% for Dentsu Japan Network and 15% for Dentsu International one year early, implying a consolidated margin improvement of +160 bp yoy.

Based on the favourable H1 results and the expected momentum in H2, and expected additional gain on sales of non-current assets, the Group is targeting a record-high statutory operating profit of JPY 209.6 bn and net profit attributable to owners of the parent of JPY 107.5 bn since Dentsu Group went public in 2001.

One of the major factors reflected in the FY2021 forecast is the total gain on sale and other associated expenses (net) associated with the sale of the headquarter building. If the transaction is completed in FY2021, it is expected to have a one-time positive impact on operating profit of approximately JPY 87 bn and net profit attributable to owners of the parent of approximately JPY 56 bn. The gain on sale has no impact on underlying operating profit or underlying net profit attributable to owners of the parent in FY2021.

Business transformation cost is also reflected in the FY2021 forecast. The cost estimate was reduced to JPY 28.0 bn from JPY 56.0 bn as of May 2021 on a consolidated basis. The charge of JPY 24.0 bn is expected at Dentsu Japan Network and JPY 4.0 bn at Dentsu International due to lower than anticipated costs to achieve the targeted savings.

Dividends

The Group aims to progressively raise the dividend payout ratio to 35% of underlying basic EPS over the next few years from FY2021, under our renewed dividend policy in the Medium-term Management Plan. In FY2021 the payout ratio is expected to be 30% of underlying basic EPS, resulting in a record annual dividend payment of JPY 101.0 and an interim dividend of JPY 50.5.

* Underlying basic EPS basis

– Ends –

Appendix

Reconciliation from Underlying to Statutory Operating Profit, H1 FY2021

Reconciliation from Underlying to Statutory Net Profit in H1 FY2021

Definitions

- Revenue less cost of sales : The metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

- Underlying operating profit : KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin : Underlying operating profit divided by Revenue less cost of sales (LCoS).

- Underlying net profit (attributable to owners of the parent) : KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS : EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA : Operating profit before depreciation, amortization and impairment losses.

Further details of these results, including all related financial statements, can be found in the Investor Relations section of Dentsu Group Inc. website: https://www.group.dentsu.com/en/ir/

About Dentsu Group (dentsu)

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: dentsu japan network, which oversees Dentsu’s agency operations in Japan, and dentsu international, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 64,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its six leadership brands—Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, and Merkle—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website: https://www.group.dentsu.com/en/

For additional inquiries

| TOKYO | LONDON | |

| MEDIA Please contact Corporate Communications: |

Shusaku Kannan +81 3 6217 6602 s.kannan@dentsu.co.jp |

Manus Wheeler +44 20 7070 7785 manus@dentsu.com |

| INVESTORS & ANALYSTS Please contact Investor Relations: |

Yoshihisa Okamoto +81 3 6217 6613 yoshihisa.okamoto@dentsu.co.jp |

Kate Stewart +44 7900 191 093 kate.stewart@dentsu.com |