H1 FY2020 Consolidated Financial Results

Aug 13, 2020

- IR-Timely Disclosure

- Management

The first half ended June 30, 2020 – reported on an IFRS basis

Executive Summary

- Dentsu Group announces that underlying operating profit is up by 14.6% yoy, despite the global economic downturn and resultant advertising market decline arising from the COVID-19 pandemic.

- The Group’s revenue less cost of sales (LCoS) fell by 9.0%, but this was more than offset by previously announced cost reductions. The cost savings include both temporary and permanent savings arising from both planned savings in the International business started last year and our actions taken this year to mitigate the impact of the economic downturn.

- The Group believes that it must plan on the basis that the downturn will continue, but at a reduced rate, in the second half of this year, with a gentle recovery expected in 2021. Accordingly, the launch of a comprehensive review and accelerated transformation plan is announced today.

- This review, across all regions, will support the focused strategy of integrated solutions, aimed at simplifying the business for both clients and operations, structurally lowering operating expenses, enhancing the efficiency of our balance sheet and maximising long-term shareholder value.

- This will deliver further benefits for our clients and enable stronger growth in the new world post the pandemic.

Highlights

- Dentsu Group H1 FY2020 organic revenue (LCoS) declined due to the impact from COVID-19, however, operating margin showed continued improvement despite top line pressure. Dentsu Group continues to accelerate its transformation into faster growth areas, such as digital solutions and CRM, supporting our clients through Integrated Growth Solutions.

- H1 FY2020, the Group delivered a decline in total revenue (LCoS) of -9.0% (-6.9% on a constant currency basis) and organic revenue decline of -8.9%.

- The Japan business saw a decline in revenues (LCoS) of -4.4% and organic revenue decline of -4.6%. Client spend on advertising was weaker due to the impact from COVID-19, although the digital solution business maintained momentum.

- The international business, Dentsu Aegis Network, delivered a decline in total revenues (LCoS) of -12.3% (-8.8% on a constant currency basis) and organic revenue decline of -12.0%. Q2 organic revenue decline of -20% was in line with expectations. All three international regions posted organic revenue decline, impacted by the COVID-19 pandemic.

- Underlying operating margin increased +270 bps (+240 bps on a constant currency basis) yoy to 12.9%. Group margin showed continued resilience due to cost actions taken in response to COVID-19 and planned savings in the International business. The Group is tracking ahead of the targeted 7% cost reduction against the planned FY2020 consolidated cost base.

- Interim dividend per share confirmed at 47.5 yen, as announced in the earnings release on February 13, 2020.

- The Group remains well-capitalized, with a strong balance sheet, JPY 576.8 bn of unused credit lines and JPY 422.6 bn of cash. The Group credit rating is “AA-” from Japan’s Rating and Investment Information, Inc. (R&I).

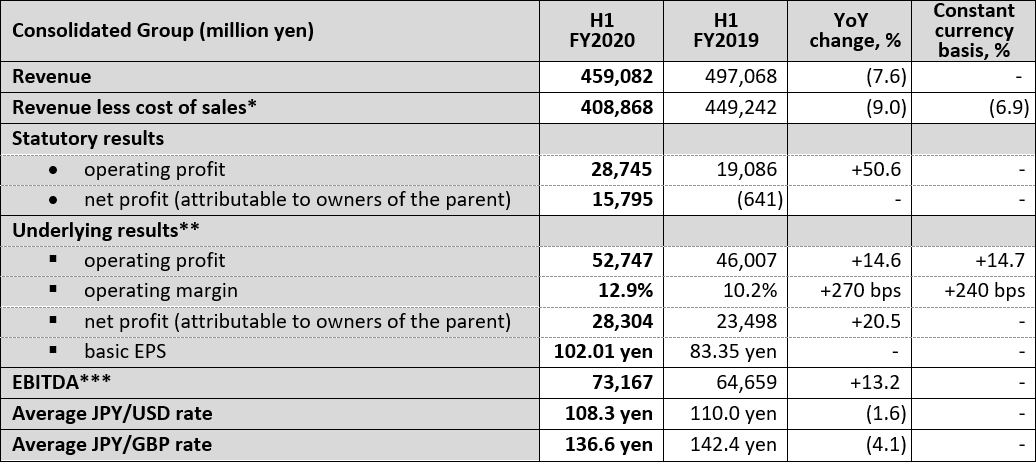

Financial Results for H1 FY2020

* Revenue less cost of sales is the metric by which the Group’s organic growth is measured. Organic growth and organic revenue decline represent the constant currency year-on-year growth/decline after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

** See page 6 for definition of “underlying.”

*** See page 6 for definition of “EBITDA.”

H1 FY2020 Results: Key Financials

- Dentsu Group delivered a decline in revenue (LCoS) of -9.0% (-6.9% on a constant currency basis).

- -4.4% in Japan, and -12.3% (-8.8% on a constant currency basis) at Dentsu Aegis Network. The breakdown in contribution is: +9.4 billion yen from M&A, (10.0) billion yen from foreign exchange rates, and (39.8) billion yen from organic revenue decline.

- The Group produced organic revenue decline of -8.9%.

- -4.6% in Japan, and -12.0% at Dentsu Aegis Network. The Japan business declined due to an industry-wide impact from the COVID-19 pandemic, partially offset by increases in digital solutions and marketing promotions and activations for event related work. The international business performance was in line with expectations. The impact from COVID-19 saw negative growth across all three regions.

- Digital business contribution to total revenue (LCoS) reached 52.7% (H1 FY2019: 48.9%), including 32.2% Japan (H1 FY2019: 28.5%), and 68.5% at Dentsu Aegis Network (H1 FY2019: 63.3%).

- International business contribution to total revenue (LCoS) was 56.4% (H1 FY2019: 58.5%).

- Group underlying operating profit was 52.7 billion yen (H1 FY2019: 46.0 billion yen).

- 38.0 billion yen in Japan (H1 FY2019: 40.1 billion yen), and 17.5 billion yen at Dentsu Aegis Network (H1 FY2019: 9.3 billion yen).

- The Group has taken a number of cost actions in the first half to mitigate the impact of the organic revenue decline due to COVID-19, such as the temporary removal of incentives, managing personnel costs, a reduction in the executive officers’ compensation in the second quarter and a reduction in other operating expenses resulting in yoy margin improvement. The Group is tracking ahead of the targeted 7% cost reduction against the planned FY2020 consolidated cost base.

- Group underlying operating margin was 12.9% (H1 FY2019: 10.2%).

- 21.4% in Japan (H1 FY2019: 21.5%), and 7.6% at Dentsu Aegis Network (H1 FY2019: 3.6%).

- In Japan, the margin was flat yoy due to continued focus on reducing operating expenses despite a decrease in revenue (LCoS). At Dentsu Aegis Network, the 400 bps yoy improvement (390 bps on a constant currency basis) in margin is attributed to COVID-19 related cost actions as well as the planned savings announced in December 2019.

- Underlying net profit (attributable to owners of the parent) increased by 20.5% mainly due to the increase of underlying operating income.

Outlook for FY2020

- The impact from COVID-19 continues to cause a slowdown in demand for services across the industry. The timing and level of recovery is expected to vary by market - yet the overall macro-economic trend remains uncertain. This continued economic uncertainty still facing many markets means the Dentsu Group will not be providing detailed FY2020 guidance at this stage.

- The Group expects the second half of FY2020 to show a modest improvement in the rate of organic revenue decline versus the second quarter. Q2 FY2020 is still expected to have been the weakest quarter. However, the decline in revenue (LCoS) will exceed the running rate of cost savings in the second half of FY2020.

Dividend

- Interim dividend per share is confirmed at 47.5 yen, as announced in the earnings release on February 13, 2020.

- The comprehensive review and transformation plan will look at balance sheet and cash efficiency, including dividend policy and the results of this review will be disclosed with the full year results.

- The review is aimed at improving long-term shareholder returns. Delivering a stable, progressive dividend will be a key part of the review’s objectives.

Toshihiro Yamamoto, President and CEO, Dentsu Group Inc., said:

“The increasing pace of consumer change prompted by COVID-19 is leading to accelerated digital adoption. Our clients recognize the need to respond, by leveraging data whilst creatively engaging with consumers to create meaningful brand experiences.

Through our diverse range of capabilities, industry leading brands and rich consumer insights we help our clients fast-track business critical transformation, creating solutions across content capabilities, media, brand experience, data-driven creativity, MarTech and CRM. Delivering innovative integrated solutions across these areas of deep expertise drives growth for our clients and sets us apart from our peers.

As we drive transformation inside our clients’ businesses we also recognize the need to continue to transform our own business. This will ensure we continue to deliver world class services tailored to our client’s needs whilst also creating value for all our stakeholders.

The comprehensive review and accelerated transformation plan, announced today, is key to the future growth and profitability of our Group. It will not only respond to the economic challenges caused by the pandemic, but also focus on long term structural growth opportunities – particularly in digital solutions and CRM. We are well-placed to seize these opportunities having just finalized the full acquisition of the world-leading data driven, technology enabled agency, Merkle. We are determined that this review will benefit our clients, partners, and our shareholders and result in a world class organization that is the most attractive to work in for the most talented people in our industry. We plan to update the market on this review with the full year results.”

H1 FY2020 Consolidated Financial Results

Japan Business:

The Group’s operations in Japan delivered organic revenue decline of -4.6% in H1 FY2020.

The decline in the Japan business performance started to appear from late March due to the impact from COVID-19. Client spend on advertising fell during the second quarter, promotional spend also pulled back after a strong start to the year. The digital solutions business maintained momentum throughout the first half, supporting client needs for digital transformation. ISID, Dentsu Digital and Dentsu Live significantly contributed to Group revenue (LCoS), all posting double digit organic growth in the first half.

Underlying operating margin in Japan was flat yoy due to swift cost actions. Due to uncertainty over COVID-19, the actions started from February which include tightly managed operating expenses such as travel cost and entertainment cost, and personnel costs achieved by improving efficiency through remote working and other initiatives.

International Business:

Dentsu Aegis Network delivered organic revenue decline of -12.0% in H1 FY2020 and -20.0% in Q2 FY2020. The slowdown in the second quarter is in line with expectations due to the macroeconomic impact of COVID-19. The impact of COVID-19 is being seen across the business with all three regions posting organic revenue decline.

Across the Lines of Business, Media and Creative saw organic revenue decline of -15.7% and -14.9% respectively, with CRM experiencing a slower organic revenue decline of -3.0% as a result of continued positive organic revenue growth within Merkle.

Media spend from our largest clients showed greater resilience through the first half, although spend varies across sectors. The new business pipeline for media is beginning to expand, with greater opportunities across all three regions in H2 FY2020. The Creative line of business saw client delays to new product launches, but towards the end of the second quarter saw an increase in demand for technology led creative projects. Within CRM, demand remains for technology services and technology enablement driven by the continued shift to the Direct to Consumer model.

Underlying operating margin showed 400 bps improvement yoy driven by continued cost saving efforts in response to COVID-19 to mitigate the impact of the organic revenue decline. Cost management was implemented throughout the markets and every layer of the organization to protect the operating margin. Cost saving initiatives include voluntary temporary salary reductions, removal of incentives, reducing discretionary spend, and a review of contractor roles. The International Business also benefited from the planned cost saving announced in December 2019 which remains on track.

Following the three acquisitions announced at the end of the first quarter, no further acquisitions have been completed in the second quarter.

From September, Wendy Clark will be joining the Dentsu Group as Global CEO, Dentsu Aegis Network.

International Business – Regions:

In EMEA, Dentsu Aegis Network reported -10.7% organic revenue decline in H1 FY2020 and -20.2% in Q2 FY2020.

In EMEA all markets performed in line with revised expectations. Lower client spend impacted all markets across the region, with The Netherlands, France and Spain underperforming due to their greater exposure to the media market. Germany, Russia and Switzerland delivered positive organic growth in the first half.

In the Americas, Dentsu Aegis Network reported -8.3% organic revenue decline in H1 FY2020 and -17.1% in Q2 FY2020.

The US market delivered -6.9% organic revenue decline in H1 showing greater resilience due to the higher exposure of CRM. Towards the end of the second quarter a number of brands saw a slight increase in media spend from a number of clients. Canada and Brazil both saw double digit organic revenue declines. The scale of the pipeline of Media opportunities for new business is becoming more meaningful in the second half across the region.

In the APAC region (excluding Japan), Dentsu Aegis Network reported -23.1% organic revenue decline in H1 FY2020 and -26.4% in Q2 FY2020.

The region’s revenues continued to be impacted by reduced client spend due to COVID-19 throughout the first half, although a number of mid-sized markets fared better than expected including Taiwan, Thailand and Indonesia. China continued its strong new business performance with new accounts won across all three lines of business in the first half. In Australia, the new leadership team has delivered performance improvements in the first half of 2020, despite the macro environment challenges. This includes client growth and retentions, strengthening media and technology partnerships, and improved staff engagement levels. India saw reduced client spend across media.

– Ends –

Further information

Further details of these results, including all related financial statements, can be found in the Investor Relations section of the Dentsu Group Inc. website: https://www.group.dentsu.com/en/.

Definitions of “underlying” and “EBITDA”

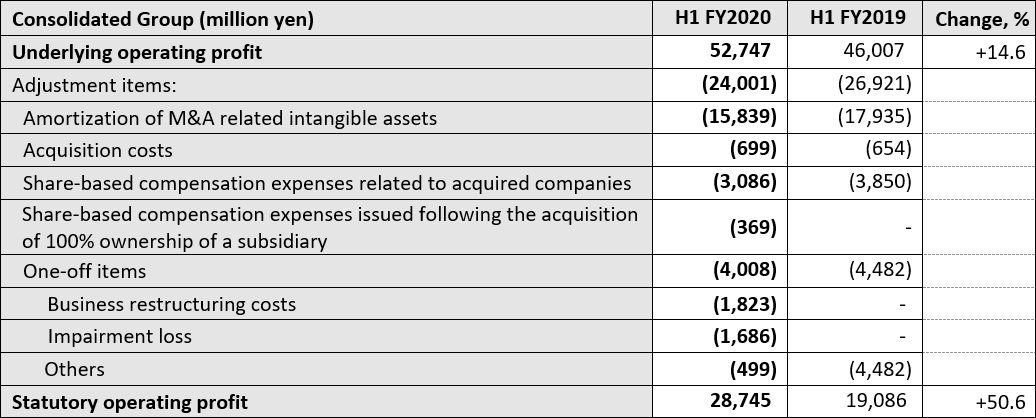

- Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with M&A related items and one-off items.

- M&A related items: amortization of purchased intangible assets, acquisition costs, share-based compensation expenses related to acquired companies, share-based compensation expense issued following the acquisition of 100% ownership of a subsidiary.

- One-off items: items such as impairment loss and gain/loss on sales of non-current assets.

- Operating margin: Underlying operating profit divided by Revenue less cost of sales (LCoS).

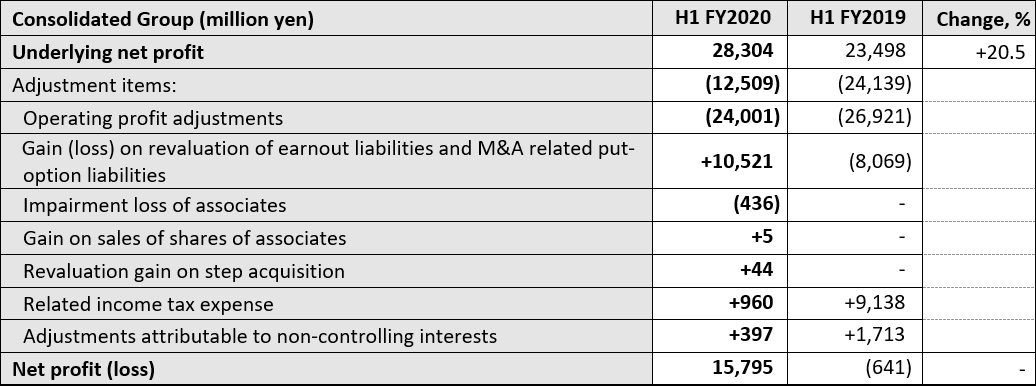

- Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit added with adjustment items related to operating profit, gain/loss on sales of shares of associates, revaluation of earnout liabilities / M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

- Underlying basic EPS: EPS based on underlying net profit (attributable to owners of the parent).

- EBITDA: Operating profit before depreciation, amortization and impairment losses.

Reconciliation from Underlying to Statutory Operating Profit in H1 FY2020

Reconciliation from Underlying to Statutory Net Profit (Loss) in H1 FY2020

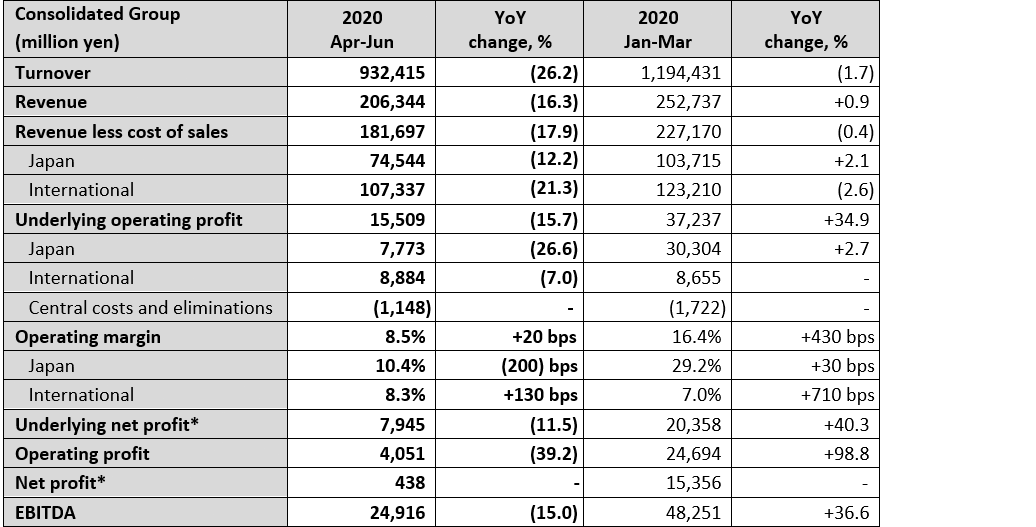

Quarterly Results

* attributable to owners of the parent

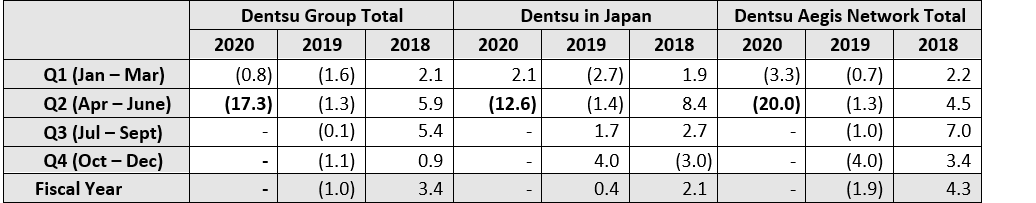

Quarterly Organic Growth/Organic Revenue Decline for the Dentsu Group, Dentsu in Japan, and Dentsu Aegis Network

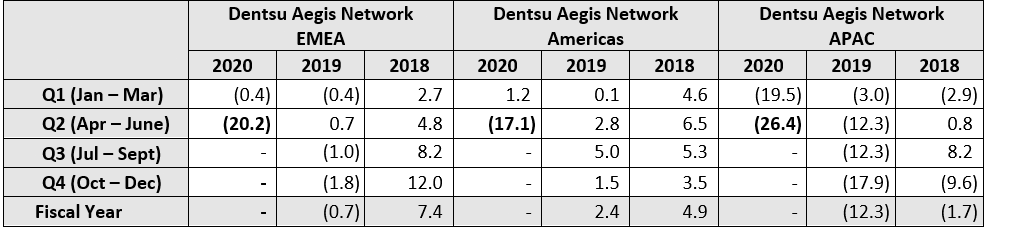

Quarterly Organic Growth/Organic Revenue Decline for Dentsu Aegis Network by Region

About the Dentsu Group

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: Dentsu Japan Network, which oversees Dentsu’s agency operations in Japan, and Dentsu Aegis Network, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 66,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its ten global brands—Carat, Dentsu, dentsu X, iProspect, Isobar, dentsumcgarrybowen, Merkle, MKTG, Posterscope and Vizeum—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website URL: https://www.group.dentsu.com/en/

For Additional Inquiries

| Tokyo | London | |

|---|---|---|

| Media – Please contact Corporate Communications: |

Shusaku Kannan: +81 3 6217 6602 s.kannan@dentsu.co.jp |

Manus Wheeler: +44 20 7070 7785 Manus.Wheeler@dentsuaegis.com |

| Investors & analysts – Please contact Investor Relations: |

Yuji Ito: +81 3 6217 6613 y.ito@dentsu.co.jp |

Kate Stewart: +44 7900 191 093 Kate.Stewart@dentsuaegis.com |