Dentsu Group Inc. FY2019 Consolidated Financial Results (Fiscal year ended December 31, 2019 – reported on an IFRS basis)

Feb 13, 2020

- IR-Timely Disclosure

- Management

Executive Summary

- In FY2019, the Dentsu Group delivered total growth of revenue less cost of sales of 3.3% (constant currency basis) and organic growth of -1.0%.

- The Japan business delivered 0% and 0.4% respectively and saw sequential improvement through each quarter of FY2019. Strong growth in subsidiaries drove the improved performance in H2 FY2019; whilst large scale events in Japan boosted the final quarter of the year.

- The international business, Dentsu Aegis Network, delivered 3.5% growth of revenue less cost of sales (constant currency basis) and -1.9% organic growth. The FY2019 performance was adversely affected by continued challenges in some key markets. The Americas continues to report positive organic growth.

- In the fourth quarter, consolidated operating margin improved 50 bps yoy to 24.6% due to cost control.

- Compared to the revised forecast announced in December 2019, consolidated revenue less cost of sales was slightly lower by 0.4% and underlying operating profit was higher by 3.9%, which resulted in the operating margin 60 bps ahead of the forecast.

- In FY2020, the Dentsu Group forecasts 2.9% increase in revenue less cost of sales (constant currency basis) and 5.8% increase in underlying operating profit (constant currency basis). The top line performance will be driven by global events including Tokyo 2020 Olympic and Paralympic Games in Japan and operating margin will benefit from restructuring activities in the international business. The forecasts are subject to the changing economic situation in China and APAC.

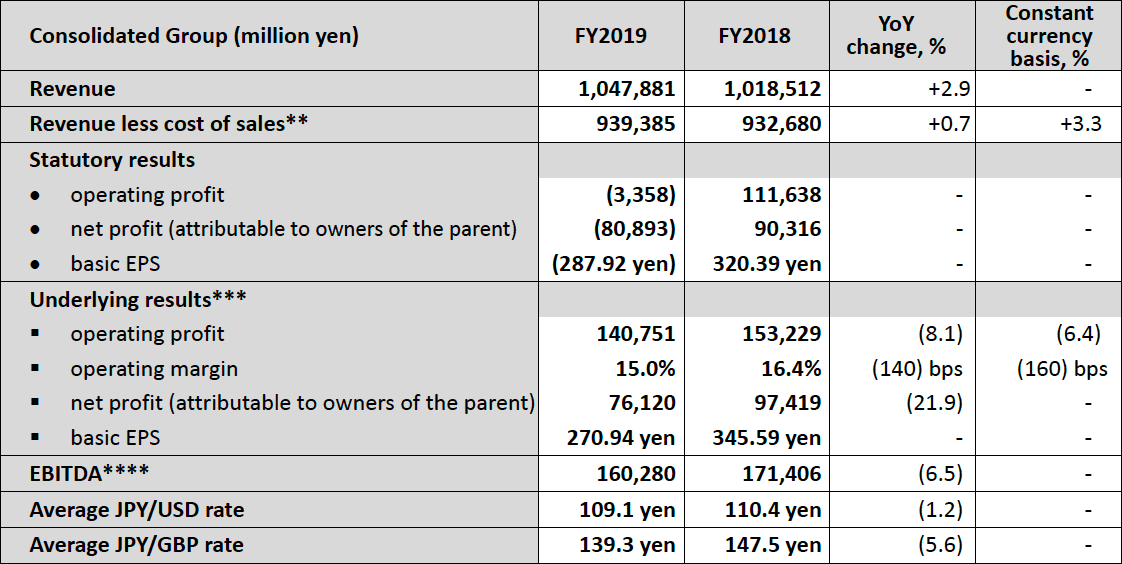

Financial Results for FY2019

*Revenue less cost of sales is the metric by which the Group’s organic growth is measured. Organic growth represents the constant currency yoy growth after adjusting for the effect of businesses acquired or disposed of since the beginning of the previous year.

** See page 7 for definition of “underlying.”

*** See page 7 for definition of “EBITDA.”

Highlights of FY2019 Results

- The Dentsu Group delivered growth of revenue less cost of sales of 0.7% (3.3% on a constant currency basis) in FY2019:

- 3.0% in Japan, and -0.7% (3.5% on a constant currency basis) at Dentsu Aegis Network driven by acquisitions.

- Contribution amount to the increase: +39.8 billion yen from M&As, (9.9) billion yen by organic growth, and (23.2) billion yen from foreign exchange rates.

- The Group produced organic growth of -1.0% in FY2019:

- 0.4% in Japan, and -1.9% at Dentsu Aegis Network. The international business was impacted by continued weakness in the APAC region.

- Digital business contribution to total revenue less cost of sales reached 47.5% (FY2018: 46.1%), including 29.3% in Japan (FY2018: 23.9%), and 59.9% at Dentsu Aegis Network (FY2018: 60.6%).

- International business contribution to total revenue less cost of sales reached 59.5% (FY2018: 60.4%).

- Group underlying operating profit was 140.7 billion yen (FY2018: 153.2 billion yen).

- 72.4 billion yen in Japan (FY2018: 80.2 billion yen), and 68.3 billion yen at Dentsu Aegis Network (FY2018: 72.9 billion yen).

- Group underlying operating margin was 15.0% (FY2018: 16.4%).

- The consolidated margin for FY2019 beat the revised forecasts announced on December 16, 2019, mainly due to strong cost management in Japan in the fourth quarter.

- Japan: FY2019 19.1% (FY2018: 21.7%). The operating margin was lower yoy due to planned investments for future growth.

- Dentsu Aegis Network: FY2019 12.2% (FY2018: 12.9%). The operating margin was lower yoy mainly due to revenue shortfall in APAC

- Underlying net profit (attributable to owners of the parent) decreased by 21.9% mainly due to the decline of underlying operating income.

- Statutory operating loss and net loss (attributable to owners of the parent) were recorded. Compared to the profits recorded in the previous fiscal year, the losses were recorded mainly due to an increase in impairment charge (73.6 billion yen) and a recording of restructuring costs (19.6 billion yen) for operating loss, and an absence of the gain on sales of shares of associates recorded in the previous fiscal year (52.1 billion yen) and an increase of loss on revaluation of earnout liabilities and M&A related put-option liabilities due to stronger than expected performance of acquired companies (15.9 billion yen).

- The share buyback announced on August 7, 2019 is progressing as planned and as of January 31, 2020, approximately 90% of the maximum amount had been purchased.

Toshihiro Yamamoto, President and CEO, Dentsu Group Inc., said:

In 2019, the performance of the Dentsu Group was below expectations for both the Japan and the International business. The Japan business did see improvements through the fourth quarter due to the Rugby World Cup and the Tokyo Motor Show and cost measures led to a margin beat. The International business suffered from a continuing weak performance in a number of key markets, leading to the decision to announce a restructuring in December.

I am confident the restructuring of the International business will deliver the necessary savings and changes to our organizational structure that we need to deliver growth and margin improvement in 2020 and beyond.

2020 is an exciting year for our business. In January, Dentsu transitioned to a new Group structure, bringing the Japan and the International business closer together under the shared understanding of “one dentsu”. This structure will create a solid foundation to allow our people to work across markets and across brands, to deliver growth for our clients.

2020 is also an important year for Japan, with the Tokyo 2020 Olympics and Paralympic Games hosted in Tokyo over the summer months. The Dentsu Group, along with many Japanese corporations, look forward to supporting and contributing towards the Olympic and Paralympic Games as a responsible corporate citizen. And our success will become a valuable legacy beyond 2020.

FY2019 Consolidated Financial Results and FY2020 Forecasts

1. FY2019 Performance Review

Japan Business:

The Group’s operations in Japan delivered organic growth of 0.4% in FY2019. H1 FY2019 was impacted by the lack of large-scale events in Japan versus H1 FY2018; but H2 FY2019 benefited from the Tokyo Motor Show, the Rugby World Cup and the G20.

The growth in digital-related services continues to offset the transition of the traditional media business into digital. Acquisitions and favorable performance of subsidiaries (Dentsu Inc.’s consolidated subsidiaries before establishing pure holding company structure) also contributed to the results. CARTA HOLDINGS, Dentsu Digital, Dentsu live and ISID (Information Services International-Dentsu, Ltd.) all posted double digit organic growth in FY2019.

The Business Momentum Index in Japan has continued to rise, showing an improving win rate throughout the year.

Underlying operating margin in Japan declined by 260 bps to 19.1% due to planned investments for future growth in HR development, enhancement of IT infrastructure, and reinforcement of digital business foundation. However, the fourth quarter showed a 170 bps improvement yoy due to a contribution from large-scale events and lower SG&A cost enabled by successful cost management.

International Business:

Dentsu Aegis Network delivered organic growth of -1.9% in FY2019 and -4.0% in Q4 FY2019. The FY2019 results were adversely affected by underperformance in five key markets (Australia, Brazil, China, France, UK). Excluding these markets, the International business delivered 2.5% organic growth for the full year.

The underperformance of these five markets resulted in the decision to implement a restructuring program to return the business to growth and to allow margin delivery for FY2020 and beyond. The restructuring will accelerate the transformation to our new business model, to deliver integrated growth solutions to our clients and ensure our services are easier to navigate.

2020 is the year of implementation of the new business model into three Lines of Business: Creative, CRM and Media. This simplification ensures the business is set up around our clients’ needs – to win, keep and grow their best customers by being ideas led, data driven and tech enabled.

Regionally, the Americas was the best performing region at 2.4% organic growth, EMEA reported -0.7% growth while APAC reported -12.3%. The Americas results are supportive of the new business model, which has been deployed in the US market first.

Dentsu Aegis Network delivered an industry leading performance for Media net new business with $4.3bn of billings added. The Creative line of business delivered an increase in net new business yoy and the CRM line of business had a record-breaking year for new business wins.

FY2019 operating margin was 12.2%, -70 bps yoy. Margin improvement in FY2020 is a key priority. Neil Gissler, the newly appointed Chief Operating Officer will continue to transform our internal operations to drive profitable growth across markets and Line of Business for FY2020 and beyond.

A number of strategic initiatives, led and delivered locally, with global oversight from the Regional Operating Officers will drive consistency within each of our markets creating efficiencies across the business.

International Business – Regions:

In EMEA, Dentsu Aegis Network reported -0.7% organic growth in FY2019 and -1.8% in Q4 FY2019.

Russia, Spain and Switzerland delivered over 5% organic growth in FY2019. Denmark, Germany, Italy and the Netherlands also delivered positive organic growth for the year. The overall regional performance deteriorated in the fourth quarter impacted by continued challenges in the UK & France.

In the Americas, Dentsu Aegis Network reported +2.4% organic growth in FY2019 and +1.5% in Q4 FY2019.

The Americas remains our fastest growing region, contributing 43% of Dentsu Aegis Network revenues. The US market delivered 3.8% organic growth in the fourth quarter and is one of our most progressed markets in adopting our new business model. Through FY2019, a number of key clients were won in the US market through the implementation of the Integrated Growth Solutions strategy. In December, we announced the appointment of Jacki Kelley as CEO of the Americas, who will lead the region, continuing to build on the solid business platform.

In the APAC region (excluding Japan), Dentsu Aegis Network reported -12.3% organic growth in FY2019 and -17.9% in Q4 FY2019.

APAC had a challenging year, driven by underperformance in Australia and China which continued into the fourth quarter. Australia continues to be impacted by client losses seen through FY2019. While some of those losses will impact FY2020 results, the market is seeing some stabilization under the new leadership of Angela Tangas. China remains another challenging market and given macro-economic conditions could see further weakness in FY2020. India’s performance slowed during the second half of the year, but still delivered positive organic growth for the full year. Taiwan and Thailand both delivered negative organic growth for the full year.

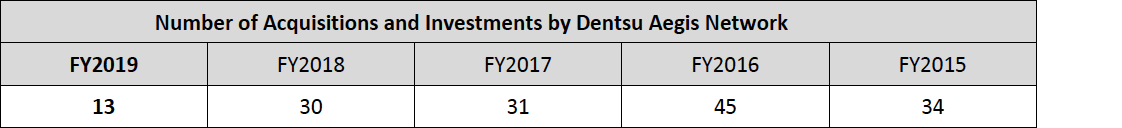

International Business – Acquisitions:

In FY2019, a total of 13 new acquisitions were signed. Three acquisitions were made in EMEA, four in the Americas and six in APAC.

We continue to invest in high quality, growth businesses related to data and technology that drive scale, geographic and capability in-fill. Two of the largest acquisitions in 2019 were Ugam and MuteSix.

In July 2019, Ugam joined Merkle, representing one of the largest transactions in Merkle’s history. Founded in 2000 in Mumbai, Ugam is a data and analytics company serving both B2B and B2C enterprises. This acquisition will add both scale and new capabilities to Merkle's service lines while further expanding the Dentsu Group's offerings in competitive data marketing services to global corporations

In August, MuteSix, one of the world’s largest direct-to-consumer marketing agencies joined iProspect, expanding iProspect’s iProspect’s suite of performance marketing solutions for both enterprise and direct-to-consumer (DTC) marketers. MuteSix bring unique expertise in the DTC market and combined with iProspect’s deep experience working with larger portfolio enterprise companies, Dentsu Group can now offer a full suite of performance marketing solutions for clients at every stage of their growth.

Number of acquisitions and investments by Dentsu Aegis Network are as follows:

2. Cash Dividends

Cash dividends per share of common stock applicable to the fiscal year ended December 31, 2019 was determined to be 95 yen, including an interim dividend of 47.5 yen and a year-end dividend of 47.5 yen. This equates to a dividend payout ratio of 35.1% based on underlying net profit attributable to owners of the parent.

Cash dividends per share of common stock applicable to the fiscal year ended December 31, 2020 was expected to be 95 yen, including an interim dividend of 47.5 yen and a year-end dividend of 47.5 yen. This equates to a dividend payout ratio of 30.4% based on underlying net profit attributable to owners of the parent forecast.

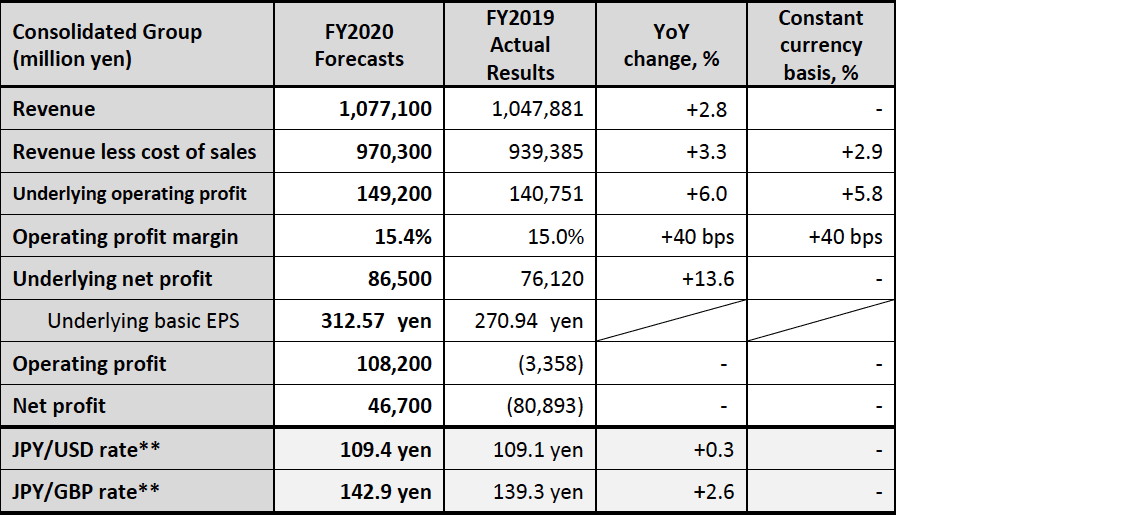

3. Forecasts for FY2020 Full Year Performance

FY2020 Forecasts

The forecasts exclude the world economy trends likely to be influenced by possible impacts from an outbreak of Coronavirus.

* FY2020 forecasts are based on average exchange rates in January 2020. Actual exchange rates in FY2019 actual results are annual average exchange rates in FY2019.

Note: Underlying net profit, Underlying basic EPS and Net profit: Excluding attribution to non-controlling interests.

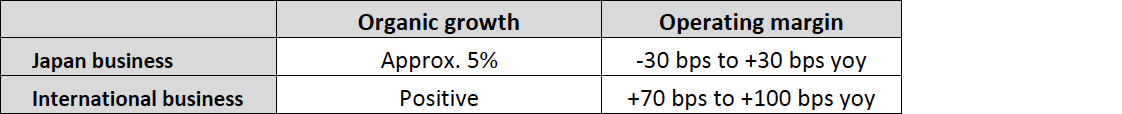

Guidances for FY2020

Further Information

Further details of these results, including all related financial statements, can be found in the Investor Relations section of the Dentsu Inc. website: https://www.group.dentsu.com/en/ir/

####

About the Dentsu Group

Led by Dentsu Group Inc. (Tokyo: 4324; ISIN: JP3551520004), a pure holding company established on January 1, 2020, the Dentsu Group encompasses two operational networks: Dentsu Japan Network, which oversees Dentsu’s agency operations in Japan, and Dentsu Aegis Network, its international business headquarters in London, which oversees Dentsu’s agency operations outside of Japan.

With a strong presence in over 145 countries and regions across five continents and with more than 62,000 dedicated professionals, the Dentsu Group provides a comprehensive range of client-centric integrated communications, media and digital services through its ten global brands—Carat, Dentsu, dentsu X, iProspect, Isobar, mcgarrybowen, Merkle, MKTG, Posterscope and Vizeum—as well as through Dentsu Japan Network companies, including Dentsu Inc., the world’s largest single brand agency with a history of innovation. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

Dentsu Group Inc. website URL: https://www.group.dentsu.com/en/