- TOP

-

Corporate Data

- Information for Shareholders/Share Information/Third-party Evaluation and Share Price Changes

Information for Shareholders

(As of December 31, 2017)

- Corporate Headquarters

- 1-8-1, Higashi-shimbashi, Minato-ku, Tokyo

105-7001, Japan

Phone: +81-3-6216-5111

- Contact Info

- Investor Relations Department,

Corporate Strategy Division,

1-8-1, Higashi-shimbashi, Minato-ku, Tokyo

105-7001, Japan

Email: irmail@dentsu.co.jp

- Stock Exchange Listing

- Tokyo Stock Exchange, First Section

Securities code: 4324

- Capital

- 74,609.81 million yen

- Total Number of Shares Issued

- 288,410,000

- General Meeting of Shareholders

- The Ordinary General Meeting of Shareholders is

held in Tokyo in March each year.

- Transfer Agent

- The Mitsubishi UFJ Trust and Banking

Corporation

4-5, Marunouchi 1-Chome, Chiyoda-ku, Tokyo

100-8212, Japan

- Internet Address

- https://www.group.dentsu.com/en/

Share Information

(As of December 31, 2017)

Breakdown of Shareholders by Type

| Number of Shareholders | Number of Shares Held | Percentage of Total Number of Shares Issued | |

|---|---|---|---|

| Japanese financial institutions | 82 | 88,696,260 | 30.75 |

| Japanese securities firms | 63 | 9,012,676 | 3.12 |

| Other Japanese corporations | 671 | 77,549,771 | 26.89 |

| Japanese individuals and others (Including treasury stock) | 40,808 | 48,278,775 | 16.74 |

| Foreign institutions and individuals | 627 | 64,827,518 | 22.49 |

| Total | 42,251 | 288,410,000 | 100.00 |

Major Shareholders (Top 10)

| Major Shareholders | Number of Shares Held |

Percentage of Total Number of Shares Issued |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust accounts) | 31,329,200 | 10.86 |

| Kyodo News | 19,375,500 | 6.72 |

| Jiji Press, Ltd. | 18,988,800 | 6.58 |

| Japan Trustee Services Bank, Ltd. (Trust accounts) | 16,678,680 | 5.78 |

| State Street Bank and Trust Company | 7,955,155 | 2.76 |

| Group Employees’ Stockholding Association | 6,511,082 | 2.26 |

| Mizuho Bank, Ltd. | 5,963,698 | 2.07 |

| Yoshida Hideo Memorial Foundation | 5,000,000 | 1.73 |

| Recruit Holdings Co., Ltd. | 4,984,808 | 1.73 |

| Tokyo Broadcasting System Television, Inc. | 4,929,900 | 1.71 |

(Note) The percentage of total number of share shows the ratio of shares held by each investor to the total number of issued shares.

Third-party Evaluation and Share Price Changes

The Dentsu Group actively engages in environmental preservation and other corporate sustainability activities. Receiving a score of B from the Carbon Disclosure Project (CDP) in 2017, we will continue promoting these activities and disclosure efforts.

Moreover, in recent years, Environment, Social and governance (ESG) investment(※1), which takes into account not only financial aspects such as corporate revenue and growth prospects, but also ethics, legal compliance and efforts to tackle environmental issues has been gaining attention in investment trust management.

Dentsu’s CSR efforts received high recognition and has been included in the MSCI Global Sustainability Indexes(※1) since June 2015. In September 2016, Dentsu was selected for the third consecutive year for inclusion in the Dow Jones Sustainability Asia Pacific Index (DJSI Asia Pacific), the Asia Pacific version of the Dow Jones Sustainability Indices (DJSI)(※2).

※1: An index developed by Morgan Stanley Capital International (MSCI) in the United States that selects companies that are particularly outstanding in environmental, social, and governance (ESG) assessments.

※2: DJSI is a stock index developed jointly by S&P Dow Jones Indices, a U.S. company that provides global financial market indices, and RobecoSAM, a Swiss company that conducts research and rates companies in relation to socially responsible investing. In addition to conventional financial analysis, this index measures broader corporate sustainability based on companies’ social and environmental initiatives, selecting companies that are excellent overall. DJSI Asia Pacific targets approximately 600 leading companies in the Asia Pacific region. In fiscal 2017, 152 companies (72 of them from Japan) were selected for inclusion.

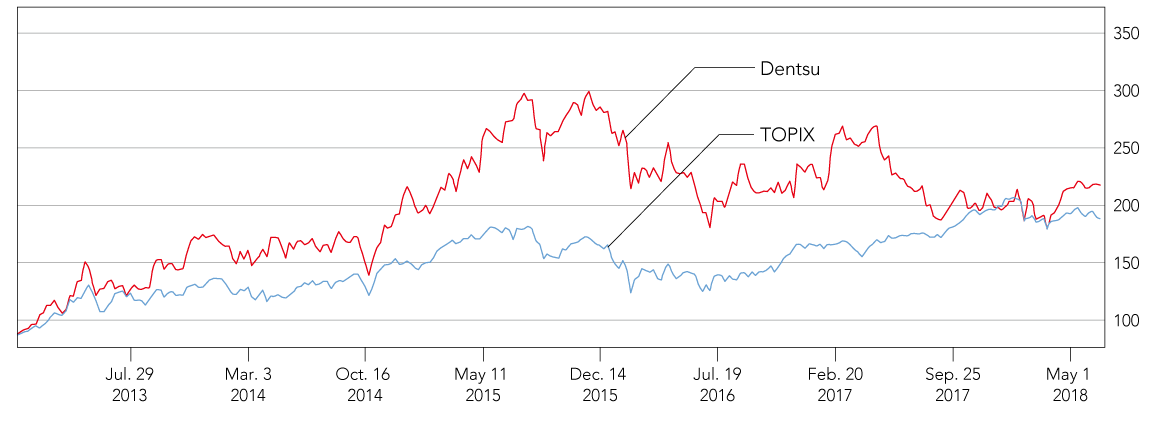

TOPIX and Dentsu (relative comparison over five years)