- TOP

-

About Dentsu

- Financial/Non-financial Highlights

Financial/Non-financial Highlights(Consolidated, IFRS)

Dentsu Inc. and Consolidated Subsidiaries

(Millions of Yen)

| Calendar year basis(1) | |||

|---|---|---|---|

| 2015 | 2016 | 2017 | |

| Turnover | 4,990,854 | 4,924,933 | 5,187,300 |

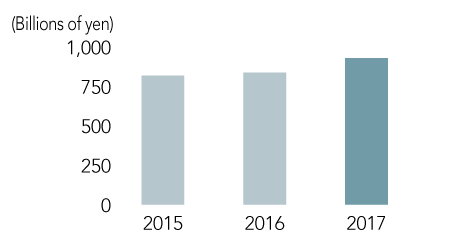

| Revenue | 818,566 | 838,359 | 928,841 |

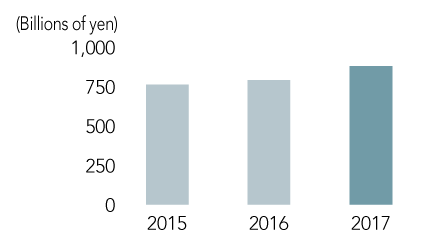

| Gross profit | 761,996 | 789,043 | 877,622 |

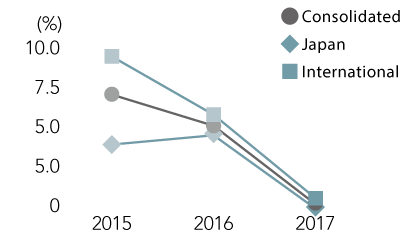

| Organic gross profit growth rate(2) (Consolidated) | 7.0% | 5.1% | 0.1% |

| Organic gross profit growth rate (Japan) | 3.9% | 4.5% | (0.3%) |

| Organic gross profit growth rate (International) | 9.4% | 5.7% | 0.4% |

| Operating profit | 128,212 | 137,681 | 137,392 |

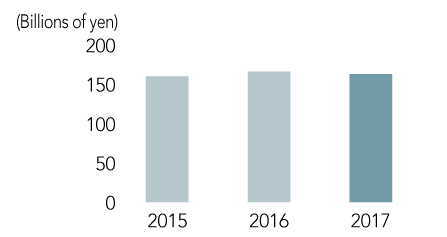

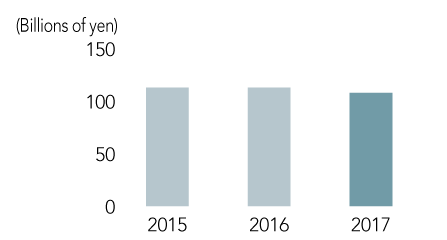

| Underlying operating profit(3) | 160,438 | 166,565 | 163,946 |

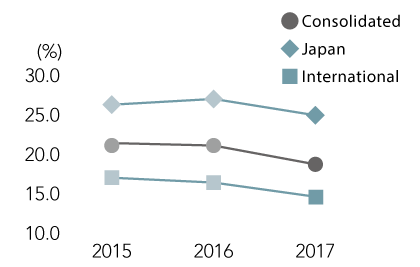

| Operating margin(4) (Consolidated) | 21.1% | 21.1% | 18.7% |

| Operating margin (Japan) | 26.0% | 26.8% | 24.5% |

| Operating margin (International) | 16.9% | 16.2% | 14.6% |

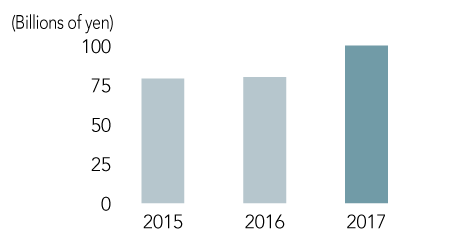

| Profit for the year attributable to owners of the parent | 83,090 | 83,501 | 105,478 |

| Underlying net profit(5) | 113,388 | 112,972 | 107,874 |

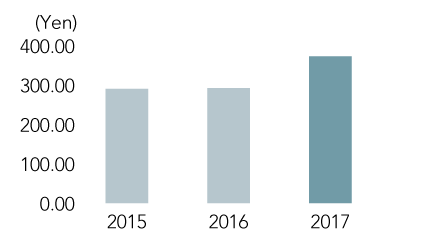

| Basic earnings per share | ¥289.95 | ¥292.85 | ¥373.11 |

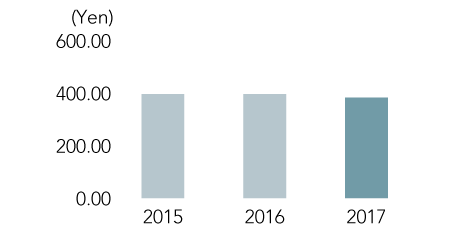

| Basic underlying net profit per share | ¥395.67 | ¥396.20 | ¥381.58 |

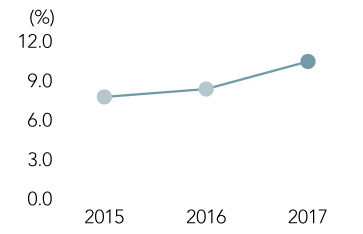

| Return on equity (ROE)(6) | 7.7% | 8.3% | 10.4% |

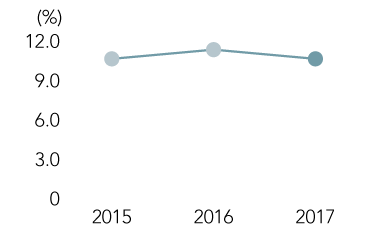

| Underlying ROE | 10.6% | 11.3% | 10.6% |

| ROA(7) | - | 4.3% | 4.5% |

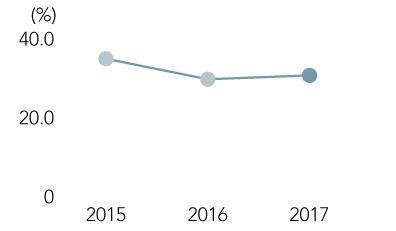

| Ratio of equity attributable to owners of the parent(8) | 34.8% | 29.6% | 30.7% |

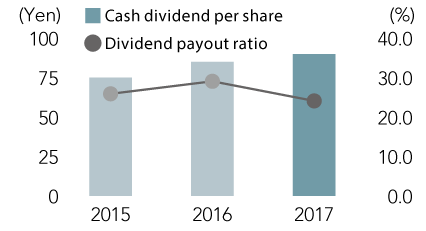

| Cash dividend per share | ¥75 | ¥85 | ¥90 |

| Dividend payout ratio(9) | 25.9% | 29.0% | 24.1% |

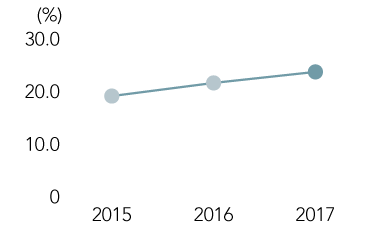

| Underlying dividend payout ratio | 19.0% | 21.5% | 23.6% |

-

Revenue

-

Gross Profit

-

Organic Gross Profit Growth Rate

-

Operating Profit

-

Underlying Operating Profit

-

Operating Margin

-

Profit for the Year Attributable to Owners of the Parent

-

Underlying Net Profit

-

Basic Earnings per Share

-

Basic Underlying Net Profit per Share

-

Return on Equity (ROE)

-

Underlying ROE

-

Ratio of Equity Attributable to Owners of the Parent

-

Cash Dividend per Share/Dividend Payout Ratio

-

Underlying Dividend Payout Ratio

Notes: 2015 are reported on a pro forma basis, and 2016 and 2017 are reported on a financial reporting basis.

-

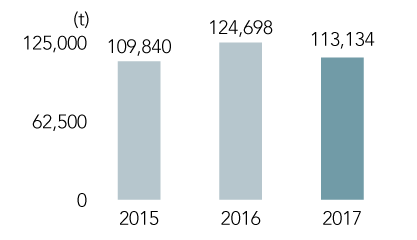

CO2 emissions(※)

(※)Excluding some of Dentsu Group companies

-

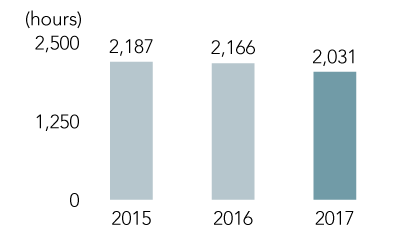

Total Hours Worked Per Year (Parent Company only)

-

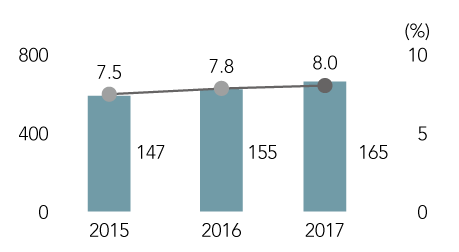

Number/Ratio of Woman Among Managers(※)

(Parent Company only)

(※)Including personnel seconded to the Company and excluding personnel seconded from the Company

(1) 2015 are reported on a pro forma basis, and 2016 and 2017 are reported on a financial reporting basis.

(2) Organic gross profit growth rate represents the constant currency year-on-year growth after adjusting for the effect of business acquired or disposed of since the beginning of the previous year

(3) Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with amortization of M&A related intangible assets, acquisition costs, share-based compensation expenses related to acquired companies and one-off items such as impairment loss and gain/loss on sales of noncurrent assets

(4) Operating margin = Underlying operating profit÷Gross profit×100

(5) Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to owners of the parent which is calculated as net profit

(attributable to owners of the parent) added with adjustment items related to operating profit, revaluation of earnout liabilities/M&A related put-option liabilities, taxrelated and NCI profit-related and other one-off items

(6) ROE (IFRS) = Profit for the year attributable to owners of the parent ÷ Average equity attributable to owners of the parent based on equity at the beginning and end of the fiscal year × 100

(7) ROA (IFRS) = Profit before tax ÷ Average total assets based on total assets at the beginning and end of the fiscal year × 100

(8) Ratio of equity attributable to owners of the parent = Equity attributable to owners of the parent÷Total assets

(9) Dividend payout ratio = Cash dividend per share ÷ Basic earnings per share × 100