CFO’s Message

Strengthening Digital Capabilities

Arinobu Soga

Director and Executive Officer

Continued transition to digital

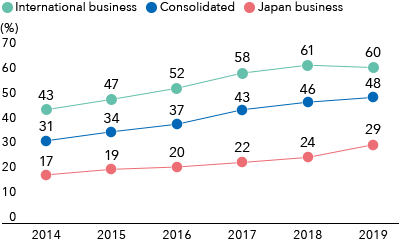

Digitalization has been a focus for the Dentsu Group for the past decade—and digital advertising, data, CRM, and digital solutions remain the fastest growth areas for the Dentsu Group. We continue to successfully transition our business, increasing our exposure in these areas and solving bigger problems for our clients that go beyond marketing.

The International business has long been focused on the high-growth digital domain and now generates 60% of its revenue less cost of sales from digital work.

The Japan business reached 29% of its revenue from digital work in 2019, meaning that as a Group almost 50% of our revenue less cost of sales is digital on a consolidated basis.

Japan: evolving our business as a growth partner for our clients

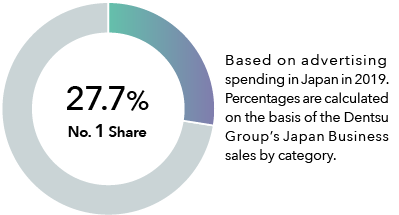

Throughout the Dentsu Group’s 120-year history, our business in Japan has maintained a large share of the domestic market. As a leading Japanese company with a solid domestic business in the world’s third-largest advertising market, Dentsu Group is said to be unlike any other global agency group.

We continue to draw on our expertise from across the Japan network to form dynamic teams, able to solve our clients’ issues at speed. As a result of providing our clients with innovative and integrated solutions, the Group has established a high degree of trust with many clients. We believe we can deliver sustainable revenue growth by supporting digital transformation for our clients in Japan.

In 2019, the organic growth rate* of revenue less cost of sales in Japan was +0.4% year on year. The growth in digital-related services continues to offset the transition of the traditional media business into digital. The Group saw a significant increase in sales in the digital, marketing, and promotion domains. Within the digital domain, we saw significant business expansion through a capital and business alliance with the VOYAGE GROUP, resulting in a +26.4% growth in digital domain.

Finally, in the fourth quarter of 2019, the Rugby World Cup Tournament in Japan was a huge success, starting a new sports movement throughout Japan. This demonstrates how the Dentsu Group can bring a positive impact on our society through a deep understanding of our clients, their customers, and society itself. By drawing on our diverse capabilities across the Group, we are able to demonstrate our ability to deliver change at scale.

- * Organic growth rate: Internal growth rate excluding the effects of exchange rates and M&A.

New business model

The Group’s International business now generates 60% of the Group’s revenue less cost of sales, with gross profit almost doubling within seven years following the acquisition of Aegis Group.

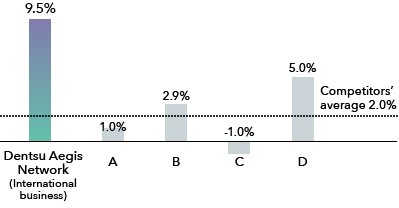

In 2019 however, Dentsu Aegis Network (DAN) delivered organic growth of -1.9%. These results were adversely affected by underperformance in five key markets (Australia, Brazil, China, France and the UK). The underperformance of these markets resulted in a decision to implement a restructuring program to return the business to growth and allow margin delivery for 2020 and beyond by reducing costs by ¥13.0 billion per annum. The restructuring accelerated the transformation to our new business model, to deliver integrated solutions to our clients, and ensure our services are easier to navigate.

The new business model streamlines the business into three Lines of Business (LoBs): Creative, Media and CRM. This simplification ensures the business is set up around our clients’ needs—to win, keep, and grow their best customers by being idea-led, data-driven, and tech-enabled.

Regionally, the Americas showed a strong performance with +2.4% organic growth. A number of key clients were won in the US market through the implementation of the Integrated Growth Solutions strategy. Europe, the Middle East and Africa (EMEA) reported -0.7% organic growth with seven markets in the region delivering positive growth. The Asia-Pacific (APAC) region reported -12.3% organic growth driven by underperformance in the Chinese and Australian markets.

We saw success with new business wins in 2019. DAN delivered an industry-leading performance for media net new business with $4.3bn of billings added.

Comparison with the Peers

Improving operating margin

Consolidated operating margin in 2019 was 15.0%, down 140 basis points year on year, due to planned investments in the development of human resources, enhancement of IT infrastructure in Japan and upfront investment in the digital domain. In the International business the margin fell due to revenue pressure in the APAC region.

Margin improvement is a key priority across the Group going forward. In the International business, a newly appointed Cheif Operating Officer will continue to transform our internal operations to drive profitable growth in 2020 and beyond. In Japan a number of initiatives started in the fourth quarter of 2019 delivered some margin improvement. I expect these cost actions to continue in 2020, improving margins over time.

M&A accelerating strategy

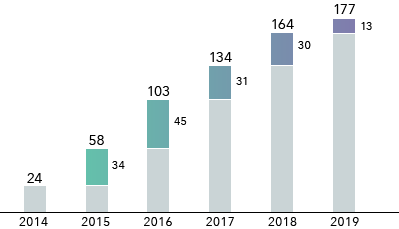

The Dentsu Group continues to use M&A as an accelerant of our strategy, whereby acquisitions allow our Group to gain scale, capabilities, and geographical infill in areas of high growth.

We continue to invest in high-quality growth businesses and in 2019 a total of 13 new acquisitions were signed. Two of the largest deals were Ugam and MuteSix. Ugam, a data and analytics company providing offshore services in data analytics fields, joined Merkle while MuteSix, a direct-to-consumer marketing agency, joined iProspect.

Paradigm shift provided by data

Marketing that analyzes and utilizes large amounts of diverse data to dramatically improve the efficacy of advertising has the potential to fundamentally change the industry’s business model.

The Dentsu Group acquired a majority stake in Merkle in 2016. Merkle has flourished under Dentsu’s ownership and now contributes almost a quarter of revenues within the International business. Merkle has transformed DAN’s client proposition, allowing us to offer fully integrated services and solutions across the marketing mix alongside our Creative and Media offerings.

In March 2020, we announced the accelerated buy-out of the remaining shares of Merkle. The purchase of these shares has brought the Group two major benefits. Firstly the deal will deliver single-digit EPS accretion for FY2020, and secondly it will allow DAN to accelerate the final stages of the integration of Merkle into the wider group.

Solid financial foundation critical

Amid increasing uncertainties surrounding the post-digital world, the age of AI, and living with COVID-19, we believe the Group can play a critical role facilitating digital transformation among our clients and their customers. Our solid financial foundation enables us to make decisions faster than ever and achieve innovation without fearing change. Investments will enhance competitiveness which, in turn, will generate cash and help the Group maintain a healthy financial position. If this virtuous circle is maintained, I believe we can achieve sustainable growth.

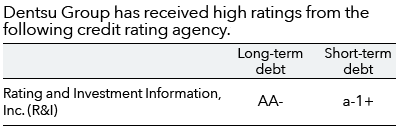

At present, the Dentsu Group has a solid reputation for its ability to generate positive cash flows and for its strong balance sheet. We are in an excellent position in terms of our ability to procure funding. The Group remains well capitalized with a strong balance sheet and a AA- credit rating from Japan’s Rating and Investment Information, Inc. (R&I).

For further information, please visit the agency’s website.

Rating and Investment Information, Inc. (R&I)

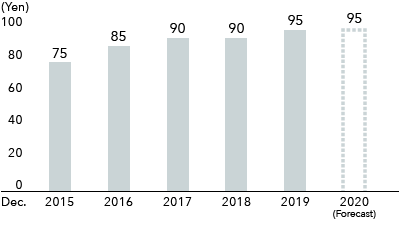

Delivering strong shareholder returns

Group management recognizes investment as an important means of achieving growth and it remains a priority for capital allocation. We view sustainable corporate value growth as the greatest return we can provide shareholders and all other stakeholders.

We believe that efforts related to shareholder returns are linked to stakeholder trust in, and expectations for, the Group. In 2019, we carried out share buybacks of approximately ¥30.0 billion. In future, we will continue to make every effort to provide comprehensive shareholder returns that combine continuous and stable dividends with the flexible acquisition of treasury stock.

I am keenly aware that maximizing balance sheet profits and exceeding the level of returns expected by shareholders are important missions of the CFO. Thus, we will strive to ensure that management responds to stakeholder expectations.