Sustainability & ESG

Corporate governance

Dentsu Group is focused on delivering sustainable growth and enhancing corporate value over the medium to long term. The pursuit of optimal corporate governance will ensure transparency and fairness in decision-making, the effective utilization of management resources, as well as swift and decisive decision-making.

The ultimate goal is to realize a better society by achieving the Group’s Medium-term Management Plan, announced in February 2021, as well as contributing to the growth of our clients, partners, people, and all consumers.

- Messages from Directors

- Corporate governance implementation structure

- Corporate governance implementation structure

- Board members

- Initiatives aimed at enhancing effectiveness of governance

- Enhancing board transparency

- Risk management

- Promoting compliance

Messages from Directors

Outside Director

Contributing to enhancing Dentsu Group’s

corporate value through rigorous

governance practices

More than one year has passed since the launch of Dentsu Group Inc.

The spread of COVID-19 throughout 2020 created a difficult business environment for both Dentsu Japan Network and Dentsu International.

Given these circumstances, Dentsu Group has begun a transformation on an unprecedented scale in the Group’s history. For these efforts to be successful, it is important that the management and all employees share a strong sense of purpose and implement changes supported by a consistent governance approach across the entire Group.

Outside Directors are committed to contributing to the growth of Dentsu Group and the enhancement of corporate value by ensuring thorough governance practices on behalf of our shareholders, and all other stakeholders.

Supervisory Committee

Member

Strengthening performance and governance

In 2020, I was appointed a Dentsu Group Director and a member of the Audit and Supervisory Committee. In the wake of rapid changes underway in the global environment, the Board of Directors successively supported management with the launch of the Group’s Comprehensive Review in August followed by the launch of the Medium-term Management Plan in February 2021.

In formulating our Group’s Medium-term Management Plan and the Accelerated Transformation Plan, we undertook many discussions covering a broad range of perspectives. The urgency created by COVID-19 served to accelerate our plans to ensure the Group’s purpose and strategy are well understood by all our stakeholders.

The Audit and Supervisory Committee has worked with the management to continually enhance the Group’s corporate value and ensure a sound financial position and appropriate resource allocation, through transparent management decision-making processes and their assessment.

We will work to strengthen internal controls, audits, compliance, and risk management in accordance with our corporate governance principles. This will support the management team’s implementation of the Medium-term Management Plan to position the Group for recovery. Furthermore, we will fulfill our responsibilities in pursuit and development of an exceptional governance system that supports management and allows for nimble and swift decision-making.

Director/Audit and

Supervisory Committee

Member

Scrutinizing corporate culture and human

resource management

It has been a very unusual year with the global COVID-19 pandemic and subsequent lockdowns across most economies. The Board and its committees have had to adapt and use video conferencing for most meetings. International Directors have not been able to travel to Japan. This has made good governance more difficult, but I think that we have coped well with this extra challenge.

We have two audit committees operating, one for the Japanese businesses and another, which I chair, for international. Both report into the Audit and Supervisory Committee (ASC), which then discusses further any major issues that arise. This works well for us with the size, geographical range and complexity of media businesses. It enables close scrutiny at a detailed level of audit and control matters that would be impossible for the ASC itself to undertake.

Our programme to enhance financial controls is continuing, particularly this year to look at culture and human resource management. Good controls are founded in strong and consistent processes and rules, but they are operated by thousands of different people across more than 145 countries. We need to ensure that our people are recruited, retained, motivated, developed, and flourish in a positive culture: One that encourages appropriate risk-taking, balancing entrepreneurial spirit with controls that enable us to manage risk. This is, of course, against continuing lockdowns, working from home in many countries, and of course the Accelerated Transformation Plan, which is reorganizing many brands, businesses and teams.

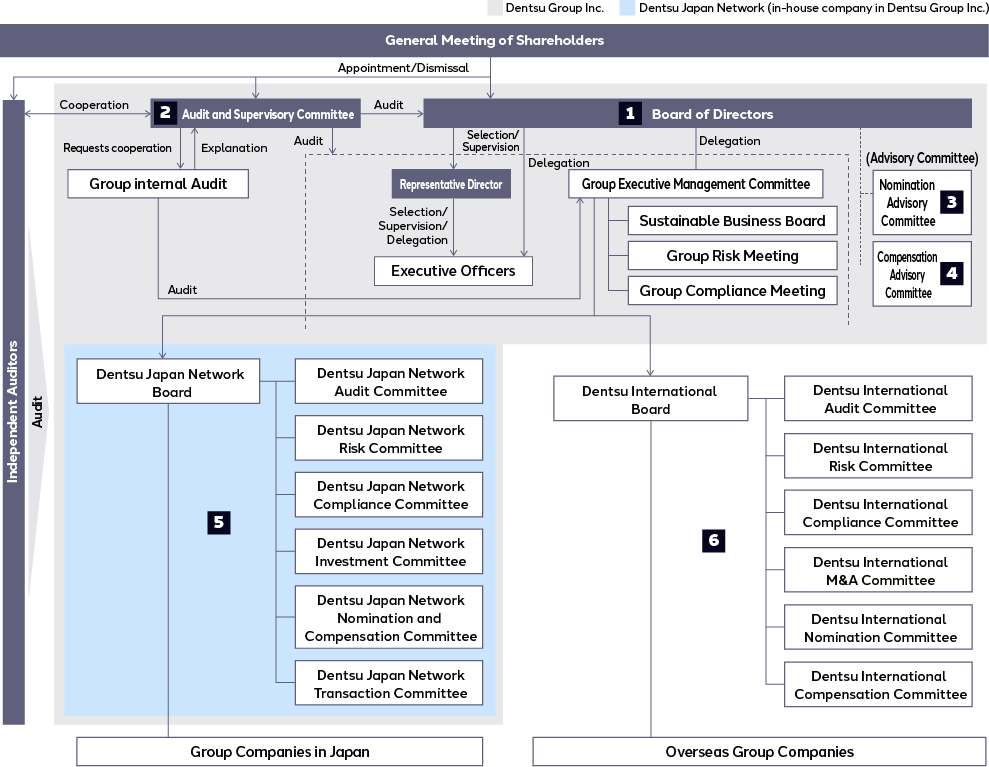

Corporate governance implementation structure

Corporate governance structure

Dentsu Group Inc. (hereinafter, the Company) has adopted a corporate governance structure defined as a Company with an Audit and Supervisory Committee that promotes swift and decisive management decisions by delegating certain authorities from the Board of Directors to Executive Officers. This strengthens the supervisory function provided by the Board of Directors, which includes at least four independent Outside Directors, and enhances effectiveness of auditing and internal control, in an attempt to enhance corporate value.

Under this system, the Company will realize effective corporate governance based on the following basic policy in order to fulfill its responsibilities to its stakeholders including shareholders, clients, employees and local communities, ensure sustainable growth, and enhance its corporate value over the medium to long term.

- To respect shareholders’ rights and ensure their equal treatment.

- To consider the interests of stakeholders, and cooperate with them appropriately.

- To appropriately disclose company information and ensure transparency.

- To enhance the effectiveness of the supervisory function of the Board of Directors concerning business execution.

- To engage in constructive dialogue with shareholders who have an investment policy that conforms to the medium- to long-term interests of shareholders.

1. Board of Directors

The Company has adopted a form of governance with an Audit and Supervisory Committee, and has transferred authority for important business execution in part from the Board of Directors to Executive Officers in order to realize an expeditious and effective business execution system. As well as exercising a supervisory function over business execution, the Board of Directors determines core management matters for Dentsu Group, such as the establishment of Group management strategy, important management issues, and appointment of Executive Officers.

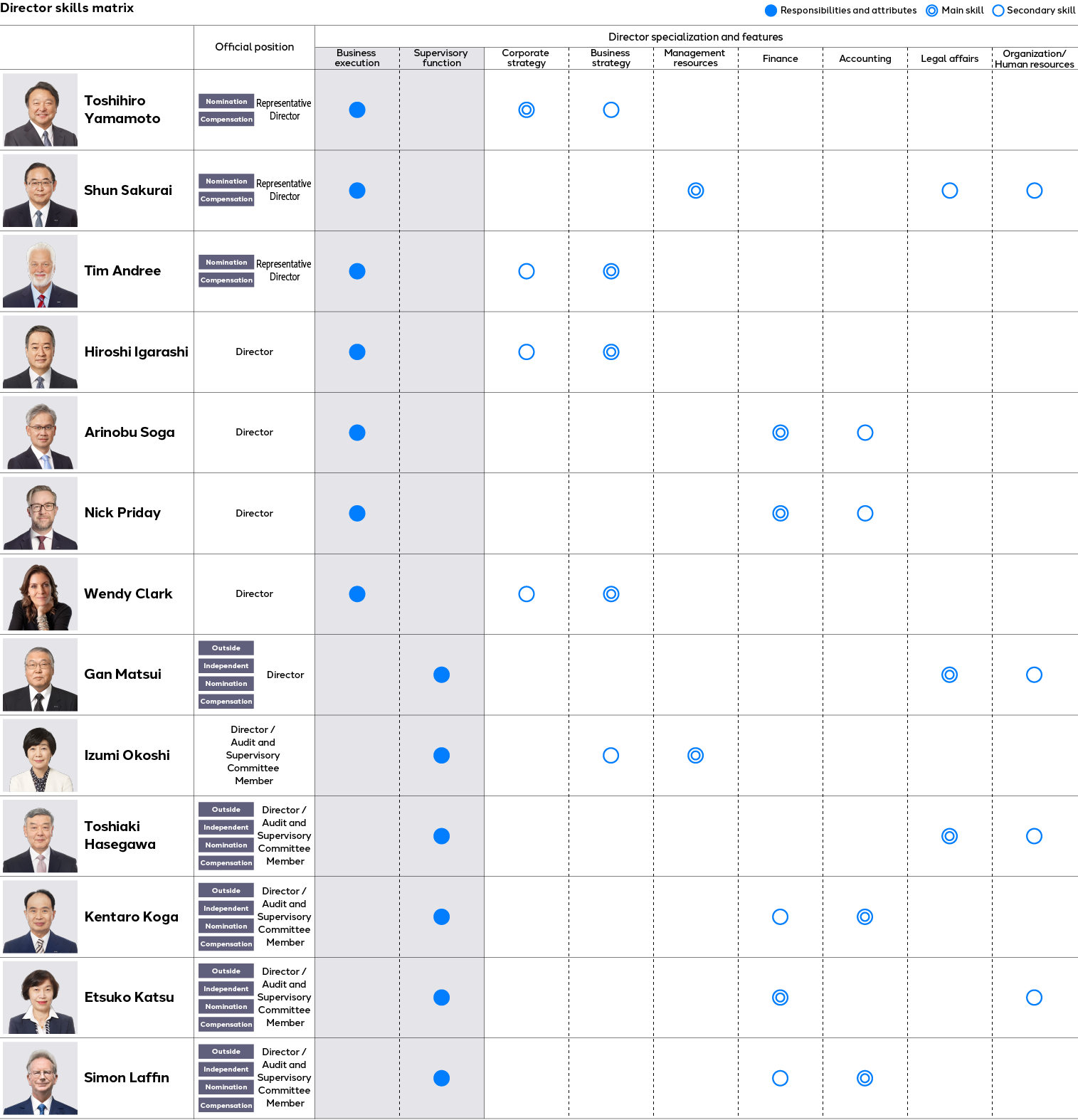

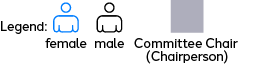

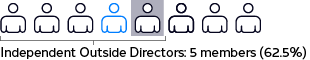

At present, the Board of Directors is composed of 13 Directors from both within and outside the Company, including five independent Outside Directors, all of whom have advanced knowledge and expertise.

Main agenda items of the Board (which met 18 times in FY2020)

- Medium-term Management Plan

- Comprehensive review of business operations and capital efficiency

- Group capital policy

- Internal Control and Risk Committee reports

- Acceptability of strategically held shares

2. Audit and Supervisory Committee

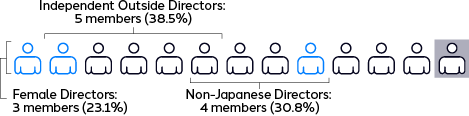

The Audit and Supervisory Committee is a body composed of all Directors who are Audit and Supervisory Committee members. Working in coordination with the internal control division and the accounting auditor, it engages in audit and supervision of the Executive Officers and Directors who are not Audit and Supervisory Committee members, from the perspectives of compliance and adequacy. The Company presently has five Directors who are Audit and Supervisory Committee members, of which one is from within the Group, and four are independent Outside Directors (of which two have extensive finance and accounting knowledge).

Main agenda items of the Audit and Supervisory Committee (which met 16 times in FY2020)

- Audit plan formulation

- Status of establishment and implementation of internal control systems

- Assessment of Group companies audit status

- Agreement on compensation, evaluation and reappointment of accounting auditors

- Judgement of appropriateness of accounting auditor’s audit

- Opinions on the appointment and compensation of Directors

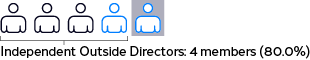

3. Nomination Advisory Committee

The Nomination Advisory Committee was established as an advisory organization to the Board of Directors in April 2020 by reorganizing the Nomination and Compensation Advisory Committee. The majority of the committee members are Outside Directors, and it is chaired by an independent Outside Director. In response to inquiries received from the Board of Directors, the committee deliberates and reports on matters relating to nomination and succession planning concerning Directors and Executive Officers, and submits items to be decided by the Board of Directors.

The main topics discussed by the Nomination Advisory Committee (which met five times in FY2020)

- Nomination policy

- Succession planning

- Candidates for the positions of Directors and Executive Officers

4. Compensation Advisory Committee

The Compensation Advisory Committee was established as an advisory organization to the Board of Directors in April 2020 by reorganizing the Nomination and Compensation Advisory Committee. The majority of the committee members are Outside Directors, and it is chaired by an independent Outside Director. In response to inquiries received from the Board of Directors, the committee deliberates and reports on matters relating to compensation concerning Directors and Executive Officers, and submits items to be decided by the Board of Directors.

Main topics discussed by the Compensation Advisory Committee (which met six times in FY2020)

- Amendment of the performance-based stock compensation plan

- Implementation of a management compensation survey by a third-party agency

- Individual compensation for Directors and Executive Officers

Reference: Nomination and Compensation Advisory Committee

The Nomination and Compensation Advisory Committee was established in July 2019 as an advisory body to the Board of Directors, with a majority of Outside Directors and an independent Outside Director as its chairperson. The committee was reorganized into a more specialized advisory body separating the nomination, appointment and dismissal functions from compensation on April 1, 2020, resulting in the Nomination Advisory Committee and the Compensation Advisory Committee.

Main topics discussed by the Nomination and Compensation Advisory Committee (which met three times in FY2020)

- • Succession planning policy

- • Skills matrix of Directors

5. Dentsu Japan Network Board

6. Dentsu International Board

The Company established the Dentsu Japan Network Board (under Dentsu Japan Network, an internal company) to deliberate important matters pertaining to Group companies engaged in the Japan business, and the Dentsu International Board to deliberate important matters pertaining to the Group’s international business, thereby dividing the business execution system into the Japan business sector and the international business sector. Each is delegated responsibility for profit and authority for its respective region.

Corporate governance implementation structure

Board members

Toshihiro Yamamoto Representative Director

Biography

- April 1981

- Joined Dentsu Inc.

- July 2008

- EPM, Communication Design Center, Dentsu Inc.

- April 2009

- Head of Communication Design Center, Dentsu Inc.

- April 2010

- Head of Communication Design Center; Managing Director, MC Planning Division, Dentsu Inc.

- April 2011

- Executive Officer, Dentsu Inc.

- June 2014

- Director, Executive Officer, Dentsu Inc.

- January 2016

- Director, Senior Vice President, Dentsu Inc.

- March 2016

- Senior Vice President, Dentsu Inc.

- January 2017

- President and CEO, Dentsu Inc.

- March 2017

- Representative Director, President and CEO, Dentsu Inc.

- January 2020

- Representative Director, President and CEO, Dentsu Group Inc. (current)

Shun Sakurai Representative Director

Biography

- April 1977

- Joined the Ministry of Posts and Telecommunications

- July 2008

- Director-General, Telecommunications Bureau, Ministry of Internal Affairs and Communications (MIC)

- September 2012

- Director-General, Global ICT Strategy Bureau, MIC

- June 2013

- Vice-Minister for Policy Coordination (Postal and Communications), MIC

- July 2015

- Vice-Minister, MIC

- September 2016

- Corporate Advisor, Sumitomo Mitsui Trust Bank, Limited

- January 2018

- Executive Officer, Dentsu Inc.

- June 2018

- Outside Director, Tokyu Fudosan Holdings Corporation

- March 2019

- Director, Executive Officer, Dentsu Inc.

- January 2020

- Director, Executive Vice President, Dentsu Group Inc.

- March 2020

- Representative Director, Executive Vice President, Dentsu Group Inc.(current)

Tim Andree Representative Director

Biography

- March 2002

- Senior Vice President, Communications & Marketing, The National Basketball Association

- December 2005

- CCO (Chief Communication Officer), BASF Corporation

- May 2006

- CEO, Dentsu America, LLC.

- June 2008

- Executive Officer, Dentsu Inc.

- November 2008

- President & CEO, Dentsu Holdings USA, LLC.

- April 2012

- Senior Vice President, Dentsu Inc.

- March 2013

- Executive Chairman, Dentsu Aegis Network Ltd. (currently Dentsu International Limited)

- April 2013

- Executive Vice President, Dentsu Inc.

- June 2013

- Director, Executive Vice President, Dentsu Inc.

- January 2018

- Director, Executive Officer, Dentsu Inc.

- January 2019

- Executive Chairman & CEO, Dentsu Aegis Network Ltd.

- January 2020

- Director, Executive Vice President, Dentsu Group Inc.

- September 2020

- Executive Chairman, Dentsu International Limited (current)

- March 2021

- Representative Director, Executive Vice President, Dentsu Group Inc. (current)

Hiroshi Igarashi Director

Biography

- April 1984

- Joined Dentsu Inc.

- April 2013

- Managing Director, Account Management Division, Dentsu Inc.

- January 2017

- Executive Officer, Dentsu Inc.

- March 2018

- Director, Executive Officer, Dentsu Inc.

- January 2020

- Director, Executive Officer, Dentsu Group Inc. (current)

President and CEO, Dentsu Japan Network (current)

Representative Director, President and CEO, Dentsu Inc. (current)

Arinobu Soga Director

Biography

- April 1988

- Joined Dentsu Inc.

- June 2015

- Managing Director, Finance & Accounting Division, Dentsu Inc.

- January 2017

- Executive Officer, Managing Director, Corporate Strategy Division, Dentsu Inc.

- March 2017

- Director, Executive Officer, Dentsu Inc.

- January 2020

- Director, Executive Officer, Dentsu Group Inc. (current)

- March 2020

- Corporate Auditor, CARTA HOLDINGS INC. (current)

Nick Priday Director

Biography

- August 1996

- Audit Manager, Ernst & Young

- August 2003

- Director, Aegis Group plc

- September 2009

- CFO, Aegis Group plc

- April 2013

- CFO, Dentsu Aegis Network Ltd. (currently Dentsu International Limited)

- January 2018

- Executive Officer, Dentsu Inc.

- March 2020

- Director, Executive Officer, Dentsu Group Inc. (current)

- October 2020

- Director, CFO, Dentsu International Limited (current)

Wendy Clark Director

Biography

- February 2001

- SVP/Director, GSD&M

- January 2004

- SVP, AT&T

- January 2008

- SVP, The Coca Cola Company

- January 2014

- President (Sparkling Brands & Strategic Marketing), The Coca Cola Company

- January 2016

- CEO, DDB Worldwide North America

- February 2018

- CEO, DDB Worldwide

- September 2020

- CEO, Dentsu Aegis Network Ltd. (currently Dentsu International Limited)

Executive Officer, Dentsu Group Inc. (current) - October 2020

- Director, Global CEO, Dentsu International Limited (current)

- March 2021

- Director, Executive Officer, Dentsu Group Inc. (current)

Gan Matsui Director

Biography

- April 1980

- Graduated from the Legal Training and Research Institute of Japan, the Supreme Court

- October 2007

- Prosecutor, Otsu District Public Prosecutors Office

- July 2009

- Deputy Prosecutor of the Nagoya High Public Prosecutors Office

- October 2010

- Deputy Prosecutor of Osaka High Public Prosecutors Office

- June 2012

- Chief Prosecutor General, Chairperson of the Supreme Financial Securities Expert Committee

- January 2014

- Yokohama Prosecutor

- January 2015

- Superintending Prosecutor of Fukuoka High Public Prosecutors Office

- September 2016

- Retired public prosecutor

- November 2016

- Registered as an attorney at law (Tokyo Bar Association), Yaesu Sogo Law Office (current)

- February 2017

- Chairman of the Independent Advisory Committee on Labor Environment Reform of Dentsu Inc.

- June 2017

- Outside Corporate Auditor, Orient Corporation (current)

- June 2018

- Outside Director, Audit and Supervisory Committee member, Globeride, Inc. (current)

Outside Corporate Auditor, Totetsu Kogyo Co. (current)

Outside Corporate Auditor, Nagase & Co., Ltd. (current) - March 2020

- Outside Director, Dentsu Group Inc. (current)

Izumi Okoshi

Director, member of Audit and Supervisory Committee

Biography

- October 1989

- Joined Social Engineering and Research Institute, Inc.

- May 1995

- Joined Warner Lambert

- January 1998

- Joined Dentsu Inc.

- April 2014

- Senior Specialist, Business Creation Division

- July 2016

- ECD, Business Creation Division

- October 2017

- EBD, Business D&A Division

- January 2018

- EBD, Dentsu Innovation Initiative

- May 2019

- EPD, Data Technology Center

- March 2020

- Director (Audit & Supervisory Committee Member), Dentsu Group Inc. (current)

Toshiaki Hasegawa

Director, member of Audit and Supervisory Committee

Biography

- April 1977

- Registered as an attorney at law (Daiichi-Tokyo Bar Association)

- January 1982

- Partner, Ohashi, Matsueda and Hasegawa Law Offices

- January 1990

- Representative, Hasegawa Toshiaki Law Office (current)

- June 2011

- Outside Corporate Auditor, Dentsu Inc.

- March 2016

- Outside Director, member of the Audit and Supervisory Committee Dentsu Inc. (currently Dentsu Group Inc.) (current)

Kentaro Koga

Director, member of Audit and Supervisory Committee

Biography

- April 1985

- Joined Mitsubishi Research Institute

- May 1993

- Completed a master’s degree course at the Graduate School of Business Administration, Columbia University

- June 1999

- Completed the Doctor’s degree course at Harvard University’s Graduate School of Business Administration and acquired Doctor of Business Administration

- April 2001

- Assistant Professor of Commerce, Waseda University

- January 2002

- Assistant Professor, Accounting Department, University of Illinois

- July 2009

- Associate Professor, Graduate School of International Corporate Strategy, Hitotsubashi University

- June 2012

- Outside Corporate Auditor, Dentsu Inc.

- June 2013

- Outside Corporate Auditor, Resona Bank

- March 2016

- Outside Director, member of the Audit and Supervisory Committee, Dentsu Inc. (currently Dentsu Group Inc.) (current)

- April 2018

- Associate Professor, School of Business Administration, Hitotsubashi University Business School (current)

Etsuko Katsu

Director, member of Audit and Supervisory Committee

Biography

- April 1978

- Joined The Bank of Tokyo, Ltd. (currently MUFG Bank, Ltd.)

- January 1992

- Research Division, The Japan Research Institute, Limited

- April 1995

- Associate Professor of Finance and Economics, Ibaraki University

- April 1998

- Associate Professor, School of Political Science and Economics, Meiji University

- January 2001

- Member of Council of Customs and Foreign Exchange Ministry of Finance

- April 2003

- Professor, School of Political Science and Economics, Meiji University (current)

- January 2007

- Member, Labor Policy Council, Ministry of Health, Labour and Welfare

- April 2008

- Vice President International, Meiji University

- March 2015

- Member, Council for Science and Technology, Ministry of Education, Culture, Sports, Science and Technology (current)

- June 2016

- Outside Director, Mitsui O.S.K. Lines, Ltd. (current)

- March 2019

- Outside Director, member of the Audit and Supervisory Committee Dentsu Inc. (currently Dentsu Group Inc.)(current)

Simon Laffin

Director, member of Audit and Supervisory Committee

Biography

- November 1990

- CFO & Property Director, Safeway plc

- January 2009

- Non-Executive Director, Mitchells & Butlers

- March 2009

- Chairman, Hozelock Group

- August 2009

- Non-Executive Director, Aegis Group plc

- August 2011

- Chairman, Assura plc

- November 2013

- Chairman, Flyve Group plc

- April 2014

- Chairman of the Audit Committee, Dentsu Aegis Network Ltd. (currently Dentsu International Limited) (current)

- March 2016

- Non-Executive Director, Watkin Jones Group (current)

- March 2020

- Outside Director, member of the Audit and Supervisory Committee, Dentsu Group Inc. (current)

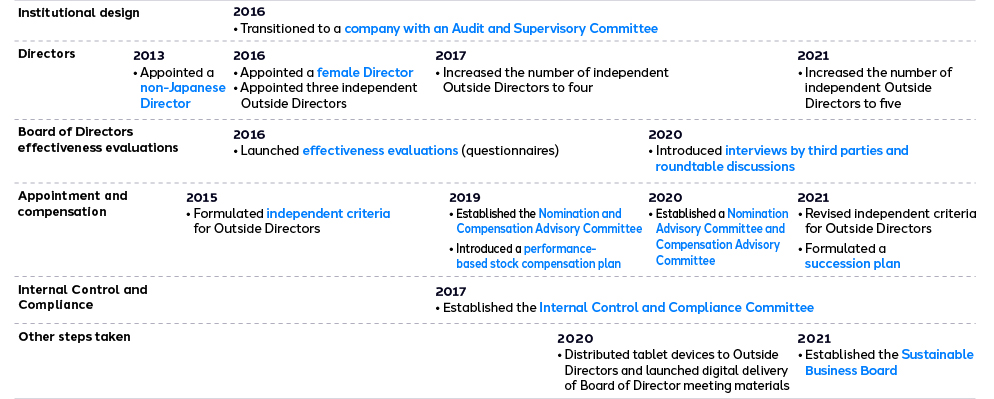

Initiatives aimed at enhancing effectiveness of governance

Evaluation of the Board’s effectiveness

To continuously increase the effectiveness of the Board of Directors, the Company implements an annual survey regarding the effectiveness and appropriateness of corporate supervision by the Board of Directors. Each Director evaluates the effectiveness of the Board of Directors, which, in turn, are analyzed and evaluated by a third-party institution. On receipt of the results from the secretariat of the Board of Directors, the Board of Directors evaluates the overall effectiveness, addresses issues raised and aims to improve the effectiveness.

Change to the method of evaluation on the effectiveness in the fiscal year ended December 31, 2020

The effectiveness of the Board of Directors had been evaluated using a questionnaire method until FY 2019. Due to the changes the Board of Directors underwent during FY 2020 such as the transition to a pure holding company and the promotion of its diversity, and in light of the announcement of the Medium-term Management Plan, the Company adopted an interview method where all Directors are interviewed by a third party in order to identify issues from a more medium- to long-term perspective.

Effectiveness evaluation

The FY2020 survey covered the following six items;

the questionnaire had a total of 32 questions from 6 categories.

- Strategic alignment and engagement (covering management strategy, capital policy, business portfolio review, ESG response, business risk, dialogue with shareholders); 9 questions.

- The Board of Directors structure and system (succession plans, skill set); 3 questions.

- Board of Directors processes and practices (Board management, deliberation themes, training); 8 questions.

- Management supervision (risk management, global governance system, governance systems of listed subsidiaries); 8 questions.

- Board of Directors culture and dynamics; 2 questions.

- The supervisory function (only for Audit and Supervisory Committee members); 2 questions.

FY2019 issues and progress

Improvement was seen in the “management and supervision of Group companies,” an issue identified in the analysis and evaluation in FY2019 as a result of the transition to a pure holding company. The rating of the “provision of necessary information for deliberation on strategy” improved by the use of online portals and other means to enhance information provision.

However, the “CEO successor training plan” and the “provision of necessary information for deliberation on strategy” were identified as ongoing issues, as there was room for further improvement.

Suggestions and actions for improvement

In January 2020, the Company embarked on major changes to its previous governance system, including the transition to a pure holding company and the promotion of diversity on the Board of Directors, and new suggestions have been made as a result of the process. The Company will aim to further enhance the effectiveness of the Board of Directors and strengthen its corporate governance through measures to consider these suggestions.

- Continuous improvement of the long-term vision, management strategy, and governance system supporting them

The long-term vision and management strategy should be reviewed in a timely and appropriate manner as the environment for the Company changes, and various measures to improve corporate value are implemented. Furthermore, the Company believes that it should not hesitate to flexibly review the organizational form and governance structure suitable for supporting the realization of the long-term vision and management strategy. What is important is that all Directors share the latest long-term vision and management strategy, and measures are implemented in a speedy manner under an appropriate governance system. Accordingly, the Company will pursue continuous improvement.

- Enhanced discussions on ESG issues and development of the Board of Directors’ common understanding

Recognizing that ESG issues are an important agenda for improving corporate value, the Board of Directors will deepen discussions on the entire Group’s sustainability strategy and establish a system to supervise subsequent actions.

- Intensified discussions on important topics by the Board of Directors / deeper communications by the Board of Directors

The Company will examine the annual schedule and other matters, set deliberation topics, and fix a schedule for the Board of Directors, with an aim to deepen the Board of Directors’ discussions on important topics. At the same time, measures to facilitate communication among Directors, including Outside Directors, will be implemented.

Training for Directors and Executive Officers

Directors and Executive Officers are provided with training and ongoing opportunities to acquire the knowledge essential for executing their duties in order to properly fulfill their given roles.

Specific examples of training

| Position | At the time of appointment |

After appointment |

|---|---|---|

| Directors and Executive Officers |

|

|

| Outside Directors |

|

|

Enhancing board transparency

Executive compensation

- Compensation policy

In order to clarify the linkage between the Executive compensation and Dentsu Group’s business performance and corporate value, and to promote the sharing of interests with shareholders and other stakeholders, the Company determines the Executive compensation under the following policy. This also aims to raise the awareness of the Executive Officers to contribute to the sustainable growth of the Group and the enhancement of corporate value over the medium to long term.

The compensation system shall:- Have a globally competitive structure and level

- Be based on management results, with an appropriate balance of fixed and variable compensation (monetary: annual bonus; performance-based: stock compensation as medium- to long-term bonus)

- Be at a level reflecting that in the relevant region

- Variable compensation

To further promote shared interests among stakeholders—including shareholders as well as Directors and Executive Officers—the indicators that had been used until FY2020 to determine variable compensation were revised in FY2021 (ending in December 2021).

The standard values for indicators determining variable compensation are from now on to be set each fiscal year, taking into account the macro- and micro-economic environment, as well as the Group’s business environment.

Compensation ratios (FY2021 revisions)

Fixed compensation: annual base salary as Executive Officers compensation (■)

Variable compensation:* annual bonus (■), Performance-based stock compensation (medium- to long-term bonus) (■)

If performance indicators meet standard values indicated for each type of variable compensation:

Fixed compensation: 60% Variable compensation: 40%

If performance indicators fall below the lower limit indicated for each type of variable compensation:

Fixed compensation: 100% Variable compensation: 0%

If performance indicators exceed the upper limit indicated for each type of variable compensation:

Fixed compensation: 40% Variable compensation: 60%

- * Variable compensation ratios indicate percentages with the annual base salary as 100%.

Note:Directors who are foreign citizens, in principle, receive the main part of their compensation from overseas subsidiaries at which they concurrently serve as officers, and are thus not subject to the system shown above.

Variable compensation indicators

●Annual bonus indicators

Until FY2020:Dentsu Group consolidated operating profit, based on the International Financial Reporting Standards (IFRS).

From FY2021:Depending on the duties of the corporate officers to be compensated, either the Group consolidated underlying operating profit or the consolidated underlying operating profit of business in Japan, based on the IFRS.

Reason:This indicator of profit assesses ongoing business performance and has been determined to be a more appropriate indicator for evaluating business performance over one year.

●Performance-based stock compensation (medium- to long-term bonus)

Until FY2020: The simple three-year average of the Group’s consolidated revenue less the cost-of-sales organic growth rate.

From FY2021: A combination of total shareholder return and Group consolidated underlying operating profit.

| Performance Indicator | Benchmark Indicator | Composition 1 |

|---|---|---|

| Total shareholder return (TSR) | Tokyo Stock Price Index (TOPIX) | 30% |

| Average total shareholder return (TSR) among peer group 2 |

20% | |

| Consolidated underlying operating profit of Dentsu Group | Compound annual growth rate (CAGR) | 50% |

- 1. Where the numerical values for indicators are standard values, ratios represent the percentage constituting performance-based stock compensation (medium- to long-term bonus).

- 2. Six companies comprising WPP plc, Omnicom Group Inc., Publicis Groupe S.A., Interpublic Group of Companies Inc, Accenture plc, and Hakuhodo DY Holdings Inc., were selected as peer competitors of Dentsu Group.

Reason:Total shareholder return is employed as an appropriate indicator in line with the perspective of shareholders and all other stakeholders. To evaluate business performance, it was deemed appropriate to adopt the Group consolidated underlying operating profit that measures constant business performance.

Corporate officer compensation

| Fixed compensation |

Variable compensation | ||

|---|---|---|---|

| Monetary compensation | Stock compensation |

||

| Basic annual compensation |

Annual bonus |

Performance- based stock compensation (medium- to long- term bonus). |

|

| Internal Director who is not an Audit and Supervisory Committee member | ✔ 1 | ✔ 2 | ✔ 2 |

| Outside Director who is not an Audit and Supervisory Committee member | ✔ | × | × |

| Internal Director who is an Audit and Supervisory Committee member | ✔ | × | × |

| Outside Director who is an Audit and Supervisory Committee member | ✔ | × | × |

- 1. Executive Officers compensation, being the annual base salary, is limited to those concurrently serving as Executive Officers.

- 2. Limited to internal Directors who are not Audit and Supervisory Committee members and who also serve as Executive Officers.

Strategic shareholding

In order to enhance medium- to long-term corporate value by maintaining and strengthening business relationships with its business partners, the Company, apart from pure investment, sometimes holds shares in listed companies that are the Company’s business partners.

Of such strategic shareholdings, Dentsu Group Inc., in principle, reviews and considers reducing individual stocks through sale, depending on whether the profit and related profits, such as the dividend, are higher than the target capital costs of the Company’s stocks, or whether the stock ownership contributes to the maintenance and enhancement of the business relationship with the investee company and the promotion of collaboration.

Accordingly, each year the Board shall examine the purpose and economic rationale for owning all strategic shareholdings, from a medium- to long-term perspective, and disclose the results in our Corporate Governance Report or other documents.

Risk management

Risk management structure

To the right is a list of major risks associated with the execution of Group strategies, business and other activities that may affect the decisions of investors. Under the corporate governance structure presented in Corporate governance implementation structure, Dentsu Group is engaged in a variety of measures to minimize risks as future uncertainties with the potential to hinder the achievement of management goals as well as to take advantage of these risks as opportunities.

Risk management process

In 2020, the Internal Control and Risk Committee met three times to identify and assess risks that are important for Group management based on the Enterprise Risk Management (ERM) approach. In order to prevent the materialization of identified risks and minimize the impact if they materialize, the Committee selected risk sponsors, delegated the formulation and implementation of risk response plans to them, and regularly monitored the response status.

In addition, an Internal Control and Risk Committee was established at Dentsu Japan Network (hereinafter, “DJN”), and a Risk Committee continued at Dentsu International (hereinafter, “DI”), with both engaging in risk management activities. In 2020, the DJN Internal Control and Risk Committee met six times and the DI Risk Committee met four times.

Starting in 2021, the evaluation of and response plans to the risks for the Group will be discussed at the Group Executive Management Meeting. The Group Risk Meeting is newly established as its subordinate organization.

Major risks with the potential to affect investor decisions and their countermeasures

| Major risk items | Countermeasures |

|---|---|

| (1) Risks associated with cyclical changes in the global economy and social changes accelerated by the impact of COVID-19 | The Group formulated the Medium-term Management Plan: Sustainable Growth through Transformation, which is designed to transform Dentsu Group business in order to promptly respond to changes in the business environment and accurately seize new business opportunities related to the acceleration of digital adoption. |

| (2) Risks associated with the development of new businesses from the medium- to long-term perspectives | One of the core pillars of the Medium-term Management Plan mentioned above is the execution of growth strategies through enhancements in areas that support clients’ business transformation. This is defined as Customer Transformation & Technology (CT&T). The Group has a stated aim of reaching 50% of Revenue Less Cost of Sales from CT&T. The progress of which is regularly monitored and reported. |

| (3) Risks related to securing human resources | With a new vision and values consisting of the tagline “an invitation to the never before.” and “the 8 Ways” action guidelines as our long-term orientation, Dentsu Group companies and employees throughout the world are promoting and accelerating the formation of teams aimed at creating value with external partners. |

| (4) Risk related to the business transformation | DJN and DI are implementing new structural reforms to respond to rapid changes in the business and competitive environments. |

| (5) Risks associated with the competitive environment and structural changes in the existing advertising industry |

|

| (i) Risk of price competition with advertising and media competitors | The Group attempts to differentiate itself from competitors by providing high added value consisting of consumer insights and integrated solutions, while maintaining strong relationships with clients to avoid excessive price competition. |

| (ii) Risk of loss of global clients | Same as above |

| (iii) Risks associated with structural changes in the media environment | Viewing structural changes in the media environment as business opportunities, the Group flexibly allocates and invests Group resources in next-generation media, consistently providing client companies with marketing solutions apposite for the latest consumer behavioral principles. |

| (iv) Expanded competition with companies in other industries | Viewing changes in the industry structure as business opportunities, the Group plans to integrate and enhance expertise cultivated in the advertising marketing with data and technology, combined with analytics to enter new markets and provide clients with integrated growth solutions. |

| (v) In-house trend overseas | The Group is enhancing its consulting function to support clients’ in-housing ambitions. |

| (6) Risks related to the content business | Many content business projects are managed as portfolios to diversify content business risks. |

| (7) Impairment risk of goodwill and intangible assets related to Dentsu International |

The impairment tests for each cash-generating unit were conducted every quarter in 2020. |

| (8) Risks related to information security and cyber security | The Group established a dedicated cyber security department at DJN and DI to ensure safety and responses to new threats. |

| (9) Risks related to laws and regulations, litigation, etc. | |

| (i) Risks related to violations of labor laws and regulations | The Group works on establishing a work environment that ensures the mental and physical wellbeing of all employees to one of its top management priorities. |

| (ii) Risk related to personal and other information | The Group complies with laws and regulations, both in Japan and abroad, including the Act on the Protection of Personal Information and the EU General Data Protection Regulation, and responds promptly to amendments to these laws and regulations. |

| (10) Risks related to unforeseen incidents, disasters, accidents, etc. | The Group regularly reviews crisis management and business continuity plans (BCP) for DJN and DI to address risks related to unforeseen incidents, disasters, accidents, etc. that are expected in each region and market. |

- Note:For details, please see “Business and Other Risks” starting on page 8 of the “Financial Report 2021.”

https://www.group.dentsu.com/en/sustainability/reports/2021/pdf/2021_finance.pdf

For “Basic Policy on Internal Control,” please check our website.

https://www.group.dentsu.com/en/about-us/governance/internal_control.html

Promoting compliance

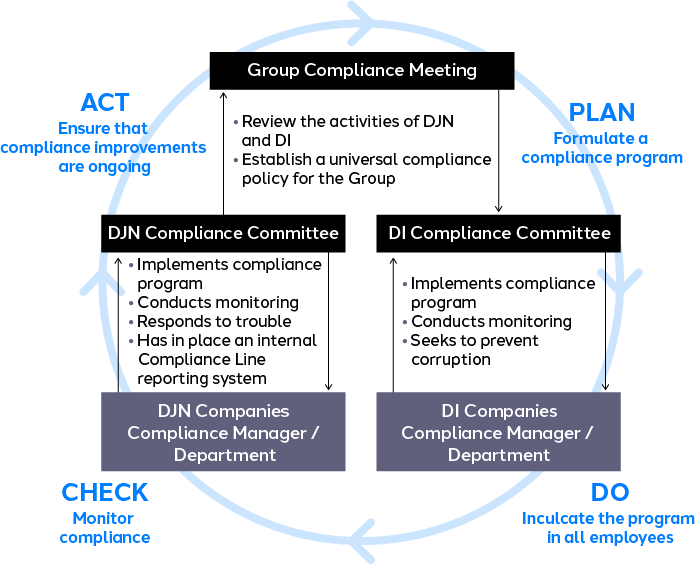

Compliance promotion system

Dentsu Group Inc. formulated the “Dentsu Group Code of Conduct” as a guideline for corporate activities. Compliance is an important pillar of the Group’s Code of Conduct, according to which it formulates rules, produces manuals, conducts training, and carries out other efforts to ensure Directors, Executive Officers and employees are able to carry out their duties appropriately.

The Compliance Committee of Dentsu Japan Network (DJN) was established to promote business in Japan, while the Compliance Committee of Dentsu International (DI) was established to promote overseas business.

In yet a further step, the Company set up the Group Compliance Meeting to supervise the aforementioned committees and make decisions on compliance matters from a global perspective.

Against this background, we are working to maintain and improve compliance through implementation of the plan-do-check-act cycle.

DJN compliance promotion

Compliance programs

Compliance related to the execution of operations involves a variety of measures, including compliance with important laws and regulations related to the advertising business.

Employees receive booklets covering all laws and regulations related to advertising activities, the implementation of information security, human rights, harassment, accounting procedures, and other measures. This is done to make sure of compliance with laws, regulations, and Company rules in all operations, and that reporting and consultation systems are set up should problems arise. Further, employees are given the chance to undertake independent online study.

Monitoring

DJN has put in place a structure for regular reports on the status of compliance at DJN companies. The reports are shared at DJN Compliance Committee meetings.

In terms of internal monitoring, we observe the status of compliance with laws and regulations to appropriately reflect DJN plans for internal monitoring.

Response to trouble

In the event a DJN company officer or employee becomes aware of compliance issues or has any concerns, regulations stipulate that the matter/s must be quickly and accurately reported to a supervisor.

The supervisor immediately reports this to their compliance manager, who contacts the DJN Compliance Committee Secretariat.

Having received a detailed report on the matter from the Secretariat, the DJN Compliance Committee provides guidance regarding investigation of the matter, while not obstructing any DJN company from conducting voluntary inquiries.

Once compliance issues are identified, the relevant DJN company promptly takes corrective action.

“Compliance Line” internal reporting system

DJN set up the Compliance Line reporting system to rapidly identify and resolve compliance violations, as well as to promote compliance by management and sound corporate development.

The Compliance Line operates according to Compliance Line Operational Guidelines and is available for use by all employees.

DI compliance promotion

Compliance programs

Dentsu International (DI) provides detailed and summarized versions of compliance regulations, as well as translations in several languages. It thereby makes sure all officers and employees are familiar with the rules and are able to comply with the requirements.

In addition, management strives to enhance employee awareness by regularly disseminating compliance-related messages to employees, and systematically providing training. Employees are encouraged to gain a deeper understanding and awareness of compliance-related matters.

Monitoring

Through measures including ascertaining attendance at training sessions and collecting answers to compliance questions from Executive each year, DI regularly monitors the penetration of compliance programs, in a bid to realize continuous improvement.

Preventing corruption

DI has in place measures to hinder corruption by providing relevant regulations and training programs.

The Company has a system in place that requires prior reporting and approval before a gift exceeding a specified amount may be accepted. By aggregating report content and approval details in a dedicated department, the system serves to monitor and contain issues.

“Speak Up!” internal reporting system

DI set up the “Speak Up!” internal reporting program that can be used by all DI company officers and employees. In addition to an in-house point of contact, employees may report violations to an independent outside specialist.

The system requires that an employee’s workplace and name be held in strict confidence, with the system designed to function effectively through the imposition of internal regulations ensuring no one is treated unfavorably after using this system.

Dentsu Group Code of Conduct (excerpt)

At Dentsu Group we believe we must be a force for good. When we do the right thing as individuals, it becomes who we are as a company. It’s what makes being a force for good possible, and it starts with each and every one of us. That’s why we expect everyone who works for, or on behalf of, Dentsu Group to understand and live by our Code of Conduct.

The Code of Conduct applies to everyone within the Group. It defines the way we act as part of the Group community and the core principles we are all committed to upholding. It sets out what we can expect of each other, and how we are expected to behave toward our stakeholders including clients and other business partners, shareholders, and our communities.

Please visit our website to read the full text.

https://www.group.dentsu.com/en/about-us/governance/codeofconduct.html

Manuals tap into creativity

Many compliance-related manuals are complicated and difficult to understand. For employees to gain a good grasp of compliance-related activities, the Group has drawn on creative staff to produce engaging manuals.

For details, please see the Corporate Governance Report.