Looking Back on Fiscal 2014

Firstly, I would like to take this opportunity to express, on behalf of the Dentsu Group, my sincere appreciation to you for your invaluable support and understanding of our efforts.

The Japanese economy during the fiscal year ended March 31, 2015 (hereinafter “fiscal 2014” or “the fiscal year under review”) was on a moderate recovery trend, supported by improved corporate earnings, a recovery in employment conditions, and higher wages, against a backdrop of aggressive economic and monetary policies by the government and the Bank of Japan. In this environment, the calendar year-based Advertising Expenditures in Japan for 2014, as compiled by Dentsu, revealed continuing moderate growth as spending increased for the third straight year, up 2.9% over 2013, to 6,152.2 billion yen, surpassing the 6 trillion yen mark on a full-year basis for the first time in six years.

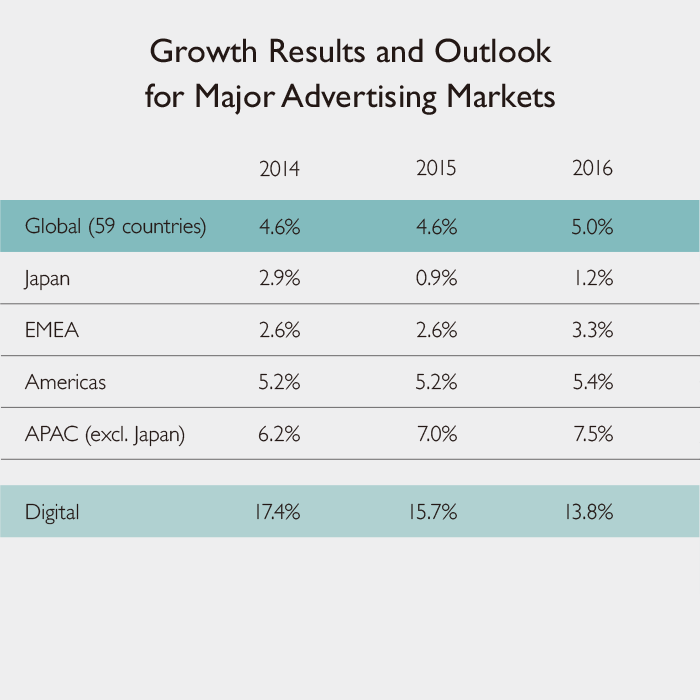

Conditions in the global economy, however, remained mixed, reflecting a moderation in the growth rate in emerging economies and geopolitical instability, despite a strong performance in the U.S. economy and other key territories. Against this backdrop, the growth rate for worldwide advertising expenditures, as compiled by the Dentsu Group’s media communications agency Carat in March 2015 for the 2014 calendar year, showed an increase of 4.6% over the previous year. By region, Europe, the Middle East and Africa (EMEA) grew 2.6%; the Americas, 5.2%; and Asia Pacific, excluding Japan (APAC), 6.2%.

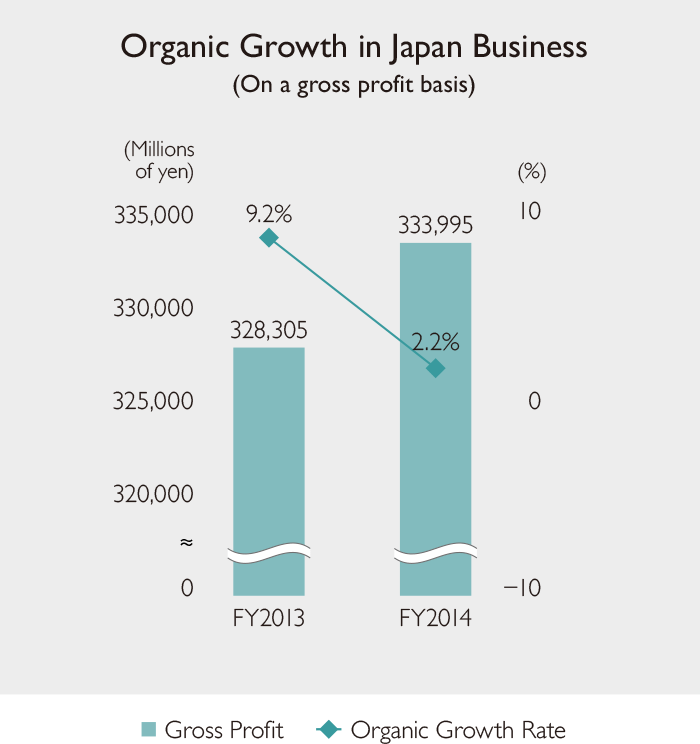

With this background in mind, the Dentsu Group recorded an increase in gross profit of 1.7% over the previous fiscal year for its business operations in Japan, reflecting the contribution of sponsorship sales associated with the 2014 FIFA World Cup BrazilTM and the Tokyo 2020 Olympic and Paralympic Games, in spite of the negative impact of the consumption tax increase in April.

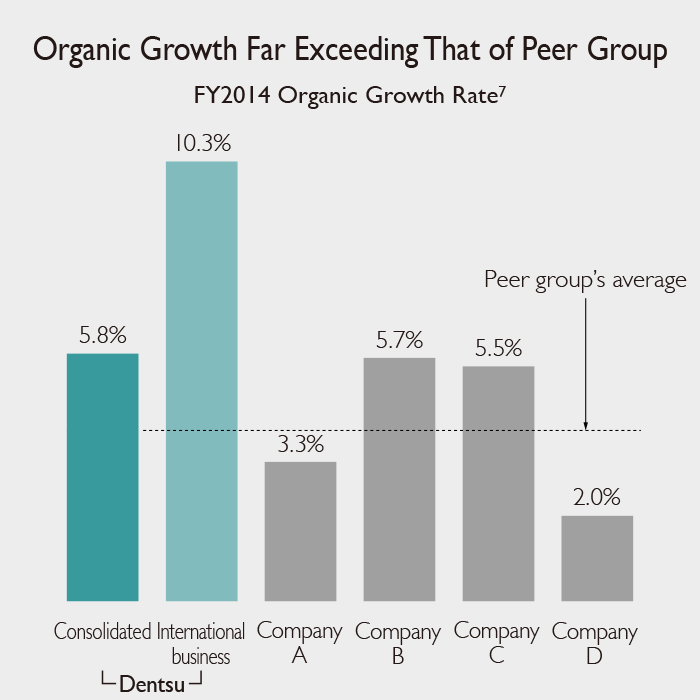

Internationally, the Dentsu Group recorded double-digit organic growth with an increase of 10.3% over the previous fiscal year, partly owing to the contribution of new client accounts. By region as well, each area was up significantly compared with the previous fiscal year, with an increase of 9.7% in EMEA, 7.9% in the Americas, and 14.4% in APAC.

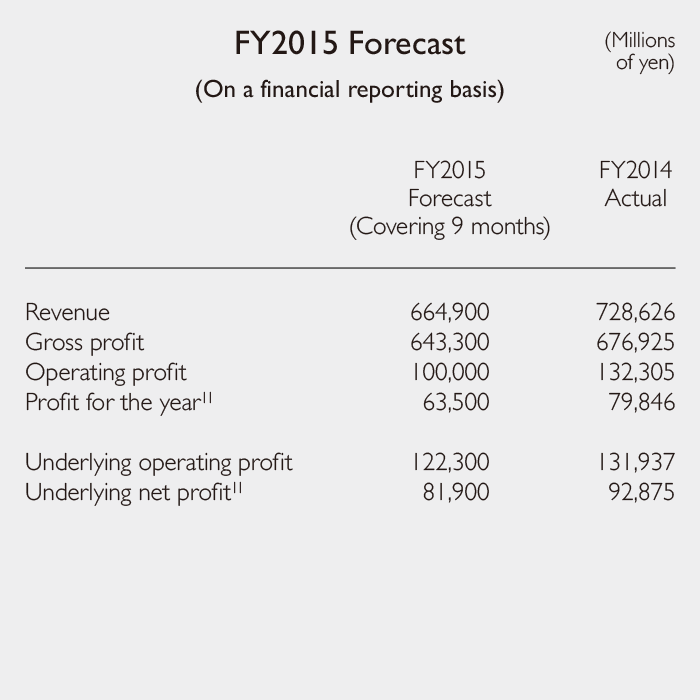

Consolidated revenue for fiscal 2014 increased 10.4% year on year, to 728,626 million yen; gross profit rose 10.1%, to 676,925 million yen; underlying operating profit1 was up 5.1%, to 131,937 million yen; operating profit climbed 23.3%, to 132,305 million yen; and profit for the year attributable to owners of the parent jumped 20.1%, to 79,846 million yen.

Furthermore, from the fiscal year under review, the Group has adopted International Financial Reporting Standards (IFRS).

- 1

- KPI to measure recurring business performance which is calculated as operating profit added with amortization of M&A-related intangible assets, impairment loss, gain/loss on sales of non-current assets, acquisition costs and other one-off items

Progress on Medium-term Management Plan “Dentsu 2017 and Beyond”

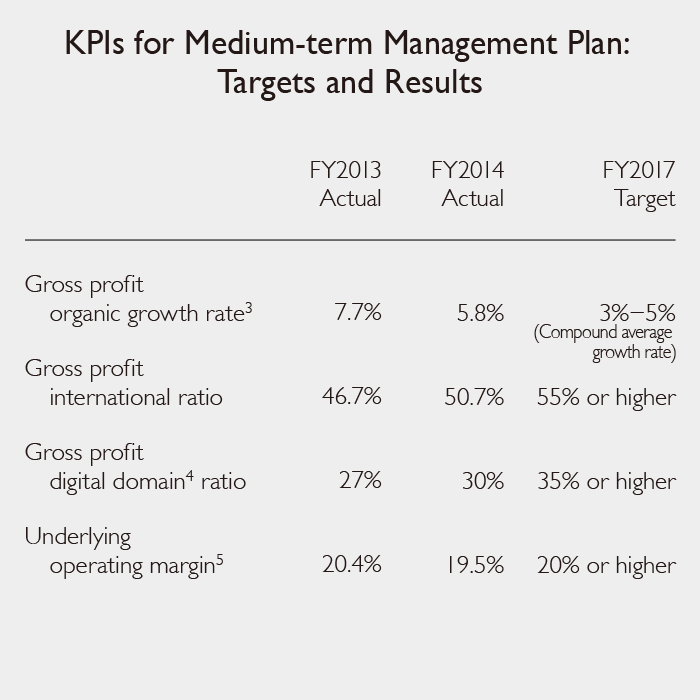

As the Group entered a new stage with the acquisition of Aegis Group plc (hereinafter “Aegis”), we formulated the medium-term management plan “Dentsu 2017 and Beyond” in fiscal 2013. The aim of “Dentsu 2017 and Beyond” is to evolve into a truly global network at the forefront of marketing convergence,2 and, as indicated by the results of the four key performance indicators, we have made steady progress thus far and are definitely realizing the deliverables from these strategies.

- Note:

- FY2013 and FY2014 commenced on April 1 and ended on March 31 of the following year.

Dentsu Inc. and its subsidiaries with closing dates other than December 31 will change their closing dates to December 31 from FY2015.

- 2

- New marketing paradigm reflecting the spread of digital media and social media in recent years as well as changing consumer behavior patterns and progress in all kinds of technologies

- 3

- Organic growth rate represents the constant currency year-on-year growth after adjusting for the effect of business acquired or disposed of since the beginning of the previous year.

- 4

- Digital domain includes Internet-related marketing services and entrusted development and sales of information technology systems.

- 5

- Underlying operating margin: Underlying operating profit ÷ Gross profit x 100

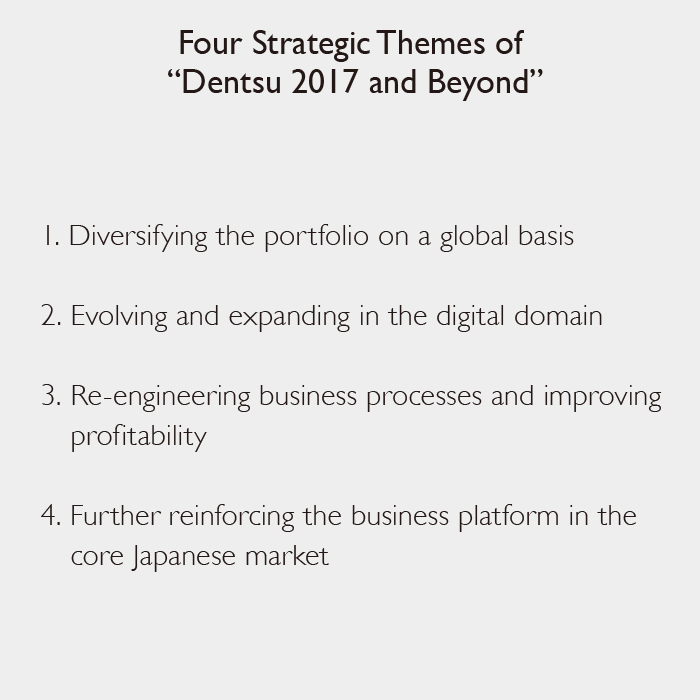

The “Dentsu 2017 and Beyond” medium-term management plan sets out the following four strategic themes. I would like to update you on our progress in fiscal 2014 within the context of these strategic themes.

1. Diversifying the portfolio on a global basis

- Expansion of the gross profit international ratio

-

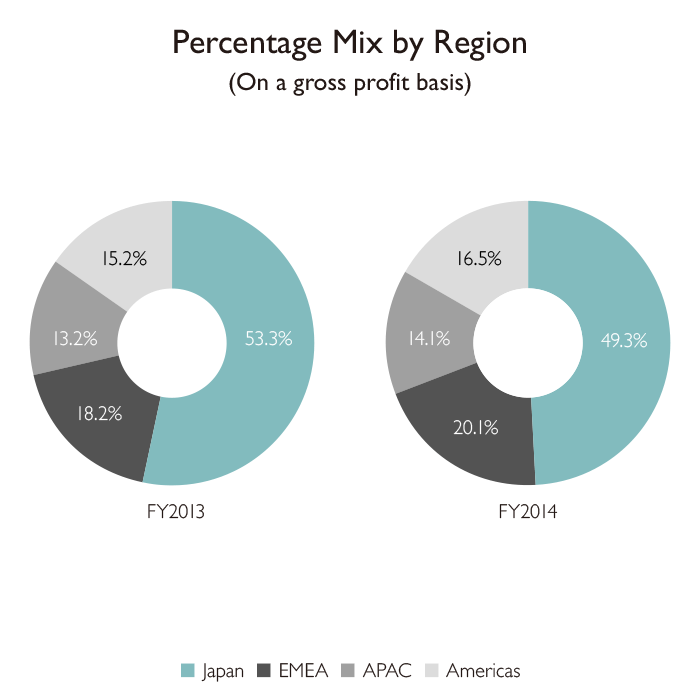

We have been making steady progress on diversifying the portfolio on a global basis, which is an issue of paramount importance. The gross profit international ratio for fiscal 2014 increased 4.0 percentage points (ppt) year on year, to 50.7%, exceeding the ratio in Japan for the first time. We are aiming to achieve 55% or higher in fiscal 2017. The percentage mix for the three regions making up the international business is EMEA, 20.1% (a 1.9 ppt increase year on year); the Americas, 16.5% (a 1.3 ppt increase); and APAC, 14.1% (a 0.9 ppt increase).

-

- Expansion of the international business through our unique operating model

-

The gross profit organic growth rate in our international business was 10.3%, continuing from the previous fiscal year to greatly exceed that of our peer group. A major factor underlying this result is our unique operating model,6 which enables Group companies to collaborate seamlessly toward shared business goals, and to provide integrated and specialist client services. This model is based around cross-selling and up-selling, contributing to an increase in business with existing clients and enabling us to strategically capture new accounts. As a result, we acquired many new client accounts in fiscal 2014. Newly acquired businesses include numerous projects that we were able to win through cooperation between Japan and our international network. With the integration of Aegis, we aimed at the further acceleration of winning Japanese clients’ businesses outside of Japan, and we are beginning to see steady results from that. In addition, by taking advantage of our strength in the Japanese market, we are succeeding in acquiring global accounts, and are beginning to fully leverage the Group’s unique strengths while maintaining our peer group-leading position.

- 6

- For more details, please see Dentsu: A Quick Read.

-

- 7

- Organic growth rates of the Dentsu Group, Dentsu Aegis Network and WPP are based on gross profit.

Other competitors’ organic growth rates are based on revenue.

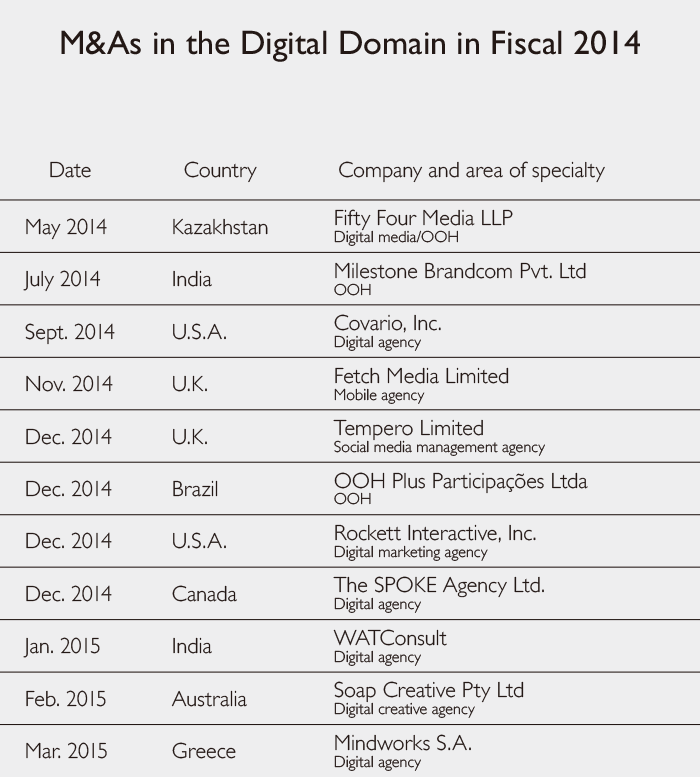

2. Evolving and expanding in the digital domain

As marketing convergence advances, clients’ needs in the digital domain are increasing.

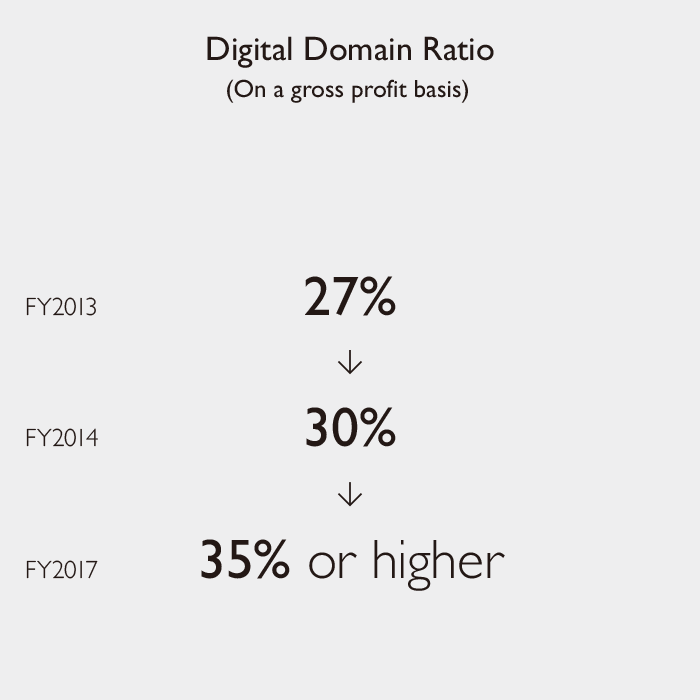

Gross profit in the digital domain in Japan in fiscal 2014 continued to achieve double-digit growth, increasing 12.2% year on year. Now with growing use of smartphones and performance-based advertising, we achieved strong results, not only by Dentsu on a non-consolidated basis, but also by key digital companies such as cci, NEXTAGE Dentsu and DA search & link.

In our international business, we carried out various acquisitions in the digital domain, with a total of 11 in fiscal 2014, and we will continue to enhance our capabilities through acquisitions. Furthermore, the driver of growth in the digital domain is programmatic buying. Amnet, the programmatic trading desk for the Group’s international business, doubled its sales in fiscal 2014. As a result of such acquisitions and organic growth, the digital domain ratio8 of our international business increased 3 ppt from the previous year, to 43%.

- 8

- Based on gross profit

As a result, the digital domain ratio for the entire Dentsu Group was 30%, up 3 ppt year on year. We will further increase this toward the fiscal 2017 target of 35% or higher.

As we continued these efforts, the digital network capability of the Dentsu Group received recognition in the form of numerous international advertising awards and awards from industry magazines in fiscal 2014. We take these awards as proof that the Dentsu Group’s digital capabilities are recognized worldwide, while at the same time we are committed to improving our capabilities and the quality of services by enhancing existing networks through an aggressive, but targeted, acquisition strategy.

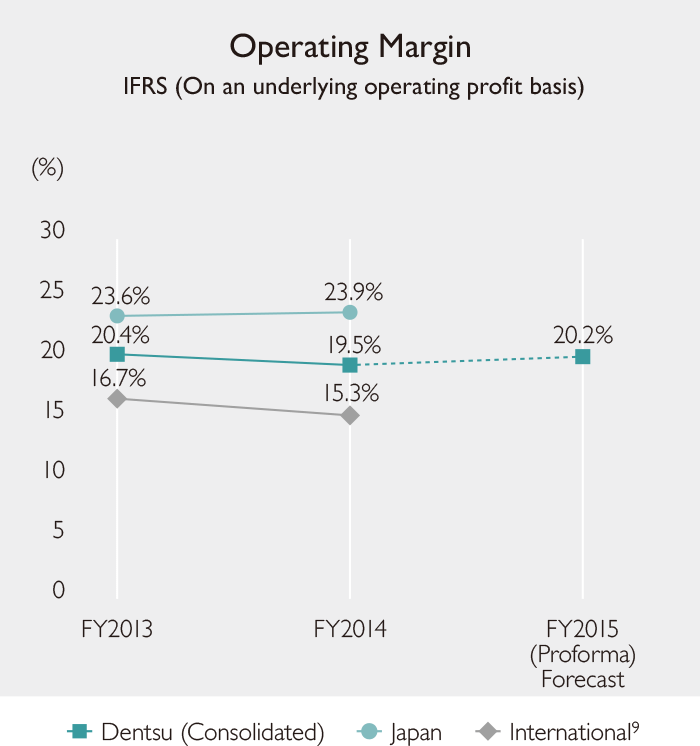

3. Re-engineering business processes and improving profitability

In our Japan business, the operating margin improved 0.2 ppt year on year, to 23.9%. This was the result of consistent cost control. Profitability is increasing in our Japan business, thanks to an improved gross profit margin in the marketing and promotion domains including digital solutions.

In our international business, we have enhanced the IT and finance infrastructure and have made upfront investment in shared and outsourced services.

As a result of these planned investments, the operating margin for the entire Dentsu Group was 19.5%, down 0.9% from the previous fiscal year.

We will continue to pursue top line growth both in Japan and internationally, while making ongoing efforts to improve operational efficiency and cost control with the goal of not only achieving but maintaining an operating margin of 20% or higher, in order to raise the profitability of the entire Group.

- 9

- From FY2013, international includes Aegis.

4. Further reinforcing the business platform in the core Japanese market

In fiscal 2014, despite concerns over the pullback in consumer spending in the wake of the consumption tax increase in April 2014, the Japan business absorbed the drop-off in spending and achieved positive growth, posting record-high gross profit notwithstanding the high benchmark established in the previous fiscal year. Meanwhile, consumer spending has started to show signs of gradual recovery in the context of strong corporate performance, rising wages and improvement in employment. Under these circumstances, orders from new clients as well as business opportunities related to new products and services from existing clients are increasing. We aim to further increase our market share through aggressive pursuit of business opportunities.

On the other hand, advancing IT technology and changing consumer behavior are further accelerating marketing convergence. With a view to further expanding the business in new domains such as customer relationship management (CRM), business intelligence and e-commerce, we have been integrating digital capabilities spread throughout the Group by facilitating and strengthening exchange and collaboration between our international digital brands such as Isobar and iProspect and our Japan business segments. In order to evolve into a partner that can support client success from multiple angles, we will hone our integrated problem-solving and revenue-generating capabilities, including in new domains.

Last year, we were selected by the Tokyo Organising Committee of the Olympic and Paralympic Games (Tokyo 2020) to be its exclusive marketing agency. The Organising Committee has set a target of 150.0 billion yen as income from Japanese marketing programs. Sponsorship sales have made steady progress, and these will be some exciting opportunities for the Group to help our clients promote or activate their sponsorship programs.

Market Outlook and Performance Forecast for Fiscal 2015

Regarding the outlook for growth in the global advertising market, based on estimates by Carat, global growth as a whole is likely to remain steady in 2015 and thereafter, despite geopolitical risks in some regions. Meanwhile, the domain of digital advertising is likely to continue its strong growth, and is expected to increase even further in importance in the future.

We will continue to enforce our business platform with a view to achieving sustainable growth in line with the four strategic themes set out under the medium-term management plan. In particular, we consider growth measures focused on capability enhancement in the rapidly growing digital domain to be of primary importance. We will continue our efforts to achieve organic growth that outperforms market growth in each region around the world. Also, we will continue to aggressively promote our growth strategies through acquisitions.

Meanwhile, in our Japan business, the core market of the Dentsu Group, we will fulfill our responsibilities as marketing agency for the Tokyo 2020 Olympic and Paralympic Games, while aggressively taking advantage of the new business opportunities available to us in that capacity and linking these to revenue. We consider the year 2020 to be the perfect opportunity to make Groupwide efforts to drive the future growth and innovation of Japan as a whole.

- Source:

- Carat, Global Advertising Expenditure Forecasts—March 2015 (Figures are on a calendar year basis.)

The consolidated performance outlook for fiscal 2015 calls for revenue of 664.9 billion yen, gross profit of 643.3 billion yen, underlying operating profit of 122.3 billion yen, operating profit of 100.0 billion yen, and profit for the year attributable to owners of the parent of 63.5 billion yen. Dentsu Inc. and its subsidiaries with closing dates other than December 31 will change their closing dates to December 31 from fiscal 2015. Therefore, fiscal 2015 will correspond to the fiscal period for the nine months from April 1 to December 31, 2015, based on an adjusted year-end.10

- 10

- For Dentsu Inc. and its subsidiaries with closing dates other than December 31, the fiscal year ending December 31, 2015 will correspond to the fiscal period for the nine months from April 1, 2015 to December 31, 2015, and for its subsidiaries with closing dates of December 31, the fiscal year ending December 31, 2015 will correspond to the fiscal period for the twelve months from January 1, 2015 to December 31, 2015, as before.

- Note:

- FY2015 forecast uses the average exchange rate for the period January–February 2015; FY2014 actual uses the average exchange rate for the period January–December 2014. For the performance forecast on a calendar year proforma basis, please see the CFO Message.

- 11

- Profit for the year and Underlying net profit: Attributable to owners of the parent

On behalf of the Dentsu Group, I am very grateful for the continued support and guidance of our shareholders, and invite you to look forward to the ongoing development of the Group.

August 2015

- Tadashi Ishii

Representative Director

President & CEO

![]()