“Diversifying the portfolio on a global basis” is set forth as one of the strategic themes of the medium-term management plan “Dentsu 2017 and Beyond.”

Five members of Dentsu Aegis Network’s Global Executive management team discuss the progress on this theme and the competitive advantages of the Dentsu Group.

Jerry Buhlmann

CEO, Dentsu Aegis Network, Executive Officer, Dentsu Inc.

Nigel Morris

CEO, Dentsu Aegis Network Americas & EMEA

Nick Waters

CEO, Dentsu Aegis Network Asia Pacific

Nick Priday

CFO, Dentsu Aegis Network

Valerie Scoular

Group HR Director, Dentsu Aegis Network

-

Jerry Buhlmann

CEO, Dentsu Aegis Network

Executive Officer, Dentsu Inc. -

Nigel Morris

CEO, Dentsu Aegis Network Americas " EMEA -

Nick Waters

CEO, Dentsu Aegis Network Asia Pacific -

Nick Priday

CFO, Dentsu Aegis Network -

Valerie Scoular

Group HR Director, Dentsu Aegis Network

“Our strategy for global growth in a complex, disruptive and fast-paced environment”

- Jerry Buhlmann

CEO, Dentsu Aegis Network

Executive Officer, Dentsu Inc.

- What is your view of the outlook for the global economy?

- We are seeing increasing economic optimism, offset by geopolitical pessimism. By economic optimism, I am referring to the currently benign set of circumstances which will help drive growth—in particular, monetary policy will be accommodating, quantitative easing will support European economies and inflation will remain low. These factors, as well as continued economic strength in the United States and China, will keep global growth on track. However, this will be counter-balanced by geopolitical pessimism, with tensions remaining in certain regions, like the Middle East and Eastern Europe.

- You have talked in the past about the dual forces of globalization and convergence driving your industry. Are these still important and relevant trends?

- Yes, they are still extremely important and very relevant to our industry and to the wider macro environment. However, they are evolving and developing. We are seeing a pullback from globalization, with hard globalization, based on geopolitics, declining. Trust between governments is falling, protectionism is increasing and regional trade is outpacing global trade, forcing industry to fragment. Soft globalization, based on consumer culture, is growing significantly through consumers’ adoption of cross-border media and knowledge sharing, which is fully connected to convergence, which is accelerating rapidly to critical mass.

- What impact will this step change in convergence have in the future?

- As technology, bandwidth and powerful devices drive consumer adoption, the “digital economy” will become increasingly fast-paced. In fact, the pace of change we will see in the next five years will be faster and more impactful than the changes of the last 15 years. As connectivity and computing power increase exponentially, we will see the transformation of business models and large-scale operational efficiencies. The Internet will become much more powerful as we approach the era of the “Internet of everything” where everything and everybody is connected.

- What is the global impact of this step change in convergence today?

- We are seeing the emergence of a new era of companies, which are providing cost-efficient services by connecting available capacity and expertise. Furthermore, these businesses are already expanding their expertise. These brands and others have established themselves globally in a very short timeframe and are following global online powerhouses in driving their brands into new areas. They are creating the “peer economy,” by-passing established competitors in their field. I can therefore envisage the next generation of business being 100% within the digital economy, causing significant disruption to established business. So, convergence is creating this momentum for change and businesses will face the choice of being disrupted or creating disruption themselves.

- What are the key drivers of this rapid step up in convergence?

- The biggest driver of convergence is the smartphone. People spend on average two hours a day on smartphones and value them more than any other device or medium. There are two billion smartphones in use today and there will be five billion in use by 2020. In China alone in 2015, 500 million smartphones will be sold. Computing power through smartphones is growing exponentially, and everything and everyone will be connected by very powerful smartphones. The “Internet of things” will rely on smartphones as a relay, and apps will become complex mini-economies of their own with direct links to relevant businesses.

- In the context of these global trends, what is the outlook for global advertising expenditure in 2015?

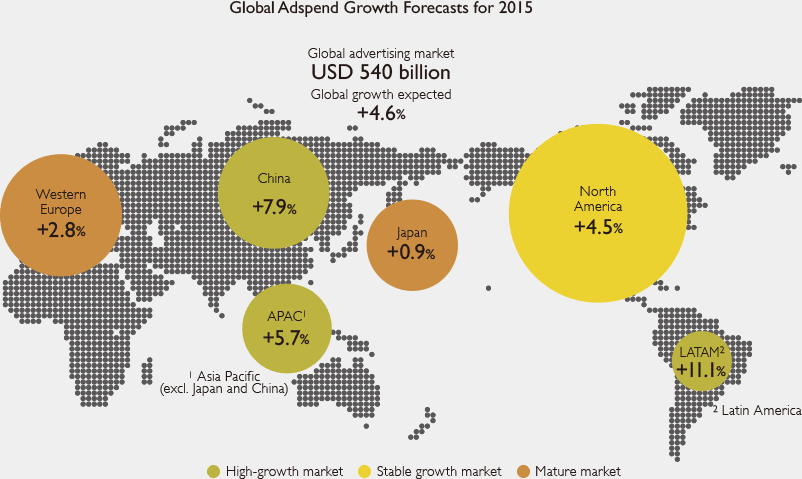

- For 2015, Carat advertising spend forecasts indicate global growth of 4.6%, reflecting continued economic optimism. Digital media channels will grow by more than three times that figure at 15.7% and take a greater share of advertising revenue than newspapers and magazines at 23% of all advertising spend. In individual markets where e-commerce is thriving, like the United Kingdom, which is leading the world in online advertising, the digital share of adspend will be 48.2% in 2015. Convergence and connectivity drive e-commerce, which powers the digital economy. Social, mobile and video will continue to grow at over 50%, and the demand for richer and more powerful consumer engagement will drive demand for multi-format and multi-time-length content.

- Source:

- Carat, March 2015

- Note:

- The size of the circle represents the ad market size of each region.

- How do you see the role of agencies in this complex and fast-moving environment?

- Increasingly, clients are looking to benefit from agencies’ ability to provide consistent best practice and instant access to information on consumer behavior and other key trends, on a global scale. In addition, a greater degree of specialization is required from agencies which can develop, manage and run focused marketing strategies for clients, supported by achievable ideas and rigorous execution. And finally, clients need independent advice from agencies which have a specialist and integrated approach, supported by highly sophisticated insight and marketing intelligence. The Dentsu Group is well positioned, with the right strategy, structure and geographic coverage, to be able to deliver this for our clients.

- What is the Dentsu Group’s global strategy?

-

Our global strategy has been designed to put our business at the heart of the digital economy, for our clients’ benefit.

We aim to:- Increase our exposure to faster growing regions and segments, to exploit growth opportunities quickly

- Build capability in the digital economy, by focusing on engaging across the entire digital economy: e- commerce, content, performance, insight and social with a significant focus on data and mobile

- Broaden our service offer across clients, by introducing our best and most innovative services

- Grow our international client and new business profile, by supporting our international clients as they build their positions in existing markets and enter new markets in the future

- Build leading positions in the top 20 markets, prioritizing the United States and China as the world’s two largest advertising markets, through consistent execution of the operating model

- Build a market-leading scalable organization that is clearly differentiated, by evolving our operating model, supporting it with a strong global platform for data and information to drive consistency and coherence.

These strategic objectives will be achieved by a continued focus on targeted acquisitions.

- You mention the Dentsu Group’s operating model. Why is it so unique?

-

Our operating model maintains the integrity of the agency and network brands while providing a framework for working together to drive collaboration. The operating model works through a “One P&L” per market structure which empowers our local teams to offer specialist and integrated services to clients at a local level, but supported by a regional and a global infrastructure. This infrastructure includes a strong portfolio of global agency “brands” and global functions, which act to support and drive our business. Overlaying all of this is a culture of collaboration and delivery, supported by consistent vision and values across the Group. Therefore, as an organization, with global scale and multiple capability streams, based around connecting our clients with consumers, we are extremely well positioned to help guide our clients in today’s complex, disruptive and fast-paced environment.

Jerry Buhlmann

CEO, Dentsu Aegis Network

Executive Officer, Dentsu Inc.

- 1989

- Founded BBJ

- 1999

- Appointed MD of Carat International, following acquisition of BBJ by Aegis Group plc

- 2003

- Appointed CEO of Aegis Media EMEA

- 2008

- Appointed CEO of Aegis Media

- 2010

- Appointed CEO of Aegis Group plc

- 2013

- Appointed CEO of Dentsu Aegis Network and Executive Officer of Dentsu Inc., following acquisition of Aegis Group plc by Dentsu Inc.

Mr. Buhlmann has over 25 years’ experience in media and advertising and worked at Young and Rubicam and WCRS in the early years of his career.

“The emergence of the digital economy will transform our business and is an immediate and significant opportunity for us in the U.S. and across the Americas”

- Nigel Morris

CEO, Dentsu Aegis Network Americas & EMEA

- The rise of the digital economy and its impact on marketing

-

Digital has become the dominant force in the global economy. It is having a fundamental impact on the way companies are organized, with potentially significant implications for the value that marketing can bring to business and to the economy as a whole. In turn this is shaping the new dynamics of the advertising and marketing communications sector.

In an interconnected, interdependent, transparent and networked global economy, people are gaining as much knowledge and power as businesses, with the conditions of near-perfect competition starting to emerge in many markets. While this is disrupting many established sectors and businesses, it is a real opportunity for the economy, the environment and society to be more efficient and sustainable. A new model for a new economy.

As traditional barriers to entry are swept away, legacy infrastructure, systems, processes and sometimes people are becoming barriers to change. But those companies that are embracing innovation have real opportunities. Central to innovation are data strategies formed around people with marketing channels being the primary source of insight into consumer behavior and intention. As the point of engagement and transaction converge through media, driving the growth of e-commerce with the ability to harness that insight into marketing action is critical to competing in the digital economy.

Marketing communications is therefore becoming a major, direct source of revenue for innovative businesses. It enables them to track their customers’ behaviors and habits, often in real time. In this context, with the ability to help brands understand market demand and its drivers, the role of marketing will change, as it becomes both a sensor and a channel to market for successful businesses in the digital economy.

- Impact of digital economy emerging at different rates in the Americas

-

The changes brought about by the emergence of the digital economy are starting to become prevalent, at varying speeds, across the Americas region. Overall, the Americas, powered by the major economies of the United States, Canada, Brazil, Argentina and Mexico, represents a major growth opportunity for the advertising industry. There are around one billion people, living in 60 countries across the region, generating GDP of around $35 trillion. The Americas region is expected to generate around $229 billion in advertising expenditure in 2015, according to Carat’s latest forecasts, which equates to over 40% of global advertising expenditure. Across the region, a major trend in the industry has been the convergence of e-commerce, content, creativity and media. This has been driven by a new set of requirements for advertising in the digital economy.

In Latin America, adspend is expected to grow at a relatively strong 11.1% in 2015, with Brazil a key potential swing factor, given it contributes over half of the region’s advertising revenue. The TV market in Latin America remains sizable and strong, representing over 60% of adspend across all media in the region. Broadband penetration remains relatively low in Latin America with just 12% of the population in the region subscribing to broadband connections, and less than one-third of households having fixed connections to the Internet, compared to around 70% in Europe and North America. However, mobile penetration is high, with over 70% of the region’s population having at least one mobile device. So, the smartphone will be the major driver of the digital economy in Latin America.

- The U.S. has consolidated its position in the world’s largest advertising market

-

The digital economy is in a more developed state in North America and, in particular, in the United States, where one in three adults now owns either a smart television or a device which streams video to their television. In that market, although TV is expected to continue to command the highest share of advertising spend in 2015 at 38%, digital media spend is forecast to increase by 16% in 2015. This includes growth of 20% in Online Video, 25% in Social Media and 50% in Mobile, which is expected to contribute nearly 30% of U.S. search spend. With the digital economy driving advertising budgets from more traditional media to these fast-growing digital channels, North American adspend is expected to continue to grow at a stable 4.5% in 2015.

Overall, the U.S. economy continues to show its strength, resilience and innovation, with advertising spend there now exceeding its 2007 pre-recession peak. This cements the position of the U.S. as the world’s largest advertising market.

- Dentsu Aegis Network has established a powerful and differentiated position in the U.S.

-

Our U.S. business is Dentsu Aegis Network’s largest by revenue, and the Dentsu Group’s second largest, behind Japan. Dentsu Aegis Network has had transformational success over the last five years in the U.S., and is perfectly positioned and designed to help clients navigate the emergence of the digital economy. In that time, we have built up significant momentum in the market as an organization and across all our agencies. We have a compelling proposition in the U.S., with a strong portfolio of media, creative, content, brand commerce and digital agency brands.

At the start of 2015, to ensure that we maximize the potential of our position over the coming years, we appointed Rob Horler as CEO of Dentsu Aegis Network, USA. Rob was previously CEO of Dentsu Aegis Network Northern Europe and, prior to that, has held a number of senior positions within the Group over many years. Rob has a track record of leveraging our Operating Model to deliver growth for our business and has deep experience and expertise in the digital economy. We are confident that our business in the U.S. will continue to be a transformational force and develop at pace, ensuring we stay ahead of the market and our competitors.

- Strong foundation in the Americas from which to build our business for the digital economy

-

That momentum is being carried through to the rest of the region. We now have a high-quality leadership team in place across the Americas, which is driving our business to be at the center of the digital economy. As well as Rob in the U.S., Claudia Colaferro is Dentsu Aegis Network CEO for Latin America, Annette Warring is Dentsu Aegis Network CEO in Canada, and Abel Reis is Dentsu Aegis Network CEO in Brazil. The team combines a strong mix of industry expertise, people management and digital leadership.

The future of our business across the region will continue to be supported by our strong agency brand portfolio, within an operating model that continues to differentiate us from our competition. The market is changing fast; the Americas is at the center of the change and Dentsu Aegis Network is positioned to lead.

Nigel Morris

CEO, Dentsu Aegis Network Americas & EMEA

- 1992

- Joined Aegis Media

- 2003

- Founded Isobar as CEO

- 2009

- Appointed CEO of Aegis Media North America

- 2011

- Appointed CEO of Aegis Media Americas

- 2012

- Appointed CEO of Aegis Media EMEA (as well as Americas)

- 2013

- Appointed CEO of Dentsu Aegis Network Americas & EMEA

Joining Aegis Media in 1992, Mr. Morris has held CEO positions across Aegis’s global expanse, now brought to bear on sustainability and products and strategies of the future.

“Leveraging our position across Asia Pacific and, in particular, in China”

- Nick Waters

CEO, Dentsu Aegis Network Asia Pacific

- Asia Pacific remains a key driver of global advertising spend

-

Asia Pacific will continue to be a major hub for global economic growth in the coming years. Across the region’s 51 countries, there are around 4.4 billion people, equating to over 60% of the world’s population. The region’s GDP stands at nearly $40 trillion, around 35% of global GDP, and this is expected to grow by around 6% in 2015, making it the fastest-growing region in the world.

Asia Pacific is expected to generate around $187 billion in advertising expenditure in 2015, according to Carat’s latest adspend forecasts, which equates to around 35% of global advertising expenditure. Across Asia Pacific adspend is expected to grow by 5.2% in 2015, supported by continued high growth in China and a bounce in India, where the BJP was elected with a strong mandate on a pro-business platform fueling positive sentiment among the business community. We also expect to see strong growth in the ASEAN region, where the launch of the ASEAN Economic Community scheduled this year will provide a boost for trade and investment with a particularly positive outlook for the advertising markets of Indonesia, the Philippines and Vietnam.

Although TV still dominates in the region, digital media is becoming increasingly prevalent, with Asia Pacific contributing around 40% of the world’s Internet population. With 50% of the world’s smartphone users now based in Asia Pacific, mobile is ubiquitous and has been a major catalyst for Internet penetration, with audiences in the region spending twice as much time on their mobile as they do watching TV. It is not surprising therefore that the adoption of social media and the growth of online video in every major market has been meteoric. These markets are leading the world in the transition of consumers and businesses to Internet-related platforms and technologies, and this uptake will drive a boom in mobile commerce in the region this year.

A fully convergent and digital advertising landscape is therefore rapidly becoming a reality in Asia Pacific, with a predicted 20.1% growth in digital advertising spend this year in Asia Pacific—the highest of any region globally.

- Dentsu Aegis Network well placed to support our clients in an increasingly convergent environment in Asia Pacific

-

The convergence of Social, Mobile and Commerce has precipitated the emergence of new business models in the digital space, which are disrupting traditional businesses. So, advertisers need to remain relevant to their customers, on a real-time 24/7 basis, and, at the same time, ensure they evolve their business models to stay ahead of the convergence curve. This will help them seize the major marketing opportunity in this fast-paced environment—the ability to drive customers from the point of engagement to the point of transaction.

Dentsu Aegis Network is well placed to help our clients seize this opportunity in the increasingly convergent marketing environment. Supported by the market-leading position of Dentsu Inc. in Japan, Dentsu Aegis Network in Asia Pacific has true scale, with 11,000 people in 36 offices across 17 countries. Furthermore, our unique operating model is fully enabled in these markets and we have strong digital leadership across our agency brands, with the highest number and ratio of digital experts, and the most digitally awarded, of any international agency group in the region.

- China, the world’s second largest advertising market, continues to be a major focus

-

China, with over 40% of Asia Pacific’s GDP, and with nearly 1.4 billion people, remains the most important economy in the region, and thus a major driver of growth. To exemplify this, GDP in China is expected to grow by around 7% in 2015, which, although a moderation from previous expectations, is still the highest growth rate in the region, which is spectacular, given that it is off such a large base.

In line with this moderation in GDP forecasts, the advertising market in China is forecast to increase by 7.9% in 2015, which is slower than previously forecast.

TV still dominates in China, with a 55.8% share of advertising spend across all media expected in 2015. However, there are signs that TV’s share is slowly decreasing, with a 53.7% share predicted for 2016. Broadcasters in China are therefore actively venturing into the digital realm, building their own online video platforms.

China dominates the region in the digital advertising arena, contributing nearly 50% of Asia Pacific’s advertising spend in digital. This is not surprising, given that smartphone penetration in China is a huge 70%, and it is now the world’s largest smartphone market.

Digital advertising spend in China is expected to grow by 29.8% in 2015. Within this, search spend is growing at 23.8%, Mobile at 55% and Display including Online Video at 18.7%. In social media, China again dominates the digital landscape in Asia Pacific, with 60% of the region’s active social media users being based in China. Finally, and importantly, China is now the world’s largest e-commerce market, having overtaken the U.S. in recent years.

- Our well executed integration program in China ensures Dentsu Aegis Network is well equipped for the future

-

At the time of Dentsu’s acquisition of Aegis in 2013, we had a combined portfolio of strong businesses in China. As a result, we immediately focused on ensuring that the integration of those businesses was well planned and executed. Consequently, we implemented the full integration in 2013 and 2014, establishing Dentsu Aegis Network in China in January 2015, with clear management structures and reporting lines across the territory.

Bringing together our businesses in China under a single management structure enables us to utilize the power of the Group and create a differentiated position in the market, to deliver truly integrated solutions to our clients. Our new management structure in China represents a high-quality talent pool, with market-leading international and local expertise. We now have a balanced, strong and experienced team, well-equipped to drive one of Dentsu Aegis Network’s largest businesses in the world.

As part of this major integration exercise, we also undertook the significant co-location of all of our businesses in Shanghai into one office in the fourth quarter of 2014. This was Dentsu Aegis Network’s biggest co-location to date anywhere in the world, with over 1,400 staff moving into one building. It enables us to continue to foster collaboration, in order to drive the execution of the operating model in our business in China.

Following the execution of this integration program in China, our business is now perfectly positioned to continue to support our clients in the world’s second largest advertising market.

Nick Waters

CEO, Dentsu Aegis Network Asia Pacific

- 1992

- Joined Ogilvy and Mather

- 1997

- Joined Mindshare

- 2010

- Joined Aegis Media as CEO of Aegis Media Asia Pacific

- 2013

- Appointed CEO of Dentsu Aegis Network Asia Pacific

With almost two decades in senior management at Mindshare, then at Aegis Media, Mr. Waters has been CEO of Pan-Asia, and also of Europe, the Middle East and Africa.

“Accelerating our strategy through acquisitions”

- Nick Priday

CFO, Dentsu Aegis Network

- Why does the Dentsu Group place so much emphasis and focus on acquisitions?

-

Acquisitions remain an important way to accelerate our strategy. In today’s disruptive world, where opportunities need to be grasped and scaled quickly, acquisitions are an excellent way to move our business with speed and direction.

- Are acquisitions commonplace in today’s corporate environment, from a global perspective?

-

Acquisitions are indeed a key feature of the global corporate environment today. And, this is particularly the case in the media sector—last year, a total of around $2.9 trillion was spent by corporates on acquisitions globally, and media was the third largest sector, in terms of funds invested.

- So, is now a good time for the Dentsu Group to be making acquisitions?

-

Yes, the environment for acquisitions remains favorable, with very low interest rates in many developed markets, negative bond yields and investors’ ongoing search for positive returns. So, it is definitely a good time to be making acquisitions.

- What is the Dentsu Group’s global acquisition strategy?

-

From a strategic perspective, we continue to target acquisitions which give us scale, help us to in-fill our product portfolio and geographic footprint and to provide cutting-edge innovation.

- What type of acquisitions is the Dentsu Group targeting and what are you looking to achieve in executing those acquisitions?

-

We are targeting acquisitions in emerging markets and digital across a diverse range of geographies and product offerings which, combined with our proven track record of integration, will help to support us in delivering on our strategic objectives. We have a particular focus on the United States and China, given they are the world’s top two largest advertising markets. From a commercial perspective, we target acquisitions which provide top line growth, margin enhancement and clear synergies with our existing businesses. Acquisitions also allow us to bring top talent into our business.

- How is the Dentsu Group structured to ensure acquisitions are properly targeted, executed and integrated?

-

We have a strong track record in executing and integrating acquisitions, supported by a well-managed global structure and a number of established processes. We have a specialized in-house central execution team in place, based in London, with regional M&A teams in our three key regions, EMEA, APAC and the Americas, running the rule over a pipeline of around 50–60 potential acquisitions, at any given time.

- What is the process for targeting and signing acquisitions?

-

Acquisition targets are identified by our local management teams, who understand the needs and requirements of their businesses locally. They are supported by the central and regional M&A teams, with a monthly review by an Acquisition Committee, chaired by Jerry Buhlmann, CEO of Dentsu Aegis Network.

- What are the Dentsu Group’s criteria for acquisitions?

-

Acquisitions also need to have strong strategic rationale—in particular, we aim to ensure they easily fit into, and work within, our operating model. We also need to ensure the right fit in terms of the key people we are bringing in. From a financial perspective, across our portfolio of targets, we measure acquisitions against strict investment criteria, including the delivery of a return on invested capital of 30% above our post-tax WACC, in the first full year of acquisition. There are various other financial criteria, including profit enhancement, payback and internal rate of return, which can vary on an acquisition-by-acquisition basis.

- How does the Dentsu Group structure deals, from a financial perspective?

-

We aim to de-risk as much as possible our financial involvement in every acquisition we make. This is done by limiting the amount of initial consideration paid up-front. Generally, 30%–40% of the total consideration we pay is up-front. In certain situations, we also leave a minority stake with the vendors to ensure they have some skin in the game after earn-outs have expired.

Nick Priday

CFO, Dentsu Aegis Network

- 2003

- Joined Aegis

- 2009

- Appointed Chief Financial Officer of Aegis Group plc

- 2013

- Appointed Chief Financial Officer of Dentsu Aegis Network

Having earned his qualifications at Ernst & Young, Mr. Priday has held senior finance positions at Aegis for over a decade.

“Accelerating our drive to develop our talent”

- Valerie Scoular

Group HR Director, Dentsu Aegis Network

- Our people are at the center of everything we do. Our Global HR strategy is therefore focused on ensuring we:

-

- Attract the right talent;

- Nurture and motivate our talent; and

- Develop their careers with care and rigor.

-

In 2014, we made great progress in accelerating this strategy, through a number of key success stories and important initiatives in the following areas:

- Design and implementation of a new vision and values for Dentsu Aegis Network

- Ongoing drive to embed a high performance culture within the organization

- Continued focus on leadership development

- Further emphasis on talent development and exchange opportunities across the Group

- Implementation and rollout of a global HR system

- 1. Design and implementation of a new vision and values for Dentsu Aegis Network

-

We believe that by focusing on a clear vision, Dentsu Aegis Network will deliver long-term success, guided by resonant values, which will help to define and shape the culture of our business. Our values are at the heart of Dentsu Aegis Network, as they show our people how to act and how to be consistent.

Following the establishment of Dentsu Aegis Network on January 1, 2014, we worked quickly to formulate and identify the organization’s new vision and values, which were then launched and rolled out across the business by the end of the first quarter of the year.

As part of this process, we consulted our leadership teams across the business, during a number of management summits, to ensure their views were properly integrated into the final output. In addition, we incorporated the vision and values of the legacy Aegis Media business into the new vision and values, which were also fully aligned with Dentsu Inc.’s 10 principles and vision of “Good Innovation.”

Ultimately, Dentsu Aegis Network’s new vision of “Innovating the Way Brands Are Built,” supported by our new values of Agile, Pioneering, Ambitious, Responsible and Collaborative, will help to build our culture and to guide our future success.

- 2. Ongoing drive to embed a high performance culture within the organization

-

At the end of every year, we conduct an extensive staff feedback survey, named “Global Check-in.” Historically, this was carried out by Aegis Media, and in 2014, we produced the first survey as Dentsu Aegis Network. The survey includes a number of questions across important areas like learning and development, diversity, innovation, communication, leadership and management, collaboration and reward, and recognition. In 2014, the survey produced a record response rate of 88% and the results showed particular success in embedding our new vision and values, which received high engagement scores across the business.

Another key finding from the survey’s results was that Dentsu Aegis Network is powered by a high performance culture. As evidence of this, engagement scores in most categories were well ahead of the industry norm, and against the previous year, with scores in many categories above the “high performance” benchmark. Furthermore, the results showed that 89% of our people feel empowered to do their jobs—another signal of a high performance culture, as well as a strong alignment with our new values.

- 3. Continued focus on leadership development

-

To drive this high performance culture throughout the organization, we are focused on energizing our leadership talent through unique experiences to help them deliver a commercial edge for the future success of the business.

Our most significant leadership development program is Route 500. This annual program has a rigorous process in candidate selection, with a detailed self-nomination procedure, followed by a series of panel interviews with senior leadership.

Once candidates attain Route 500 membership, they have access to senior Dentsu Aegis Network leaders, as mentors, sounding boards and guides, an accelerated career development plan, with opportunities for additional local, regional and global experience within the organization, supported by a structured training and e-learning program.

Importantly, Route 500 members are able to build important, long-term internal networks with their colleagues from other agencies, functions and geographies. This enables the fostering of collaboration and has already precipitated a number of important commercial projects within the organization. By the end of 2015, there will be over 1,000 people on the Route 500 program.

Route 500 also has resonance with our clients and, during 2014, an outline of the program and its benefits was included in a number of major pitches and client presentations, as evidence of how Dentsu Aegis Network develops the best industry talent.

In addition, in March 2015, Dentsu Aegis Network held its annual Global Conference in Tokyo, for the first time, with the theme of “Leading Through Innovation.” At the event, there were significant opportunities for the sharing of our vision, strategic objectives and key business successes of 2014.

There were also sessions which enabled the development of important collaboration projects across our key leadership teams from around the Group.

- 4. Further emphasis on talent development and exchange opportunities across the Group

-

As we continue to grow and develop as a Group, we are placing an increasing focus on talent development and exchange. More specifically, we are looking at significant opportunities in these areas between Dentsu Inc. and Dentsu Aegis Network. The objective here is to improve the Group’s HR infrastructure to promote collaborative working, with a view to nurturing future leaders and creating business synergies.

In talent development, our immediate focus is on the expansion of existing programs across the entire Group. As an example of this, we are aiming to extend the Route 500 program to Dentsu Inc. employees who are currently working in international markets. In addition, there are many cases of Dentsu Inc. and Dentsu Aegis Network employees working jointly on international business assignments. This includes collaboration on short-term assignments, like new business pitches, to longer-term projects, like embedding talent within agencies.

Another major program in talent development is Dentsu Inc.’s Dentsu Management Institute, which takes place in Tokyo every year. Around 50 of our key talent from across the Group are selected and invited to a week of presentations from senior leadership and external business experts, as well as a number of working sessions based on key opportunities for the Group. The rationale of this program is to promote a mutual understanding and education across the Group, in particular, around our business strategies, and to trigger potential business synergy ideas, as well as to build a network of top talent for future leadership roles.

We made great progress in our talent exchange program across the Group in 2014. A number of Dentsu Aegis Network’s agency brands invited relevant Dentsu Inc. employees to spend a period of time working with, and learning about, these agencies, to create a mutual understanding and a culture of collaboration. These structured talent exchange programs included formal training sessions, collaboration in pitches, the sharing of tools and capabilities, and in some cases, a longer-term exchange program. Also in 2014, we seconded a number of senior Dentsu Aegis Network employees to Tokyo and, in addition, there are now many Dentsu Inc. secondees in a number of our international markets.

- 5. Implementation and rollout of a global HR system

-

To support the various initiatives we are implementing to drive our Global HR strategy, we rolled out a global HR system in 2014, driving a technology-enabled transformation and enabling a single, consistent global HR organization.

This global system was launched to drive increased automation and efficiency in HR and will provide greater insights on our talent as well as enabling our people to be more effective and efficient in their roles. The system includes real-time access for our people to day-to-day activities, like the management of expenses and annual leave, as well as elements like training programs and e-learning. In 2014, the system was launched in five major markets, covering 3,600 employees, with rollouts in more markets planned for 2015.

In summary, we had great success in 2014 in driving our Global HR strategy, supported by our efforts in continuing to embed a high performance culture, through an ongoing focus on leadership and talent development, supported by a new global HR system. We will continue to drive our global HR strategy in 2015 and beyond, as we look to support the organization in “Innovating the Way Brands Are Built.”

Valerie Scoular

Group HR Director, Dentsu Aegis Network

- 1977

- Joined British Airways

- 1997

- Appointed Advisor to The New Deal Task Force

- 2001

- Joined Barclays Bank

- 2006

- Joined Aegis Group plc as Group HR Director

- 2013

- Appointed Group HR Director of Dentsu Aegis Network

Ms. Scoular’s illustrious career spans almost two decades in senior HR roles, at British Airways and Barclays Bank and in non-executive directorships.

![]()