Risk Management

Structure

The major risks associated with the execution of Group strategies, business, and other activities that may affect the decisions of investors are listed below . Under the corporate governance structure, Dentsu Group is engaged in a variety of measures to minimize risks—i.e. future uncertainties with the potential to hinder the achievement of management goals—as well as taking advantage of these risks as opportunities.

In FY2021, the Internal Control and Risk Committee met three times, and it was decided that, starting in July 2021, Group-level risk management would be undertaken by the Group Executive Management Meeting (GEMM), which assesses risks and conducts regular discussions from a Group-wide perspective.

Following that decision, the Group Risk Meeting was established as a subcommittee of the GEMM. Risk Committees exist within Dentsu Japan Network (DJN) and throughout Dentsu International (DI) to manage risks. In FY2021, the DJN Risk Committee met five times and the DI Risk Committee met four times.

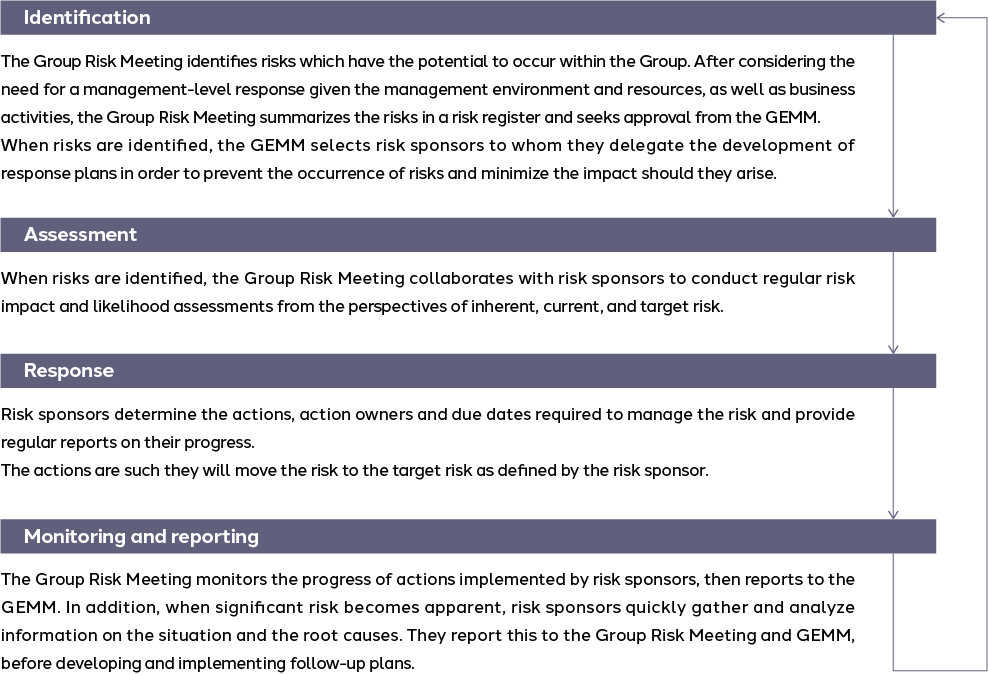

Risk management process

Based on the Enterprise Risk Management approach, Dentsu Group aims to minimize the likelihood of identified risks from materializing. However, should they occur, the Group minimizes their impact by selecting risk sponsors to whom they delegate the formulation and implementation of risk response plans, with the GEMM regularly monitoring the responses.

Major risks with the potential to affect investor decisions and their countermeasures

| (1) Risks associated with cyclical changes in the global economy and social changes accelerated by the impact of COVID-19 | The Group formulated the Medium-term Management Plan designed to transform Dentsu Group business so that it can promptly respond to changes in the business environment and seize new business opportunities. The plan, targeting business transformation, was updated in February 2022. It supports B2B2S, a new management policy focused on sustainable growth that embodies the plan’s strategies and goals. |

|---|---|

| (2) Risks associated with the development of new businesses from the medium- to long-term perspectives | One of the core pillars of the Medium-term Management Plan mentioned above is the execution of growth strategies through enhancements in areas that support clients’ business transformation. This is defined as Customer Transformation & Technology (CT&T). The Group has a stated aim of reaching 50% of Revenue Less Cost of Sales from CT&T, the progress of which is regularly monitored and reported. |

| (3) Risks related to securing human resources | A Group-wide engagement survey is conducted to identify challenges in the organization and make improvement while listening to our employees . A range of training programs offered, aiming at Diversity, Equity & Inclusion, and skill development programs for all employees. Succession planning for senior leadership roles is also in place, ensuring transparency and equity. |

| (4) Risk related to the business transformation | Continuously monitoring the implementation of structural reforms of DJN and DI to respond to rapid changes in the business and competitive environments. |

| (5) Risks associated with the competitive environment and structural changes in the existing advertising industry |

|

| (i) Risk of price competition with advertising and media competitors | The Group attempts to differentiate itself from competitors by providing high added value consisting of consumer insights and integrated solutions, while maintaining strong relationships with clients to avoid excessive price competition. |

| (ii) Risk of loss of global clients | Same as above |

| (iii) Risks associated with structural changes in the media environment | Viewing structural changes in the media environment as business opportunities, the Group flexibly allocates and invests Group resources in next-generation media, consistently providing client companies with marketing solutions apposite for the latest consumer behavioral principles. |

| (iv) Expanded competition with companies in other industries | Viewing changes in the industry structure as business opportunities, the Group plans to integrate and enhance expertise cultivated in the advertising marketing with data and technology, combined with analytics to enter new markets and provide clients with integrated growth solutions. |

| (6) Risks related to the content business | Many content business projects are managed as portfolios to diversify content business risks. |

| (7) Impairment risk of goodwill and intangible assets related to Dentsu International |

In addition to the regular impairment tests, reviewed past overseas investment in 2021 and clarified the framework to review going forward. |

| (8) Risks related to information security and cyber security | The Group established a dedicated cyber security department at DJN and DI to ensure safety and responses to new threats. |

| (9) Sustainability-related risks | The 2030 Sustainability Strategy was formulated to create truly sustainable value for all in the future, and to promote measures to achieve the plan’s environmental and social index targets. |

| (10) Risks related to laws and regulations, litigation, etc. | |

| (i) Risks related to violations of labor laws and regulations | The Group works on establishing a work environment that ensures the mental and physical wellbeing of all employees as one of its top management priorities. |

| (ii) Risk related to personal and other information | The Group complies with laws and regulations, both in Japan and abroad, including the Act on the Protection of Personal Information and the EU General Data Protection Regulation, and responds promptly to amendments to these laws and regulations. |

| (11) Risks related to unforeseen incidents, disasters, accidents, etc. | The Group regularly reviews crisis management and business continuity plans for DJN and DI to address risks related to unforeseen incidents, disasters, accidents, etc. that are expected in each region and market. |