CFO Message

Record performance in FY2021;

FY2022 sees continued focus on

sustainable growth and

maximization of corporate value

through capital allocation and

transformation.

Arinobu Soga

Representative Director,

Executive Vice President & CFO,

Dentsu Group Inc.

Comprehensive review

While FY2020 saw the Group begin its journey of transformation when much of the groundwork was laid, FY2021 was the year when many of our plans came to fruition.

In August 2020 we recognized the need for Dentsu Group to accelerate its transformation and launched a comprehensive review of the business.

Throughout 2021 our people, our clients and our shareholders all felt the benefit of our transformation. With a simpler structure our people found less friction within their working environment, clients were able to navigate our services more easily and our shareholders saw improved returns as we restructured our balance sheet.

Return to growth

In FY2021, Dentsu Group reported record-high net revenue, record underlying and statutory operating profit and a record dividend payment of 117.5 yen per share. This performance is testament to the return to growth in our industry, the cyclical recovery in advertising as well as the continued investment clients are making in our structural growth area, Customer Transformation & Technology. Our FY2021 net revenue was above that reported in FY2019 demonstrating we are delivering services to our clients that are supporting growth within their own businesses.

Dentsu Japan Network

In FY2021, 43% of our net revenue was generated within Japan, which reported organic growth of 17.9%, exceeding expectations following a recovery across all advertising mediums, with particular strength in television and digital solutions. Client spend increased as consumer confidence returned to the Japanese economy as COVID-19 related restrictions continued to be lifted. We announced the consolidation of Septeni Holdings—which firmly cements dentsu as the number one player in digital advertising in Japan.

Our fastest growth area continued to be in Customer Transformation & Technology led by Dentsu Digital, which reported organic growth of over 30%, giving confidence our digital solutions are well-placed to meet clients’ needs. We continue to make progress as we shift our business toward the fast-growth Customer Transformation & Technology area with the ratio of net revenue in Japan reaching 24.4% in FY2021.

Dentsu International

Dentsu International, 57% of our Group net revenue, reported organic growth of 9.7% in FY2021.The Americas region contributes 25% of our Group net revenue and is the largest region outside of Japan. The 10.6% organic growth was led by the US market and Canada. In EMEA, which accounts for 22% of Group net revenue, organic growth was 11.1% in FY2021 with five of the largest European markets reporting double digit organic growth. In APAC, which represents 10% of Group net revenue, organic growth was 4.7% for FY2021. FY2021 growth was predominantly driven by strong performances in Singapore, Indonesia, and Australia. This strong growth was partly offset by some weakness in China and India.

Customer Transformation & Technology at Dentsu International reached 32.6% in FY2021 as clients continue to embrace data and digital transformation solutions to meet their customers’ expectations.

The broad-based recovery at Dentsu International was supported by the increased focus on integration of our services to deliver bigger solutions for our clients. This approach is benefitting a number of our major markets as clients increasingly require solutions across a range of capabilities.

Margins

In FY2021, Dentsu Group reported a record operating profit and underlying operating profit with 340 bps of margin improvement resulting in a 44.4% operating profit increase year-on-year driven by the cost savings we had promised to deliver through de-duplication across the business.

Japan delivered a margin of 22.9% (+490 bps year-on-year) with an increase in underlying operating profit of +52.0% year-on-year. At Dentsu International, underlying operating profit was +33.8% year-on-year (+28.4% on a constant-currency basis); with an underlying operating margin of 15.9% (+220 bps year-on-year, +230 bps on a constant-currency basis).

Margins were also improved by a reduction in property costs in many markets. COVID has prompted new ways of working, with more flexible working patterns for our people allowing us to reduce our property costs in high-cost, city central locations.

Balance sheet restructuring and shareholder returns

In FY2021 we made some major changes to our balance sheet. To improve capital efficiency, we announced in FY2021 our plan to sell and lease back our headquarters building in Tokyo, as well as announcing two further property sales in Japan and the sale of 21-billion-yen strategic share holdings. The funds generated from the transactions allow for investment for growth and improving returns to shareholders. Along with the recovery in business performance in FY2021 we ended the year in a net cash position, allowing the Group to focus on investing for growth going forward.

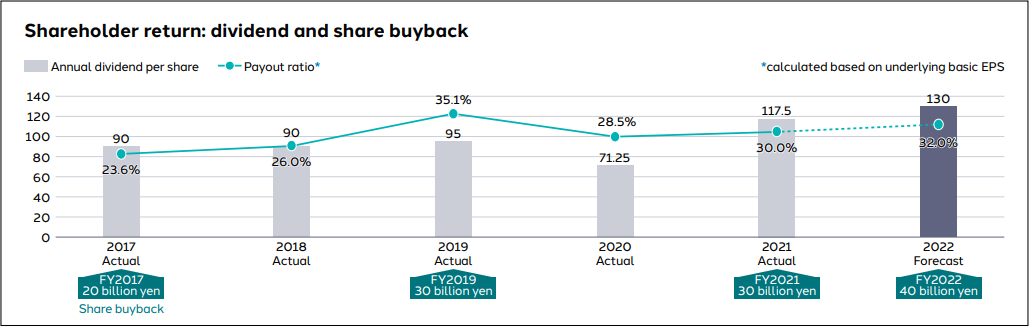

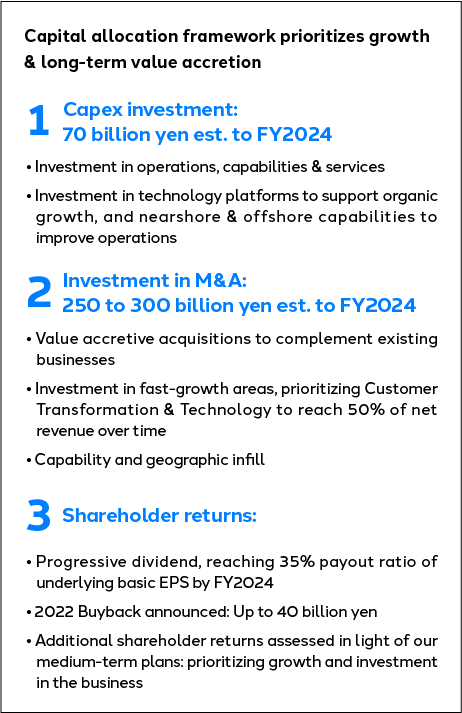

Following the 30-billion-yen buyback announced in February 2021, we were pleased to announce a further buyback of a maximum of 40 billion yen for FY2022. Improving our returns and creating long-term sustainable value for our shareholders remain key focus points for me and other senior leaders.

We maintain our progressive dividend policy of reaching a 35% payout ratio by FY2024, the final year of our Medium-term Management Plan. In line with this, we expect the payout ratio for FY2022 to be 32% with the dividend guided to a record-high 130 yen per share.

Strategic capital allocation for future growth

Looking ahead, I am pleased to share our updated capital allocation framework for the next three years, which prioritizes growth and long-term value accretion.

Our capex investment over the coming three years will total approximately 70 billion yen—in line with previous years.

The acquisition fund to invest for growth is 250 to 300 billion yen over three years to be spent across Japan and the International business. We will focus our spend on the fast-growth areas of Customer Transformation & Technology, growing our exposure to the structural growth areas of our industry, such as Commerce & Experience. We aim to reach 50% of Group net revenue generated by Customer Transformation & Technology over time and this will be driven by organic growth and acquisitions.

Disciplined M&A

Our acquisition strategy will focus on fewer, larger deals than we have done previously. This is the advantage of being the first mover in the data and analytics space through our acquisition of Merkle in 2016—we got the scale early, so we can afford to be selective with bolt-on deals.

The acquisition portfolio built over the past five years has delivered strong returns with ROIC in excess of the Group’s cost of capital. This reflects the robust process and procedures we have in our M&A committee and post-merger integration process.

Acquisitions have also transformed our operations. Through Septeni Holdings in Japan, UGAM, Paragon and Sokrati, we have nearshore and offshore delivery centers which help support our margin as the cost to deliver services reduces.

Growing exposure to Customer Transformation & Technology also benefits the business through an expanded offer; more recurring revenue and providing less cyclicality within the business.

In 2021, we completed one acquisition, LiveArea. LiveArea is headquartered in and serves clients in the United States, with a presence in EMEA and significant global offshore delivery capabilities in India and Bulgaria, with over 50% of their revenue recurring through ongoing managed services. LiveArea bolsters our global experience and commerce capabilities and furthers our position as a go-to experience partner for businesses around the world. Following this acquisition, dentsu is now the largest Salesforce Commerce Cloud agency partner demonstrating our hybrid agency / consultant positioning.

We also announced the consolidation of Septeni Holdings as we increased our stake to 52%. This announcement will further strengthen the digital marketing business within Dentsu Japan Network, bringing expertise and scale in the fast-growth digital media market. Dentsu Japan Network will become the largest and most advanced digital marketing partner for clients in Japan.

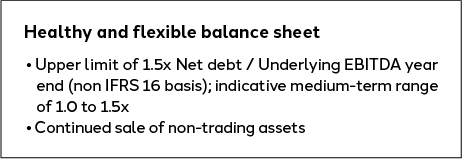

Our investments will be supported by a healthy and flexible balance sheet; the net debt / underlying EBITDA operating in an indicative medium-term range of 1.0 to 1.5x.。

Investment in our People

The greatest asset that supports the business is our people. In order to achieve the business transformation and sustainable growth that we aim for, we will focus more than ever on talent development and new hiring of highly skilled specialists. We will strive to strengthen our growth potential by promoting this initiative.

In order to enhance our competitiveness in the talent market, we intend to accelerate investments aimed at rebuilding the Group’s brand and improving employee engagement.

Outlook for FY2022: improved for sector

We enter FY2022 with optimism, backed by the strong growth of digital advertising and Customer Transformation & Technology, and the guidance of 4 to 5% organic growth. This optimism leads to the upgrading of our medium-term targets to 4 to 5% organic growth rate from 3 to 4%, and the operating margin from 17.0% to 18.0%.

Fulfilling the role of CFO to maximize corporate value

As we made progress with the structural reforms, we have shifted our focus to investments for growth.

In FY2021, Dentsu Group met with over 450 of our shareholders and potential investors globally, and we will continue this effort to improve the management of our business as we have entered the second year of the Medium-term Management Plan.

The business environment is constantly changing, and the speed of change continues to increase. As Group CFO, I plan to pursue financial soundness while properly allocating resources to acquisitions and our people that underline future growth.

Dentsu Group will realize the business transformation and sustainable growth to maximize corporate value for all of our stakeholders.